- Home

- »

- Medical Imaging

- »

-

Endoscopic Ultrasound Market Size & Share Report, 2030GVR Report cover

![Endoscopic Ultrasound Market Size, Share & Trends Report]()

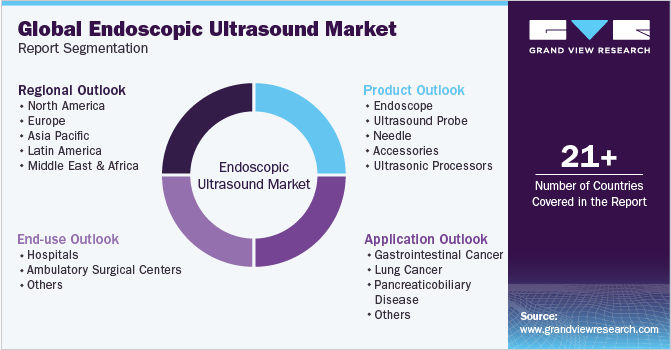

Endoscopic Ultrasound Market Size, Share & Trends Analysis Report By Product (Needle, Endoscope), By Application (Gastrointestinal Cancer, Lung Cancer), By End-use (ASCs, Hospitals), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-126-5

- Number of Report Pages: 13

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

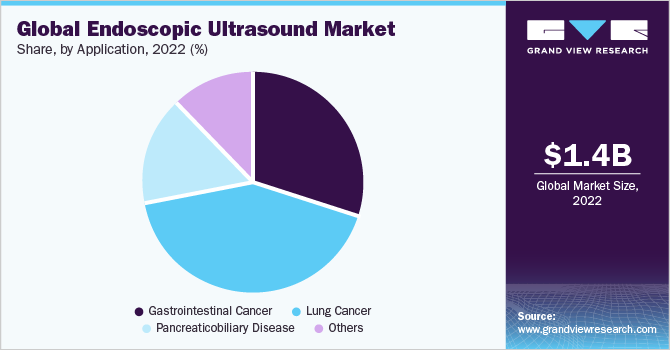

The global endoscopic ultrasound market size was estimated at USD 1.36 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 6.72% from 2023 to 2030. The growth of the market is due to various factors, such as the rising prevalence of gastrointestinal cancer, technological advancements, and increasing instances of pancreaticobiliary malignancies. For instance, as per the American Cancer Society’s estimates for 2023, about 64,050 new cases of pancreatic cancer will be diagnosed in the U.S., and around 50,550 deaths are expected due topancreatic cancer. Lung cancer is the major cause of cancer deaths worldwide; according to the Lung Cancer Research Foundation, 1 in 16 people will be identified with lung cancer in their lifespan.

For instance, as per Cancer.Net, in March 2023, about 238,340 new lung cancer cases were diagnosed in the U.S. In addition, around 2,206,771 patients were diagnosed with lung cancer worldwide in 2020. Colorectal cancer (CRC) is the second-largest cause of cancer deaths worldwide. According to the American Cancer Society, in 2023, nearly 153,020 new cases of colorectal cancer will be found in the U.S., and 52,550 deaths will occurdue to colorectal cancer. The abovementioned statistics help understand the potential growth of the market during the forecast period. In addition, the rising investment in research and development in the field of endoscopic ultrasound is expected to boost the market growth during the forecast period.

For instance, as per the article published by NIH in June 2023, according to the American Society for Gastrointestinal Endoscopy, a new ultrasound capsule endoscopy (USCE) is incorporated with white light & ultrasound imaging into a secured capsule, and it is developed for superficial and submucosal imaging of esophagus. Also, a variety of devices were developed for interventional endoscopic ultrasound, such as puncture needles and guidewires, tract dilation devices, stents, and troubleshooting devices. In addition, an increase in the R&D activities of an advanced endoscopic ultrasound (EUS) by key companies is expected to propel the market growth. For instance, in October 2022, the Olympus introduced EU-ME3 endoscopic ultrasound processor platform, which boosts diagnostics for pancreatitis, pancreatic cancer, and the detection of stomach and esophageal cancer invasion.

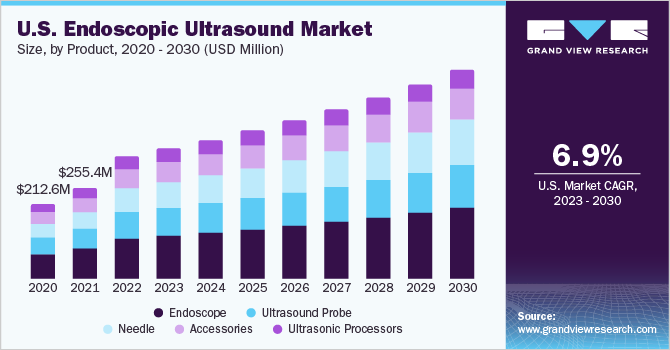

Product Insights

The endoscope segment dominated the market with the highest revenue share of around 33.68% in 2022. This dominance can be attributed to factors, such as an increasing number of echo-endoscopy procedures, an increase in awareness about the benefits of early detection of diseases, and advancement in endoscope technology. For instance, in May 2023, Olympus Corp. announced the FDA clearance of the EVIS X1 endoscopy system, with two compatible gastrointestinal endoscopes i.e., GIF-1100 gastrointestinal videoscope and CF-HQ1100DL/I colonovideoscope. Medical professionals use Olympus GI endoscopy devices to aid in the diagnosis, treatment, and observation of diseases and disorders of the upper and lower GI tract, including acid reflux, ulcers, Crohn's disease, Celiac disease, and colon cancer.

An endoscope is often utilized for screening colonoscopies, in which a doctor examines the lining of the colon and removes any polyps that could potentially be malignant growths. Physicians may find it easier to see anomalies with the inclusion of modern imaging technologies. The needle segment is expected to grow at the highest CAGR of 8.0% from 2023 to 2030. The needle is commonly used to obtain tissue samples from various organs and lesions within the gastrointestinal tract, such as the pancreas, liver, lymph nodes, and gastrointestinal wall. Also, the fine-needle aspiration of lymph nodes and adjacent structures helps in staging tumors accurately. In addition, the rising prevalence of gastrointestinal diseases is expected to propel the market growth. For instance, as per the American Cancer Society Journal, in January 2023, about 21,560 new cases were estimated for esophagus cancer in the U.S., and 26,500 cases were estimated for stomach cancer.

End-use Insights

The hospital segment held the largest share of 39.74% in 2022. This growth can be attributed to the favorable health reimbursement for minimally invasive processes, developed and advanced healthcare infrastructure, and an increase in the number of trained and qualified endoscopists. For instance, as per the American Hospital Association, in May 2023, there were a total of 6129 hospitals present in the U.S. Moreover, the rising geriatric population is expected to boost the hospital segment growth as most hospitalizations in the United States are related to people aged 65 years and over.

The ambulatory surgical centers segment is expected to grow at the highest CAGR of 7.19% from 2023 to 2030. The increasing prevalence of gastrointestinal diseases, such as esophageal cancer, gastric (stomach) cancer, colorectal cancer, liver cancer, and pancreaticobiliary diseases, such as gallbladder disease, pancreas disease, and bile duct disease, is expected to boost segment growth. For instance, as per the Cancer.Net, about 26,500 new cases of stomach cancer will be diagnosed in the U.S. In addition, ASCs provide a more convenient and comfortable environment for patients, which can lead to higher patient satisfaction and increased demand for EUS procedures.

Application Insights

On the basis of application, the lung cancer segment dominated the market with a share of 42.25% in 2022. The rising prevalence of lung cancer is the major factor propelling the market growth. As per the American Cancer Society, about 21,560 new cases of lung cancer will be diagnosed in the U.S. in 2023. Lung cancer can be caused by several factors, such as tobacco smoking, previous radiation therapy, and exposure to radon gases. According to statistics published by the Center for Disease Control and Prevention in May 2023, about 28.3 million adults in the U.S. smoke cigarettes, about 3.08 million middle and secondary school students in the U.S. use at minimum one tobacco product, including e-cigarettes, an estimated 1,600 U.S. youth smoke their first cigarette every day.

Nearly 500,000 Americans die prematurely each year as a result of smoking or being exposed to secondhand smoke. Another 16 million people suffer from a severe illness brought on by smoking. The U.S. spends about USD 225 billion annually on medical treatment to treat diseases brought on by adult smoking. The gastrointestinal cancer segment is expected to grow at the highest CAGRof 7.6% from 2023 to 2030. The rising prevalence of gastrointestinal cancer is expected to boost market growth. GI tract cancer includes anal cancer, bile duct cancer, colon cancer, esophageal cancer, gallbladder cancer, liver cancer, rectal cancer, gastrointestinal stromal cancer, small intestine cancer, and stomach cancer.

For instance, as per the American Cancer Society Journal published in January 2023, about 348,840 new cases will be estimated for digestive system cancer in the U.S. in 2023.Every year, 1.5% of all new cancer cases in the U.S. are diagnosed as stomach cancer.Usually, older people of average age 68 years and above get diagnosed with stomach cancer. Each year, 6 out of 10 instances of stomach cancer are diagnosed in patients aged 65 years or older. Men are at higher risk of developing stomach cancer (approximately 1 in 96) than women (about 1 in 152).

Regional Insights

North America dominated the global market in 2022 and accounted for the largest share of around 30.89% of the global revenue. Increasing investment in R&D by the government & key companies present in the region, well-developed healthcare infrastructure, and technological development in endoscopic ultrasound in North America contribute to its growth. For instance, in July 2023, Cook Medical launched the high-resolution ultrasound biopsy needle i.e., EchoTip ProCore, which allows clinicians to collect larger tissue samples from the inaccessible region using minimally invasive endoscopic ultrasound procedures.

Asia Pacific is expected to grow at the highest CAGR of 7.61% from 2023 to 2030. Increasing awareness among people about the early detection of diseases and rising instances of CRC in the Asia Pacific region is expected to boost demand for endoscopic ultrasound in this region. In addition, the rising geriatric population is boosting the demand for endoscopic ultrasound in Asia Pacific. For instance, as per the NIH, in August 2022, the AsiaPacific region had the largest number of CRC cases and the highest rate of mortality.

Key Companies & Market Share Insights

Companies are either launching new product lines or adding more features to their existing products to gain a larger share of the market. Major players are frequently incorporating technologies that can meet specific requirements of patients, which further drives market growth. For instance, in February 2023, FUJIFILM India Private Limited introduced the compact ultrasonic probe system PB2020-M2. This ultrasonic probe is designed to enable actual ultrasound imaging of peripheral lung lesions for a more effective evaluation.

This compact, lightweight device offers high-quality ultrasonic images. In addition, in October 2022, Olympus, a specialist in endoscopic ultrasound (EUS) technology, introduced EU-ME3, a new endoscopic ultrasound processor, for clinicians to get high-quality clear images at the time of endoscopic ultrasound procedure. Some of the prominent players in the global endoscopic ultrasound market include:

-

Boston Scientific Corporation

-

Medtronic

-

ConMed

-

Olympus Corporation

-

Steris

-

SonoScape Medical Corp.

-

PENTEX Medical

-

FUJIFILM India Private Limited

-

Cook Medical

Endoscopic Ultrasound Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.44 billion

Revenue forecast in 2030

USD 2.27 billion

Growth rate

CAGR of 6.72% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Boston Scientific Corp.; Medtronic; ConMed; Olympus Corp.; Steris, SonoScape; Medical Corp.; PENTEX Medical; FUJIFILM India Pvt. Ltd.; Cook Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopic Ultrasound Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the endoscopic ultrasound market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Endoscope

-

Ultrasound Probe

-

Needle

-

Accessories

-

Ultrasonic Processors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Gastrointestinal Cancer

-

Lung Cancer

-

Pancreaticobiliary Disease

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopic ultrasound market size was estimated at USD 1.36 billion in 2022 and is expected to reach USD 1.44 billion in 2023.

b. The global endoscopic ultrasound market is expected to grow at a compound annual growth rate of 6.72% from 2023 to 2030 to reach USD 2.27 billion by 2030.

b. North America dominated the endoscopic ultrasound market with a share of 30.89% in 2022. This is attributable to increasing investment in the research and development by government and key companies present in the region, well-developed healthcare infrastructure and technological development in endoscopic ultrasound.

b. Some key players operating in the endoscopic ultrasound market include Boston Scientific Corporation; Medtronic, ConMed; Olympus Corporation; Steris; SonoScape; Medical Corp.; PENTEX Medical; FUJIFILM India Private Limited; Cook Medical.

b. Key factors that are driving the endoscopic ultrasound market growth include the increasing prevalence of gastrointestinal cancer, the growing geriatric population, rapid technological advancements, and the rise in demand for minimally invasive procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."