Enterprise Artificial Intelligence Market Size, Share & Trends Analysis Report By Deployment, By Technology, By Organization, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-959-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Enterprise AI Market Size & Trends

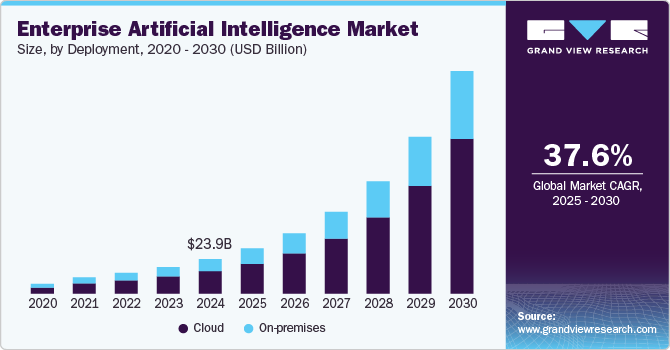

The global enterprise artificial intelligence market size was estimated at USD 23.95 billion in 2024 and is projected to grow at a CAGR of 37.6% from 2025 to 2030. The market has been experiencing significant growth, driven by increasing demand for automation, efficiency, and data-driven decision-making across various sectors. Organizations recognize the potential of AI technologies to enhance productivity, simplify operations, and improve customer experience.

As companies adopt AI solutions, they utilize machine learning, natural language processing, and robotics to gain a competitive edge. The integration of AI into business processes enables organizations to analyze vast amounts of data, leading to insights that inform strategic initiatives. Moreover, advancements in cloud computing and big data analytics are facilitating the widespread adoption of AI technologies, creating numerous opportunities for innovation and investment.

Key industries driving the adoption of Enterprise AI include healthcare, finance, retail, and manufacturing. In healthcare, AI is transforming patient care through predictive analytics, personalized treatments, and improved diagnostics. The finance sector is using AI for fraud detection, risk assessment, and automated trading to enhance operational efficiency. Retailers are employing AI for inventory management, personalized marketing, and customer service automation, improving the shopping experience. Moreover, the emphasis on data privacy and ethical AI usage is shaping industry standards, leading to the development of regulations to ensure responsible implementation.

Deployment Insights

The cloud segment held the dominant share of 65.8% in 2024. The cloud segment’s dominance in the market can be attributed to its scalability, flexibility, and cost-efficiency in deployment. Organizations are adopting cloud-based AI solutions to handle large volumes of data without needing significant infrastructure investments. Cloud platforms enable easy deployment and management of AI applications, streamlining processes for businesses. Moreover, cloud services provide access to advanced analytics and real-time processing, which are critical for AI-driven operations. As a result, cloud-based AI deployment continues to grow as companies increasingly move their workloads to cloud environments.

The on-premises deployment has also benefited the market, especially for organizations with strict data privacy or security concerns. These solutions allow businesses to retain complete control over their data and infrastructure, minimizing risks associated with third-party access. On-premises AI deployments are highly customizable, allowing organizations to align AI tools with their specific operational needs. Many companies favor on-premises AI for mission-critical applications where reliability and control are essential. Even with the growing popularity of cloud-based solutions, on-premises AI deployments remain an attractive option for industries with stringent regulatory requirements.

Technology Insights

The natural language processing segment held the dominant share in 2024. Natural language processing (NLP) has emerged as a dominant segment in the market due to its broad applications in understanding and analysis of human language. Businesses use NLP for tasks such as customer service automation, sentiment analysis, and chatbots for improving communication between systems and users. It is especially valuable for processing unstructured data, such as emails, social media posts, and documents, allowing companies to extract meaningful insights. The ability of NLP to handle large volumes of text-based data makes it crucial for industries that rely on text-heavy interactions. As demand for smarter, more efficient communication grows, NLP continues to expand its presence in the AI landscape.

Computer vision is anticipated to experience rapid growth over the forecast period, with increasing adoption across various sectors. This technology is being used for object recognition, image classification, and video analytics, making it invaluable in industries such as healthcare, retail, and manufacturing. Companies are implementing computer vision to automate visual inspections, improve security, and enhance customer experiences. The ability to interpret and analyze visual data is becoming essential for many applications, from quality control in factories to patient diagnosis in hospitals. As AI capabilities advance, the role of computer vision is expected to grow further, contributing to innovations in automation and real-time decision-making.

Organization Insights

The large enterprises segment held the dominant revenue share in 2024. Large enterprises have dominated the market due to their capacity to invest heavily in advanced technologies and infrastructure. These organizations have the resources to deploy AI across various departments, optimizing operations, improving decision-making, and enhancing customer experiences. Artificial intelligence (AI) implementation in large enterprises often includes complex systems such as machine learning, predictive analytics, and automation tailored to address specific business needs. With dedicated teams and substantial budgets, these enterprises are leading the way in AI adoption and innovation. As a result, they continue to maintain a strong presence in shaping the AI landscape.

Small and medium enterprises (SMEs) are increasingly growing their adoption of AI technologies, recognizing their potential to enhance efficiency and competitiveness. The rise of more affordable, scalable AI solutions is allowing SMEs to integrate AI into their operations without significant upfront costs. These businesses are using AI for customer service automation, marketing optimization, and data-driven decision-making, enabling them to compete more effectively with larger players. As AI becomes more accessible, SMEs are finding new opportunities to streamline their processes and improve performance. This growth is expected to continue, contributing to a more diverse and dynamic AI market.

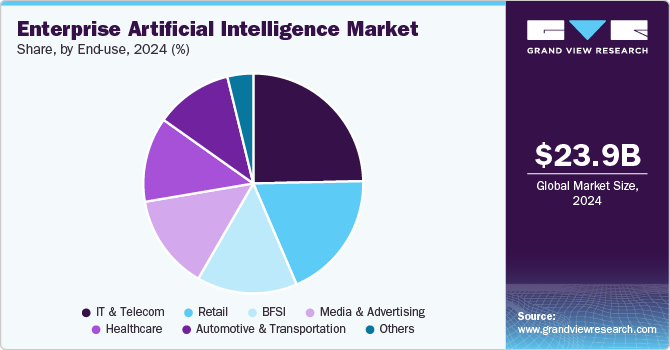

End-use Insights

The IT & Telecommunications segment accounted for the dominant share in 2024. The IT and Telecom sectors dominate the market due to their early adoption of AI technologies and the vast amounts of data they generate. These industries utilize AI for optimizing network performance, enhancing cybersecurity, and improving customer service through automation. With the rapid advancements in 5G and IoT, IT and Telecom companies are continuously implementing AI to enhance connectivity and manage complex infrastructures. Their ability to integrate AI solutions into large-scale operations has placed them at the forefront of AI innovation.

The automotive and transportation industries are experiencing significant growth in AI adoption, primarily due to the rise of autonomous vehicles, smart logistics, and predictive maintenance. AI is being used to improve vehicle safety, optimize supply chains, and reduce operational costs through automation and real-time analytics. As these industries move towards more connected and automated systems, the demand for AI technologies continues to grow. Autonomous driving and AI-driven traffic management systems are key areas of innovation.

Regional Insights

North America enterprise artificial intelligence market held the largest global share of 36.9% in 2024. North America dominates the market, driven by high investments in advanced technologies and a strong ecosystem of AI innovation. The region is home to numerous tech giants and AI startups, fostering a vibrant AI development landscape. North American companies are heavily focused on AI for automation, data analytics, and machine learning across industries such as healthcare, finance, and retail. The availability of advanced infrastructure and skilled talent further supports the widespread adoption of AI in the region. This dominance is expected to continue as North America remains a global leader in AI research and commercialization.

U.S. Enterprise Artificial Intelligence Market Trends

The Enterprise Artificial Intelligence market in the U.S. is growing rapidly, fueled by strong investments from both private and public sectors. Companies across industries, such as finance, healthcare, and retail, are increasingly adopting AI to improve efficiency, automation, and data-driven decision-making. AI startups and established tech firms are driving innovation, focusing on advancements in machine learning, natural language processing, and robotics.

Europe Enterprise Artificial Intelligence Market Trends

The enterprise Artificial Intelligence market in Europe is a growing market for Enterprise AI, with governments and organizations investing in AI technologies to improve productivity and innovation. The European Union has placed significant emphasis on ethical AI, creating regulations to ensure responsible development and use. Key industries adopting AI in Europe include manufacturing, healthcare, and finance, where AI-driven automation and data analytics are transforming business processes. The region is also focused on AI research, with collaborative efforts between academia, industry, and government.

Asia Pacific Enterprise Artificial Intelligence Market Trends

The enterprise Artificial Intelligence market in Asia Pacific is anticipated to experience rapid growth in AI adoption, driven by the increasing demand for automation and data analytics in countries such as China, Japan, and South Korea. The region's focus on digital transformation and smart technologies is pushing industries such as manufacturing, retail, and logistics to embrace AI solutions. Governments in the Asia Pacific are supporting AI development with policies and initiatives that promote innovation and technology integration. AI-powered applications in areas such as robotics, facial recognition, and predictive analytics are gaining traction across the region.

Key Enterprise Artificial Intelligence Company Insights

Some of the key companies in the market for Enterprise Artificial Intelligence include Alphabet Inc., Amazon Web Services, Inc., C3.ai, Inc., DataRobot, Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Amazon Web Services, Inc. offers a wide range of AI and machine learning services, including tools for natural language processing, computer vision, and predictive analytics, enabling businesses to integrate AI into their operations seamlessly. The company is also investing in AI research and development to enhance capabilities in areas such as automation, recommendation systems, and data processing. By providing scalable and cost-effective AI solutions, Amazon is empowering organizations of all sizes to harness the power of AI for improved efficiency and innovation.

-

Alphabet Inc. is significantly advancing its position in the Enterprise Artificial Intelligence market through its innovative technologies and platforms, particularly Google Cloud. Google Cloud offers a robust suite of AI and machine learning tools, including TensorFlow, AutoML, and BigQuery, which enable businesses to develop and deploy AI applications effectively. The company is also focused on enhancing its AI capabilities in areas such as natural language processing, image recognition, and data analytics to support various industries.

Key Enterprise Artificial Intelligence Companies:

The following are the leading companies in the enterprise artificial intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Alphabet Inc.

- Amazon Web Services, Inc.

- C3.ai, Inc.

- DataRobot, Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corporation

- SAP SE

- Wipro Limited

Recent Developments

-

In September 2024, Oracle Corporation introduced a generative development (GenDev) infrastructure for enterprises, utilizing Oracle Database 23ai technologies to enable developers to focus on app functionality while simplifying data infrastructure needs. This AI-centric platform supports rapid application generation with advanced features such as natural language interfaces, modular applications, and robust AI capabilities, streamlining the development process and enhancing the integration of generative AI into enterprise solutions.

-

In August 2024, IBM Corporation and Intel Corporation collaborate to deploy Intel Gaudi 3 AI accelerators to improve the scalability of enterprise AI solutions. This collaboration aims to integrate Gaudi 3 with IBM's Watson AI platform, providing flexible, cost-effective solutions for AI workloads across hybrid cloud environments.

-

In May 2024, IBM Corporation collaborated with Mistral AI and the Saudi Data and AI Authority (SDAIA) to enhance its Watsonx platform, providing clients with suitable model choices, robust integration platforms, and reliable partners for implementing generative AI with minimal risks. This collaboration enriches IBM's offerings with advanced models, fostering a customized approach that empowers enterprises to innovate, customize applications, and navigate the complexities of AI deployment effectively.

-

In April 2024, Oracle Corporation and Palantir Technologies Inc., a U.S.-based software company, collaborated to deliver secure cloud and AI solutions to enhance decision-making for businesses and governments globally. By utilizing Oracle Cloud Infrastructure and Palantir's advanced AI platforms, the collaboration seeks to maximize data value, improve efficiency, and address sovereignty requirements across various deployment environments.

Enterprise Artificial Intelligence Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 31,512 million |

|

Revenue forecast in 2030 |

USD 1,55,210.3 million |

|

Growth rate |

CAGR of 37.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Deployment, technology, organization, end-use, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil |

|

Key companies profiled |

Alphabet Inc., Amazon Web Services, Inc., C3.ai, Inc., DataRobot, Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, Microsoft Corporation, Nvidia Corporation, Oracle Corporation, SAP SE, Wipro Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Enterprise Artificial Intelligence Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise artificial intelligence market report based on deployment, technology, organization, End-use, and region:

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Language Processing (NLP)

-

Machine Learning

-

Computer Vision

-

Speech Recognition

-

Others

-

-

Organization Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use (Revenue, USD Million, 2018 - 2030)

-

Media & Advertising

-

Retail

-

BFSI

-

IT & Telecom

-

Healthcare

-

Automotive & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise artificial intelligence market size was estimated at USD 23.95 billion in 2024 and is expected to reach USD 31,512.9 million in 2025.

b. The global enterprise artificial intelligence market is expected to grow at a compound annual growth rate of 37.6% from 2025 to 2030 to reach USD 1,55,210.3 million by 2030.

b. North America dominated the enterprise artificial intelligence market with a share of 36.9% in 2024. This is attributable to its robust technological infrastructure, significant investments, strong presence of leading technology companies, and growing demand for automation and data-driven decision-making among enterprises.

b. Some key players operating in the enterprise artificial intelligence market include Alphabet Inc., Amazon Web Services, Inc., C3.ai, Inc., DataRobot, Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, Microsoft Corporation, Nvidia Corporation, Oracle Corporation, SAP SE, and Wipro Limited.

b. Key factors driving the enterprise artificial intelligence market growth include increasing demand for automation and efficiency, advancements in machine learning and natural language processing, and the growing need for data analytics.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."