- Home

- »

- Next Generation Technologies

- »

-

Engineering Services Market Size, Industry Report, 2030GVR Report cover

![Engineering Services Market Size, Share & Trends Report]()

Engineering Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Engineering Discipline (Civil, Mechanical, Electrical), By Engineering Service Type, By Application (Infrastructure Development, Industrial Projects), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-326-9

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Engineering Services Market Summary

The global engineering services market size was estimated at USD 3,419.59 billion in 2024 and is projected to reach USD 4,722.7 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. This growth is primarily driven by increasing investments in infrastructure development, energy transformation initiatives, and industrial automation in both developed and emerging markets.

Key Market Trends & Insights

- Asia Pacific accounted for the largest revenue share of nearly 37% in 2024.

- The U.S. engineering services market is witnessing steady growth.

- By engineering service type, the non-memory ATE segment accounted for the largest market share of over 19% in 2024.

- By application, the environmental projects segment dominated the engineering services market in 2024.

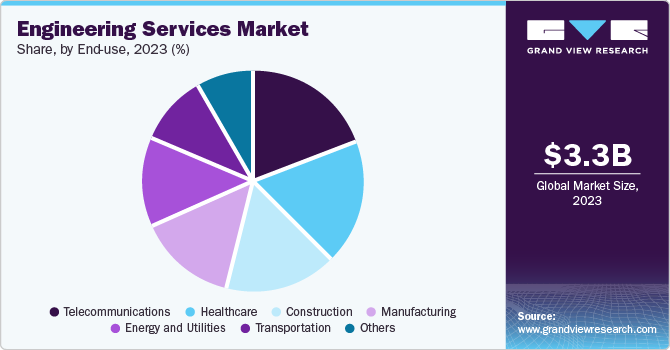

- By end-use, the communications segment is currently leading the market for engineering services.

Market Size & Forecast

- 2024 Market Size: USD 3,419.59 billion

- 2030 Projected Market Size: USD 4,722.7 billion

- CAGR (2025-2030): 5.7%

- Asia Pacific: Largest market in 2024

Governments are focusing on upgrading transport, water and sanitation, and clean energy infrastructure, leading to a steady demand for engineering design, consulting, and construction-related services. In addition, private sector investments in smart manufacturing, commercial buildings, and data centers are boosting the market. Engineering companies play a crucial role in helping clients meet project deadlines, comply with environmental regulations, and improve cost-effectiveness through integrated services across the planning, design, and execution stages.One significant trend in the international market for engineering services is the growing adoption of digital tools and processes. Technologies such as Building Information Modeling (BIM), digital twins, and AI-driven simulations are transforming the planning and delivery of engineering projects. These innovations promote collaboration, reduce design flaws, and enhance asset lifecycle management. Many companies are investing in software integration and digital infrastructure to automate workflows and improve project visibility. As clients increasingly demand faster delivery and greater accuracy, digital transformation has become central to engineering service offerings for construction, energy, industrial, and infrastructure projects worldwide.

Furthermore, there is a growing emphasis on sustainability and regulatory compliance in engineering projects. With more stringent emissions regulations, energy efficiency requirements, and environmental assessment procedures, engineering firms are expanding their services to include green design, renewable energy systems, and low-impact infrastructure planning. These services cover solar and wind project design, sustainable material selection, and energy modeling for buildings and industrial facilities. Customers across various industries-including transportation, utilities, manufacturing, and real estate-are demanding environmentally sustainable project execution, which is consequently altering service scopes and technical specifications in engineering contracts.

Moreover, the Leading Companies in the engineering services sector are actively expanding geographically, enhancing their digital capabilities, and pursuing high-value public and private sector projects. Companies such as AECOM, WSP Global, Jacobs Engineering Group, and Bechtel are engaged in large-scale infrastructure, energy, and urban development projects in North America, Europe, and Asia Pacific. Regional and mid-sized companies are also capitalizing on their specialties in MEP design, environmental consulting, and civil works. Many firms are forming joint ventures, acquiring boutique consultancies, and improving their in-house capabilities to respond more effectively to complex, multi-disciplinary projects in both local and global markets.

Engineering Service Type Insights

The Non-Memory ATE segment accounted for the largest market share of over 19% in 2024, driven by consistent demand for project planning, feasibility studies, regulatory advisory, and design optimization across infrastructure, energy, and industrial sectors. Clients now more than ever depend on consulting firms to facilitate regulatory compliance, cost control, and risk mitigation at initial stages of a project. Public sector project work and high-value private development, particularly in developed economies, continue to generate stable income for this segment. The increasing size and complexity of projects and the trend towards holistic planning methodologies have further established consulting services as a key element in the value chain of engineering services.

On the other hand, the specialized engineering services is poised to experience the highest growth during the next few years. This involves sophisticated services in geotechnical, environmental, structural, and systems engineering. Growing technical sophistication in infrastructure and industrial projects is leading clients to hire firms with specialized domain knowledge. Moreover, growing demand for services in renewable energy systems, smart grid infrastructure, water treatment, and advanced manufacturing is opening up opportunities for niche engineering providers. As sustainability, automation, and digital infrastructure increasingly shape project demand, expert engineering capabilities are assuming greater significance in international and regional markets, especially in energy, utilities, and transport markets.

Application Insights

The environmental projects segment dominated the engineering services market in 2024, fueled by rising global focus on sustainability, climate change reduction, and natural resource management. Public sectors, industries, and private organizations are spending heavily on projects related to waste management, water treatment, air quality management, and renewable energy systems. As nations introduce stricter environmental standards, engineering companies are serving to design and implement green infrastructure, environmental cleanups, and green urban planning. As increased awareness of the environmental footprint of building and industrial operations takes effect, this sector is anticipated to remain at the helm of the market for the foreseeable future.

On the other hand, technology implementation segment is registering the fastest growth, driven by the growing adoption of digital solutions and automation in engineering projects. Solutions such as Building Information Modeling (BIM), digital twins, artificial intelligence (AI), and Internet of Things (IoT) are revolutionizing engineering services delivery. These solutions provide enhanced project efficiency, real-time data analysis, and better predictive modeling for infrastructure and industrial projects. The embedding of intelligent systems within buildings, transportation, and energy management is fueling demand for technology implementation services, hence it is among the fastest-growing sectors in the engineering services sector.

End-use Insights

The communications segment is currently leading the market for engineering services, primarily due to the ongoing expansion of 5G networks, data centers, and telecommunications infrastructure worldwide. As the demand for fast internet and connectivity increases, engineering companies play a crucial role in designing and deploying network infrastructure, such as towers, fiber optics, and data storage units. The rising complexity of telecommunications projects, combined with the need for reliable and scalable systems, ensures that this sector continues to drive significant market growth. In addition, the momentum towards smart cities and the growing reliance on interconnected devices further accelerates the demand for specialized engineering services in this field.

The construction segment is experiencing the fastest growth, fueled by a surge in residential, commercial, and public infrastructure projects globally. Rapid urbanization in emerging economies, along with ongoing infrastructure investments in developed economies, is driving the construction industry's expansion. Engineering services related to structural design, civil engineering, project management, and green building practices are in high demand. With an increasing focus on green building certification, energy-efficient designs, and advanced construction methods, the building construction sector is emerging as one of the key drivers of demand for engineering services, making it one of the most rapidly growing end-use segments in the market.

Engineering Discipline Insights

The civil engineering segment accounts for a significant portion of the engineering services market, primarily due to the high demand for infrastructure development across various sectors, including transportation, water systems, and urban planning. Civil engineers are vital in designing, constructing, and maintaining essential infrastructure projects such as roads, bridges, airports, and public utilities. As governments and the private sector prioritize infrastructure development, civil engineering remains a dominant segment, particularly in emerging markets, where rapid urbanization and industrial growth lead to an increased demand for civil works.

Moreover, the civil engineering discipline is experiencing the fastest growth, driven by a rise in large-scale infrastructure projects, especially in emerging economies. With urbanization accelerating and populations expanding, there is an urgent need for sustainable infrastructure, efficient transportation networks, and resilient buildings. The increasing focus on smart cities, green construction, and climate-resilient infrastructure further boosts the demand for civil engineering services. This trend is particularly evident in regions such as Asia Pacific, where substantial investments in public infrastructure, including roads, bridges, and water systems, are anticipated to continue propelling the sector's rapid growth.

The printed circuit board (PCB) testing automated test equipment segment is projected to experience the highest growth rate during the forecast period. This expansion is primarily driven by the increasing global need for miniature, multilayer, and high-density circuit boards utilized in a broad range of electronic devices. Since PCBs are the backbone of all electronics, their integrity and functionality are of utmost importance. Growing miniaturization, increasingly sophisticated circuit designs, and the inclusion of high-speed signal paths have dramatically increased the challenge of testing accuracy. Automated PCB test equipment assists manufacturers in identifying faults including open circuits, shorts, and component misplacements effectively during in-circuit and functional test phases. In addition, the fast growth in consumer electronics, EV production, and medical electronics is further driving the demand for cutting-edge PCB testing technologies that provide speed, precision, and reliability in high-volume production settings.

Regional Insights

Asia Pacific accounted for the largest revenue share of nearly 37% in 2024 in the Engineering Services Market. The region is expected to witness a significant growth at a CAGR of 6.5%. The Asia Pacific engineering services industry is growing because of increased urbanization, industrialization, and infrastructure investments in emerging as well as developed economies. Governments in nations such as China, India, Japan, and Australia are budgeting for smart cities, renewable energy, and transportation networks. There is demand for engineering services across sectors such as rail, highways, energy, and manufacturing. Public-private partnerships are prevalent, particularly in infrastructure-driven markets. Engineering companies are adjusting to tighter environmental regulations, computer-aided design processes, and automation. As local supply chains become more diversified, numerous companies are also providing product engineering, plant design, and energy systems consulting to respond to changing project and compliance requirements.

China engineering services market is driven by ongoing urban infrastructure growth, high-speed rail development, and the government push towards renewable energy and digital manufacturing. Engineering companies are engaged in large-scale public works, such as water management, metro networks, and industrial parks. The move to carbon neutrality by 2060 has boosted demand for energy-efficient design and engineering contribution in wind, solar, and hydrogen facilities. Domestic companies usually collaborate with state-owned companies, whereas foreign companies generally participate through joint ventures or technical consulting positions. Implementation of intelligent engineering tools such as BIM and AI-based modeling is on the rise to enhance project efficiency and lifecycle performance.

Engineering services market in India is expanding with countrywide infrastructure growth, manufacturing expansion, and digitization in construction. Government initiatives such as Bharatmala, Smart Cities Mission, and Make in India are fueling demand for civil, structural, and mechanical engineering services. An expanding market for outsourced engineering services in design, simulation, and product development to serve global customers also exists. Renewable energy initiatives and public transport networks such as metro rail and expressways are among the prominent contributors. Multinational and domestic engineering companies are increasing capacity, particularly in Tier 2 towns, and embracing digital engineering processes to facilitate cost-effective and sustainable project delivery.

North America Engineering Services Market Trends

The North America engineering services market is underpinned by continued investment in infrastructure upgrades, renewable energy growth, and digitalization of construction and manufacturing. Public investment in transportation, water infrastructure, and broadband through U.S. federal infrastructure programs is fueling the demand for civil and structural engineering services. Private sector projects in data centers, electric vehicle manufacturing, and smart buildings are also offering opportunities for mechanical, electrical, and systems engineering. Environmental compliance, energy efficiency, and climate resilience are major themes influencing project needs. Engineering companies are also embracing digital technologies such as BIM, GIS, and simulation software to enhance project planning, coordination, and delivery.

U.S. Engineering Services Market Trends

The U.S. engineering services market is witnessing steady growth fueled by infrastructure revitalization, clean energy projects, and investments in advanced manufacturing. Federal efforts such as the Infrastructure Investment and Jobs Act are driving demand for engineering in highways, bridges, public transportation, and water systems. Renewable energy, such as solar, wind, and energy storage, also has rising activity. Investments by the private sector in semiconductor facilities, EV manufacturing facilities, and logistics infrastructure further contribute to market demand. Engineering companies are emphasizing integrated project delivery, sustainability, and digital engineering tools such as BIM, digital twins, and automation to enhance efficiency and comply with regulatory requirements.

Europe Engineering Services Market Trends

The Europe engineering services market is influenced by continued infrastructure development, green energy programs, and intensifying digitalization in industries. Demand is generated primarily through transportation modernization, energy efficiency requirements, and government spending on city development. Western and Northern European countries are concentrating on sustainable infrastructure, while Central and Eastern Europe are experiencing growth in industrial engineering and energy projects. The rise of design-build and EPC contracts is significant, as public and private clients look for integrated solutions. Engineering companies are also increasing offerings in digital twin technology, BIM, and smart infrastructure to meet Europe's changing regulatory and environmental objectives.

The UK engineering services market continues to grow with significant emphasis on decarbonization and renewal of infrastructure. Work on National Infrastructure Strategy projects such as high-speed rail (HS2), upgrade of road networks, and development of offshore wind further propels stable demand. Both design and delivery phases have participation by engineering firms with increasing attention towards sustainability and meeting building safety regulations after Grenfell. Public sector procurement continues to be significant, while private clients are investing in smart buildings and retrofitting existing buildings. The trend towards modular construction and digital engineering tools is affecting the way firms plan and deliver engineering services across sectors.

Engineering services market in Germany is driven by industrial modernization, energy transition objectives, and infrastructure resilience. Engineering companies are backing energy-efficient building retrofits, public transport system upgrades, and automotive sector transformation. The nation's initiative towards renewable energy and hydrogen infrastructure has generated engineering demand in complicated energy systems. Moreover, old bridges, tunnels, and roads are being refurbished with technical assistance from civil and structural engineering companies. In production, firms are looking for process engineering and automation services in order to remain competitive. Digital engineering technologies such as simulation tools and BIM are being widely used to enhance project efficiency and compliance.

Key Engineering Services Company Insights

Some of the key players operating in the market are STRABAG SE, Jones Lang LaSalle Incorporated, Balfour Beatty Inc., among others.

-

STRABAG SE offers engineering services related to construction in the areas of transportation infrastructure, building construction, and civil engineering. The firm has its headquarters in Austria and serves all over Europe and chosen overseas markets. STRABAG deals with technical facility management, large-scale infrastructure projects, and integrated design-to-delivery engineering solutions such as energy and environmental technologies.

-

Jones Lang LaSalle Incorporated (JLL) provides engineering and technical consulting solutions as part of its overall real estate and facilities management business. JLL provides building systems design, energy management, sustainability, and infrastructure optimization solutions. It provides services to industries such as commercial real estate, industrial facilities, and public infrastructure.

-

Balfour Beatty Inc. offers engineering and construction services across the civil infrastructure, transportation, and utilities markets. Headquartered in the UK with substantial operations in the U.S., the firm undertakes sophisticated engineering work such as railways, highways, and energy networks. It also offers lifecycle support such as maintenance and refurbishment.

AECOM Engineering Company, NV5 Global, Inc., and Barton Malow are some of the emerging market participants in the Engineering Services Market.

-

AECOM Engineering Company provides multidisciplinary engineering, architecture, and construction services for sectors such as transportation, water, defense, and environmental systems. AECOM is active globally, working with public authorities and private clients on long-term capital improvement programs and infrastructure modernization.

-

NV5 Global, Inc. is a company which provides infrastructure, environmental, utility, and construction market compliance, consulting, and engineering services. NV5's services include geotechnical engineering, transportation design, energy optimization, and building code consulting. NV5 both consults private developers and works with public sector agencies, primarily in North America.

-

Barton Malow is an American company providing construction and engineering solutions in the industrial, education, healthcare, and sports markets. The firm assists project delivery using design-assist, integrated project delivery (IPD), and preconstruction services, with a focus on efficiency and teamwork in the engineering stage.

Key Engineering Services Companies:

The following are the leading companies in the engineering services market. These companies collectively hold the largest market share and dictate industry trends.

- STRABAG SE

- Jones Lang LaSalle Incorporated

- Balfour Beatty Inc.

- Kiewit Corporation

- AECOM Engineering company

- NV5 Global, Inc.

- Barton Malow

- Brasfield & Gorrie LLC

- Nearby Engineers

- RMF Engineering Inc.

- Bechtel Corporation

- Gilbane Building Company

- WSP Global Inc.

- Jacobs Engineering Group

Recent Developments

-

In 2024, STRABAG SE, together with PORR AG, entered into a purchase agreement to buy assets of the VAMED Group, including Vienna General Hospital (AKH Wien) technical operations management and construction projects divisions, Austrian project development business, and spa holdings, for around €90 million. The acquisition is expected to strengthen the service portfolio of STRABAG in technical facility management in the medical segment.

-

In 2025, Balfour Beatty won an $889 million deal from the Texas Department of Transportation to rebuild 2.3 miles of Interstate 30 in east Dallas County. The project will start pre-construction work in 2026, demonstrating the company's presence in the U.S. infrastructure market.

-

In 2024, Glenfarne Group LLC hired Kiewit as the construction contractor for its planned Texas LNG export terminal in Brownsville, Texas. The facility will be capable of converting about 0.5 billion cubic feet per day of natural gas into 4 million tonnes of liquefied natural gas per year. Construction was scheduled to start by November 2024.

Engineering Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,578.2 billion

Revenue forecast in 2030

USD 4,722.7 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Engineering service type, engineering discipline, application, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

STRABAG SE; Jones Lang LaSalle Incorporated; Balfour Beatty Inc.; Kiewit Corporation; AECOM Engineering company; NV5 Global, Inc.; Barton Malow; Brasfield & Gorrie LLC; Nearby Engineers; RMF Engineering Inc.; Bechtel Corporation; Gilbane Building Company; WSP Global Inc.; Jacobs Engineering Group

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Engineering Services Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global engineering services market report based on engineering service type, engineering discipline, application, end-use and region:

-

Engineering Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Design and Development

-

Consulting

-

Construction and Project Management

-

Maintenance and Support

-

Specialized Engineering Services

-

Technology Integration

-

-

Engineering Discipline Outlook (Revenue, USD Million, 2018 - 2030)

-

Civil

-

Mechanical

-

Electrical

-

Piping and Structural

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrastructure Development

-

Industrial Projects

-

Technology Implementation

-

Environmental Projects

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrastructure Development

-

Industrial Projects

-

Technology Implementation

-

Environmental Projects

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global engineering services market size was estimated at USD 3.41 trillion in 2024 and is expected to reach USD 3.58 trillion in 2025.

b. The global engineering services market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 4.71 trillion by 2030.

b. Asia Pacific dominated the engineering services market with a share of nearly 37% in 2024. This is attributable to the rapid economic expansion, which fuels extensive investments in infrastructure across transportation, energy, telecommunications, and urban development sectors.

b. Some key players operating in the engineering services market include STRABAG SE, Jones Lang LaSalle Incorporated, Balfour Beatty Inc., Kiewit Corporation, AECOM Engineering company, NV5 Global, Inc., Barton Malow, Brasfield & Gorrie LLC, Nearby Engineers, RMF Engineering Inc, Bechtel Corporation, Gilbane Building Company, WSP Global Inc among others.

b. Key drivers include the adoption of automation, AI, and IoT, which enhance productivity and efficiency. Rapid urbanization and government investments in infrastructure, along with the push for eco-friendly practices due to stringent environmental regulations, are also propelling the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.