- Home

- »

- Consumer F&B

- »

-

Energy Bar Market Size, Share And Growth Report, 2030GVR Report cover

![Energy Bar Market Size, Share & Trends Report]()

Energy Bar Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Organic, Conventional), By Packaging (Single Pack, Multi Pack), By Ingredient (Cereals & Grains, Fruits), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-437-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy Bar Market Market Summary

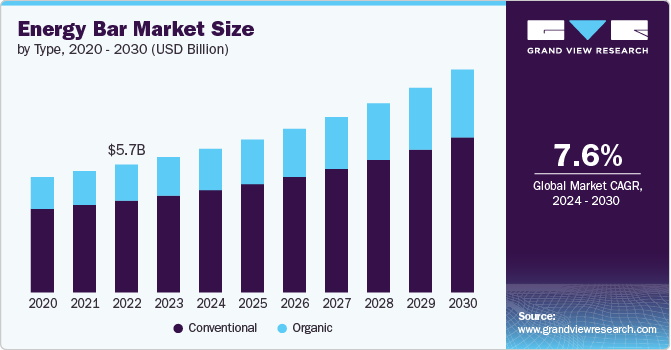

The global energy bar market size was estimated at USD 6,024.4 million in 2023 and is projected to reach USD 9,918.2 million by 2030, growing at a CAGR of 7.4% from 2024 to 2030. As consumers increasingly prioritize health and wellness, they are driving demand for convenient, nutritious snacks that fit into busy lifestyles.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, organic accounted for a revenue of USD 6,024.4 million in 2023.

- Organic is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 6,024.4 million

- 2030 Projected Market Size: USD 9,918.2 million

- CAGR (2024-2030): 7.4%

- North America: Largest market in 2023

This shift has propelled the energy bars market, as these products offer an appealing balance of portability and functional benefits. Consumers are looking for bars that provide high protein for muscle recovery, low sugar for weight management, and added vitamins or natural ingredients for overall health, likely driving the growth of the market.

Moreover, energy bars present a convenient and portable meal solution catering to the fast-paced lifestyles of busy professionals, athletes, and students. These consumers value the ability to quickly access balanced nutrition without compromising on quality or performance. Energy bars provide a practical alternative to traditional meals, offering a blend of proteins, fibers, and essential nutrients designed to support energy and focus throughout the day. This market segment continues to expand as manufacturers align product offerings with evolving consumer preferences for healthy, functional, and time-efficient food options.

The growing focus on fitness and sports nutrition has significantly fueled the demand for energy bars specifically formulated for pre-and post-workout consumption. As consumers increasingly prioritize performance and recovery, they seek products that offer targeted nutritional benefits, such as fast-absorbing carbohydrates for energy and high-quality proteins for muscle repair. Energy bars tailored for these purposes are now a key segment within the broader market, appealing to both professional athletes and fitness enthusiasts. This trend has led to increased innovation, with brands developing specialized formulations that address specific workout phases, further driving product differentiation and market growth.

Innovations in the energy bars market are driving growth by catering to diverse consumer needs and preferences, particularly in areas like ingredient transparency, dietary customization, and sustainability. Companies are leveraging advancements in food science to create bars with unique formulations, such as plant-based proteins, adaptogens, and functional superfoods, appealing to health-conscious consumers. For instance, RXBAR has disrupted the market with its "no B.S." approach, offering bars with minimal, whole-food ingredients listed clearly on the packaging. This innovation has not only set a new standard for product transparency but also resonates with consumers seeking clean labels and functional benefits, thus fueling market expansion.

Furthermore, the availability of a wide variety of energy bars in the market favors market growth by catering to a broad spectrum of consumer preferences and dietary needs. This diversity includes options such as high-protein bars for muscle recovery, low-sugar and keto-friendly bars for weight management, and plant-based bars for vegan diets. For instance, brands like Clif Bar offer energy bars tailored for endurance athletes, and Quest Nutrition provides bars that are high in protein and low in sugar. By addressing specific nutritional requirements and lifestyle choices, these varied offerings not only attract a wider audience but also foster brand loyalty and repeat purchases, thus propelling market expansion.

Type Insights

Conventional energy bars accounted for a share of around 72% in 2023. The segmental growth is primarily driven by their established brand recognition, consistent quality, and convenience. These products have positioned themselves as reliable sources of quick, portable nutrition, often appealing to busy lifestyles and health-conscious individuals. Key factors include widespread availability, effective marketing strategies that emphasize performance and health benefits, and the integration of familiar, trusted ingredients. Additionally, their competitive pricing and variety of flavors cater to diverse consumer preferences, reinforcing their market presence and consumer loyalty, likely favoring the growth of the market.

The demand for organic energy bars is expected to grow at a CAGR of 8.7% from 2024 to 2030. Increasing demand for clean, sustainable, and health-conscious food options drives the growth of the market. Consumers are increasingly prioritizing products with transparent ingredient lists, minimal processing, and eco-friendly packaging. This shift is fueled by heightened awareness of environmental issues and a preference for non-GMO, organic ingredients. For instance, the company LÄRABAR has capitalized on this trend by offering energy bars made from organic fruits, nuts, and spices, which resonate with consumers seeking natural and wholesome snacks. Their commitment to simplicity and quality has helped them capture a significant share of the growing organic market.

Packaging Insights

Multi-pack energy bars accounted for a market share of about 60% in 2023. Multi-pack energy bars are preferred among consumers due to their cost-efficiency, convenience, and perceived value. Purchasing energy bar in multi-packs often results in a lower per-unit cost, making it more economical for frequent users. Additionally, bulk packaging provides convenience by reducing the frequency of repurchases and ensuring a ready supply of snacks, which is particularly appealing to busy individuals or families. This format also aligns with consumers' preference for bulk buying and stocking up, further enhancing its attractiveness in the marketplace.

The demand for single-pack energy bars is anticipated to grow at a CAGR of 8.5% from 2024 to 2030. The growth of single-pack energy bars among consumers is driven by an emphasis on convenience, portability, and portion control. Single packs offer a ready-to-eat solution for on-the-go lifestyles, allowing consumers to easily incorporate them into busy schedules without the need for preparation or multiple servings. This format also caters to individual consumption needs, preventing waste and enabling precise calorie and nutritional management. Additionally, single packs often provide an opportunity for consumers to sample different flavors or brands without committing to a larger quantity, appealing to those seeking variety and flexibility in snacking choices, likely driving the market growth.

Ingredient Insights

Cereals & grains energy bars accounted for a market share of about 36% in 2023. These bars are often marketed as a source of essential fiber, whole grains, and sustained energy, which aligns with health-conscious consumers' increasing focus on balanced diets and digestive health. The inclusion of familiar, wholesome ingredients like oats, quinoa, and bran appeals to those seeking a more natural and functional snack option. Additionally, the versatility of cereals and grains allows for a variety of flavor profiles and combinations, enhancing consumer appeal and driving market demand.

The demand for protein energy bars is anticipated to grow at a CAGR of 9.8% from 2024 to 2030. The increasing emphasis on fitness, muscle recovery, and overall health propels the growth of the market. These bars cater to a growing segment of health-conscious individuals and athletes who seek convenient, high-protein snacks to support their dietary and performance goals. The perceived benefits of enhanced muscle repair, satiety, and energy boost make protein bars an attractive option for those with active lifestyles. For instance, according to the “Consumer Health & Wellness Attitude and Usage” study conducted by Glanbia Nutritionals, over 50% of consumers in the U.S. prefer bars with high protein.

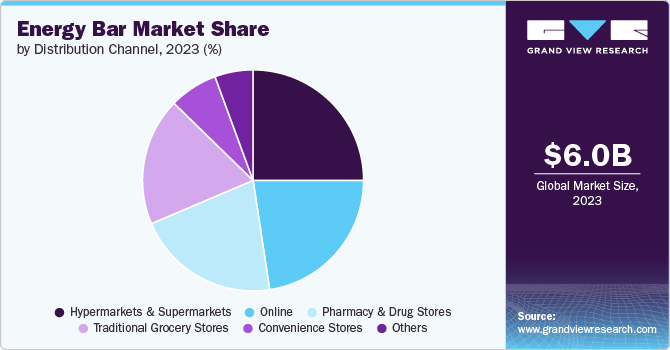

Distribution Channel Insights

Hypermarkets & supermarkets accounted for a revenue share of around 25% in 2023. Energy bars are majorly purchased through hypermarkets & supermarkets due to their extensive consumer reach, high foot traffic, and convenience. These retail environments offer a broad product assortment and are frequented by shoppers seeking a one-stop solution for various grocery needs, making them an ideal venue for impulse purchases and frequent replenishment of energy bars. The large-format stores benefit from economies of scale, allowing for competitive pricing and prominent shelf placement that enhances visibility and accessibility. Additionally, hypermarkets & supermarkets often provide promotional opportunities and bulk purchasing options, further driving consumer preference and sales volume for energy bars.

The sale of energy bars online is expected to grow at a CAGR of 8.7% from 2024 to 2030. The sale of energy bars through online channels is driven by the convenience, personalization, and expansive reach these platforms offer. Online shopping allows consumers to easily compare products, access detailed nutritional information, and take advantage of personalized recommendations based on their preferences and purchase history. The ability to order from anywhere and have products delivered directly to their doorstep aligns with the growing demand for convenience and time efficiency. Additionally, e-commerce platforms often provide a wider selection of brands and flavors, including niche or specialty products, which can attract consumers seeking unique or premium options not available in physical stores.

Regional Insights

North America energy bar market accounted for a market share of around 40% in 2023 in the global market. Consumers are increasingly seeking convenient, nutrient-dense snacks that can provide quick energy boosts or serve as meal replacements. The rising popularity of high-protein diets, plant-based eating, and clean label products have also fueled demand for specialized energy bars. Additionally, the market benefits from the expanding demographic of fitness enthusiasts and athletes who use energy bars for pre-and post-workout nutrition.

U.S. Energy Bar Market Trends

The energy bar market in the U.S. accounted for a market share of around 78% in 2023 in the North American market. Key factors, including the rise in fitness trends, growing awareness of protein intake, and the shift toward plant-based diets, have fueled the market growth in the U.S. Moreover, the availability of various brands offering diverse products drives the growth of the market. For instance, Clif Bar has capitalized on these trends by offering a diverse portfolio of organic, plant-based energy bars that cater to health-conscious consumers and athletes. The company's commitment to sustainability and the use of wholesome ingredients has resonated with millennials and Gen Z consumers, driving brand loyalty.

Asia Pacific Energy Bar Market Trends

The energy bar market in Asia Pacific accounted for a revenue share of around 15% of global revenue in 2023. The market in Asia Pacific is driven by a combination of rising health consciousness, urbanization, and increasing disposable incomes. As consumers in the region become more health-focused, there is a growing demand for convenient, nutritious snacks that align with modern, active lifestyles. Urbanization has led to busier schedules, increasing the need for on-the-go food options. Additionally, higher disposable incomes and greater exposure to global food trends are expanding consumer choices and driving market growth.

Europe Energy Bar Market Trends

The energy bar market in Europe is expected to grow at a CAGR of 7.0% from 2024 to 2030. European consumers are increasingly seeking out nutritious, functional snacks that fit their busy lifestyles and align with health goals, such as weight management and muscle recovery. The growing trend toward personalized nutrition and clean-label products also supports market growth. For example, Clif Bar, a prominent player in the European market, has capitalized on these trends by offering a range of organic and non-GMO energy bar that cater to health-conscious consumers and meet various dietary needs. Their focus on quality ingredients and sustainability resonates well with the European consumer base, driving market expansion.

Key Energy Bar Company Insights

The energy bar market is highly competitive, driven by a mix of established global players and emerging niche brands. Major companies like Mondelez International (Clif Bar), Kellogg’s (RXBAR, Nutri-Grain), and General Mills (LÄRABAR, Nature Valley) dominate with strong distribution networks and product innovation. Simultaneously, smaller brands like GoMacro and ALOHA appeal to health-conscious consumers with organic, plant-based offerings. Key competitive factors include product differentiation (e.g., protein content, clean labels), brand loyalty, and expanding into specialty diets like keto or vegan to capture diverse consumer preferences.

Key Energy Bar Companies:

The following are the leading companies in the energy bar market. These companies collectively hold the largest market share and dictate industry trends.

- Mondelez International, Inc.

- Kellanova

- General Mills Inc.

- Post Holdings Inc.

- Mars, Incorporated

- Post Holdings Inc.

- Nestlé S.A.

- PROBAR LLC

- The Simple Good Foods Company

- Glanbia plc

Recent Developments

-

In May 2024, Clif Bar, a brand under Mondelez International, launched its integrated ad campaign, "The Most Important Ingredient is You" The campaign highlights personal passion and perseverance, featuring Clif Athletes like Frances Tiafoe and Breanna Stewart. It emphasizes how Clif Bars fuels individuals to pursue their goals, whether in sports or outdoor activities. The campaign includes digital content, TV ads, and social media outreach, aiming to connect with consumers on a deeper, motivational level across the U.S. and Canada.

-

In August 2024, Kellogg's expanded its Nutri-Grain brand with "Fruit & Vegetables Mash-Ups," featuring flavors like strawberry and squash, and chocolatey banana bites. This innovation targets children’s nutrition, blending fruits and vegetables into enjoyable snacks. By diversifying into this hybrid snacking segment, Kellogg's Nutri-Grain portfolio broadens its appeal beyond traditional cereal bars. This strategic move could position the brand to capture a larger share of the energy bars market, especially among health-conscious parents seeking convenient, nutrient-rich options for kids.

Energy Bar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.39 billion

Revenue forecast in 2030

USD 9.92 billion

Growth rate (Revenue)

CAGR of 7.6% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, packaging, ingredient, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; Saudi Arabia; and South Africa

Key companies profiled

Mondelez International, Inc.; Kellanova; General Mills Inc.; Post Holdings Inc.; Mars, Incorporated; Post Holdings Inc.; Nestlé S.A.; PROBAR LLC; The Simple Good Foods Company; Glanbia plc

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Energy Bar Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global energy bar market report on the basis of type, packaging, ingredient, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Organic

-

Conventional

-

-

Packaging Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Pack

-

Multi Pack

-

-

Ingredient Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cereals & Grains

-

Nuts & Seeds

-

Fruits

-

Protein

-

Chocolate Coated

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Traditional Grocery Store

-

Pharmacy & Drug Store

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global energy bar market was estimated at USD 6.02 billion in 2023 and is expected to reach USD 6.39 billion in 2024.

b. The global energy bar market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 9.92 billion by 2030.

b. North America dominated the energy bar market with a share of around 40% in 2023. The energy bar market in North America is driven by growing consumer demand for convenient, nutritious snacks that cater to health-conscious lifestyles, active routines, and dietary preferences.

b. Key players in the energy bar market are Mondelez International, Inc.; Kellanova; General Mills Inc.; Post Holdings Inc.; Mars, Incorporated; Post Holdings Inc.; Nestlé S.A.; PROBAR LLC; The Simple Good Foods Company; and Glanbia plc.

b. Key factors that are driving the energy bar market growth include increasing health consciousness, rising demand for convenient on-the-go snacks, innovations in flavors and ingredients, and the growing popularity of fitness and wellness trends.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.