Enteric Empty Capsules Market Size, Share & Trends Analysis Report By Product (Gelatin Capsules, Vegetable Capsules), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-377-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Enteric Empty Capsules Market Trends

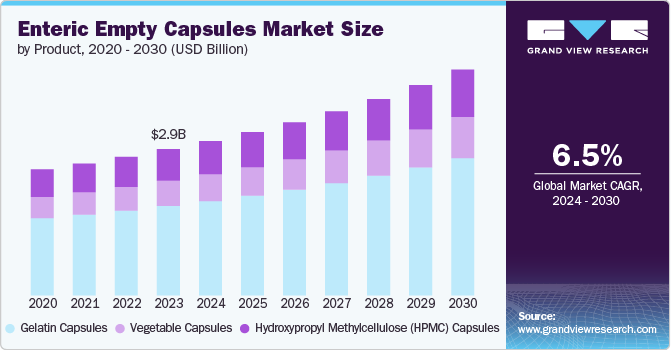

The global enteric empty capsules market size was estimated at USD 2.96 billion in 2023 and is projected to grow at a CAGR of 6.54% from 2024 to 2030. The growth of the market is driven by an increasing demand for pharmaceutical products, growing adoption of enteric capsules by pharmaceutical companies, rising prevalence of gastrointestinal disorders, and technological advancements in capsule manufacturing.

The pharmaceutical industry’s growth is a significant driver of the enteric empty capsules market. With the increasing global population and rising healthcare awareness, there is a growing demand for pharmaceutical products worldwide. They are widely used for encapsulating various drugs, especially those sensitive to gastric acid.In May 2021, Evonik launched EUDRACAP, a commercial-scale functional capsule for fast and effective drug development. EUDRACAP, based on oral drug delivery technology, accommodates sensitive molecules, including biologicals, from early development to commercial scaling.

Pharmaceutical companies are increasingly opting for enteric capsules due to their ability to protect drugs from degradation in the acidic environment of the stomach. This trend is driving the demand for enteric empty capsules in the market.In a March 2024 study from Nutrients, researchers found that an enteric-coated tablet formulation enables sodium bicarbonate protection in acidic conditions and its release in the intestine. This approach reduces the required dose to reach a blood bicarbonate level over 5 mmol∙L−1 from 300 mg∙kg−1 to 225 mg∙kg−1, cutting the dose by 25% and lessening gastrointestinal discomfort.

The increasing prevalence of gastrointestinal disorders such as acid reflux, ulcers, and inflammatory bowel diseases is fueling the demand for enteric empty capsules. Patients with these conditions often require medications that can bypass the stomach and release their contents in the intestines. This has led to a higher utilization in drug delivery systems.In a May 2024 publication in Molecular Pharmaceutics, researchers presented enteric-coated capsules designed for precise drug delivery to the distal ileum, effectively targeting the area richest in Peyer’s patches.

Advancements in capsule manufacturing technologies contribute to the market growth. Innovations such as improved coating techniques and materials have enhanced the performance and functionality, making them more appealing to pharmaceutical manufacturers. These technological advancements increase the efficiency and reliability in drug delivery applications.In May 2021, Qualicaps Europe introduced a new range of titanium dioxide-free capsules, catering to health-conscious consumers with over 25 color options, including an innovative extra-white vegan option. With more than 120 years of expertise, the company ensures high-quality encapsulation solutions for ingredient masking, enhancing consumer healthcare products.

Product Insights

Gelatin capsules segment held the largest market share of 61.21% in 2023. Gelatin capsules are driven their widespread use in the pharmaceutical industry. This is due to their adaptability, simple production process, and compatibility with various formulations. Their popularity among consumers stems from their ease of ingestion and digestibility. The growth in the nutraceuticals and dietary supplements industry worldwide boosts their demand, as they offer an ideal method for delivering these products. The rise of personalized medicine and custom dosage forms contributes to the increased need for gelatin capsules in this sector. In May 2022, Lonza Group Ltd. expanded its Capsugel range with Titanium Dioxide-Free White Hard Gelatin Capsules, offering a bright white alternative that complies with EU regulations, provides effective masking, and protects against light.

Hydroxypropyl Methylcellulose (HPMC) segment is expected to grow at the fastest CAGR over the forecast period. The HPMC market is growing due to demand for vegetarian, vegan-friendly, and non-animal-derived options. HPMC capsules are stable, suitable for controlled release, and preferred in pharmaceuticals and nutraceuticals for their natural ingredients. The trend towards HPMC over traditional gelatin capsules is expected to continue. In March 2024, an article by Zhejiang Huili Capsule Co., Ltd. highlighted that HPMC empty organic capsules were stable and resisted cross-linking or brittleness, making them suitable for encapsulating sensitive substances such as probiotics, enzymes, and certain pharmaceuticals.

Application Insights

Antibiotic and antibacterial drugs segment held the largest market share of 45.86% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The market is fueled by the rising prevalence of bacterial infections and the demand for effective drug delivery systems. They are designed to release medication in the small intestine, optimizing absorption and minimizing side effects, which is key for antibiotic efficacy. Pharmaceutical industry advancements, increase use in veterinary medicine for gastrointestinal infections, and their user-friendly features, such as ease of swallowing and less aftertaste.For instance, Capsuline supplies acid-resistant vegetarian capsules that are empty and designed for enteric use. These vegetarian acid-resistant products hold Kosher and Halal certifications and are manufactured in a facility adhering to cGMP standards and approved by the FDA.

Antacid and antiflatulent preparations segment is expected to grow at a significant rate over the forecast period. The antacid and antiflatulent segment is driven by the rising incidence of gastroesophageal reflux disease (GERD), peptic ulcers, and gastric disorders. In August 2023, a BMC Gastroenterology study revealed that 7.1% of participants experienced GERD symptoms. About 20% of Egyptian medical students suffer from GERD. Smoking cessation and stress management programs at universities may help combat the condition. These capsules effectively deliver these medications, protecting them from stomach acid and ensuring targeted release in the intestines, improving efficacy and reducing gastrointestinal side effects. Increasing awareness of functional gastrointestinal disorders (FGIDs) such as irritable bowel syndrome (IBS) and bloating, lead to higher demand for over-the-counter antacids and antiflatulents.

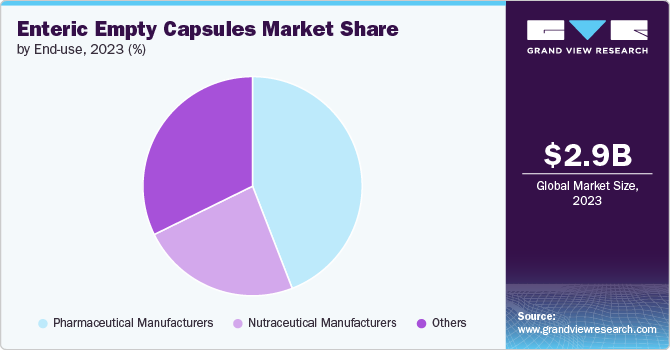

End-use Insights

Pharmaceutical manufacturers segment held the largest market share of 44.11% in 2023. The pharmaceutical manufacturers segment is driven by the increasing prevalence of gastrointestinal disorders globally, designed to protect active ingredients from stomach acid and ensure targeted delivery in the intestines. The rising geriatric population, requiring medications with enteric protection, boosts capsule consumption. Advancements in drug delivery technologies and stricter regulations on enteric coatings for certain medications compel pharmaceutical companies to invest in enteric capsule production.In November 2022, Lonza Group Ltd. introduced Capsugel Enprotect, the first coating-free capsule designed for intestinal delivery of acid-sensitive active pharmaceutical ingredients (APIs). This innovation aims to simplify manufacturing, speeding up drug development and first-in-human studies.

Nutraceutical manufacturers segment is expected to witness the fastest CAGR over the forecast period. In the nutraceutical manufacturers segment, key drivers include increasing awareness of digestive health, targeted nutrient delivery benefits, interest in personalized nutrition, and demand in the sports nutrition and dietary supplements market. This pushes the growth by encouraging nutraceutical companies to use them for optimal nutrient absorption, bioavailability, and differentiated product offerings.A March 2023 ACS Omega article emphasized that capsules are a practical method for delivering nutraceuticals, enabling large-scale, cost-effective production and easier preclinical and clinical trials through the use of gastro resistant shells for targeted and controlled release.

Regional Insights

North America dominated the global market with 42.74% share in 2023.In North America, the market is driven by factors such as the increasing prevalence of gastrointestinal disorders and the rising demand for nutraceuticals and dietary supplements. A March 2023 ACS Omega study reports a 20.2 per 100,000 annual incidence of inflammatory bowel disease (IBD) in North America, suggesting a genetic and immunological origin. New drug delivery methods like enteric-coated capsules and hydrogels are designed for targeted therapy in the gastrointestinal tract, showing promise in administering various medications. There is a notable increase in the adoption of enteric empty capsules in the region, with a growing number of pharmaceutical companies incorporating them into their product offerings.

U.S. Enteric Empty Capsules Market Trends

The market in the U.S. is expected to grow at a significant rate over the forecast period. The U.S represents a significant portion of the market in North America. This demand is fueled by the expanding pharmaceutical and nutraceutical industries. The U.S. market is characterized by a high level of research and development activities aimed at enhancing capsule formulations and ensuring optimal drug delivery mechanisms. Increasing consumer awareness regarding preventive healthcare measures and the benefits of dietary supplements is driving the uptake of enteric empty capsules among the population.In September 2022, the American Gastroenterological Association (AGA) launched the "Trust Your Gut" campaign to urge prompt discussions about bowel symptoms, highlighting that nearly 40% of Americans modify daily activities due to such issues. This initiative addresses the widespread impact of gastrointestinal diseases, emphasizing the importance of early conversation and intervention.

Europe Enteric Empty Capsules Market Trends

Europe market was identified as a lucrative region in this industry. In Europe, the market is experiencing notable growth supported by factors such as the increasing geriatric population, which has propelled the demand for pharmaceutical products. There is a rising trend towards personalized medicine and customized drug formulations in countries across Europe, driving innovation in enteric capsule technology. Stringent regulations governing pharmaceutical manufacturing processes are contributing to the overall quality standards observed in the production of enteric empty capsules in Europe. In October 2023, Roquette Frères acquired Qualicaps from Mitsubishi Chemical Group, aiming to broaden its pharmaceutical offerings and enhance its global footprint. This initiatives aims to combines Roquette’s expertise in excipients with Qualicaps’ capsule technologies, focusing to deliver a diverse range of superior pharmaceutical solutions.

Asia Pacific Enteric Empty Capsules Market Trends

Asia Pacific market is anticipated to witness the fastest CAGR from 2024 to 2030. The Asia Pacific region is emerging, driven by factors like rapid urbanization, increasing antibiotic and antibacterial drugs incomes, and a growing focus on healthcare infrastructure development. There is a surge in demand for enteric empty capsules in countries like China and India, where pharmaceutical manufacturing activities are on the rise. The market in Asia Pacific is also witnessing investments in research and development initiatives aimed at enhancing drug delivery systems through innovative capsule technologies.

Key Enteric Empty Capsules Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Enteric Empty Capsules Companies:

The following are the leading companies in the enteric empty capsules market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza

- Roquette Frères

- SUHEUNG

- Farmacápsulas

- Nectar Lifesciences Ltd.

- ZHEJIANG HUILI CAPSULES CO., LTD

- Shaoxing Zhongya Capsule Co., Ltd.

- Chemcaps Limited

- Fortcaps

- Natural Capsules Limited

Recent Developments

-

In June 2024, Lonza Group Ltd. introduced the Capsugel Enprotect. This innovation features a size 9 capsule designed for drug protection against stomach acid, ensuring enteric release. Targeted primarily at pre-clinical rodent testing, this development aims to fast-track the drug evaluation process.

-

In December 2023, the World Economic Forum included ACG Worldwide's capsule manufacturing facility in Pithampur, India in its Global Lighthouse Network. This network recognizes entities employing advanced technologies to significantly transform their operations and business models. ACG Worldwide serves as a supplier and service provider to the pharmaceutical sector.

-

In October 2023, Evonik unveiled a new EUDRACAP functional oral capsule for preclinical studies, adding a globally available size 9h enteric-coated capsule to its range. This enhances the EUDRACAP platform, easing the shift from preclinical to first-in-human studies and lowering drug developers' risks and complexities.

Enteric Empty Capsules Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.12 billion |

|

Revenue forecast in 2030 |

USD 4.56 billion |

|

Growth Rate |

CAGR of 6.54% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Lonza; Roquette Frères; SUHEUNG; Farmacápsulas ; Nectar Lifesciences Ltd.; ZHEJIANG HUILI CAPSULES CO., LTD; Shaoxing Zhongya Capsule Co., Ltd.; Chemcaps Limited; Fortcaps; Natural Capsules Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Enteric Empty Capsules Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enteric empty capsules market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gelatin Capsules

-

Hydroxypropyl Methylcellulose (HPMC) Capsules

-

Vegetable Capsules

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antacid and Antiflatulent Preparations

-

Antibiotic and Antibacterial Drugs

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Manufacturers

-

Nutraceutical Manufacturers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global enteric empty capsules market was valued at USD 2.96 billion in 2023 and is expected to reach USD 3.12 billion in 2024.

b. The global enteric empty capsules market is projected to grow at a compound annual growth rate (CAGR) of 6.54% from 2024 to 2030 to reach USD 4.56 billion by 2030.

b. Gelatin capsules segment dominated the enteric empty capsules market with a share of 61.21% in 2023. Gelatin capsules are driven their widespread use in the pharmaceutical industry. This is due to their adaptability, simple production process, and compatibility with various formulations

b. Some key players operating in the enteric empty capsules market include Lonza, Roquette Frères, SUHEUNG, Farmacápsulas , Nectar Lifesciences Ltd., ZHEJIANG HUILI CAPSULES CO., LTD, Shaoxing Zhongya Capsule Co., Ltd., Chemcaps Limited, Fortcaps, Natural Capsules Limited

b. Key factors that are driving the market growth include increasing demand for pharmaceutical products, growing adoption of enteric capsules by pharmaceutical companies, rising prevalence of gastrointestinal disorders, and technological advancements in capsule manufacturing

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."