- Home

- »

- Medical Devices

- »

-

Energy-based Aesthetic Devices Market, Industry Report 2030GVR Report cover

![Energy-based Aesthetic Devices Market Size, Share & Trends Report]()

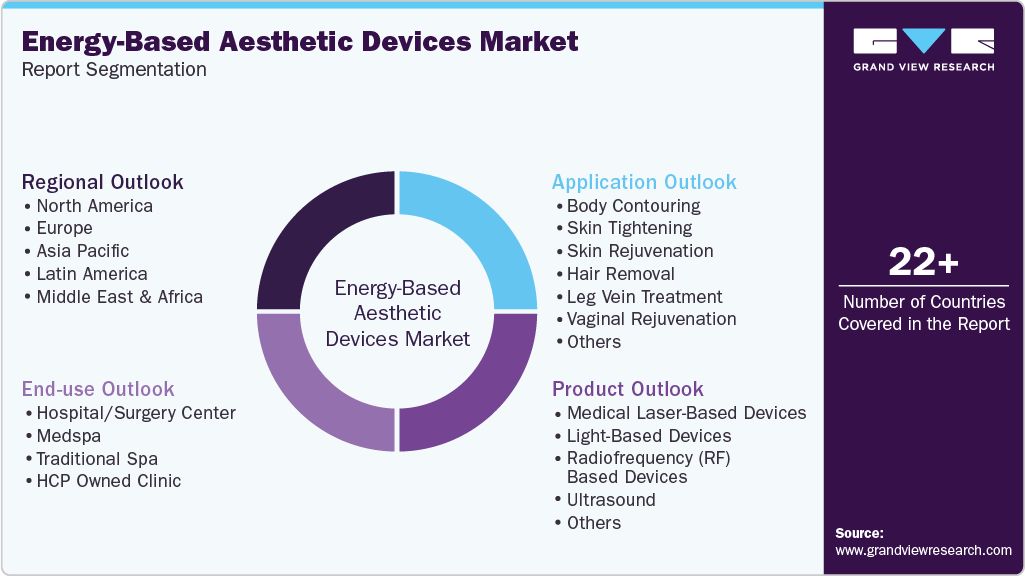

Energy-based Aesthetic Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Body Contouring, Skin Rejuvenation, Hair Removal), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-970-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy-based Aesthetic Devices Market Summary

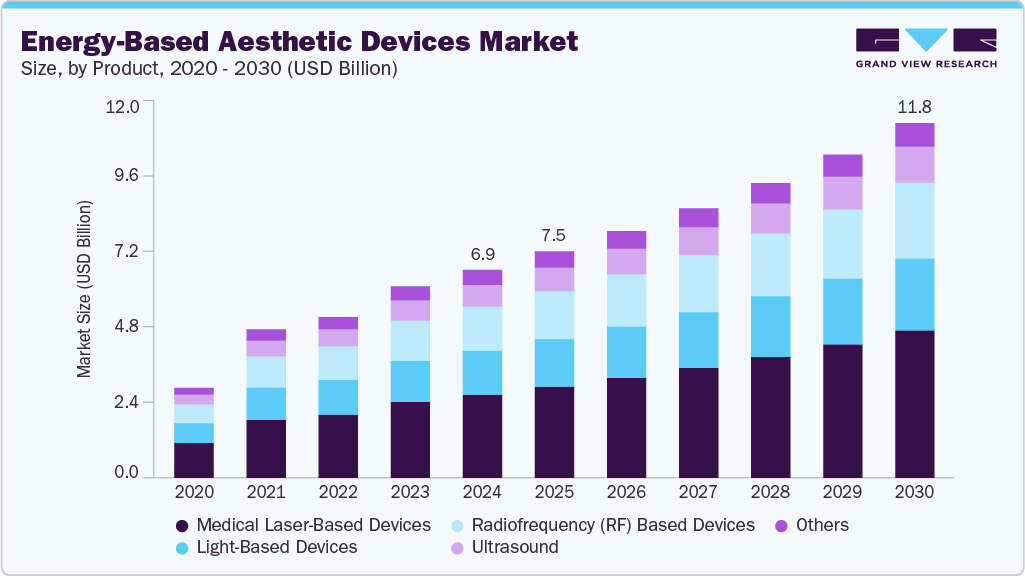

The global energy-based aesthetic devices market size was estimated at USD 6.91 billion in 2024 and is projected to reach USD 11.78 billion by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The rising prevalence of skin conditions such as dryness, acne, and fungal infections majorly drives the market growth.

Key Market Trends & Insights

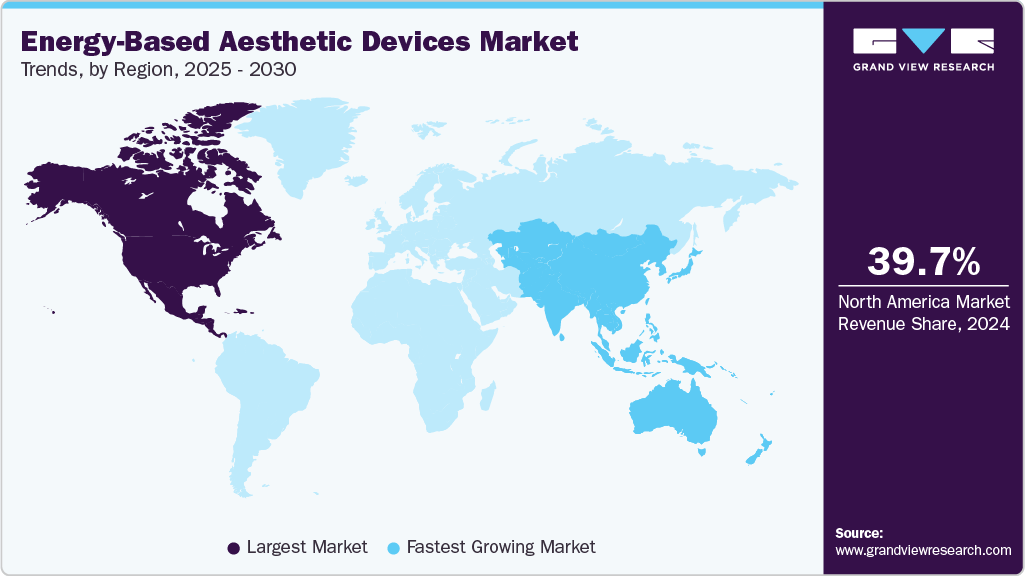

- The North America energy-based aesthetic devices industry accounted for the largest revenue share of 39.7% in 2024.

- The energy-based aesthetic devices industry in the U.S. had the largest revenue share in 2024.

- By product, the medical laser-based devices segment held the largest market share of 39.9% in 2024.

- By application, the body contouring segment held the largest market share of 20.6% in 2024.

- The wrinkles skin rejuvenation sub-segment held the largest market share of 31.1% in 2024.

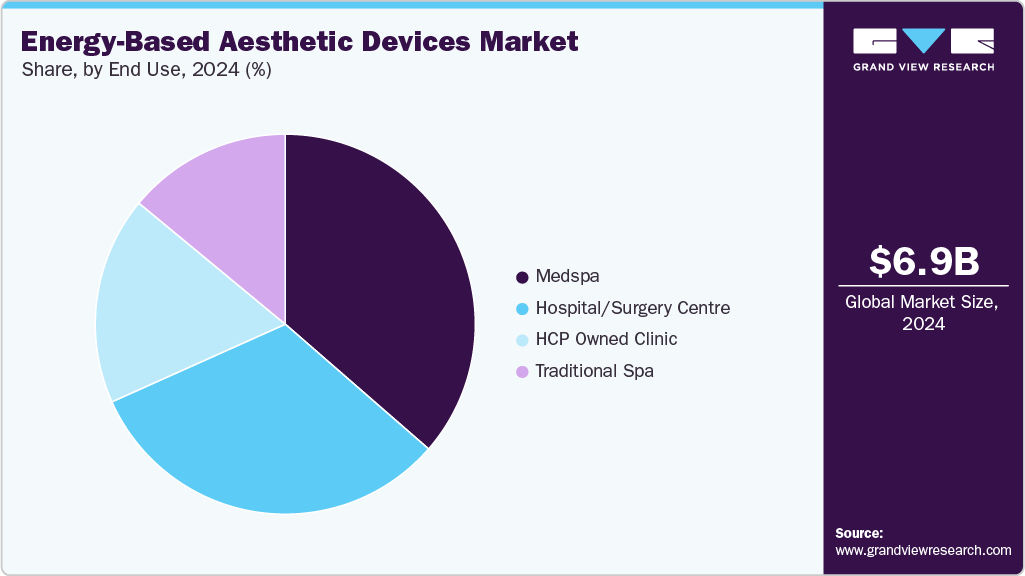

- By end use, the medspa segment accounted for the largest market share of 36.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.91 Billion

- 2030 Projected Market Size: USD 11.78 Billion

- CAGR (2025-2030): 9.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, ongoing technological advancements in aesthetic devices have further strengthened market development. Advancements in energy-based aesthetic devices are driving the market growth. According to the Aesthetic Guide article published in October 2023, Micro-Coring is an innovative technique gaining popularity for enhancing skin texture and tightening areas prone to laxity, such as the lower face & jowls. This non-invasive method removes tiny tissue cores to stimulate skin rejuvenation and tightening. The significance of Micro-Coring lies in its ability to offer substantial improvements in skin quality with minimal downtime, making it an appealing option for patients seeking effective aesthetic treatments without resorting to invasive surgery.In May 2025, Laser and Health Academy (LA&HA), in collaboration with Fotona and Zaneo / Odella, opened two new training centers in Latin America: the LA&HA Colombia Training Center in Bogotá and the LA&HA Mexico Training Center in Mexico City. This will further expand the academy's global footprint in medical laser education. Both new centers are expected to offer specialized workshops in gynecology and aesthetics, supported by experienced LA&HA faculty and local doctors.

A growing population of appearance-conscious individuals drives the demand for energy-based aesthetic devices. The market’s expansion is further reinforced by greater access to aesthetic procedures, a rising global incidence of obesity, heightened awareness of medical aesthetic treatments, and continual technological innovation in device design and functionality. Moreover, social media's influence has been pivotal in shaping aesthetic preferences and promoting awareness of various energy-based treatment options. These factors encourage more individuals worldwide to pursue youthful and revitalized appearances.

The rising prevalence of obesity is driving the demand for effective treatment options, including energy-based aesthetic devices. As more individuals seek solutions to manage and reduce obesity-related concerns, the market for noninvasive treatments is expanding. Energy-based aesthetic devices offer innovative body contouring and weight management approaches, positioning them as crucial in addressing the growing global obesity epidemic. According to a WHO article published in March 2024, obesity has become a significant global health concern, with 1 in 8 people worldwide affected by this condition in 2022. The rate of adult obesity has more than doubled since 1990, while adolescent obesity has increased fourfold. In particular, 2.5 billion adults are now categorized as overweight, with 890 million living with obesity. In addition, 43% of adults aged 18 & over were overweight, and 16% were affected by obesity. Among children, 37 million under the age of 5 and over 390 million aged 5-19 were overweight, with 160 million of the latter group being obese.

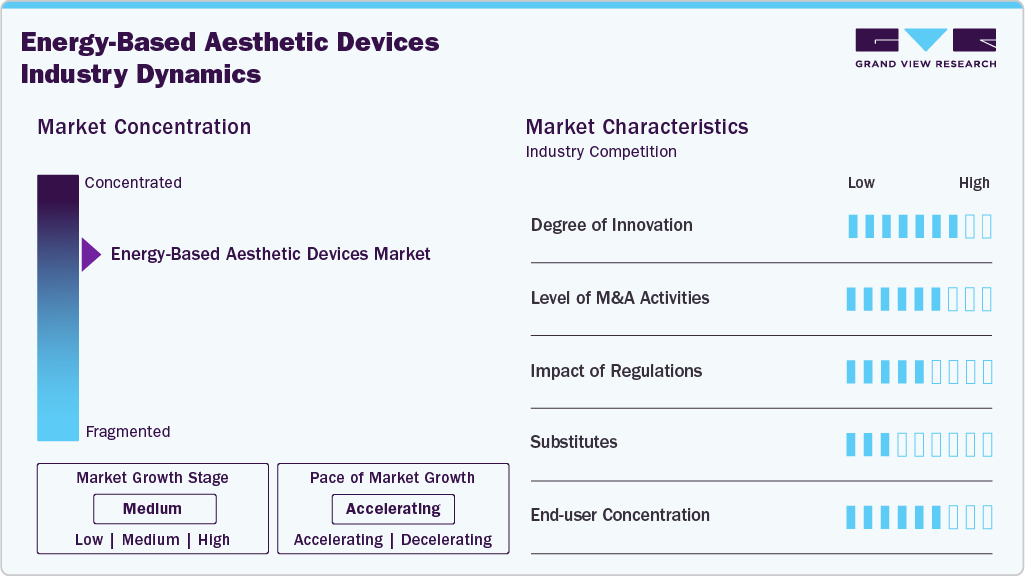

Market Concentration & Characteristics

The market is witnessing a high degree of innovation, with companies introducing devices to integrate multiple energy modalities in a single device, AI-driven treatment customization, improved cooling systems for enhanced patient comfort, and devices with greater precision that allow targeted treatments with minimal side effects.

Entry into the energy-based aesthetic devices market faces significant barriers due to high research and development costs, stringent regulatory standards, and the need for clinical validation. Established players hold strong brand recognition and global distribution networks, intensifying competition. Moreover, capital-intensive manufacturing processes, physician training requirements, and intellectual property constraints limit the ability of new entrants to penetrate the market effectively without substantial investment and technological expertise.

Regulations profoundly influence the global energy-based aesthetic devices industry, ensuring product safety, efficacy, and compliance with medical device standards. Authorities such as the U.S. FDA, European CE Marking, and other regional agencies enforce strict clinical testing and labeling protocols.

Product Insights

The medical laser-based devices dominated the market with a revenue share of 39.9% in 2024 and are expected to grow at the fastest CAGR during the forecast period. Medical laser-based devices are specialized instruments that utilize focused light beams to perform precise surgical products, treat tissues, or remove unwanted materials. These devices leverage the unique properties of laser light, such as coherence & monochromaticity, for accuracy and minimal damage to surrounding tissues. Rapid advancements in laser technology have led to more effective and safer devices. Innovations such as fractional lasers, which target only a fraction of the skin at a time, allow for improved healing times and reduced adverse effects.

In August 2023, Acclaro Medical introduced UltraClear Laser-Coring, a pioneering laser technology for tissue coring. This innovative device targets deep wrinkles, scars, and other age-related skin issues across all skin types while ensuring minimal discomfort and downtime. The latest mode of UltraClear enhances collagen remodeling by integrating fractional tissue coring with laser rejuvenation, eliminating the need for scalpels or sutures, and can be completed in around 30 minutes.

Technological advancements further propel this demand, with modern devices integrating radiofrequency, ultrasound, and laser energy systems to stimulate collagen and tighten skin without incisions. These technologies target deep skin layers, promoting natural tissue tightening and rejuvenation with minimal discomfort and downtime. In June 2025, Omni Laser participated for the first time in the U.S. at the Aesthetic Show 2025. Omni Laser is focused on developing non-invasive and advanced technologies, such as the diode laser hair removal system and Intense Pulsed Light, which are widely used in medspas, professional clinics, and dermatology practices worldwide.

The radiofrequency (RF) based devices are expected to grow at a significant CAGR of 9.7% during the forecast period. The global aging population is increasingly seeking solutions for skin laxity, wrinkles, and rejuvenation to maintain a youthful appearance. As of 2024, approximately 10% of the world's population is aged 65 and older. Between 2015 and 2050, the share of the global population aged 60 years and older is projected to nearly double, increasing from about 12% to approximately 22%. These changes drive strong demand for innovative skin tightening and rejuvenation treatments tailored to address age-related skin concerns effectively.

The light-based devices segment is expected to witness lucrative growth during the forecast period. This growth is attributed to the rapid increase in the elderly population, technological advancements, product launches, and increasing demand for noninvasive aesthetic treatments. Light-based devices utilize light energy for various applications, including medical treatments and cosmetic products. Two prominent types of these devices are Dynamic Pulse Control (DPC) systems and Intense Pulsed Light (IPL) systems, which harness specific wavelengths of light to target skin conditions effectively. DPC is a sophisticated technology that modulates the pulse duration and intensity of light to optimize treatment outcomes while minimizing discomfort and adverse effects.

Application Insights

The body contouring segment accounted for the largest revenue share in 2024 due to increasing obesity rates across the globe, growing initiatives by key players, and recent advancements. Muscle hypertrophy and toning are induced by Magnetic Muscle Stimulation (MMS) and Electrical Muscle Stimulation (EMS), which complete the range of body sculpting operations. Acoustic Wave Treatment (AWT) uses ultrasonic waves to break down fibrous tissue and treat cellulite. Another technique for destroying targeted fat cells is laser therapy. Common preoperative comorbidities included hypertension, obesity, and diabetes; meanwhile, postoperative complications observed within 90 days were wound dehiscence, hematoma, and urinary tract infections. In May 2025, Apyx Medical announced that it was planning a commercial launch of the AYON Body Contouring System after it received FDA clearance for the technology to support various aesthetic treatments.

The skin rejuvenation segment is expected to grow at a significant CAGR during the forecast period. The rising awareness regarding medical aesthetics, rising obesity cases, and technological advancements fuel the segment growth. The demand for skin rejuvenation treatments can be attributed to growing concerns about physical appearance and key players' increasing advancements in skin care products, research, and development strategies. In September 2023, Cutera, Inc. launched Secret DUO, a skin resurfacing platform that employs dual nonablative fractional technologies. This system features a radio frequency microneedling handpiece and a 1540 nm erbium glass laser, allowing practitioners to customize treatments for various aesthetic concerns, including fine lines, skin texture, pigmentation, stretch marks, and scars. Each modality can be used separately or together to enhance treatment outcomes.

End Use Insights

In 2024, the medspa dominated the market and accounted for the largest revenue share, and the segment is projected to grow at the fastest CAGR during the forecast period. MedSpas are facilities where cosmetic treatments are provided under the supervision of a licensed physician. These MedSpas blend aesthetic medical centers & day spas, offering rejuvenation and corrective treatments using energy-based aesthetic devices. The market growth reflects the increasing awareness and acceptance of aesthetic therapies, which is evident through the expanding presence of cosmetic clinics and providers. According to the American Medical Spa Association (AmSpa) article published in January 2023, the medical spa industry continued to grow during the pandemic.

The hospital/surgery center is expected to grow significantly during the forecast period. Hospitals and surgery centers continue to serve as a vital end-use segment within the energy-based aesthetic devices industry, supported by their robust clinical infrastructure and advanced treatment technologies. These facilities attract patients seeking safe, effective, and professionally supervised aesthetic procedures. The growing acceptance of minimally invasive cosmetic treatments has driven greater integration of energy-based systems across surgical and dermatology departments. Additionally, the presence of skilled medical practitioners and access to comprehensive post-treatment care enhance patient satisfaction and treatment outcomes. The combination of credibility, expertise, and innovation within these institutions fosters sustained market growth and strengthens their position in the aesthetic healthcare landscape.

Regional Insights

The North America energy-based aesthetic devices industry accounted for the largest revenue share of 39.7% in 2024, owing to the high consumer awareness, growing preference for non-invasive procedures, product launches, regulatory approvals, and advanced healthcare infrastructure. The region’s substantial population aged between 25 and 65 years is particularly prone to skin aging concerns, such as skin laxity, wrinkles, and dark spots. In the U.S., 62% of consumers are seeking changes in their appearance. The number of aesthetic procedures performed has substantially increased over the past few years, nearly doubling to 7.45 million in 2022 compared to 2018. This demographic has contributed to a surge in demand for cosmetic enhancement products and procedures.

U.S. Energy-Based Aesthetic Devices Market Trends

The energy-based aesthetic devices industry in the U.S. had the largest revenue share in 2024. The critical factor for the market's growth is the rising preference for nonsurgical methods. According to a September 2023 article by the American Society of Plastic Surgeons (ASPS), there was a 19% increase in cosmetic surgeries and procedures in the U.S. from 2019 to 2022, reaching 26.2 million. This trend indicates a growing acceptance of and demand for aesthetic enhancements. The article also highlighted that nearly 23.7 million minimally invasive cosmetic procedures were performed in 2022. With 4,883,419 procedures performed, this represents a substantial 70% increase from 2019.

In May 2025, The Laser Lounge Spa in Sarasota, Florida, launched medical-grade aesthetic treatments to meet the rising demand for non-surgical beauty solutions. The spa offers expert-led, customized services, including Radiofrequency (RF) microneedling, a deep skin remodeling technique that uses RF energy to tighten and boost collagen.

Asia Pacific Energy-Based Aesthetic Devices Market Trends

The Asia Pacific energy-based aesthetic devices industry is expected to grow at the fastest CAGR over the forecast period. Rising disposable incomes, awareness of aesthetic treatments, and increasing preference for minimally invasive procedures. Energy-based devices, including lasers, radiofrequency, and ultrasound, dominated over half the market share, benefiting from technological advancements that enhance safety and efficacy. The expanding middle class in countries such as China, India, and South Korea, along with aging populations, fuels demand for anti-aging and cosmetic treatments. According to the ISAPS 2022 report, about 2,100,169 nonsurgical procedures were performed in Japan, with hair removal being one of the most common procedures undertaken. Hair removal procedures accounted for 595,232, making up approximately 28.3%. This significant volume of nonsurgical procedures highlights the growing demand for energy-based aesthetic devices in the region. Moreover, the increasing elderly population in the Asia Pacific region contributes to market growth. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, approximately 697 million individuals aged 60 years or older live in Asia and the Pacific region, constituting approximately 60% of the global older population.

In July 2025, Aerolase took a significant step in the Indian market by introducing the U.S. FDA-approved Neo Elite laser treatment. Aerolase introduced it in India by collaborating with Kaya, one of the dermatology chain clinics.

The energy-based aesthetic devices industry in India dominated the region with the largest revenue share in 2024 and is expected to grow at the fastest CAGR over the forecast period. The increasing prevalence of obesity has driven a rising demand for non-invasive body contouring and fat reduction treatments. With heightened health and wellness awareness, consumers increasingly favor effective, minimally invasive procedures to enhance body aesthetics. In March 2024, the 4th UNCOVER Laser, Skin & Hair Clinic was inaugurated in Punjabi Bagh, Delhi. This launch marked a significant milestone for UNCOVER Clinics, which previously operated three successful centers in India, as it expanded into central Delhi. This expansion is fueled by rising consumer demand for advanced, noninvasive treatments and the proliferation of advanced technologies.

In April 2025, Spectra Medical India Pvt. Ltd., in collaboration with Italy’s Eufoton, launched EndoliftX in India. The advanced, non-surgical laser treatment tightens skin, reduces fat, and contours the face and body with minimal discomfort and recovery.

The Australia energy-based aesthetic devices industry held the second-largest market share in the Asia Pacific region in 2024. The market is influenced by increased demand for advanced cosmetic treatments. The recent launch of new laser clinics across major cities reflects this trend, with establishments like Laser Clinics Australia expanding their reach. For instance, in March 2024, Medipledge, a new postlaser skincare brand, debuted in Australia. Medipledge focuses on restoring the skin barrier following cosmetic treatments, adhering to principles of aesthetic dermatology. Therefore, market growth in Australia is fueled by rising consumer interest in noninvasive procedures and technological advancements.

The energy-based aesthetic devices industry in Thailand is expected to witness significant growth in the coming years, driven by growing aesthetic consciousness, increasing availability of advanced treatment options, and rising medical tourism. The market is witnessing a high demand for innovative solutions to address various types of scars, including laser therapies. According to the Medical Tourism Association, in 2022, Thailand was the world’s fifth most desirable health tourism destination. The availability of advanced & noninvasive cosmetic solutions will likely boost the Thailand market. According to the ISAPS 2023 report, approximately 1,967 nonsurgical skin tightening procedures were performed in Thailand. The report added that nearly 172,840 aesthetic procedures were performed, owing to increased accessibility to these treatments, which is expected to boost energy-based aesthetic interventions in Thailand.

Europe Energy-Based Aesthetic Devices Market Trends

Europe energy-based aesthetic devices industry was identified as a lucrative region in 2024. This market is experiencing robust growth, driven by rising demand for minimally invasive and noninvasive cosmetic procedures. Increasing awareness of physical appearance, bolstered by the growing influence of social media, is significantly contributing to this market expansion.

The energy-based aesthetic devices industry in Germany held the largest revenue share of 25.0%, in 2024. The factors contributing to this large share are the presence of key market players, the rising number of noninvasive aesthetic treatments, and technological advancements. Key players are focused on developing advanced devices with enhanced precision, safety, and effectiveness. For instance, in February 2024, Braun launched the skin i·expert IPL system, which delivers a personalized hair removal experience using adaptive technology. Such advancements and the rising demand for noninvasive cosmetic procedures position Germany as a crucial hub in the global energy-based aesthetic devices industry.

The energy-based aesthetic devices industry in the UK held the second-largest market share in the Europe region in 2024. This large share is attributed to raising awareness regarding medical aesthetics and increasing cosmetic procedures. According to the British Association of Aesthetic Plastic Surgeons (BAAPS), the number of procedures in the UK surged to 31,057 in 2022, a 102% increase from the 15,405 procedures recorded in 2021. This significant rise follows a period when private cosmetic procedures were restricted during some coronavirus lockdowns. In 2019, before the pandemic, BAAPS reported 28,347 surgeries.

The France energy-based aesthetic devices industry is anticipated to witness a significant CAGR during the forecast period. Growing consumer awareness about the benefits of aesthetic procedures and the increasing adoption of minimally invasive treatments drive market growth. In addition, factors such as rising purchasing power, greater participation of international players, increased spending on cosmetics and personal care, and the expanding number of beauty clinics are contributing to market growth. According to the ISAPS 2023 report, approximately 423,085 nonsurgical aesthetic treatments were performed in France, including 60,000 hair removal procedures.

Latin America Energy-Based Aesthetic Devices Market Trends

Latin America energy-based aesthetic devices industry is growing due to several factors, including the middle class expansion, which increases disposable income and a greater propensity for aesthetic procedures.

The Brazil energy-based aesthetic devices industry is expanding due to several distinct growth drivers: a rapidly aging population and the high adoption of noninvasive aesthetic procedures. Brazil ranks second only to the U.S. for the most nonsurgical procedures, representing 7.1% of the global noninvasive aesthetic treatment market. According to the ISAPS 2023 survey, this includes 16,412 hair removal procedures. This significant volume is anticipated to drive market growth throughout the forecast period.

Middle East & Africa Energy-based Aesthetic Devices Market Trends

The Middle East & Africa energy-based aesthetic devices industry is expected to grow lucratively due to economic growth and enhanced access to state-of-the-art medical technologies. Noninvasive cosmetic treatments, such as hair removal and laser therapies, have gained significant traction among consumers desiring to improve their appearance without surgery.

The energy-based aesthetic devices industry in the UAE is expected to grow at a CAGR of 5.6% over the forecast period. The UAE’s healthcare sector is experiencing rapid expansion, driven by factors such as the growth of hospital networks, the introduction of specialized services, and a rising demand for nonsurgical procedures. Technological advancements and heightened consumer awareness are expected to drive further evolution in the energy-based aesthetic devices. For instance, in May 2024, Tentech, Inc. received certification from the UAE Ministry of Health for its 10THERMA device, a 6.78 MHz monopolar RF system with a 400W output. This device offers enhanced efficacy with a 5-sq.cm. Ace tip provides 20% more energy coverage per shot and features a Smart Temperature Cooling system with seven cooling pulses per shot.

Key Energy-based Aesthetic Devices Company Insights

Some companies in the market for energy-based aesthetic devices include Cynosure, Syneron Medical Ltd, and Lumenis Ltd.

-

Syneron Medical Ltd. is a renowned company specializing in developing, manufacturing, and marketing aesthetic medical devices. Its product range addresses various aesthetic needs, including hair removal, skin rejuvenation, wrinkle reduction, and body contouring. Syneron’s innovative solutions have positioned it globally as a key player in the industry, catering extensively to dermatologists, plastic surgeons, and cosmetic practitioners.

Key Energy-based Aesthetic Devices Companies:

The following are the leading companies in the energy-based aesthetic devices market. These companies collectively hold the largest market share and dictate industry trends.

- Syneron Medical Ltd

- Sinclair

- Acclaro Medical

- Candela Corporation

- Lumenis

- El.En. S.p.A.

- Cutera, Inc.

- Alma Lasers.

- Cynosure

Recent Developments

-

In March 2025, Alma Lasers, a Sisram Medical company, announced the global debut of Alma Harmony. It is a new multiplatform offering robust capabilities of standalone lasers in a single, sophisticated platform, with up to a 45% increase in energy.

-

In January 2025, Aesthetic Management Partners launched the NOUVADerm Total Body Restoration Laser in the U.S.. This next-generation total body restoration laser is the fastest & powerful in the market, offering versatility, precision, and results.

-

In May 2024, Alma launched Alma Harmony and Alma IQ, significantly advancing personalized aesthetic treatments. Alma Harmony is the latest evolution of the organization’s multi-technology aesthetics workstation, and Alma IQ is a skin consultation and analysis solution.

-

In June 2024, Lumenis Be. Ltd. announced the launch of FoLix, a groundbreaking laser system for hair loss treatment. Recently approved by the FDA, FoLix is the first and only fractional laser system in the U.S. that offers a safe, effective, and natural solution for hair loss in both women & men.

-

In May 2024, Sinclair introduced its latest addition to the EBD, Sculpt & Shape. This new technology represents Sinclair’s commitment to advancing aesthetic treatments, offering innovative solutions for body contouring and facial rejuvenation.

-

In February 2024, Cynosure and Hahn & Company, which acquired Lutronic, entered into a definitive merger agreement to combine the two companies strategically. Both companies are leading global providers of energy-based medical aesthetic treatment systems and related technologies.

Energy-based Aesthetic Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.52 billion

Revenue forecast in 2030

USD 11.78 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico, UK; Germany; France; Italy; Spain; Norway, Denmark, Sweden, Switzerland, Austria, Netherlands; India; Australia; Thailand, Singapore, Indonesia, Malaysia, Mexico; Brazil; Argentina; Chile, Colombia, South Africa; Saudi Arabia; UAE, Kuwait, Qatar, Morocco, Jordan

Key companies profiled

Syneron Medical Ltd; Sinclair; Acclaro Medical; Candela Corporation; Lumenis; El.En. S.p.A.; Cutera, Inc.; Alma Lasers; Cynosure

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy-based Aesthetic Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global energy-based aesthetic devices market report on the basis of product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Laser-Based Devices

-

Light-Based Devices

-

Radiofrequency (RF) Based Devices

-

Ultrasound

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Body Contouring

-

Skin Tightening

-

Skin Rejuvenation

-

Wrinkles

-

Acne & Other Scars

-

Skin Pigmentation

-

Aging

-

-

Hair Removal

-

Leg Vein Treatment

-

Vaginal Rejuvenation

-

Pigmented Lesion

-

Tattoo Removal

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital/Surgery Center

-

Medspa

-

Traditional Spa

-

HCP Owned Clinic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Sweden

-

Denmark

-

Norway

-

Netherlands

-

Switzerland

-

Austria

-

-

Asia Pacific

-

India

-

Australia

-

Thailand

-

Singapore

-

Malaysia

-

Indonesia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Jordan

-

Qatar

-

Morocco

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.