- Home

- »

- Medical Devices

- »

-

Endoscopic Submucosal Dissection Market Size Report 2030GVR Report cover

![Endoscopic Submucosal Dissection Market Size, Share & Trends Report]()

Endoscopic Submucosal Dissection Market Size, Share & Trends Analysis Report By Product (Gastroscopes & Colonoscopes), By Indication (Stomach Cancer), By End-use (Hospitals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-352-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

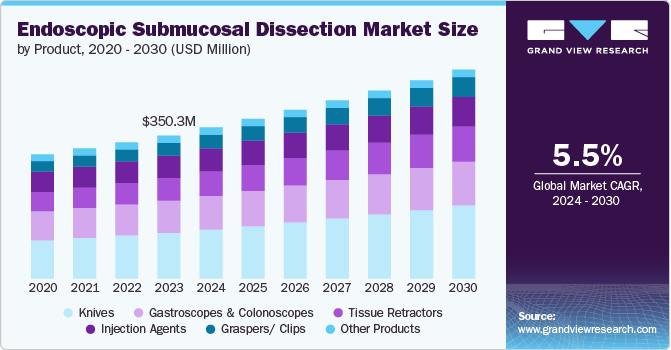

The global endoscopic submucosal dissection market size was estimated at USD 350.3 million in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The increasing prevalence of gastrointestinal cancers and other related disorders and advancements in endoscopic technology & instrumentation drive the demand for diagnostic and therapeutic procedures such as ESD. According to the World Cancer Research Fund International, stomach cancer is the fifth most common cancer worldwide, ranking fourth in men and seventh in women, with over 968,784 new cases in 2022, with China reporting the highest incidence at 358,672 cases. As esophageal, gastric, and colorectal cancer rates continue to rise globally, the need for advanced procedures, including ESD, becomes more persistent.

Furthermore, the aging population worldwide is a crucial factor boosting the demand for ESD. As the global population grows older, age-related gastrointestinal conditions, including cancers, are expected to rise. According to the American Cancer Society, gastric cancer, predominantly affects older individuals, with an average age of 68 when diagnosed, and 6 out of 10 diagnosed annually are 65 or older. Older patients often have comorbidities that make traditional surgery riskier, thereby increasing the preference for less invasive options including ESD.

The development of high-definition endoscopes improved electrosurgical knives, and enhanced imaging techniques have significantly increased the precision and safety of ESD procedures. These technological innovations have improved the efficacy of the treatment and expanded the indications for ESD, allowing it to be used for a broader range of lesions. Moreover, integrating artificial intelligence and machine learning in endoscopic procedures enhances diagnostic accuracy and procedural outcomes, further propelling market growth. For instance, in September 2020, Olympus Corporation launched an AI-powered colon endoscopy platform, ENDO-AID, that allows real-time display of detected suspicious lesions.

The growing awareness and training programs for healthcare professionals in ESD techniques also contribute to market expansion. The proficiency of gastroenterologists and surgeons in ESD has been increasing, enhancing both the reach and feasibility of this advanced procedure, particularly in areas that previously had limited access to such treatments. Various medical societies and institutions offer specialized training and certification programs, which are instrumental in disseminating knowledge and expertise in ESD. For instance, in April 2024, FUJIFILM Healthcare Europe GmbH introduced EndoGel, an innovative training model designed for performing Peroral Endoscopic Myotomy (POEM) and Endoscopic Submucosal Dissection (ESD) procedures. This simulator comes in two versions and accurately replicates the texture of human tissue involved in these complex procedures, offering clinicians a realistic training experience. It is also compatible with a range of medical devices typically used in POEM and ESD procedures, including high-frequency devices. It is specifically engineered to be cost-effective for endoscopy professionals and healthcare institutions, aiming to enhance proficiency and patient outcomes through realistic simulation training.

Product Insights

Based on the product, knives held the largest market share of 32.0% in 2023 and is expected to grow at the fastest CAGR during the forecast period. The dominance of knives in this market can be attributed to their critical role in the precision and accuracy of sample preparation and handling during chromatographic procedures. Moreover, the increasing investment in research and development across various industries supports the adoption of advanced chromatographic tools, including knives. As laboratories seek to enhance their analytical capabilities and efficiency, the demand for high-performance knives continues to rise. For instance, in August 2023, Erbe Elektromedizin launched the HYBRIDknife flex, a CE-marked instrument designed for colorectal Endoscopic Submucosal Dissection (ESD). This innovative tool has garnered early success in initial human cases, demonstrating its efficacy in lesion management within the gastrointestinal tract. Part of Erbe Elektromedizin's portfolio of electrosurgical and hydrodissection devices, the HYBRIDknife flex has been developed in collaboration with therapeutic and surgical endoscopists worldwide to meet the demanding requirements of modern endoscopic procedures.

Indication Insights

The stomach cancer segment held the largest market share of 48.9% share in 2023. The increasing prevalence of stomach cancer and the rising awareness and early detection of disorders globally has necessitated the development and adoption of advanced treatment techniques such as ESD, which allows for the precise removal of cancerous lesions from the stomach lining with minimal invasiveness. The American Cancer Society’s estimates that there will be approximately 26,890 new stomach cancer cases in the U.S. in 2024. Moreover, the push for minimally invasive procedures driven by patient demand for less painful treatments with quicker recovery times supports the adoption of ESD for stomach cancer.

Colon cancer is expected to grow at the fastest CAGR during the forecast period. The incidence of colon cancer is increasing globally, largely due to factors such as aging populations, lifestyle changes, and dietary habits such as high consumption of processed meats, obesity, smoking, and excessive alcohol intake. According to the report published by WHO in July 2023, colorectal cancer ranks as the third most prevalent cancer worldwide, comprising 10% of all cancer cases and is the second leading cause of cancer-related mortality. Continuous advancements in endoscopic technology, such as high-definition imaging and improved endoscopic knives and accessories, have enhanced the safety and efficacy of ESD. These advancements facilitate the precise removal of large and complex polyps or early-stage cancer lesions in the colon.

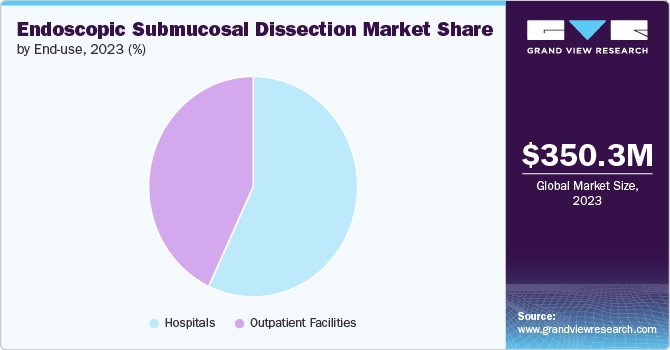

End-use Insights

The hospitals segment held the largest market share in 2023 and is expected to grow at the fastest CAGR of 6.2% during the forecast period. Hospitals typically possess the advanced infrastructure and state-of-the-art medical equipment required for complex procedures such as ESD. This includes high-definition endoscopic systems, advanced imaging technologies, and specialized surgical tools, which are essential for the precision and success of ESD. They offer comprehensive healthcare services, access to advanced technologies, multidisciplinary care teams, inpatient monitoring capabilities, and a foundation for research and innovation, enabling high-quality, specialized care that improves patient outcomes and advances global medical knowledge.

Outpatient facilities is also expected to grow at a significant growth rate during the forecast period owing to the increasing demand for outpatient procedures and patient preference for less invasive treatments. Outpatient facilities align with the growing preference for patient-centric care models, where convenience and minimized disruption to daily life are prioritized. Patients prefer outpatient procedures because they typically involve shorter wait times, reduced hospital stays, and lower costs compared to inpatient care.

Regional Insights

North America endoscopic submucosal dissection (ESD) marketdominated with a revenue share of over 40.0% in 2023 owing to the advanced healthcare infrastructure, high healthcare expenditure, and a strong focus on technological innovation. The region benefits from a large patient pool with a high prevalence of gastrointestinal disorders and cancers, which necessitates advanced diagnostic and therapeutic procedures. Moreover, collaborations between healthcare providers, research institutions, and industry players promote continuous advancements in surgical techniques.

U.S. Endoscopic Submucosal Dissection Market Trends

The U.S. endoscopic submucosal dissection (ESD) market is experiencing significant growth, driven by several key factors including the rising prevalence of gastrointestinal cancers, such as stomach and colorectal cancers, which necessitates advanced treatment options such as ESD. According to the National Cancer Institute, in 2021, 130,263 people were living with stomach cancer in the U.S. The region also benefits from a robust healthcare infrastructure and substantial healthcare expenditure, which facilitate the rapid adoption of innovative medical procedures like ESD Major hospitals and medical centers are equipped with state-of-the-art facilities and cutting-edge technologies, ensuring that they can offer the latest treatments with high precision and safety. Additionally, there is a concerted effort to increase awareness about gastrointestinal cancers and the importance of early detection, which is critical for the timely intervention of diseases amenable to ESD.

Europe Endoscopic Submucosal Dissection Market Trends

The endoscopic submucosal dissection (ESD) market of Europe is characterized by a strong regulatory environment, technological innovation, and increasing healthcare expenditures. The region benefits from universal healthcare systems in many countries, ensuring broad access to advanced medical procedures including ESD. High prevalence of aging population and the rising prevalence of gastrointestinal cancers, such as stomach and colorectal cancers drives demand. In July 2023, Penlon Limited launched a new endoscopic accessories division in the UK, partnering with Vedkang Medical to provide clinicians with high-quality products for Endoscopic Submucosal Dissection (ESD), Endoscopic Mucosal Resection (EMR), and Gastrointestinal (GI) tract endoscopic treatments.

Asia Pacific Endoscopic Submucosal Dissection Market Trends

Asia Pacific endoscopic submucosal dissection (ESD) marketregion is anticipated to witness significant growth over the forecast period owing to the rising healthcare expenditure, and growing prevalence of chronic disorders related to stomach and colon. Countries such as China, Japan, and India are major contributors to market growth, driven by large patient populations and improving access to advanced medical technologies. According to the World Cancer Research Fund International, esophageal cancer ranks as the 11th most prevalent cancer worldwide. In 2022 alone, there were over 511,054 new cases reported globally. China recorded the highest number of cases, with 224,012 reported cases, highlighting its significant burden in that region.

Key Endoscopic Submucosal Dissection Company Insights

The market is moderately competitive and encompasses various renowned global market players and several emerging ventures. Market participants are focusing on devising several strategic initiatives in the form of technological collaborations, partnerships, mergers & acquisitions, and product launches to expand their business footprint to developing economies and capture a larger clientele.

Key Endoscopic Submucosal Dissection Companies:

The following are the leading companies in the endoscopic submucosal dissection market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- Boston Scientific Corporation

- FUJIFILM Holdings Corporation

- Creo Medical

- Medtronic PLC

- HOYA Corporation

- KARL STORZ SE & Co. KG

- CONMED Corporation

- Steris PLC

- Taewoong Medical

- Micro-tech Endoscopy

- Cook Group

Recent Developments

-

In April 2024, Fujifilm launched Tracmotion, an Endoscopic Submucosal Dissection (ESD) device, at a gastroenterology event. The device, designed for single-operator use, has a 360° rotatable retraction capability, allowing precise tissue manipulation.

-

In October 2023, Olympus unveiled its latest advancement in gastrointestinal endoscopy by introducing the EVIS X1 system, accompanied by the CF-HQ1100DL/I and GIF-1100 series compatible endoscopes. This next-generation system incorporates Color Enhancement Imaging technology, enhancing image color and texture to improve lesion and polyp visibility during endoscopic screenings.

-

In January 2023, Fujifilm India introduced two innovative endoscopy solutions: the FushKnife and ClutchCutter. These cutting-edge tools are designed for use with compatible endoscopes, enabling clinicians to perform precise incision, dissection, and coagulation during endoscopic submucosal dissection (ESD) and EMR procedures.

Endoscopic Submucosal Dissection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 370.4 million

Revenue forecast in 2030

USD 512.0 million

Growth rate

CAGR of 5.5 % from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Product, indication, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; Boston Scientific Corporation; FUJIFILM Holdings Corporation; Creo Medical; Medtronic PLC ; HOYA Corporation; KARL STORZ SE & Co. KG; CONMED Corporation; Steris PLC; Taewoong Medical; Micro-tech Endoscopy; Cook Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopic Submucosal Dissection Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the endoscopic submucosal dissection (ESD) market based on product, indication, end-use, and regions.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gastroscopes and Colonoscopes

-

Knives

-

Injection Agents

-

Tissue Retractors

-

Graspers/ Clips

-

Other Products

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Stomach Cancer

-

Colon Cancer

-

Esophageal Cancer

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopic submucosal dissection market size was estimated at USD 350.3 million in 2023 and is expected to reach USD 370.4 million in 2024.

b. The global endoscopic submucosal dissection market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 512.0 billion by 2030.

b. North America dominated the market with a revenue share of over 40.0% in 2023 owing to the advanced healthcare infrastructure, high healthcare expenditure, and a strong focus on technological innovation.

b. Some key players operating in the market include Olympus Corporation; Boston Scientific Corporation; FUJIFILM Holdings Corporation; Creo Medical; Medtronic PLC ; HOYA Corporation; KARL STORZ SE & Co. KG; CONMED Corporation; Steris PLC; Taewoong Medical; Micro-tech Endoscopy; Cook Group

b. The increasing prevalence of gastrointestinal cancers and other related disorders and advancements in endoscopic technology & instrumentation drive the demand for diagnostic and therapeutic procedures such as ESD

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."