- Home

- »

- Medical Devices

- »

-

Endotracheal Tube Market Size, Share, Industry Report 2030GVR Report cover

![Endotracheal Tube Market Size, Share & Trends Report]()

Endotracheal Tube Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Regular, Reinforced, Preformed, Double-lumen), By Route (Orotracheal, Nasotracheal), By Application (Emergency Treatment, Therapy), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-727-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endotracheal Tube Market Summary

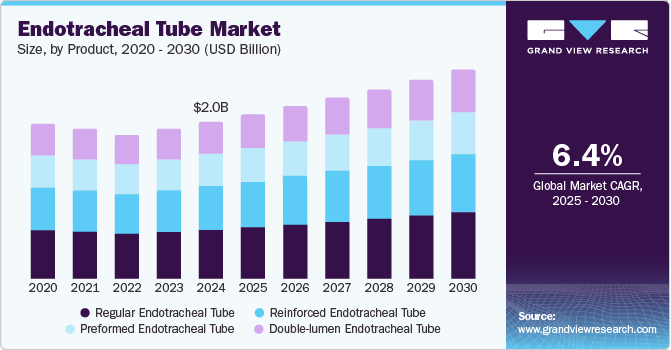

The global endotracheal tube market size was estimated at USD 2.03 billion in 2024 and is projected to reach USD 2.92 billion by 2030, growing at a CAGR of 6.40% from 2025 to 2030. The demand for endotracheal tubes is increasing due to technological advancements such as anti-fouling coating products, a significant increase in surgeries, strategic initiatives by key companies, and increasing incidences of chronic diseases.

Key Market Trends & Insights

- North America dominated the global endotracheal tube market with the largest revenue share of 34.54% in 2024.

- The endotracheal tube market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, the regular endotracheal tube segment led the market with the largest revenue share of 32.17% in 2024.

- By route, the nasotracheal segment is expected to register at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.03 Billion

- 2030 Projected Market Size: USD 2.92 Billion

- CAGR (2025-2030): 6.40%

- North America: Largest market in 2024

There has been a rise in the prevalence of chronic diseases such as urological disorders, cancer, stroke, cardiovascular disorders, and neurovascular diseases, among other chronic problems. According to the British Heart Foundation Report 2025, over 7.6 million people in the UK live with heart and circulatory diseases - over 4 million males and over 3.6 million females.

The table below highlights the high burden of cardiovascular disease (CVD) mortality among individuals under 75 across selected local authorities in the UK. Glasgow City, Scotland, reports the highest premature CVD death rate (139.1 per 100,000 people), with the most significant number of annual deaths (659), reflecting substantial health inequalities. The data suggests a clear link between socioeconomic factors and higher premature mortality rates from cardiovascular disease, highlighting the need for targeted public health interventions.

Top five UK premature heart & circulatory disease death rates 2020-22

Local Authority

Region

Under 75 Death Rate (per 100,000 People)

Annual Number of CVD Deaths (Under 75)

Glasgow City

Scotland

139.1

659

Blackpool

North West England

133.1

180

Manchester

North West England

125.3

390

North Lanarkshire

Scotland

125.2

397

Barking & Dagenham

Greater London

123.7

148

Source: British Heart Foundation, 2025

According to the WHO, in September 2022, non-communicable diseases were responsible for the death of approximately 40 million people worldwide. Factors such as high blood pressure, diabetes, obesity, and other unhealthy lifestyle-related disorders result in a higher percentage of the population developing non-communicable diseases. According to World Heart Report 2023, more than half a billion people around the world continue to be affected by cardiovascular diseases, which accounted for 20.5 million deaths in 2021 - close to a third of all deaths globally and an overall increase in the estimated 121 million CVD deaths. In addition, according to the report published by The Lancet in November 2024, in 2022, an estimated 828 million adults worldwide had diabetes, with the highest prevalence in Polynesia, Micronesia, the Middle East, Pakistan, and Malaysia, while the lowest rates were in Western Europe, East Africa, Japan, and Canada. The disease burden was more prominent in low- and middle-income countries, particularly in Southeast Asia, South Asia, the Middle East, and the Caribbean. Around 59% of adults aged 30 years or older with diabetes (445 million) did not receive treatment.

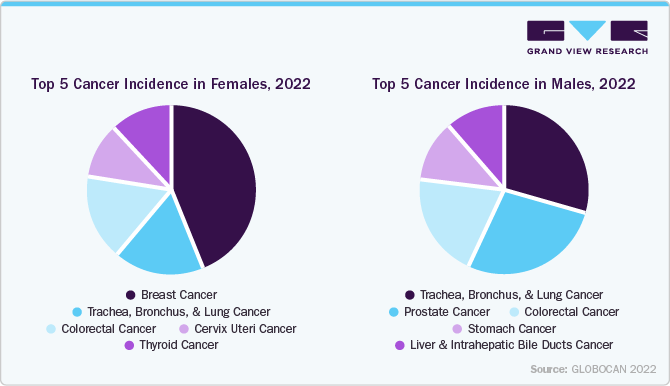

Moreover, the increasing prevalence of cancer among males and females is a key factor driving the Endotracheal Tube (ETT) market, as cancer patients frequently require airway management during treatment and critical care. The rising incidence of lung cancer in men and breast cancer in women, along with cancers of the head, neck, esophagus, and gastrointestinal tract, significantly contributes to the demand for endotracheal tubes. Cancer patients undergoing surgical tumor removal procedures, especially in thoracic, abdominal, or head and neck regions, often need general anesthesia, where endotracheal intubation is a standard practice to secure the airway. In addition, chemotherapy and radiation therapy can cause complications such as airway obstruction, respiratory distress, or aspiration risk, further increasing the need for intubation in advanced cancer cases. Patients with advanced-stage cancer frequently suffer from dyspnea, respiratory failure, or airway collapse, requiring ventilatory support through endotracheal tubes as part of palliative care. The growing number of immunocompromised cancer patients due to aggressive treatments makes them more susceptible to respiratory infections and pneumonia, leading to prolonged ICU stays and mechanical ventilation needs.

The figure below illustrates the top five cancers by global incidence in females and males, highlighting the significant disease burden across genders. Breast cancer is the most prevalent cancer in females, while lung cancer dominates in males, reflecting gender-specific cancer patterns. The data highlights the need for gender-specific cancer prevention strategies, early detection programs, and improved treatment access to reduce the global cancer burden.

The increasing number of investment programs to continue product development and commercialization will drive the endotracheal tube industry in the future. For instance, in November 2022, the third batch of firms to participate in AlphaLab Health, a partnership program of Innovation Works and Allegheny Health Network to accelerate the growth of life sciences and healthcare entrepreneurs, was announced. The AlphaLab Health startups were chosen through a competitive process to participate in a 6-month program, which was to assist them in navigating major risk points in the clinical and commercial development of early-stage companies.This cohort includes a diverse set of companies involved in diagnostics, medicines, medical equipment, and healthcare information technology, which is expected to boost the market growth.

Technological advancements in anesthesia, surgeries, and endotracheal products are anticipated to drive the market. Advancements in the field enabled healthcare professionals to isolate a lung, minimize aspiration, and prevent Ventilator-associated Pneumonia (VAP). For instance, in November 2021, GE Healthcare announced that it gained FDA 510(k) clearance for an Artificial Intelligence (AI) algorithm that will assist doctors in assessing placements of Endotracheal Tube (ETT).

The need for endotracheal tubes in various healthcare settings is expected to increase with a growing aging population, a demographic that is more susceptible to chronic illnesses such as diabetes and other lifestyle-related disorders. In addition, according to the CDC, adults aged 65 years and above are more likely to suffer from heart disease, Chronic Obstructive Pulmonary Disease (COPD), diabetes, cancer, neurological disorders, and other chronic illnesses. Patients with such illnesses require emergency and nonemergency hospital services. According to the WHO, the global population of individuals aged 60 years or more is expected to reach 2 billion by 2050. Furthermore, by 2050, 80% of the world's elderly population will reside in middle- and low-income countries. As a result, one of the high-impact drivers for the endotracheal tube industry is expected to be the growing elderly population.

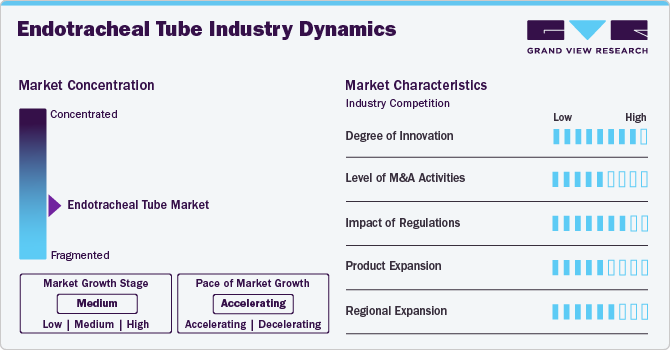

Market Concentration & Characteristics

The endotracheal tube industry is experiencing significant growth, driven by the rising prevalence of chronic diseases such as cancer, respiratory disorders, and cardiovascular diseases, which require airway management during surgeries and critical care. The increasing number of cancer cases, particularly lung and head & neck cancers, along with the growing geriatric population and advancements in tube designs such as cuffed and antimicrobial-coated tubes, are key market drivers.

The endotracheal tube industry is witnessing a significant degree of innovation, driven by the need to enhance patient safety, infection control, and procedural efficiency. Innovations such as pressure-sensing ETTs further strengthen patient safety by maintaining optimal cuff pressure. For instance, in November 2020, GE Healthcare launched Critical Care Suite 2.0, an AI-based solution that assists clinicians in assessing ETT placement in intubated patients, including COVID-19 critical patients. This AI suite helps reduce assessment time and improves operational efficiency without compromising diagnostic precision. These technological advancements significantly improve airway management, reduce complications, and drive the growing adoption of ETTs in clinical settings.

The endotracheal tube industry has witnessed moderate merger and acquisition (M&A) activities in recent years, driven by the growing demand for advanced airway management solutions and the need for market consolidation. Leading medical device manufacturers acquire smaller companies to expand their product portfolios, enhance technological capabilities, and strengthen their market position. These acquisitions enable companies to offer innovative endotracheal tubes with features such as antimicrobial coatings, subglottic suction systems, and AI-based intubation solutions. For instance, in January 2022, ICU Medical acquired Smiths Medical, a major player in airway management devices, including ETTs, to expand its product range in the critical care segment.

Regulations are essential in shaping the endotracheal tube industry, ensuring product safety, efficacy, and quality standards. Stringent regulatory frameworks by bodies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and China’s National Medical Products Administration (NMPA) mandate manufacturers to comply with product safety guidelines, clinical testing requirements, and quality certifications before market approval. Regulatory standards such as the U.S. FDA Class II medical devices approval process and the European CE Mark certification ensure that ETTs meet specific safety and performance criteria.

The endotracheal tube industry is witnessing product expansion, driven by the rising demand for advanced airway management solutions and the need to improve patient safety and clinical efficiency. Manufacturers continuously introduce innovative products to address complications like tube misplacement, obstruction, and infections. Key product expansions include antimicrobial-coated tubes to prevent infections and cuffed ETTs with subglottic suction ports that reduce the risk of ventilator-associated pneumonia. In May 2021, Medtronic plc announced the commercial launch of the SonarMed airway monitoring system in the U.S., the first and only device that uses acoustic technology to detect ETT obstruction and verify tube position in real time. This innovation provides clinicians with crucial data to make informed, life-saving decisions, particularly for pediatric and neonatal patients.

The endotracheal tube industry is experiencing significant regional expansion, driven by rising healthcare infrastructure investments and increasing demand for airway management solutions across various regions. Leading manufacturers are strategically expanding their manufacturing capacities and geographical presence to strengthen their market foothold. For instance, in November 2022, Hollister Incorporated, a medical device company, invested USD 25 million in novel manufacturing equipment to expand its manufacturing capacity at its Kaunas facility in Lithuania. This investment meets the growing demand for airway management products across Europe and other emerging regions.

Product Insights

The regular endotracheal tube segment held the largest market share of around 32.17% in 2024 due to its wide applicability, cost-effectiveness, and high usage in surgical and critical care procedures. These tubes are the standard choice in most healthcare settings for providing mechanical ventilation and ensuring airway patency during surgeries, trauma care, and emergencies. The simplicity of design, ease of use, and availability of various sizes make regular ETTs suitable for adult and pediatric patients. In addition, the lower cost of regular tubes compared to advanced variants such as antimicrobial-coated or subglottic suction ETTs makes them highly preferred in low- and middle-income countries where budget constraints are prevalent. Technological advancements, the lack of widespread awareness, and the higher cost of innovative ETTs further contribute to the dominance of regular ETTs in the market.

The reinforced endotracheal tube segment is expected to exhibit the fastest CAGR during the forecast period.Reinforced endotracheal tubes are used during neurosurgeries and facial surgeries. According to the WHO, over 1 in 3 people are affected by neurological conditions, the leading cause of illness and disability worldwide. The requirement for neurosurgical procedures is anticipated to fuel the market. Reinforced ETTs are widely used in neurosurgery, maxillofacial, and ENT surgeries, where maintaining a secure airway is critical. New products are expected to support segment growth in the forecast years. For instance, in January 2020, Smiths Medical launched the Portex Soft Seal Flex Reinforced Endotracheal Tube, designed to provide superior flexibility and prevent tube occlusion during long-duration surgeries. In addition, the growing adoption of reinforced tubes in oncological and orthopedic surgeries due to their ability to maintain airway patency under high-pressure ventilation further accelerates market growth.

Route Insights

The orotracheal segment held the largest market share in 2024. Orotracheal intubation is most widely used in case of emergency indications like respiratory or cardiac arrest to protect the airway from aspiration, ventilation, inadequate oxygenation, and existing or anticipated airway obstruction. As the prevalence of respiratory and cardiac disorders continues to increase, the demand for orotracheal tubes is expected to grow over the forecast period. The high success rate associated with the procedure is one of the major reasons for the increasing demand for orotracheal intubation over recent years. As per NIH, in 2023, China reported a high prevalence of cardiovascular diseases, with an estimated 330 million individuals affected, including 13 million stroke cases, 11.39 million with coronary heart disease, and 245 million with hypertension.

The nasotracheal segment held the second-largest market share in 2022. Nasotracheal intubation is a commonly used airway management technique in patients undergoing oral, dental, or throat surgical procedures. It is primarily used to deliver anesthesia in oral surgery patients as it provides easy accessibility to the surgical site during these procedures. For instance, according to the American Cancer Society, approximately 59,660 new cases of oral cavity and oropharyngeal cancer and around 12,770 related deaths are expected in the U.S. in 2025. The increasing prevalence of oral cavity and oropharyngeal cancers is expected to significantly support the growth of the nasotracheal endotracheal tube segment.

Application Insights

The emergency treatment segment held the largest market share in 2024. The emergency treatment department is equipped to treat injuries, infections, heart attacks, stroke, asthma attacks, and acute pregnancy complications. The high volume of emergency department visits is an important driver of market growth, particularly in critical care and trauma cases. According to the National Hospital Ambulatory Medical Care Survey 2021, approximately 139.8 million emergency visits were recorded in the U.S., with 40 million injury-related visits and around 2.8 million cases requiring critical care admission. Many of these essential patients of care undergo endotracheal intubation to secure the airway during respiratory distress, trauma, or poisoning-related emergencies. The rising incidence of trauma cases, cardiac arrests, and respiratory emergencies underscores the increasing demand for endotracheal tubes in emergency care settings, thereby propelling market growth.

The therapy treatment segment held the second-largest market share in 2024. The therapy treatment segment is experiencing significant growth, primarily driven by the increasing prevalence of Chronic Obstructive Pulmonary Disease (COPD). As per the WHO data published in 2024, COPD was the fourth leading cause of death globally in 2021, contributing to approximately 3.5 million deaths, accounting for 5% of all global deaths. Patients with severe COPD frequently experience acute respiratory failure, necessitating mechanical ventilation and endotracheal intubation to maintain airway patency. This condition is particularly prevalent in low- and middle-income countries, where nearly 90% of COPD deaths in individuals under 70 years of age occur. The rising incidence of COPD, coupled with the growing need for respiratory support therapies and critical care interventions, is expected to fuel the demand for endotracheal tubes within the therapy treatment segment across developed and developing regions.

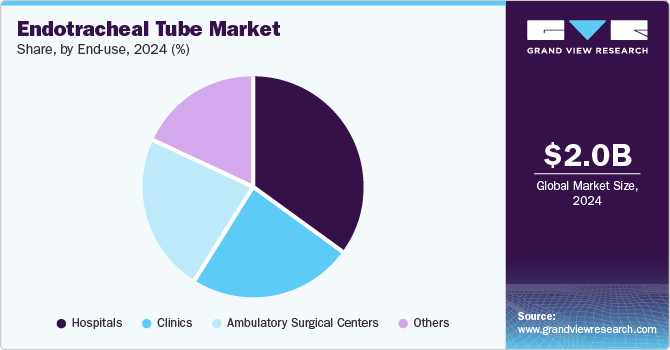

End-use Insights

The hospital segment held the largest market share of around 36.22% in 2024. The growth is driven by the increasing number of emergency admissions and critical care cases. Hospitals are primary healthcare facilities for emergency intubation procedures, particularly in chronic respiratory diseases, cardiovascular emergencies, trauma, and post-surgical care. The rising prevalence of COPD, cancer-related surgeries, and cardiovascular diseases further contributes to the demand for endotracheal tubes in hospitals. In addition, the growing number of intensive care units and the availability of advanced medical infrastructure have significantly boosted the adoption of endotracheal tubes in hospitals, making this segment the dominant end user in the market.

Clinics are expected to exhibit the fastest CAGR during the forecast period. The increasing prevalence of respiratory disorders and the growing geriatric population with a high prevalence of chronic diseases are estimated to fuel this segment. Shorter waiting times at clinics, convenient access to care, and affordability are among the key factors due to which patients prefer to undergo surgeries at clinics over other medical settings. In addition, clinics can help reduce the need to visit emergency departments.

Regional Insights

North America endotracheal tube market accounted for 34.54% of the global revenue share in 2024. The region's growth is attributed to the high prevalence of respiratory diseases, including COPD, asthma, and lung cancer, coupled with the presence of advanced healthcare infrastructure. The rising number of intensive care unit admissions, surgical procedures, and emergency department visits further fuels the demand for endotracheal tubes. In addition, the growing geriatric population, increased adoption of innovative airway management devices, and favorable reimbursement policies are key factors driving market growth in North America. The presence of leading medical device manufacturers and ongoing technological advancements also contribute to the region's significant market share.

U.S. Endotracheal Tube Market Trends

The U.S. endotracheal tube market dominated the North American in 2024, owing to its advanced healthcare system and high healthcare expenditure. The rising incidence of respiratory disorders is one of the primary factors driving the U.S. endotracheal tube industry. Conditions such as chronic obstructive pulmonary disease (COPD), asthma, acute respiratory distress syndrome (ARDS), and pneumonia are becoming more common due to aging populations, pollution, and lifestyle habits like smoking. Patients with severe respiratory distress often require mechanical ventilation through endotracheal intubation, boosting the demand for these devices.

The growing number of surgical procedures requiring general anesthesia is a significant market driver. Endotracheal tubes are essential during surgery intubation to maintain airway patency and deliver anesthetic gases. According to the American Society of Anesthesiologists, approximately 40-50 million surgeries are performed annually in the U.S., with a significant portion requiring intubation. Minimally invasive surgeries, particularly in cardiac, orthopedic, and gastrointestinal fields, are further boosting demand for endotracheal tubes.

As per the 2025 Heart Disease and Stroke Statistics Update Fact Sheet,

-

In 2022, CVD caused 941,652 deaths in the U.S., more than all forms of cancer and chronic lower respiratory disease combined.

-

Coronary Heart Disease (CHD) was the leading cause of CVD-related deaths (39.5%) in the U.S., followed by stroke (17.6%), other CVD (17.0%), hypertensive diseases (14.0%), heart failure (9.3%), and diseases of the arteries (2.6%).

-

Stroke caused 165,393 deaths in the U.S. in 2022, with someone dying of stroke every 3 minutes 11 seconds on average.

Europe Endotracheal Tube Market Trends

The Europe endotracheal tube industry is driven by the increasing number of surgical procedures, particularly among the aging population. This significantly boosts the demand for endotracheal tubes, which are essential for airway management during anesthesia. The rising prevalence of respiratory diseases such as chronic obstructive pulmonary disease and lung cancer further fuels the need for intubation in critical care settings. Technological advancements, including antimicrobial-coated and reinforced endotracheal tubes, have improved patient safety by reducing infection risks and encouraging wider adoption in healthcare facilities. Europe's well-established healthcare infrastructure also plays a key role in supporting the integration of advanced medical devices. As per PubMed, in 2023, cardiovascular diseases remained a leading cause of death in Europe, with over 4 million deaths annually, primarily from coronary heart disease and stroke.

The UK endotracheal tube industry is a significant contributor to the European market. The increasing incidence of chronic respiratory disorders such as COPD, asthma, and other lung-related diseases has significantly raised the demand for airway management solutions in critical care. The aging population in the UK further boosts this demand, as older adults are more susceptible to chronic illnesses and require surgical procedures that involve intubation. Technological advancements, particularly the introduction of antimicrobial-coated and reinforced endotracheal tubes, have improved patient outcomes by reducing the risk of infections like ventilator-associated pneumonia (VAP). In addition, the rise in surgical procedures, including emergency and elective surgeries, has increased the need for endotracheal tubes in hospitals and ambulatory surgical centers. The growing awareness of infection prevention and patient safety protocols in healthcare facilities has further accelerated the adoption of advanced endotracheal tubes, positioning the market for continued growth in the UK.

The table below highlights the significant burden of cardiovascular disease across the UK in 2023, with a total of 174,693 deaths attributed to CVD. Among these, 48,697 individuals were under the age of 75, indicating the widespread impact of CVD on the working-age population. England accounted for the highest number of CVD deaths and cases, with over 6.4 million people living with the condition.

British Heart Foundation, 2025

Nation

No. of People Dying from CVD (2023)

No. of People Under 75 Years Old Dying from CVD (2023)

Estimated Number of People Living with CVD (Latest Estimate)

England

142,460

38,996

6.4 million +

Scotland

17,787

5,313

730,000

Wales

9,701

2,918

340,000

Northern Ireland

4,227

1,133

225,000

UK total

174,693

48,697

7.6 million +

Source: British Heart Foundation, 2025

The country’s market is supported by a healthcare infrastructure and significant investments in research and development. Government initiatives and funding for research, along with the presence of leading medical device companies, are key factors driving market growth.

The endotracheal tube market in Germany is experiencing significant growth. The increasing aging population and rising prevalence of chronic diseases such as cardiovascular disorders, chronic obstructive pulmonary disease, and neurological conditions are significant drivers, as these health issues require surgical interventions and mechanical ventilation, where endotracheal tubes play a critical role. According to NIH, approximately 1.8 million people were living with dementia in Germany as of December 31, 2021; the number of new dementia cases in 2021 is estimated at 360,000 to 440,000. In 2033, depending on the scenario, 1.65 to 2 million people aged 65 and older may be affected. In addition, technological advancements in endotracheal tubes, including developing reinforced and antimicrobial-coated tubes, have enhanced their safety, efficacy, and infection control capabilities, further boosting their adoption. The growing number of elective and emergency surgical procedures across the country is another major factor driving market demand. Moreover, increased investments in healthcare infrastructure and the expansion of hospitals and surgical centers have improved access to advanced medical care, contributing to the rising utilization of endotracheal tubes.

Asia Pacific Endotracheal Tube Market Trends

The APAC endotracheal tube market is anticipated to grow at the fastest CAGR globally, driven by several factors, including the rising number of surgical procedures, increasing prevalence of respiratory diseases, and advancements in healthcare infrastructure. The growing geriatric population in countries such as Japan, China, and South Korea contributes significantly to the demand for endotracheal tubes, as older individuals are more prone to respiratory conditions such as chronic obstructive pulmonary disease and asthma. In addition, the increasing incidence of critical illnesses and trauma cases requiring intensive care unit admissions is further fueling the market's expansion. Technological advancements, such as anti-microbial coated tubes to reduce ventilator-associated pneumonia and cuffed endotracheal tubes to prevent aspiration, enhance patient safety, and drive product adoption. Moreover, rising healthcare expenditure, coupled with improving medical facilities across developing nations such as India and Southeast Asian countries, is creating new growth opportunities. The increasing focus on infection control and the growing number of elective surgeries are expected to accelerate market growth further.

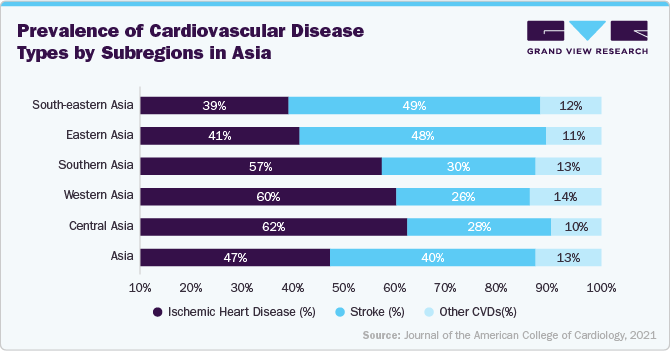

The below figure illustrates the distribution of cardiovascular disease types across different subregions in Asia, categorized into Ischemic Heart Disease (IHD), Stroke, and Other CVDs. Ischemic heart disease accounts for the highest proportion of CVD cases in Central Asia (62%) and Western Asia (60%), indicating a significant burden of coronary artery-related conditions in these regions. This regional variation in CVD burden highlights the diverse risk factors, healthcare infrastructure, and lifestyle patterns across Asia, highlighting the need for preventive strategies and healthcare interventions.

The China endotracheal tube market is experiencing significant growth, driven by the country's expanding healthcare infrastructure and increasing government investments in public health initiatives. The rising prevalence of chronic conditions such as cardiovascular diseases, respiratory infections, and diabetes is fueling the demand for surgical interventions, where endotracheal tubes play a vital role in airway management during anesthesia. According to the British Medical Journal, CVD mortality is expected to rise from 0.39% in 2021 to 0.46% in 2024, after which it will stabilize at 0.44% by 2030. Community-based interventions and improved access to inpatient care are predicted to significantly reduce the projected burden of CVD. As per IDF, with a total adult population of 1,079,960,800 in 2021, the country recorded a 13% prevalence of diabetes in adults, amounting to approximately 140,869,600 cases. The high prevalence of diabetes increases the risk of complications and the need for surgical interventions, where endotracheal tubes are essential for airway management during anesthesia. In addition, China's rapidly aging population, more prone to chronic diseases and critical care needs, further boosts market demand. As per WHO, the population of people over 60 years old in China is projected to reach 28% by 2040.

Latin America Endotracheal Tube Market Trends

The Latin America endotracheal tube industry is driven by the rising incidence of respiratory infections, increasing surgical procedures, and the growing demand for critical care services. The region's expanding healthcare infrastructure and government initiatives to improve emergency medical services play a pivotal role in boosting market growth. Technological advancements such as antimicrobial-coated tubes and video-assisted intubation systems are gaining traction, enhancing patient safety and reducing complications. In addition, the surge in road accidents and trauma cases across Latin American countries contributes to the increasing demand for endotracheal tubes in emergency care settings. In 2024, Latin America and the Caribbean face a significant public health challenge with road traffic accidents, leading to approximately 110,000 fatalities and over 5 million injuries annually.

Middle East & Africa Endotracheal Tube Market Trends

The Middle East and Africa (MEA) endotracheal tube industry is experiencing growth, primarily driven by the rising prevalence of respiratory diseases such as chronic obstructive pulmonary disease, asthma, and pneumonia. The increasing number of surgical procedures requiring intubation, particularly in countries with expanding healthcare infrastructure such as Saudi Arabia, the UAE, and South Africa, further fuels market demand. In addition, advancements in medical technologies, including antimicrobial-coated tubes and cuffed tubes, are enhancing patient safety and promoting product adoption. Improvements in healthcare infrastructure, along with government initiatives to upgrade critical care services, are also contributing to market growth. According to World Health Federation, cardiovascular disease is the number one cause of death in the Middle East and North Africa region, responsible for more than one third of all deaths, or 1.4 million people every year.

Key Endotracheal Tube Company Insights

As the demand for endotracheal tubes increases, global manufacturers are accelerating their production processes and modernizing them with cost-effective solutions. To support the growing demand for various endotracheal tube applications, leading companies in the global endotracheal tube industry are pushing for higher product quality. For instance, in January 2022, ICU Medical, Inc. acquired Smith’s Medical, a medical device company. This helped the company gain a strong position on a global level in the medical industry & technology sector. In addition, in January 2022, Medtronic agreed to acquire Affera, Inc, a privately held medical technology company. The acquisition was expected to expand Medtronic’s portfolio of advanced cardiac ablation products.

Key Endotracheal Tube Companies:

The following are the leading companies in the endotracheal tube market. These companies collectively hold the largest market share and dictate industry trends.

- Angiplast Pvt Ltd

- Advin Health Care

- Sterimed Group

- ICU Medical, Inc.

- Medtronic (Covidien)

- Van Oostveen Medical B.V.

- Teleflex Incorporated

- Convatec Inc.

- Fuji Systems Corp

- SEWOON MEDICAL Co., Ltd.

- Mercury Medical

- Hollister Incorporated

- Well Lead Medical Co., Ltd

- Viggo Medical Devices

- ARMSTRONG MEDICAL

- Medline

- BD (BESDATA)

- BRIO DEVICE, LLC.

- pfm medical ag

Recent Developments

-

In November 2024, Asahi Kasei Medical Co., Ltd. announced the launch of TrachFlush in Japan, an innovative endotracheal tube with an integrated suction and flushing system. This device automatically removes secretions without disconnecting the ventilator, minimizing the risk of ventilator-associated infections and enhancing patient safety.

-

In August 2023, SourceMark Medical introduced the SuctionPlus Endotracheal Tube, a new addition to its Anesthesia and Airway Management product line. This latex and DEHP-free tube features an evacuation lumen designed to protect against aspiration and reduce the risk of ventilator-associated pneumonia. It also includes a high-volume, low-pressure cylindrical cuff, and a removable 15mm connector.

-

In September 2022, Teleflex Incorporated announced the complete acquisition of Standard Bariatrics, Inc., a medical device company. This acquisition assisted the company in expanding its surgical portfolio with various stapling technologies for bariatric surgeries. Furthermore, this acquisition added several products serving the growing gastrectomy market, increasing the company's revenue.

Endotracheal Tube Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.14 billion

Revenue forecast in 2030

USD 2.92 billion

Growth rate

CAGR of 6.40% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume unit, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, route, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexcio: UK; Germany; Italy; Spain; France; Sweden; Denmark; Norway; China; India; Japan; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Angiplast Pvt Ltd; Advin Health Care; Sterimed Group; ICU Medical, Inc.; Medtronic (Covidien); Van Oostveen Medical B.V.; Teleflex Incorporated; Convatec Inc.; Fuji Systems Corp; SEWOON MEDICAL Co., Ltd.; Mercury Medical; Hollister Incorporated; Well Lead Medical Co.,Ltd; Viggo Medical Devices; ARMSTRONG MEDICAL; Medline; BD; BRIO DEVICE, LLC.; pfm medical ag

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endotracheal Tube Market Report Segmentation

This report forecasts volume & revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global endotracheal tube market report based on product, route, application, end-use, and region:

-

Product Outlook (Volume, Per Unit; Revenue, USD Million, 2018 - 2030)

-

Regular Endotracheal Tube

-

Reinforced Endotracheal Tube

-

Preformed Endotracheal Tube

-

Double-lumen Endotracheal Tube

-

-

Route Outlook (Revenue, USD Million, 2018 - 2030)

-

Orotracheal

-

Nasotracheal

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Emergency Treatment

-

Therapy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexcio

-

-

Europe

-

UK

-

Germany

-

Italy

-

Spain

-

France

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endotracheal tube market size was estimated at USD 2.03 billion in 2024 and is expected to reach USD 2.14 billion in 2025

b. The global endotracheal tube market is expected to grow at a compound annual growth rate of 6.40% from 2025 to 2030 to reach USD 2.93 billion by 2030.

b. North America dominated the endotracheal tubes market with a share of 34.54% in 2024. This is attributable to technological development in endotracheal tubes, the rising prevalence of chronic disease, and the increasing number of surgical procedures.

b. Some key players operating in the endotracheal tube market include TAngiplast Pvt Ltd, Advin Health Care, Sterimed Group, ICU Medical, Inc., Medtronic (Covidien), Van Oostveen Medical B.V., Teleflex Incorporated, Convatec Inc., Fuji Systems Corp, SEWOON MEDICAL Co., Ltd., Mercury Medical, Hollister Incorporated, Well Lead Medical Co., Ltd, Viggo Medical Devices, ARMSTRONG MEDICAL, Medline, BD (BESDATA), BRIO DEVICE, LLC., pfm medical ag, and others.

b. Key drivers expected to contribute to market growth include increase in disease burden, constant increase in the number of surgeries being performed worldwide, technological advancements, and increase in private & public healthcare expenditure

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.