- Home

- »

- Plastics, Polymers & Resins

- »

-

Engineering Plastics Market Size And Share Report, 2030GVR Report cover

![Engineering Plastics Market Size, Share & Trends Report]()

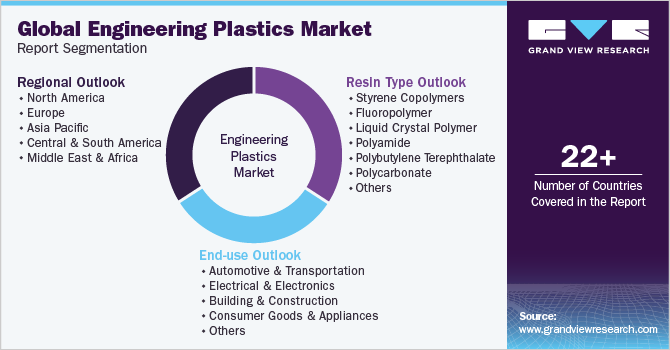

Engineering Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Resin Type (ABS, LCP, PA, PET, PC), By End-use (Automotive & Transportation, Electrical & Electronics, Building & Construction, Industrial, Aerospace), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-249-3

- Number of Report Pages: 154

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Engineering Plastics Market Summary

The global engineering plastics market size was estimated at USD 133.62 billion in 2023 and is projected to reach USD 230.64 billion by 2030, growing at a CAGR of 7.8% from 2024 to 2030. The industry growth is primarily driven by the rising demand for engineering plastics across diverse end-use sectors, such as packaging, automotive, and construction due to its attributes, such as low weight, high durability, and cost-effectiveness.

Key Market Trends & Insights

- The engineering plastics market in Asia Pacific led the global industry and accounted for a 45% share of the global revenue in 2023

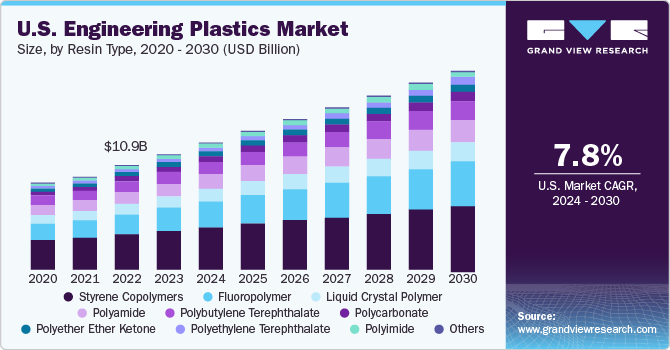

- The U.S. engineering plastic market is expected to grow at a CAGR of 6.5% from 2024 to 2030.

- By resin type, The styrene copolymers (ABS and SAN) segment held the largest share of 33.7% in 2023.

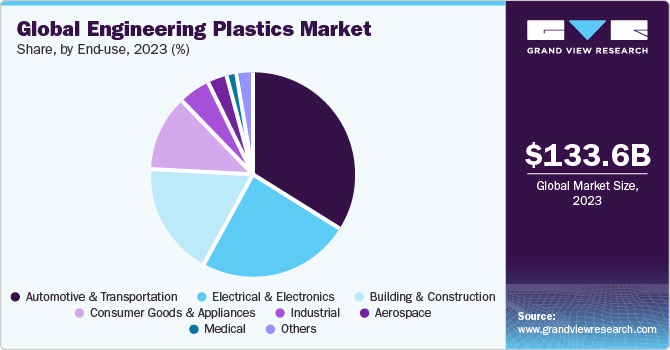

- By end use, The automotive & transportation end-use segment dominated the market and accounted for the largest share of over 34.85% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 133.62 Billion

- 2030 Projected Market Size: USD 230.64 Billion

- CAGR (2024-2030): 7.8%

- Asia Pacific: Largest market in 2023

In recent years, there has been significant product demand to replace alloys and metals in various industries, such as industrial machinery, automobile, and consumer goods. The critical importance of the industry lies in technology, as ever-increasing end-user demands for versatility and product specifications gradually tend to overshadow consumption dynamics.

Other factors, such as production processes, raw material availability, and socio-political events also have a significant influence on industry trends. Rapid industrial growth and the expanding machinery industry across the region create opportunities for manufacturers to enhance their machinery and automation solutions. For instance, in July 2022, Vaski entered the U.S. and Mexican industrial machine service and sales market. The company offers punching, bending, shearing, and advanced automation technologies. This development is expected to boost the production of various engineered plastic resins.

Market Concentration & Characteristics

The market is slightly concentrated with the presence of several key players, such as Eastman Chemical Company, Chevron Phillips Chemical Company LLC, Evonik Industries AG, and Mitsubishi Engineering-Plastics Corp. These companies launch new products to meet the rising demand for products, such as Polyethylene Terephthalate (PET) and polybutylene terephthalate (PBT). For instance, in February 2023, Polyplastics Co., Ltd., an engineering plastics manufacturer, announced the launch of a new PBT, namely, DURANEX 201EB PBT resin. This is an electrically conductive grade resin for millimeter wave radar applications in the automotive industry.

With rising concerns regarding the use of engineering plastics and their compounds, an increase in demand for alternatives, such as biodegradable plastics, wood-based compounds, bioplastics, glass, and aluminum, has been observed. With ongoing innovations and new product developments, manufacturers in the industry are shifting their attention toward the development of bio-based plastics. This trend is now pushing manufacturers to develop new bio-based and easy-to-recycle engineering plastics.

The engineering plastics market is marked by its global presence and significant market players. Key manufacturers operate on a multinational scale, catering to the demands of diverse industries across the world. This global footprint allows for a widespread distribution network and ensures timely availability of these materials to end-users.

Additionally, sustainability and environmental consciousness are increasingly shaping the engineering plastics market. With growing concerns over plastic waste and its impact on the environment, there is a rising demand for eco-friendly alternatives and recyclable engineering plastics. Manufacturers are investing in research and development to create sustainable solutions without compromising on performance, thereby aligning with the principles of circular economy and sustainable development.

Resin Type Insights

The styrene copolymers (ABS and SAN) segment held the largest share of 33.7% in 2023. Acrylonitrile butadiene styrene (ABS) finds major applications in the electrical & electronics industry. However, the growing application scope of these compounds in the automotive industry is expected to provide the segment with growth opportunities. The product is used in bumpers, interior components, and automotive trims, and its usage scope is expected to increase, considering the high production of lightweight passenger cars, especially in North America and Europe.

The demand for polycarbonate (PC) has experienced a substantial rise, particularly within electrical and automotive applications, marking potential growth in recent times. The innate malleability and flexibility of this polymer make it an exceptional candidate for thermoforming applications. Setting itself apart from its thermoplastic counterparts, polycarbonate exhibits a remarkable ability to undergo substantial plastic deformations without succumbing to fractures or cracks.

End-use Insights

The automotive & transportation end-use segment dominated the market and accounted for the largest share of over 34.85% in 2023. The increasing product usage in automotive components, such as bumpers, interior trims, and dashboards, as opposed to alloys and metals, has been a major factor driving the segment's growth. Over the recent past, there has been a significant rise in automotive production, which is mainly driven by the growing industry and manufacturing landscape.

The electrical & electronics segment is anticipated to grow at a significant CAGR from 2024 to 2030 due to increasing demand for housing electrical & electronics including wires, cables, sockets, and circuit breakers. Several market players are tapping into a variety of polymer products and filler technologies to address new design challenges in the electronics industry. For instance, in May 2023, Borealis AG announced the launch of a new class of engineering polymer known as Stelora.

Regional Insights

The engineering plastics market in North America is one of the key regional markets. It held a revenue share of over 32% in 2023. The recent surge in production utilizing shale gas and increasing exploration activities have enabled North American consumers and producers to obtain an unprecedented level of cost-effectiveness, which, in turn, has bolstered the demand for engineering plastic compounding in the region.

U.S. Engineering Plastics Market Trends

The U.S. engineering plastic market is expected to grow at a CAGR of 6.5% from 2024 to 2030. The demand for engineered plastic compounds in the country is majorly generated by the expanding automotive industry coupled with rising construction activities.

Europe Engineering Plastics Trends

The engineering plastics market in Europe is anticipated to grow at a moderate CAGR of 6.2% from 2024 to 2030. The regional market is shaped by stringent environmental regulations enforced by entities, such as the European Chemicals Agency (ECHA) and the European Commission, along with other federal-level agencies, further influencing industry dynamics.

The UK engineering plastics market is anticipated to experience a gradual growth trajectory, influenced by multiple factors, including muted industrial output amid economic uncertainties, potential supply chain disruptions, and evolving regulatory conditions, which collectively shape the market's landscape and growth potential.

The engineering plastics market in Germany will witness lucrative growth. Germany was the leading manufacturer of engineering plastics in Europe and captured around 34% of the revenue market share in 2023. The country is self-sufficient in terms of engineering plastic production, with an adequate number of plants and production capacities to fulfill the local demand.

The France engineering plastics market will grow significantly on account of improvements in socioeconomic conditions and an ease in the high-price perception among households, which are likely to spur investments in the consumer electronics industry in France.

Asia Pacific Engineering Plastics Trends

The engineering plastics market in Asia Pacific led the global industry and accounted for a 45% share of the global revenue in 2023 due to the high availability of skilled labor at a low cost, as well as easily accessible land. The region is a major hub for rapidly expanding industries like construction, automotive, and electronics, offering significant potential for engineering plastics manufacturers.

The China engineering plastics market is expected to have considerable growth in the future. The automotive and transportation segment captured the largest revenue share of 35% in 2023. Continuous infrastructural investments are expected to sustain economic growth in China and the automotive, aerospace, and construction sectors are expected to benefit from reforms including regulatory changes, policy adjustments, or structural enhancements.

The engineering plastics market in India will witness lucrative growth. The automotive, aerospace, and construction sectors in India are poised for a robust growth trajectory in the coming years, thereby supporting market growth. This projection is underpinned by escalating consumer demand and a notable uptick in disposable income levels.

Central & South America Engineering Plastics Trends

The Central & South America engineering plastics market has significant growth potential as it offers opportunities for investors to increase the domestic production of these plastics. Changes in consumer preferences, low production costs, rapid industrialization, and an increase in disposable income in the region are anticipated to drive economic growth over the next few years.

The engineering plastics market in Brazil accounts for the highest passenger car production and is expected to continue to witness growth at a CAGR of 7.3% from 2024 to 2030 owing to increasing GDP and high demand for Brazilian & other exports. Passenger cars make up a substantial portion of the total automobile sales in the Central & South American region.

Middle East & Africa Engineering Plastics Trends

The MEA engineering plastics market is anticipated to grow at a moderate CAGR from 2024 to 2030. GCC countries have ongoing infrastructure projects, including rails, roads, and bridges, which require the use of engineering plastic products, such as pipes and tubes. This is expected to boost product demand in the region.

Key Engineering Plastics Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to expand and maintain their market share.

-

In November 2023, Celanese Corp. announced the global commercial launch of two new polyamide compounds, namely Frianyl PA W-Series and Celanyl PA B3 GF30 E for manufacturers of electric vehicle (EV) powertrain components and batteries

-

In May 2023, Borealis, one of the leading providers of advanced & circular plastic solutions and a European market leader in base chemicals, fertilizers, & the mechanical recycling of plastics, launched Stelora, which is a sustainable engineering polymer

Key Engineering Plastics Companies:

The following are the leading companies in the engineering plastics market. These companies collectively hold the largest market share and dictate industry trends.

- Grand Pacific Petrochemical Corporation

- Mitsubishi Engineering-Plastics Corporation

- Wittenburg Group

- Piper Plastics Corp.

- Chevron Phillips Chemical Company LLC

- Daicel Corporation

- Evonik Industries AG

- Eastman Chemical Company

- Ascend Performance Materials

- Ravago

- Teknor Apex

- Trinseo LLC

- Polyplastics Co., Ltd.

- Ngai Hong Kong Company Ltd.

- Ginar Technology Co., Ltd.

Engineering Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 146.80 billion

Revenue forecast in 2030

USD 230.64 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Base year

2022

Historical data

2019 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Resin type, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; India; Japan; Australia; Brazil; Saudi Arabia

Key companies profiled

Grand Pacific Petrochemical Corp.; Mitsubishi Engineering-Plastics Corp.; Wittenburg Group; Piper Plastics Corp; Chevron Phillips Chemical Company LLC; Daicel Corp.; Evonik Industries AG; Eastman Chemical Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Engineering Plastics Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global engineering plastics market report based on resin type, end-use, and region:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Styrene Copolymers (ABS and SAN)

-

Fluoropolymer

-

Ethylene Tetrafluoroethylene (ETFE)

-

Fluorinated Ethylene-propylene (FEP)

-

Polytetrafluoroethylene (PTFE)

-

Polyvinyl Fluoride (PVF)

-

Polyvinylidene Fluoride (PVDF)

-

-

Liquid Crystal Polymer (LCP)

-

Polyamide (PA)

-

Aramid

-

Polyamide (PA) 6

-

Polyamide (PA) 66

-

Polyphthalamide

-

-

Polybutylene Terephthalate (PBT)

-

Polycarbonate (PC)

-

Polyether Ether Ketone (PEEK)

-

Polyethylene Terephthalate (PET)

-

Polyimide (PI)

-

Polymethyl Methacrylate (PMMA)

-

Polyoxymethylene (POM)

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Building & Construction

-

Consumer Goods & Appliances

-

Industrial

-

Aerospace

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global engineering plastics Market size was estimated at USD 133.62 billion in 2023 and is expected to reach USD 146.80 billion in 2024.

b. The global engineering plastics market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 and reach USD 230.64 billion by 2030.

b. Based on region, Asia Pacific was the largest market, with a revenue share of over 46% in 2023, owing to the high demand from packaging, construction, and automotive industries in the region.

b. Some of the key players operating in the engineering plastics market include Berry Global Inc., Mitsubishi Engineering-Plastics Corporation, Evonik Industries AG, Eastman Chemical Company, and Ravago.

b. Key factors that are driving the engineering plastics market is the increasing use of engineering plastics in automotive components such as bumpers, interior trims, and dashboards, as opposed to alloys and metals, has been a major factor driving this sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.