Enriched Biochar Market Size, Share & Trends Analysis Report By Application (Agriculture, Gardening, Turf), By Region (Europe, North America, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-157-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Enriched Biochar Market Size & Trends

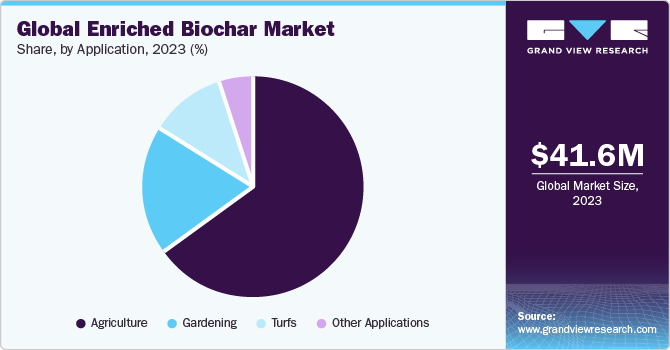

The global enriched biochar market size was valued at USD 41.6 million in 2023 and is anticipated to witness a compound annual growth rate (CAGR) of 8.7% from 2024 to 2030. The growth is attributed to the growing demand for environment-friendly soil improvement products. The increasing requirement to improve crop yield has resulted in the surged utilization of chemical fertilizers in agriculture, leading to the risen acidity levels of the soil. As such, the adoption of new farming practices is being promoted across the world that has led to the proliferation of substitutes for conventional inorganic soil improvement products. Farmers are becoming aware of the benefits of various organic products that has led to a significant rise in the awareness among the manufacturers of these products about using environment-friendly raw materials.

However, lack of awareness about the product among consumers has been a major concern for the market. Most of the farmers are still using synthetic pesticides for crop protection and enhancing plant growth. A large section of farmers across the world is still unaware of the benefits of enriched biochar over other fertilizers and therefore, avoid using enriched biochar for soil amendment or crop growth. Thus, farmers and consumers have to be taught by soil scientists and horticulturalists about the potential benefits of the products.

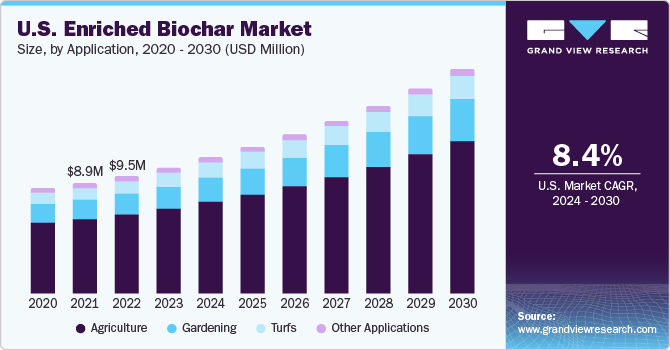

The U.S. is the largest consumer of the product in North America with a revenue share of 80.8% in 2023. Enriched biochar serves as an effective soil amendment to improve soil quality and enhance nutrient retention. By incorporating essential nutrients such as nitrogen, phosphorus, and potassium into the biochar, it becomes a powerful tool in sustainable farming practices. This allows for reduced reliance on synthetic fertilizers, leading to improved soil health and decreased nutrient runoff into water bodies.

Furthermore, the porosity of enriched biochar enables it to act as a sponge, which helps in retaining water and reducing irrigation needs, contributing to water conservation efforts. In the U.S., where agriculture plays a vital role in the economy and faces challenges such as soil degradation and water pollution, enriched biochar presents a promising solution. According to the U.S. Department of Agriculture, agriculture, food, and related industries accounted for 5.4% of the total GDP of the country, amounting to USD 1.26 trillion in 2021. Thus, the advancing agricultural industry in the country is anticipated to drive the demand for the product over the forecast period.

Application Insights

The agriculture application segment dominated the market with a share of 65.4% in 2023. This growth is attributed to the fact that it improves the physical, chemical, and biological properties of soil. By enhancing water retention, reducing soil erosion, and promoting aeration, it creates an optimal environment for root development and nutrient absorption by plants. Its porous structure acts as a sponge, effectively retaining essential nutrients like nitrogen, phosphorus, and potassium, making them available to plants over an extended period.

Turf is another application segment anticipated to dominate the market over the forecast period. Enriched biochar has emerged as a promising solution for enhancing turf management and maintaining lush green lawns. This carbon-rich substance offers numerous benefits that contribute to soil health and plant growth. Firstly, it improves soil structure by acting as a sponge, effectively retaining water and nutrients in the soil. This leads to reduced water runoff, enhanced water infiltration, and decreased irrigation needs for the turf.

Additionally, it serves as a nutrient reservoir, preventing leaching and loss while providing a steady supply of nutrients to the turf's roots. Its porous structure also promotes beneficial microbial activity in the soil, fostering symbiotic relationships with mycorrhizal fungi and nitrogen-fixing bacteria. These microorganisms aid in nutrient acquisition and disease suppression, further supporting the health of the turf.

Furthermore, the application of enriched biochar in turf management offers a sustainable approach to carbon sequestration. As biochar remains in the soil for long periods, it effectively stores carbon, mitigating greenhouse gas emissions and contributing to climate change mitigation efforts. Overall, by harnessing the power of enriched biochar, turf professionals can create and maintain vibrant lawns while minimizing environmental impact and reducing reliance on synthetic inputs.

Regional Insights

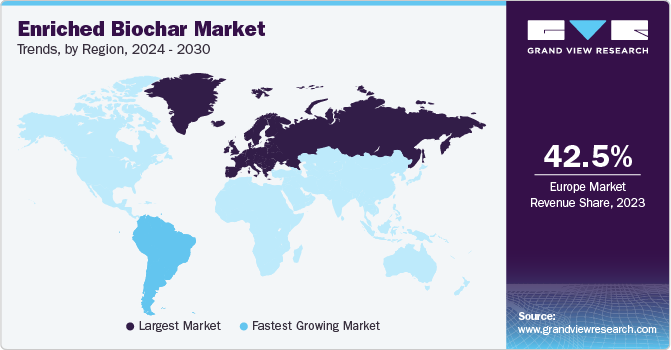

Europe dominated the market with a revenue share of 42.5% in 2023. This growth is attributed to the growing demand for organic and sustainable farming practices in Europe. According to the European Environment Agency, the European Green Deal initiatives, including the EU Biodiversity Strategy for 2030 and the Farm to Fork strategy, have set a goal of having at least 25% of the EU's utilized agricultural area (UAA) dedicated to organic farming by 2030.

The UAA dedicated to organic farming in the EU has been steadily increasing since 2012, driven by the growing demand for organic products and supportive policies. As of 2021, approximately 16 million hectares, equivalent to 9.9% of the EU's UAA, were under organic farming. Thus, with advancing organic farming in the region, the demand for biochar and enriched biochar is anticipated to witness growth over the forecast period.

The demand for the product in Spain is growing due to the increasing recognition of its benefits in agriculture, the emergence of carbon markets and carbon credits, the need for sustainable solutions, and the relevance of biochar for specific crops grown in Spain. According to USDA, Spain accounted for 20% of the total organic acreage in Europe with 2.7 million hectares of land in 2022 witnessing a growth of 2.3% compared to 2021. This growing demand for organic food in the country is anticipated to drive the demand for enriched biochar used to replace synthetic fertilizers in organic farming.

Latin America is another region anticipated to witness growth over the forecast period. Brazil, Argentina, Mexico, and Colombia are the major contributors to the enriched biochar industry growth in Latin America. The significant growth of agriculture sector, mainly in Brazil, to enhance the production of Brazilian soybean is the key driving factor for the product market in Latin America.

Moreover, according to the Federal Ministry for Economic Affairs and Climate Action, Latin America is the largest net food exporting region. It is responsible for producing 13% of the global agricultural goods and fish, making a significant contribution to 25% of the world's food exports in 2022. Thus, the advancing demand for agricultural production is anticipated to drive the demand for enriched biochar to improve soil productivity in the region over the forecast period.

Key Companies & Market Share Insights

The market is consolidated with a very limited number of players. Companies compete on the basis of quality of products and technologies used for manufacturing them. An increasing focus of companies on new product launches, expansions, and partnerships is expected to be a key trend in the market. In July 2023, A joint venture comprising Canadian and French companies, namely Airex Energy, Groupe Rémabec, and SUEZ, has recently unveiled plans to invest a significant sum of USD 58.3 million toward the establishment of the largest biochar production facility in North America.

Key Enriched Biochar Companies:

- Carbon Gold Ltd

- The Natural Charcoal Company

- The Dorset Charcoal Company

- Swiss Biochar GmbH

- CharGrow

- SymSoil

- Engrow Carbon Energy Private Limited

- SoilFixer

- Bio365

Enriched Biochar Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 45 million |

|

Revenue forecast in 2030 |

USD 74.7 million |

|

Growth rate |

CAGR of 8.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; Spain; UK; France; Italy; China; India; Japan; South Korea; Colombia; Brazil; Mexico; Ecuador; Venezuela; Saudi Arabia; South Africa |

|

Key companies profiled |

Carbon Gold Ltd; The Natural Charcoal Company; The Dorset Charcoal Company; Swiss Biochar GmbH; CharGrow; SymSoil; Engrow Carbon Energy Private Limited; SoilFixer; Bio365 |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Enriched Biochar Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enriched biochar market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Gardening

-

Turfs

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Spain

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Colombia

-

Brazil

-

Mexico

-

Ecuador

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enriched biochar market size was estimated at USD 41.6 million in 2023 and is expected to reach USD 45 million in 2024.

b. The global enriched biochar market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 74.7 million by 2030.

b. Europe dominated the enriched biochar market with a share of 42.5% in 2023. This is attributable to the growing demand for organic and sustainable farming practices in the region

b. Some key players operating in the enriched biochar market include Carbon Gold Ltd., The Natural Charcoal Company, The Dorset Charcoal Company, and CharGrow.

b. Key factors that are driving the market growth include increasing requirement to improve crop yield, and growing awareness amongst farmers regarding the benefits of organic products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."