Enterprise Architecture Tools Market Size, Share & Trends Analysis Report By Component, By Solution, By Services, By Deployment (On-premise, Cloud), By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-626-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Enterprise Architecture Tools Market Trends

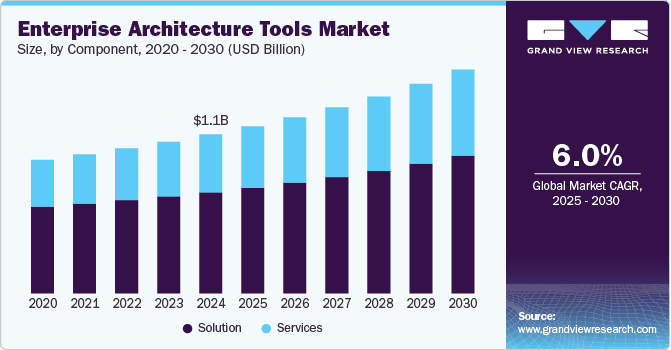

The global enterprise architecture tools market size was estimated at USD 1.14 billion in 2024 and is anticipated to grow at a CAGR of 6.0% from 2025 to 2030. This market growth can be attributed to organizations' emphasis on managing and aligning their IT infrastructure with business objectives efficiently. As enterprises pursue digital transformation, they typically face the challenge of integrating complex IT systems, necessitating robust Enterprise Architecture (EA) tools to ensure agility and optimize resource utilization.

The enterprise architecture (EA) tools market is poised for significant growth, driven by key areas such as automation, analytics, data governance, IT compliance, and delivering measurable business outcomes. Integrating data, infrastructure, and application architecture offers businesses a more structured way to share ideas and facilitate decision-making. With a focus on outcome-driven EA, the market is seeing new opportunities for growth as companies look to align architecture with strategic goals.

Organizations leverage EA to control their IT environments, enabling them to assess application portfolios for cost savings, rationalize systems, analyze application criticality, and eliminate redundancies. In this context, EA helps businesses minimize risks, manage complexity, and streamline digital transformation efforts.

Companies increasingly adopt enterprise architecture management as part of their digital transformation strategies. For instance, The TOGAF Standard, Version 9.2, provides a proven framework for using EA as a strategic discipline, supporting digital transformation success. Global standards, such as the European Interoperability Framework (EIF) and the United States Federal Enterprise Architecture (FEA), also play a key role in shaping enterprise architecture practices to meet organizational goals.

Enterprise architecture (EA) tools play a critical role in ensuring compliance with data privacy regulations, such as the General Data Protection Regulation (GDPR) and the Electronic Communications Privacy Act (ECPA). As businesses become more cautious about data exchange and accessibility, EA tool vendors must prioritize robust privacy and security measures. However, the rising incidence of data breaches and cyberattacks has significantly increased the cost of data breaches, posing a restraint on the global EA tools market.

Component Insights

The solution segment accounted for the largest revenue share of over 63.0% in 2024, driven by the increasing demand for real-time data analysis and decision-making capabilities. As organizations adopt more agile and data-driven strategies, EA tools that offer advanced analytics, real-time insights, and seamless integration across IT systems are becoming essential.

The services segment is expected to expand significantly over the forecast period. This segment includes consulting, training, support, and implementation services. These services are critical for organizations that adopt EA tools but need guidance in configuring, deploying, and maximizing their usage to align with business objectives. The complexity of EA tools and their integration with existing IT infrastructure drive the demand for these services.

Solution Insights

The application architecture segment accounted for the largest revenue share of over 30.0% in 2024, driven by the increasing need for scalable and flexible software systems. As businesses prioritize rapid application development and deployment, they are expected to adopt EA tools that support modular architectures, microservices, and cloud-native solutions to help streamline application management, improve scalability, and ensure seamless integration.

The security architecture segment is expected to expand at a CAGR of 6.2% over the forecast period. With cyberattacks becoming increasingly frequent and sophisticated, organizations prioritize security from the design phase. Enterprise architecture tools that offer built-in security features help businesses address vulnerabilities proactively, reducing the risk of data breaches and other security incidents.

Services Insights

The managed segment accounted for the largest revenue share of over 57.0% in 2024, driven by the preference to outsource the management of complex IT environments to third-party service providers. As organizations focus on digital transformation, they prefer approaching managed services providers to optimize their EA tools, reduce operational costs, and enhance system performance. The professional segment is poised for the fastest growth over the forecast period, owing to the rising demand for expert guidance and customized implementation.

The professional segment is expected to grow significantly over the forecast period. The increasing demand for cloud-based and hybrid EA tools has augmented the importance of professional services, as they assist in customizing and deploying them within diverse environments.

Deployment Insights

The cloud segment accounted for the largest revenue share of over 53.0% in 2024, driven by the increasing adoption of cloud-based infrastructure by organizations seeking scalability, flexibility, and cost efficiency. As businesses move away from on-premise solutions, the demand for EA tools that support cloud environments, seamless integration, remote access, and easier collaboration across teams is expected to gain traction. Cloud-based solutions allow organizations to manage complex IT ecosystems more effectively while reducing infrastructure costs and improving agility.

The on-premise segment is expected to grow significantly over the forecast period. Regulatory compliance in industries such as financial services and healthcare requires strict control over data storage and access, prompting companies to opt for on-premise deployments to meet legal and compliance obligations.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of over 68.0% in 2024, driven by the need for comprehensive IT governance and strategic alignment across complex, global operations. As large enterprises manage vast IT infrastructures and multiple business units, EA tools help ensure consistency, optimize resource utilization, and improve decision-making by providing a unified view of IT systems.

The small & medium enterprises (SMEs) segment is expected to grow significantly over the forecast period. As cloud-based solutions gain prominence, many SMEs are drawn to EA tools because they provide flexibility and scalability at a lower upfront cost. Additionally, as regulatory requirements and data compliance pressures increase, EA tools help SMEs adhere to industry standards and maintain operational transparency.

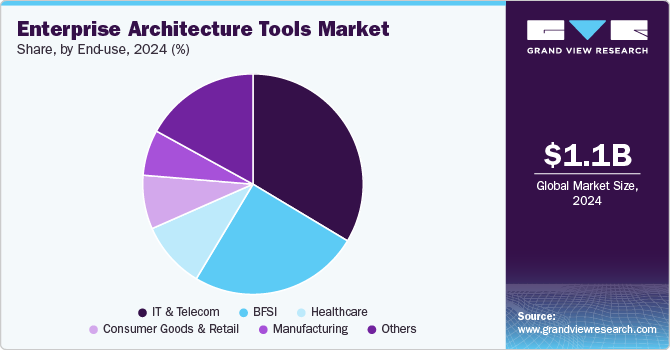

End-use Insights

The IT & telecom segment accounted for the largest revenue share of over 33.0% in 2024, driven by the increasing need for seamless network and system integration to support emerging technologies, such as 5G, IoT, and edge computing. As IT & telecom companies expand their infrastructure to handle growing data volumes and new digital services, EA tools become crucial for ensuring interoperability, optimizing network performance, and managing complex, distributed systems.

The manufacturing segment is expected to grow significantly over the forecast period. This growth is driven by the rising demand for efficient supply chain management, the growing complexity of IT and operational systems, and the pressure to remain agile in response to market changes. The need for digital twins, which offer virtual models of physical manufacturing systems and improved product lifecycle management (PLM), has also accelerated the deployment of EA solutions.

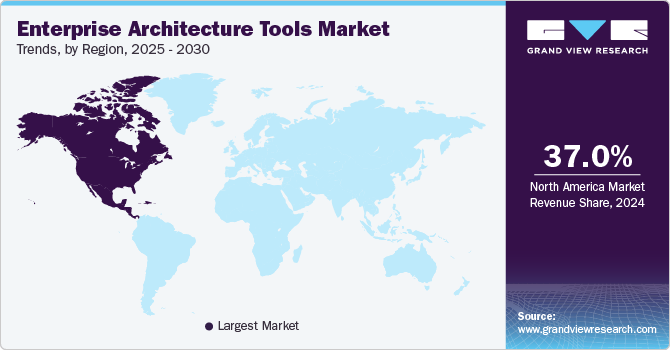

Regional Insights

The North America enterprise architecture tools market held a share of over 37.0% in 2024. Enterprises inNorth America are undertaking digital transformation initiatives as they strive to remain competitive in an increasingly technology-driven marketplace. This transformation involves integrating digital technologies into all aspects of a business, changing how operations are being conducted, and delivering value to customers.

U.S. Enterprise Architecture Tools Market Trends

The enterprise architecture tools market in U.S. is expected to grow significantly at a CAGR of 4.7% from 2025 to 2030. Digital transformation has become a priority for enterprises aiming to boost operational efficiency, enhance customer experiences, and foster innovation. This transformation involves integrating digital technologies into all aspects of business operations, requiring a cohesive alignment between IT strategies and overarching business objectives.

Europe Enterprise Architecture Tools Market Trends

The enterprise architecture tools market in Europe is growing with a significant CAGR from 2025 to 2030. The growing shift towards cloud-based solutions is significantly transforming the market. As more organizations migrate their operations to the cloud, EA tools become essential in managing the complexity of hybrid IT environments.

The UK enterprise architecture tools market is expected to grow rapidly in the coming years as businesses are increasingly investing in cybersecurity due to the rising frequency of data breaches and cyber-attacks. These incidents highlight vulnerabilities in IT systems, especially with the proliferation of remote work and cloud services.

Theenterprise architecture tools market in Germany held a substantial market share in 2024. The increasing adoption of Industry 4.0 and smart manufacturing in Germany drives the demand for Enterprise Architecture (EA) tools. As businesses integrate advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), and robotics into their operations, they face increasingly complex IT infrastructures that require effective management.

Asia Pacific Enterprise Architecture Tools Market Trends

The enterprise architecture tools market in Asia Pacific is growing significantly at a CAGR of 7.4% from 2025 to 2030, driven by the rapid expansion of digital transformation initiatives among businesses striving to enhance operational efficiency and competitiveness. As companies across various industries embrace advanced technologies, such as AI, big data, and IoT, there is a growing demand for EA tools that facilitate integrating and managing these technologies, enabling organizations to streamline processes, improve agility, and respond effectively to market changes.

Japan enterprise architecture tools market is expected to grow rapidly in the coming years. Japan's aging population and shrinking workforce drive companies to invest in automation and artificial intelligence (AI) to maintain productivity. EA tools play a crucial role in supporting the integration of these advanced technologies by providing frameworks to optimize operations and streamline processes, helping businesses address labor shortages efficiently.

The enterprise architecture tools market in China held a substantial market share in 2024. China's push towards Industry 4.0 and the "Made in China 2025" initiative play a crucial role in driving the integration of advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), and automation in manufacturing. The initiative focuses on modernizing China's manufacturing sector by promoting advanced technologies to improve production efficiency, reduce costs, and enhance global competitiveness. This transformation requires sophisticated management of complex systems, where Enterprise Architecture (EA) tools become essential.

Key Enterprise Architecture Tools Company Insights

Key players operating in the market includeSoftware GmbH, SAP SE, MEGA International, Sparx Systems Pty Ltd., Orbus Software, BOC Products & Services AG, and LeanIX GmbH. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Enterprise Architecture Tools Companies:

The following are the leading companies in the enterprise architecture tools market. These companies collectively hold the largest market share and dictate industry trends.

- Avolution

- BiZZdesign

- BOC Products & Services AG.

- LeanIX GmbH

- MEGA International

- Orbus Software

- QualiWare ApS.

- Quest Software Inc. (erwin, Inc.)

- Software GmbH

- ValueBlue

Recent Developments

-

In September 2024, ValueBlue partnered with Iasa Global, a global association for all technology architects, to enhance career guidance and training for architects in the Netherlands. The collaboration combines Iasa Global’s global frameworks with ValueBlue’s BlueDolphin platform, offering architects training, networking, and tools to drive innovation and support business transformations through advanced architecture strategies.

-

In January 2024, Sparx Systems Pty Ltd. completed the acquisition of Prolaborate, a platform designed for collaborative enterprise architecture. The acquisition aimed to strengthen Sparx Systems Pty Ltd.’s Enterprise Architect platform, allowing better collaboration, data visualization, and stakeholder engagement. The move aligned with Sparx Systems Pty Ltd.’s goal to expand its offerings in the enterprise architecture domain.

Enterprise Architecture Tools Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.19 billion |

|

Revenue forecast in 2030 |

USD 1.60 billion |

|

Growth rate |

CAGR of 6.0% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report component |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, solution, services, deployment, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Avolution; BiZZdesign; BOC Products & Services AG.; LeanIX GmbH; MEGA International; Orbus Software; QualiWare ApS.; Quest Software Inc. (erwin, Inc.); Software GmbH; ValueBlue |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Enterprise Architecture Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise architecture tools market report based on component, deployment, solution, services, deployment, enterprise size, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrastructure Architecture

-

Application Architecture

-

Data Architecture

-

Security Architecture

-

Others

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Managed

-

Professional

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Consumer Goods and Retail

-

IT & Telecom

-

Manufacturing

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise architecture tools market size was estimated at USD 1.14 billion in 2024 and is expected to reach USD 1.19 billion in 2025.

b. The global enterprise architecture tools market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD 1.60 billion by 2030.

b. The solution segment accounted for the largest revenue share of over 63.0% in 2024, driven by the increasing demand for real-time data analysis and decision-making capabilities. As organizations adopt more agile and data-driven strategies, EA tools that offer advanced analytics, real-time insights, and seamless integration across IT systems are becoming essential.

b. Some key players operating in the enterprise architecture tools market include SAvolution, BiZZdesign, BOC Products & Services AG., LeanIX GmbH, MEGA International, Orbus Software, QualiWare ApS., Quest Software Inc. (erwin, Inc.), Software GmbH, an ValueBlue

b. Key factors driving the enterprise architecture tools market growth include the emphasis organizations are putting on managing and aligning their IT infrastructure with business objectives efficiently. As enterprises pursue digital transformation, they typically face the challenge of integrating complex IT systems, necessitating robust Enterprise Architecture (EA) tools to ensure agility and optimize resource utilization.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."