- Home

- »

- Next Generation Technologies

- »

-

Enterprise Application Market Size, Industry Report, 2030GVR Report cover

![Enterprise Application Market Size, Share & Trends Report]()

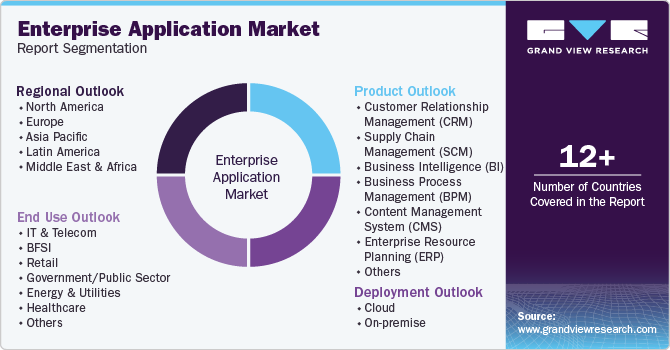

Enterprise Application Market Size, Share & Trends Analysis Report By Product (Customer Relationship Management (CRM), Supply Chain Management (SCM)), By Deployment (Cloud, On-premise), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-640-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Enterprise Application Market Size & Trends

The global enterprise application market size was valued at USD 320.40 billion in 2024 and is projected to grow at a CAGR of 11.8% from 2025 to 2030. The growth can be attributed to increasing end-use enterprises’ expenditures on improving their digital infrastructure and advancements in cloud analytical tools. Furthermore, enterprise software offers an analysis of unstructured & structured data, which assists companies in identifying current market trends and gaining actionable insights, supporting market growth. The rapid pace of digitization across different industries and integration of modern technologies such as Artificial Intelligence (AI), Machine Learning, Intelligent Process Automation (IPA), and others with core business processes are primarily driving this market. A growing inclination towards streamlining processes such as sales, accounting, customer relationship management, procurement, supply chain management, and others to reduce costs and enhance business performance is projected to drive growth in this market in the coming years.

Significant changes in the business environment worldwide, driven by the emergence of advanced technologies and unprecedented growth in innovation associated with information and communication technology, are developing lucrative growth opportunities for this market. With a rise in the application of the latest IT solutions designed with customized approaches and user-friendly technologies, multiple large-scale businesses are under transition. The growing focus of enterprises on reducing costs, streamlining processes, enhancing efficiency, improving productivity, and attaining operational excellence to address global demand and competition has developed noteworthy growth for enterprise applications in various industries.

Enterprise application, a scalable software solution designed to streamline and automate certain business processes, helps large enterprises reduce complexities in operations, enable collaboration among large teams working from multiple locations, ensure safe and secure information sharing, and protect data with enhanced security measures. The increasing inclination towards adopting advanced technology tools and software support to reduce risks, maintain process agility, and maximize efficiency in the manufacturing industry is also contributing to the growing demand.

For instance, in January 2024, Jowat SE, one of the prominent companies operating in the adhesives industry, selected SAP Digital Manufacturing, a manufacturing execution system (MES), to continue its technology transformation initiatives. Continuous growth in raw materials and energy costs encouraged this organization to ensure enhanced control over inventory management and production processes.

Product Insights

Based on products, the customer relationship management (CRM) segment dominated the global industry with a revenue share of 22.3% in 2024. The emergence of solutions related to customer relationship management has changed the approach of multiple industries toward core business processes and customer interactions. Some of the key CRM solutions include contact management, lead management, sales forecasting, employee tracking, reporting & analytics, workflow automation, and more. It has significantly helped companies understand customer behavior, develop strategies based on actionable insights, and substantially increase profitability. Increasing adoption, partnerships among businesses from various industries, and CRM solutions providers add to growth opportunities. For instance, in October 2024, Tottenham Hotspur football club, one of the prominent clubs to compete in the Premier League, announced Salesforce as its newly appointed official CRM partner. Through this partnership, the club aims to deliver an enhanced and personalized digital experience to its fans and viewers worldwide.

Business Process Management (BPM) is expected to experience fastest CAGR of 19.0% from 2025 to 2030. This is attributed to increasing demand from various industries to enhance productivity, improve customer satisfaction, and increase the emphasis on process automation. As industries experience significant changes driven by economic changes worldwide, digital transformation, and the use of modern technologies in several business functions, multiple businesses have focused on including business process management software solutions to sustain in a changing business environment.

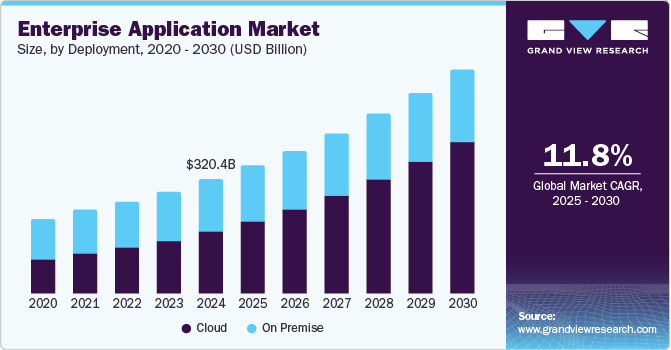

Deployment Insights

The cloud deployments segment held the largest revenue share in 2024, owing to a significant increase in the availability of cloud technology and benefits offered by cloud deployments. Enterprise applications are typically used by large-scale organizations that operate with sophisticated networks and technology infrastructures. Scalability, flexibility to change scales according to workloads and projects, increased accessibility offered by cloud deployments, remote monitoring facilitated by the deployment model, and advancements in cloud computing have driven the growth of this segment in recent years.

On-premise deployment is still utilized by a few businesses that operate software within the enterprise while focusing on complete control over monitoring, data, and functions. Often, companies from highly regulated industries, which must adopt enterprise applications while maintaining data security and control, choose on premise deployments.

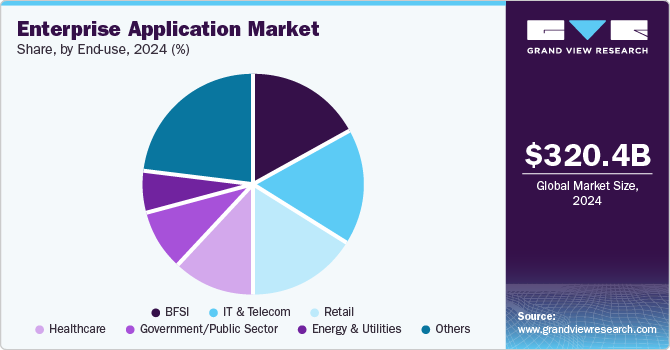

End-use Insights

Based on end use, the IT & telecom industry dominated the global market enterprise application. The IT & telecom industry has become one of the key stakeholders in multiple sectors owing to technological transition and the role of modern technologies in changing business environments. This has significantly driven the demand experienced by the IT & telecom industry. However, companies are focusing on enhancing organizational productivity and efficiency by embracing enterprise application solutions such as CRM and others.

The retail segment is projected to experience the fastest CAGR from 2025 to 2030. This is attributed to the increasing inclination of consumers towards online shopping, leading to unprecedented growth for this industry. In recent years, the growth experienced by the e-commerce and quick commerce sectors has driven demand for enterprise application solutions. To address increasing competition, innovation-based technology transitions, and constantly growing demand for products and services, companies in the retail industry have focused on process automation, adoption of enhanced CRM solutions, and more. This is anticipated to drive growth for this segment in the approaching years.

Regional Insights

North America enterprise application market dominated the global industry with revenue share of 42.5% in 2024. This is attributed to the presence of a robust IT & telecom industry in the region, increasing adoption of modern technologies by various sectors, enhanced availability and accessibility of enterprise solutions, and focus of businesses on streamlining processes to improve productivity and reduce costs.

U.S. Enterprise Application Market Trends

The U.S. enterprise application market held the largest revenue share of the regional market in 2024. This market is primarily driven by factors such as early adoption trends of innovation and technology in the country, the presence of multiple key players and other IT enterprises in the U.S., growing adoption of process automation, and increasing awareness regarding the role of CRM solutions and other enterprise application solutions in enhancing profitability.

Europe Enterprise Application Market Trends

Europe enterprise application market held a significant revenue share of the global industry in 2024. The presence of multiple large enterprises in the region, especially from manufacturing, personal care, textile, agriculture, and others, the rapid pace of digital transformation in the area, the increasing availability of advanced technology-driven enterprise application solutions, and the focus of multiple industries on reducing costs while improving productivity and efficiency.

Asia Pacific Enterprise Application Market Trends

Asia Pacific enterprise application market is projected to experience the fastest CAGR of 15.3% from 2025 to 2030. The rapid pace of technology transformation in the region, enhancements in infrastructure and network capabilities facilitated by numerous governments such as China, India, and others, and growing focus on the adoption of process automation and other performance enhancement solutions in multiple industries are projected to drive the growth of this market in next few years.

Key Enterprise Application Company Insights

Some of the key companies operating in the enterprise application market are Epicor Software Corporation, Hewlett Packard Enterprise Development LP, IBM, Microsoft, and others. These players are pursuing growth strategies such as new product launches, mergers and acquisitions, and strategic partnerships to strengthen their foothold in the market and expand further. For instance, in March 2021, Capado announced that it had acquired NewContext, a multi-cloud DevSecOps service provider. The acquisition would help expand Capado’s DevSecOps platform, enabling companies to make compliance, quality, and security the foundation of their DevOps practices. Major players are also investing in the innovation of labs and centers and collaborating with various research institutes to increase their market share.

-

Epicor Software Corporation, one of the prominent companies in the market, offers a range of software products and solutions, including AI-powered applications and others associated with areas such as cybersecurity, cloud strategy, employee experience-centric automation, and more.

-

IBM is a major market participant in the technology and innovation industry. It offers a wide range of solutions and enterprise applications. It provides products and solutions associated with automation, data, AI, industry-specific customized solutions, security, sustainability, etc.

Key Enterprise Application Companies:

The following are the leading companies in the enterprise application market. These companies collectively hold the largest market share and dictate industry trends.

- Epicor Software Corporation

- Hewlett Packard Enterprise Development LP

- IBM

- Microsoft

- Oracle

- Accenture

- SAP SE

- SYSPRO

- Salesforce, Inc.

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In October 2024, Salesforce, Inc., key company in technology and innovation industry entered in strategic collaboration with Tata Consumer Products Limited (TCPL), to introduce MAVIC, a Go-to-Market (GTM) platform equipped with AI technology, aimed at enhancing TCPL’s operations in terms of sales & distribution.

-

In May 2024, Epicor Software Corporation, one of the key companies in the enterprise application industry, acquired Smart Software, a major market participant in the inventory planning and optimization (IP&O) applications. The cloud-based, AI driven portfolio of Smart Software is now part of Epicor’s ISV partners.

Enterprise Application Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 357.56 billion

Revenue forecast in 2030

USD 625.66 billion

Growth rate

CAGR of 11.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, deployment, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, KSA, UAE, South Africa

Key companies profiled

Epicor Software Corporation; Hewlett Packard Enterprise Development LP; IBM; Microsoft; Oracle; Accenture; SAP SE; SYSPRO; Salesforce, Inc.; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Application Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand view research has segmented the global enterprise application market report based on product, deployment, end-use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customer Relationship Management (CRM)

-

Supply Chain Management (SCM)

-

Business Intelligence (BI)

-

Business Process Management (BPM)

-

Content Management System (CMS)

-

Enterprise Resource Planning (ERP)

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On Premise

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Retail

-

Government/Public Sector

-

Energy & Utilities

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."