- Home

- »

- Next Generation Technologies

- »

-

Enterprise Agentic AI Market Size, Industry Report, 2030GVR Report cover

![Enterprise Agentic AI Market Size, Share & Trends Report]()

Enterprise Agentic AI Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Machine Learning, Deep Learning), By Agent System (Single Agent Systems, Multi Agent Systems), By Type, By Application, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-546-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 -2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Agentic AI Market Summary

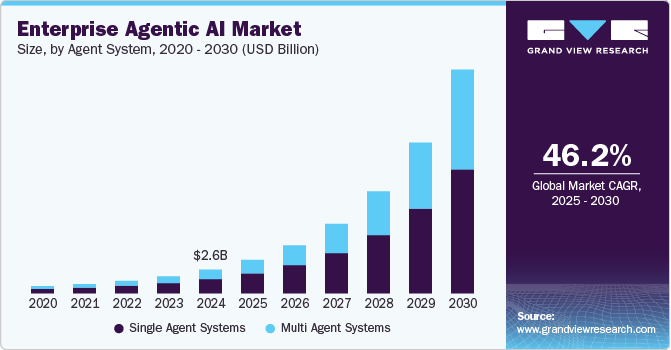

The global enterprise agentic AI Market size was estimated at USD 2.58 billion in 2024 and is projected to reach USD 24.50 billion by 2030, growing at a CAGR of 46.2% from 2025 to 2030. The market is driven by several factors, including the increasing complexity of business environments and the essential need for rapid decision-making.

Key Market Trends & Insights

- North America enterprise agentic AI industry dominated the global industry in 2024, accounting for a revenue share of over 39%.

- The enterprise agentic AI industry in the U.S. is anticipated to exhibit a significant CAGR over the forecast period.

- By technology, the machine learning segment led the market in 2024, accounting for over 29% revenue share of the global revenue.

- By agent system, the multiple agent systems segment is anticipated to grow at the highest CAGR during the forecast period.

- By application, the customer service and virtual assistants segment led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.58 Billion

- 2030 Projected Market Size: USD 24.50 Billion

- CAGR (2025-2030): 46.2%

- North America: Largest market in 2024

Businesses are recognizing the potential of agentic AI to streamline operations and reduce reliance on human intervention. This has led to increased investments in agentic AI technologies as enterprises seek to gain a competitive edge, swiftly adapt to market changes, and improve overall productivity.The demand for automation and efficiency is a primary driver for adopting agentic AI. These systems are capable of automating complex tasks that previously demanded significant human effort, which accelerates operations and improves accuracy, helping enterprises reduce costs. For instance, IBM Watsonx.ai serves as an enterprise-grade studio designed for the development and deployment of AI services within various applications. It provides a comprehensive collection of APIs, tools, models, and runtimes necessary to transform ideas and requirements into practical solutions.

In addition, the exponential growth of big data also fuels the adoption of agentic AI, which uses advanced algorithms to analyze large datasets and provide insights for faster, more informed decision-making, giving businesses a competitive advantage. The rise of AI as a service is further democratizing access to agentic AI technologies, enabling companies of all sizes to implement AI solutions without high initial infrastructure investments.

Furthermore, AI's ability to enhance productivity and efficiency across various sectors is significant. In finance, agentic AI can handle rapid trading and fraud detection by analyzing massive amounts of data in real time to facilitate quick decisions. Similarly, in healthcare, AI can assist doctors and specialists in diagnosing and recommending treatments for complex cases. Moreover, the integration of multiple automation systems to create end-to-end workflows powered by intelligent AI agents is expected to drive market growth.

Technology Insights

The Machine Learning (ML) segment led the market in 2024, accounting for over 29% revenue share of the global revenue, as it provides the foundational algorithms for agentic AI, enabling systems to learn from data and improve performance without explicit programming. ML algorithms are important for predictive analytics, pattern recognition, and decision-making processes, which are essential components of enterprise AI applications. The widespread deployment of ML across various industries has established its dominance, with enterprises leveraging ML for automating tasks and enhancing operational efficiency. Furthermore, the relative maturity and availability of ML tools and resources have facilitated its extensive adoption, contributing to its leading position in the enterprise agentic AI market.

The deep learning system segment is anticipated to grow at the highest CAGR during the forecast period. The ability of deep learning to process unstructured data, including images, speech, and text, makes it essential for advanced applications. Enterprises are increasingly leveraging deep learning for complex tasks such as natural language understanding, computer vision, and predictive modeling. These capabilities are essential for developing AI agents that can handle complicated and context-rich data. The increasing availability of large datasets and powerful computing resources further enables the development and deployment of deep learning models, driving its growth.

Agent System Insights

The single agent systems segment led the market in 2024 due to their simplicity and cost-effectiveness in automating specific, well-defined tasks. Single agent systems are easier to deploy and manage, making them a feasible option for enterprises seeking to automate routine processes without extensive integration efforts. These systems are commonly used in applications such as customer service chatbots, data entry automation, and simple decision-making tasks. The nature of single agent systems allows businesses to quickly realize the benefits of AI without the complexities associated with multi-agent architecture.

The multiple agent systems segment is anticipated to grow at the highest CAGR during the forecast period as enterprises increasingly require AI solutions that can handle complex, collaborative tasks. Multi-agent systems enable coordination and communication between multiple AI agents, allowing for problem-solving and decision-making capabilities. These systems are particularly valuable in scenarios such as supply chain optimization, robotic process automation, and distributed decision-making. The ability of multi-agent systems to mimic human collaboration and handle intricate workflows drives their adoption in organizations seeking advanced AI solutions.

Type Insights

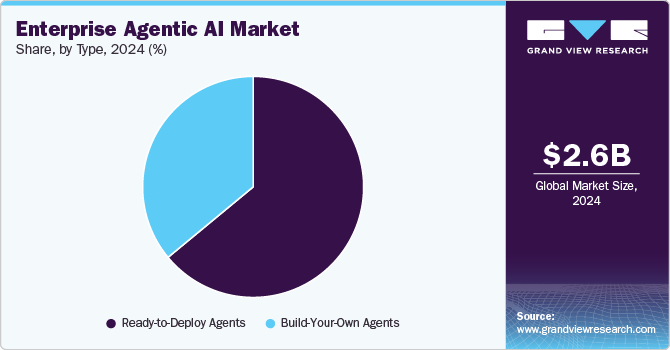

The ready-to-deploy agents segment led the market in 2024. These solutions offer immediate value and require minimal customization, making them convenient to enterprises seeking quick AI implementations. Ready-to-deploy agents address common business needs such as customer service, sales automation, and data analysis, providing a straightforward path to AI adoption. Their ease of integration and reduced development time enable businesses to realize the benefits of AI without the complexities and costs associated with custom development. The ease of implementation and accessibility of ready-to-deploy agents have contributed significantly to their widespread adoption, positioning them as a dominant force in the enterprise agentic AI market.

The build-your-own agents segment is expected to grow at the highest CAGR during the forecast period as enterprises seek tailored AI solutions that precisely meet their unique business requirements. Building custom AI agents allows organizations to address specific challenges and optimize processes that are not adequately served by off-the-shelf solutions. This approach provides greater control over AI functionalities, enabling businesses to fine-tune algorithms and integrate them seamlessly into existing systems. The increasing availability of AI development platforms and tools further empowers enterprises to create their own agents, driving the growth of this segment.

Application Insights

The customer service and virtual assistants segment led the market in 2024 due to the widespread adoption of AI-powered chatbots and virtual assistants for enhancing customer engagement and streamlining support operations. These AI agents provide 24/7 customer support, handle routine inquiries, and personalize customer interactions, improving overall customer satisfaction. The ability of virtual assistants to automate tasks, reduce response times, and provide consistent service has made them a critical component of modern customer service strategies. Their proven effectiveness in improving customer experiences and reducing operational costs has driven their widespread deployment, establishing this segment as a market leader.

The healthcare segment is expected to grow at the highest CAGR during the forecast period. Agentic AI can assist healthcare professionals in analyzing medical images, predicting patient outcomes, and personalizing treatment plans, improving the accuracy and efficiency of healthcare delivery. AI-powered virtual assistants can also support patient monitoring, medication management, and remote consultations, enhancing access to healthcare services.

The increasing demand for AI solutions in healthcare is driven by the need to improve patient outcomes, reduce costs, and address the growing shortage of healthcare professionals. For instance, according to a review published in the National Center for Biotechnology Information (NCBI), advances in AI are poised to revolutionize healthcare, potentially enabling a future characterized by more personalized, precise, predictive, and portable medical practices. As AI technologies continue to advance, their impact on the healthcare industry is expected to expand significantly.

Regional Insights

North America enterprise agentic AI industry dominated the global industry in 2024, accounting for a revenue share of over 39% due to its advanced technological infrastructure, substantial investments in AI research and development, and the presence of AI technology companies. The region's environment for innovation facilitates the rapid adoption of agentic AI solutions across different industries. North American enterprises are at the forefront of leveraging AI to enhance operational efficiency, improve decision-making, and deliver personalized customer experiences.

U.S. Enterprise Agentic AI Market Trends

The enterprise agentic AI industry in the U.S. is anticipated to exhibit a significant CAGR over the forecast period. U.S. enterprises are increasingly adopting agentic AI solutions to enhance productivity, streamline operations, and improve customer engagement. The presence of major technology companies and a supportive regulatory environment further contribute to the market's growth. As businesses across various sectors recognize the value of AI-driven automation and decision-making, the U.S. enterprise agentic AI industry is expected to grow rapidly.

Europe Enterprise Agentic AI Market Trends

The Europe enterprise agentic AI industry is expected to witness significant growth over the forecast period. The region's focus on innovation, combined with supportive government initiatives and funding for AI research, supports market expansion. European businesses are leveraging agentic AI to improve operational efficiency, enhance customer experiences, and develop new products and services. For instance, in January 2025, three major technology companies, Vantage Data Centres, Nscale, and Kyndryl, committed to an approximately USD 17 billion investment in the U.K. to establish the necessary AI infrastructure. Additionally, the region's strong emphasis on data privacy and ethical AI practices promotes responsible and sustainable AI deployment.

Asia Pacific Enterprise Agentic AI Market Trends

The enterprise agentic AI industry in the Asia Pacific is anticipated to register the highest CAGR over the forecast period. Countries such as China, India, and Japan are making substantial investments in AI research and development, which supports innovation and accelerates market growth. The adoption of agentic AI is expanding across various sectors, including manufacturing, healthcare, and finance, to improve efficiency, reduce costs, and enhance customer engagement. The increasing availability of data, coupled with advancements in AI technologies, further fuels the growth of the enterprise agentic AI industry in the Asia Pacific region.

China enterprise agentic AI market dominated the regional market in 2024 due to the country's substantial investments in AI research and development, supportive government policies, and a vast amount of available data. China's strategic focus on becoming a global leader in AI has driven significant advancements in AI technologies and their applications across various industries. Chinese enterprises are rapidly adopting agentic AI to automate processes, improve decision-making, and enhance competitiveness. The country's large population and increasing digital connectivity further fuel the demand for AI-powered solutions, contributing to its market dominance.

Key Enterprise Agentic AI Company Insights

Some key companies in the enterprise agentic AI industry are qBotica, NVIDIA Corporation, Accenture, and OpenAI

-

NVIDIA Corporation is primarily recognized for its hardware and software solutions that enable the development and deployment of AI applications. Their contributions span providing the AI infrastructure, including GPUs and AI Enterprise software, necessary for building sophisticated AI agents capable of reasoning, planning, and acting autonomously. Collaborations, such as the EY.ai Agentic Platform built with NVIDIA AI, showcase their crucial role in enhancing operational excellence across various industries, helping businesses navigate complexity with unprecedented intelligence.

-

OpenAI is impacting the enterprise agentic AI market by developing tools and APIs that enable developers and enterprises to build AI systems capable of independently accomplishing tasks on behalf of users. Their advancements include the Responses API, which facilitates the creation of context-aware outputs tailored for specific workflows, and the Agents SDK, which coordinates both single-agent and multi-agent workflows.

Key Enterprise Agentic AI Companies:

The following are the leading companies in the enterprise agentic AI market. These companies collectively hold the largest market share and dictate industry trends.

- qBotica

- NVIDIA Corporation

- SAP SE

- Oracle

- Accenture

- OpenAI

- Capgemini

- Celonis

- Dataiku

- Shield AI

Recent Developments

-

In March 2025, Capgemini, in collaboration with NVIDIA Corporation, announced the introduction of customized agentic solutions to accelerate enterprise AI adoption. These solutions are designed to provide end-to-end AI services tailored to meet the diverse needs of various industries. By leveraging NVIDIA NIM and a dedicated agentic gallery, Capgemini aims to streamline deployment and reduce complexity for enterprise clients, enabling them to derive actionable insights for agentic-driven business transformation.

-

In March 2025, Deloitte Touche Tohmatsu Limited introduced Zora AI, an agentic AI platform designed to offer a suite of AI agents for various business functions, including finance, human capital, sales and marketing, supply chain, procurement, and customer service. Zora AI agents can complete complex tasks and provide insights, reporting, analysis, workflow automation, data sourcing, and decision support.

-

In March 2025, Oracle and NVIDIA Corporation announced a collaboration to integrate NVIDIA's accelerated computing and inference software with Oracle's generative AI services and AI infrastructure, aiming to expedite the creation of agentic AI applications for organizations globally. This integration between the NVIDIA AI Enterprise software platform and Oracle ready-to-deploy agents infrastructure is to make more than 100 NVIDIA NIM microservices and over 160 AI tools natively available through the OCI Console.

Enterprise Agentic AI Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.67 billion

Revenue forecast in 2030

USD 24.50 billion

Growth rate

CAGR of 46.2% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, agent system, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.,; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

QBotica; NVIDIA Corporation; SAP SE; Oracle; Accenture; OpenAI; Capgemini; Celonis; Dataiku; Shield AI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Agentic AI Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global enterprise agentic AI market report based on the technology, agent system, type, application, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning

-

Natural Language Processing (NLP)

-

Deep Learning

-

Computer Vision

-

Others

-

-

Agent System Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Agent Systems

-

Multi Agent Systems

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Ready-to-Deploy Agents

-

Build-Your-Own Agents

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Customer Service and Virtual Assistants

-

Robotics and Automation

-

Healthcare

-

Financial Services

-

Security and Surveillance

-

Gaming and Entertainment

-

Marketing and Sales

-

Human Resources

-

Legal and Compliance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global enterprise agentic AI market size was estimated at USD 2.59 billion in 2024 and is expected to reach USD 3.67 billion in 2025.

b. The global enterprise agentic AI market is expected to grow at a compound annual growth rate of 46.2% from 2025 to 2030 to reach USD 24.50 billion by 2030.

b. North America dominated the enterprise agentic AI market with a share of over 39.0% in 2024. This is attributable to substantial investments in AI research and development and the presence of AI technology companies in the region.

b. Some key players operating in the enterprise agentic AI market include qBotica; NVIDIA Corporation; SAP SE; Oracle; Accenture; OpenAI; Capgemini; Celonis; Dataiku; and Shield AI.

b. Key factors that are driving the market growth include the increasing complexity of business environments and the essential need for rapid decision-making.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.