- Home

- »

- Medical Devices

- »

-

Endoscopy Operative Devices Market, Industry Report, 2030GVR Report cover

![Endoscopy Operative Devices Market Size, Share & Trends Report]()

Endoscopy Operative Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Reusable Operative Devices, Disposable Operative Devices), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-391-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endoscopy Operative Devices Market Trends

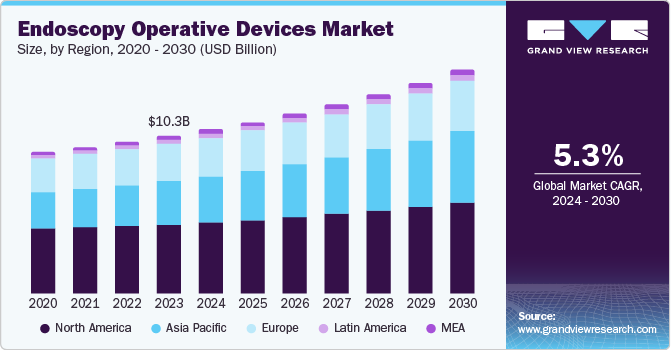

The global endoscopy operative devices market size reached a value of USD 10.34 billion in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The increasing prevalence of chronic diseases, particularly among the elderly population, is a major driver of market growth. Conditions such as gallstones, liver abscesses, pelvic abscesses, intestinal perforation, and endometriosis often require endoscopic intervention, resulting in a growing demand for endoscopy operative devices.

The shift to minimally invasive procedures is another key factor accelerating market growth. Endoscopic procedures offer numerous advantages, including reduced post-operative pain and complications, faster recovery, lighter anesthesia, and shorter hospital stays. This trend is expected to continue as patients and healthcare providers increasingly recognize the benefits of minimally invasive procedures. Technological advancements in endoscopic devices are also driving market growth, enabling better visualization and treatment while reducing the cost of procedures.

The favorable demographics of the global population are also contributing to market growth. According to the UN, by 2050, the global population aged 60 years and above is projected to double to its current value, representing approximately 22.0% of the total population. This demographic shift is expected to drive demand for endoscopic procedures as the elderly population is more prone to chronic diseases requiring endoscopic intervention. Furthermore, the growing awareness of the advantages of minimally invasive procedures is contributing to the rising demand for endoscopies.

The increasing demand for gastrointestinal endoscopy is also expected to drive market growth. This trend is driven by the rising prevalence of gastrointestinal disorders globally. The growing number of healthcare centers and the upgrading of healthcare infrastructure in developed and emerging economies are also leading to an increase in demand for endoscopes and operative devices.

Product Insights

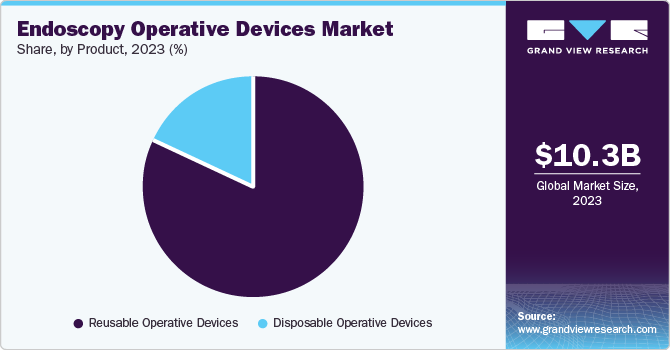

Reusable operative devices led the market in 2023, accounting for a revenue share of 82.0%, fueled by their cost-effectiveness, improved durability, and performance. Healthcare providers are drawn to this option as it enables better visualization and maneuverability during procedures, while also aligning with the growing demand for minimally invasive surgeries. The increasing geriatric population and associated chronic diseases are further driving demand for reusable operative devices.

Disposable operative devices are projected to grow at the fastest CAGR of 6.1% over the forecast period, driven by concerns about infection control and cross-contamination risks associated with reusable devices. The COVID-19 pandemic accelerated this trend, as healthcare facilities sought to minimize infection risks. Advancements in technology have enabled the development of high-quality disposable endoscopes with comparable performance, while minimally invasive procedures also contribute to the segment’s growth.

Regional Insights

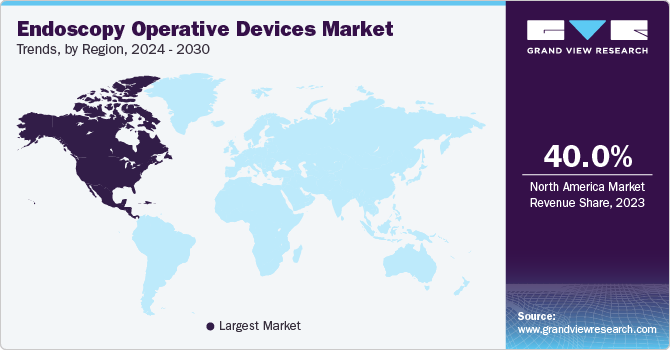

North America endoscopy operative devices market accounted for the largest revenue share of over 40.0% in the global endoscopy operative devices market in 2023. Market growth in the region is aided by its advanced healthcare infrastructure, widespread adoption of cutting-edge technologies, and high prevalence rates of gastrointestinal disorders and chronic diseases. The growing geriatric population and emphasis on minimally invasive surgeries, which offer reduced recovery times and lower complication rates, also contribute to the region’s market dominance.

U.S. Endoscopy Operative Devices Market Trends

The endoscopy operative devices market in the U.S. dominated the North America endoscopy operative devices market with a share of over 90.0% in 2023. Market growth in the country is driven by the growing preference for minimally invasive procedures, offering benefits such as reduced post-operative pain and shorter recovery times. Advancements in endoscopic technology, high healthcare expenditure, and the presence of key manufacturers such as Olympus and Boston Scientific contribute to the market’s growth.

Europe Endoscopy Operative Devices Market Trends

Europe endoscopy operative devices market is anticipated to grow lucratively over the forecast period, owing to its advanced healthcare infrastructure, strong regulatory framework, and growing demand for minimally invasive surgeries. The increasing prevalence of chronic diseases and aging population, particularly vulnerable to age-related ailments, fuel demand. Technological advancements in imaging and device design also contribute to growth.

The endoscopy operative devices market in Germany is driven by its focus on technological innovation and medical device advancements, resulting in sophisticated endoscopic solutions. The growing prevalence of chronic diseases, particularly gastrointestinal disorders, requires more endoscopic procedures. Minimally invasive surgeries’ benefits, such as reduced recovery times, drive demand. Germany’s robust healthcare infrastructure and high expenditure support market growth.

Asia Pacific Endoscopy Operative Devices Market Trends

Asia Pacific endoscopy operative devices market is anticipated to register the fastest growth of 7.3% in the global endoscopy operative devices market between 2024 and 2030. Factors such as increasing disposable incomes, improved healthcare infrastructure, and advanced endoscopic techniques are contributing to industry growth in the region. Global players are expanding their presence through distribution agreements and local manufacturing facilities.

The endoscopy operative devices market in Japan is driven by its aging population, with a high proportion of elderly individuals, leading to a rising demand for age-related disease treatment. The country’s technological innovation and emphasis on regulatory quality and safety standards ensure high-quality devices. Minimally invasive surgeries adoption and robust healthcare infrastructure further boost market growth.

Key Endoscopy Operative Devices Company Insights

Some key companies in the endoscopy operative devices market include Cook; Medtronic; CONMED Corporation; Boston Scientific Corporation; and Medical Device Business Services, Inc.; among others. Manufacturers are adopting strategies such as technological collaborations, acquisitions, and expanded product portfolios to enhance their market position.

-

Stryker offers medical technologies and surgical instruments to enhance surgical precision and patient outcomes. Its extensive product portfolio and commitment to R&D drive growth in minimally invasive procedures.

-

Richard Wolf GmbH is a developer and manufacturer of high-quality endoscopic instruments and systems. The company focuses on minimally invasive procedures and user-friendly technology.

Key Endoscopy Operative Devices Companies:

The following are the leading companies in the endoscopy operative devices market. These companies collectively hold the largest market share and dictate industry trends.

- Cook

- Medtronic

- CONMED Corporation

- Boston Scientific Corporation

- Medical Device Business Services, Inc.

- Stryker

- KARL STORZ SE & Co. KG

- Richard Wolf GmbH

- FUJIFILM Corporation

- Olympus

- Smith+Nephew

- BD

Recent Developments

-

In July 2024, Merit Medical Systems acquired EndoGastric Solutions’ EsophyX Z+ device for USD 105.00 million, expanding its endoscopy portfolio and enhancing its global footprint in the gastrointestinal market.

-

In April 2024, Medtronic unveiled the future of AI in GI at the Genius Summit 2024, introducing ColonPRO™ software for the GI Genius™ intelligent endoscopy system and a strategic collaboration with ModMed to enhance patient care.

-

In April 2024, KARL STORZ acquired the business of a distributor in Belgium, Luxembourg, and the Netherlands- Stöpler-expanding its direct sales presence in the region.

-

In January 2024, Canon Medical Systems and Olympus announced a business alliance to develop and market Endoscopic Ultrasound Systems, combining Canon’s advanced diagnostic ultrasound technology with Olympus’ endoscope expertise.

Endoscopy Operative Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.77 billion

Revenue forecast in 2030

USD 14.69 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Cook; Medtronic; CONMED Corporation; Boston Scientific Corporation; Medical Device Business Services, Inc.; Stryker; KARL STORZ SE & Co. KG; Richard Wolf GmbH; FUJIFILM Corporation; Olympus; Smith+Nephew; BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopy Operative Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global endoscopy operative devices market report on the basis of product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable Operative Devices

-

Energy Systems

-

Access Devices

-

Suction & Irrigation Systems

-

Hand Instruments

-

Wound Retractors

-

Snares

-

-

Disposable Operative Devices

-

Energy Systems

-

Access Devices

-

Suction & Irrigation Systems

-

Hand Instruments

-

Wound Retractors

-

Snares

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.