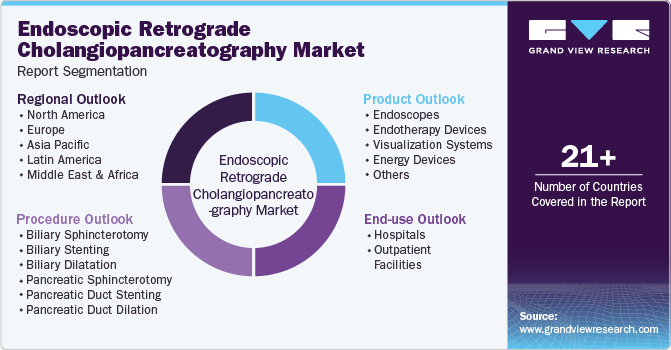

Endoscopic Retrograde Cholangiopancreatography Market Size, Share & Trends Analysis Report By Product (Endoscopes, Endotherapy Devices), By Procedure (Biliary Sphincterotomy, Biliary Stenting), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-327-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

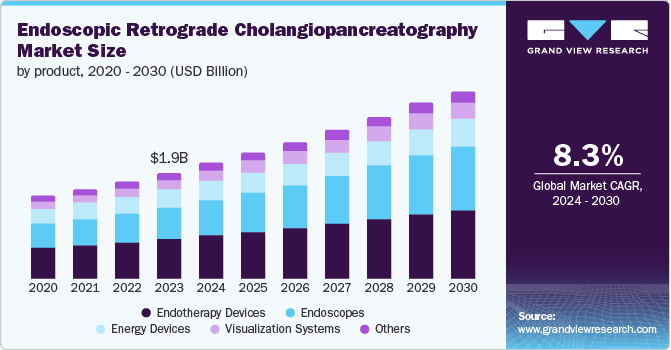

The global endoscopic retrograde cholangiopancreatography market size was estimated at USD 2.17 billion in 2024 and is projected to grow at a CAGR of 8.26% from 2025 to 2030. The market is gaining popularity due to its reduced risk of complications and faster recovery compared to traditional surgery. The growing incidence of chronic gastrointestinal and biliary conditions, including Crohn's disease, Barrett's esophagus, and liver disorders, is contributing to the growth.

This growth is majorly driven by the rising incidence of pancreatic and biliary diseases, such as gallstones, pancreatitis, and bile duct obstructions, which are fueling the demand for ERCP procedures. As the population ages and lifestyles change, the prevalence of these conditions is expected to increase, driving market growth. For instance, according to the National Health Service (NHS), more than one in ten adults in the UK has gallstones. Moreover, several studies indicated that the incidence rate of gallstones is anticipated to rise rapidly over the forecast period, driving the demand for ERCP procedures.

Furthermore, advances in endoscopic technology have improved the safety and efficacy of ERCP procedures. For instance, in January 2023, Advantech introduced the MIO-5377R single-board computer as a groundbreaking innovation in the field of endoscope technology. This compact and powerful device is designed to address the traditional challenges faced by endoscopes, offering enhanced performance, reliability, and functionality. Moreover, innovations such as high-definition imaging, better maneuverability of endoscopes, and the development of therapeutic accessories have made ERCP a more precise and effective diagnostic and treatment tool. These technological advancements are attracting both healthcare providers and patients to opt for ERCP procedures.

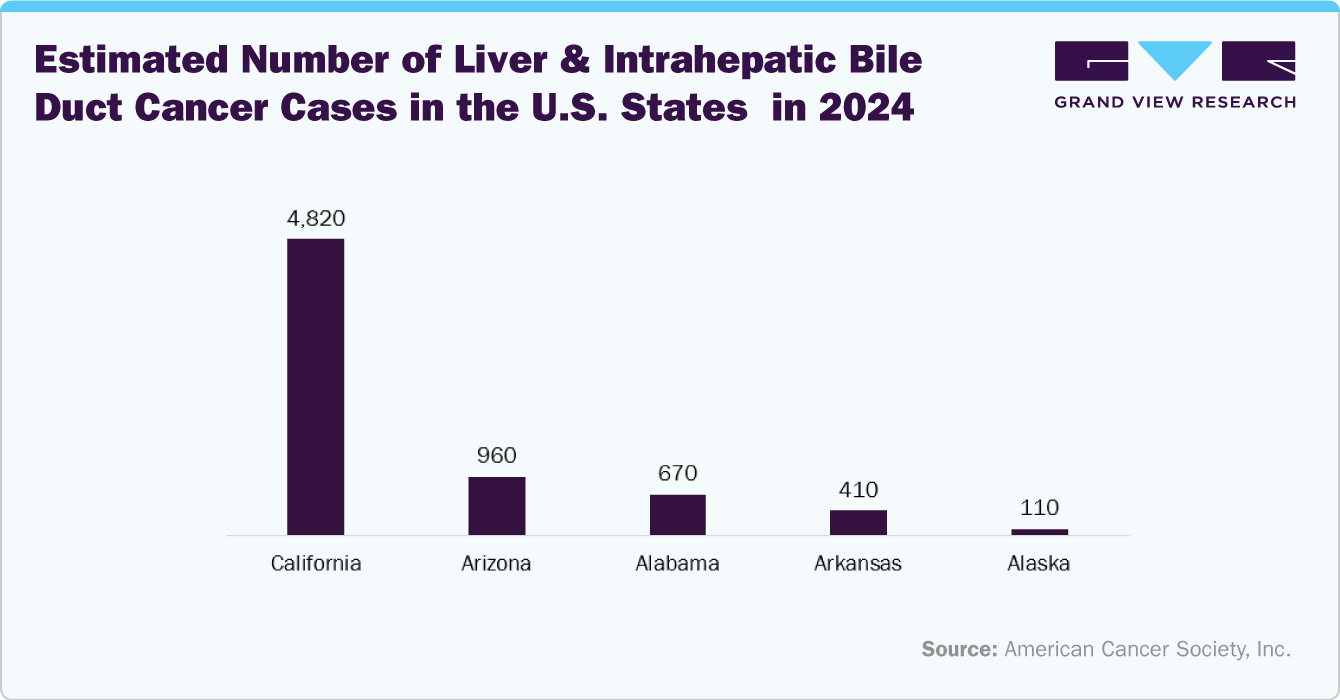

The rise in the adoption of minimally invasive surgical techniques has led to an increased demand for ERCP procedures, which is expected to drive growth in the industry in the upcoming years. For instance, according to the American Cancer Society's annual report published in January 2024, an estimated 41,630 new cases of liver cancer are expected to be diagnosed in the U.S. In addition, as per the same source, liver cancer is more prevalent in countries in sub- Southeast Asia and Saharan Africa compared to the U.S. It is the most common type of cancer in many of these nations, with over 800,000 new cases diagnosed globally each year. Moreover, liver cancer ranks as a leading cause of cancer-related deaths worldwide, claiming more than 700,000 lives annually.

Moreover, the increased awareness about the benefits of early diagnosis and treatment of pancreatic and biliary diseases has led to a higher demand for minimally invasive procedures such as ERCP. For instance, in October 2023, the Biliary Atresia Awareness Committee launched the Biliary Atresia Awareness Campaign under the guidance of the Gauteng Provincial Solid Organ Transplant Division and the University of the Witwatersrand at Charlotte Maxeke Academic Hospital. The campaign was aimed to raise awareness and support for children affected by biliary atresia. This rare and life-threatening liver disease affects infants by obstructing or obliterating bile ducts. The initiative was focused on educating diverse demographics about biliary atresia, offering resources and support to affected families, advancing research for diagnostic tools and treatments, and fostering collaboration with medical entities globally.

Market Concentration & Characteristics

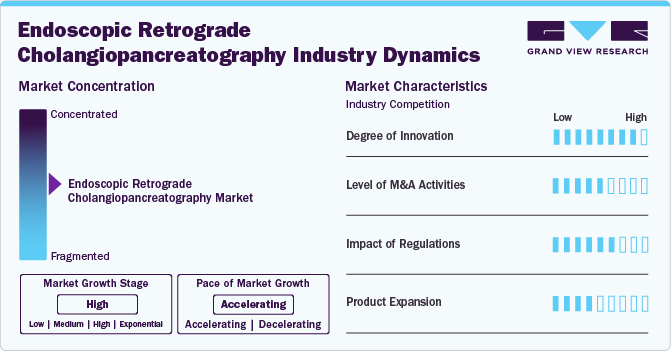

The global endoscopic retrograde cholangiopancreatography (ERCP) industry is characterized by a high degree of innovation, owing to rising investments, growing research activities, and approvals from governments & regulatory bodies to advance research in the endoscopy field. For instance, according to a research study published in Optica Publishing Group journal in July 2022, researchers at the School of Biomedical Engineering & Imaging Sciences developed a photoacoustic imaging endoscope probe that can be inserted into a medical needle with an inner diameter as small as 0.6 millimeters. They suggested that artificial intelligence (AI) could be utilized to accelerate imaging procedures.

The endoscopic retrograde cholangiopancreatography industry is characterized by a medium level of mergers and acquisitions activity. For instance, in November 2022, Boston Scientific Corporation acquired Apollo Endosurgery, Inc. for USD 10 per share, valuing the enterprise at USD 615 million. The company would fully control the endoluminal surgery product portfolio through this acquisition, further enhancing its resources in the endoscopy business division.

Companies actively invest substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. This may result in increasing the cost of developing novel endoscopic technologies. To ensure infection control while using endoscopes, several regulations have been established for reprocessing endoscopes. Proper reprocessing of these devices is essential to ensure a safe and successful procedure. According to standards set by federal agencies such as FDA & CDC and organizations such as the American Society for Gastrointestinal Endoscopy, flexible GI endoscopes should be washed thoroughly and later subjected to high-level disinfection.

Several market players are expanding their business by launching new products to strengthen their market position and expand their product portfolio. For instance, in August 2024, Ambu received CE mark approval for its new-generation duodenoscopy solutions, Ambu aScope Duodeno 2 and Ambu aBox 2, for ERCP procedures.

Product Insights

The endotherapy devices segment accounted for the largest market share of 37.1% in 2024. The market growth is driven by the less invasive nature of the procedure and the cost-effectiveness of endoscopy devices before and after the procedure. As ERCP procedures become more commonly used for diagnosing and treating biliary and pancreatic disorders, the need for specialized devices, such as biopsy forceps, dilation balloons, and stents, is rising. These devices enhance the accuracy and effectiveness of ERCP, offering patients faster recovery times and fewer complications compared to traditional surgical options. In addition, the growing prevalence of gastrointestinal and biliary diseases, along with improvements in healthcare infrastructure and rising awareness of minimally invasive alternatives, is further fueling the demand for endotherapy devices in ERCP procedures.

Furthermore, the growing adoption of disposable endoscopic components to minimize the procedure cost, as well as the chance of cross-contamination, is also expected to accelerate market growth over the years. In addition, the development and adoption of endoscopic techniques such as uniportal full endoscopic posterolateral transforaminal lumbar interbody fusion (Endo-TLIF) have been driven by the desire to reduce operative time, blood loss, postoperative pain, and complications related to extensive tissue disruption in traditional procedures.

The endoscopes segment is expected to grow at the fastest CAGR during the forecast period. Technological advancements have significantly impacted the field of endoscopes, which is expected to drive innovation and improve patient care. These advancements have led to the development of more advanced & sophisticated disposable endoscopes, offering enhanced imaging capabilities, improved maneuverability, and ease of use. For instance, integrating high-definition cameras and advanced optics has resulted in sharper and clearer images, aiding in accurate diagnosis and treatment. The miniaturization of components has created smaller and more flexible endoscopes, enabling easier access to narrow & complex anatomical structures.

End Use Insights

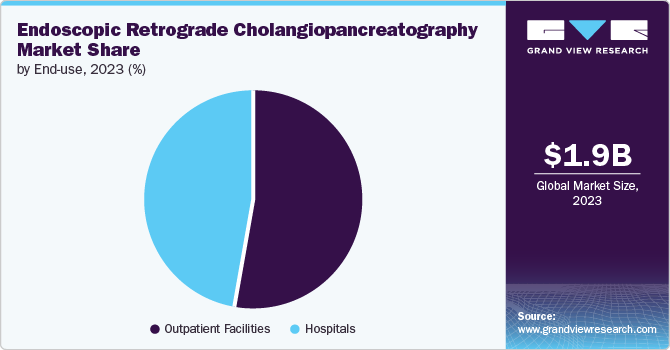

The outpatient facilities segment accounted for the largest market share of 53.6% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The growing use of endoscopes in outpatient centers, such as diagnostic clinics and ambulatory surgery centers (ASCs), is expected to promote segment growth by enabling early diagnosis and detection of chronic conditions. These outpatient centers offer effective diagnostic and therapeutic options. The rising demand for endoscopes in these settings is increasing due to their multiple benefits. For instance, according to the Canadian Medical Association, there are over 237,000 ambulatory care centers in Canada. A key benefit in these outpatient environments is the cost-efficiency. Using disposable endoscopes eliminates time-consuming reprocessing activities, including cleaning, sterilizing, and maintaining reusable endoscopes. This efficiency enhances workflow and patient throughput, accelerating market growth.

The hospital segment is expected to grow at a significant CAGR during the forecast period. The growing number of healthcare centers, such as oncology specialty clinics, cancer centers, and hospitals, is fueling the need for endoscopy devices, which is anticipated to propel market growth. The number of endoscopies performed in hospitals is increasing with the rise in hospital facilities. The number of hospitals is growing in most countries, including Canada, the U.S., Italy, the UK, China, Spain, Thailand, India, Brazil, Japan, South Africa, Argentina, and the UAE. For instance, according to the American Hospital Association, in 2024, there were 6,120 hospitals in the U.S.

Procedure Insights

The biliary sphincterotomy segment accounted for the largest market share of 18.7% in 2024, owing to the several benefits offered by this procedure, which include relief of symptoms, management of complications, and improvement in quality of life. Patients with gallstones or other obstructions in the bile ducts may experience symptoms such as abdominal pain, jaundice, nausea, and vomiting. These symptoms can be alleviated by allowing better bile drainage from the liver and gallbladder by performing a biliary sphincterotomy. In addition, this procedure can help manage complications, including cholangitis (infection of the bile ducts) or pancreatitis (inflammation of the pancreas), which can arise from blocked bile flow.

The pancreatic sphincterotomy segment is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to the need for a pancreatic sphincterotomy to alleviate symptoms and improve the flow of digestive enzymes and bile from the pancreas into the small intestine. This procedure helps to reduce inflammation, prevent complications such as pancreatitis, and improve overall pancreatic function. Patients with recurrent episodes of pancreatitis or those with obstructive pancreatic ductal diseases benefit from this intervention to enhance their quality of life and prevent further complications.

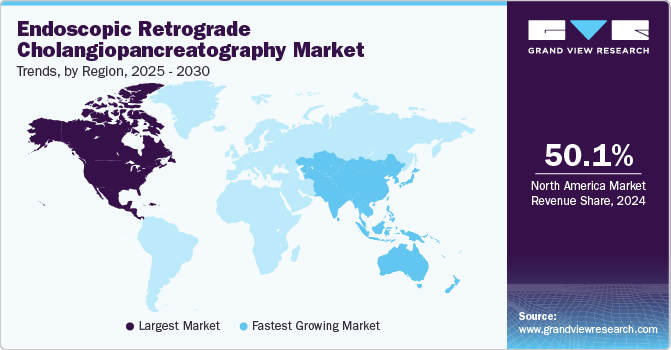

Regional Insights

North America endoscopic retrograde cholangiopancreatography market dominated globally with a revenue share of 50.1% in 2024. The high prevalence of several diseases, such as gastrointestinal disorders, respiratory conditions, urological problems, gynecological issues, and cancer, is increasing the need for endoscopic procedures for diagnosis & treatment in North America. For instance, according to a report by ResearchGate, it is projected that there will be 2,001,140 new cases of cancer and 611,720 cancer-related deaths in the U.S. in 2024. Hence, the growing need for accurate and minimally invasive diagnostic tools is driving the adoption of endoscopes. Moreover, the market is also fueled by rapid technological advancements, leading to the development of new and innovative endoscopic devices. These technological breakthroughs have improved the adoption of endoscopes. For instance, in October 2022, OMNIVISION, a prominent developer of semiconductor solutions, collaborated with AdaptivEndo, a technology disruptor in single-use endoscopes, to create a flexible and unified platform.

U.S. Endoscopic Retrograde Cholangiopancreatography Market Trends

The endoscopic retrograde cholangiopancreatography marketin the U.S. held the largest revenue share in the North American region in 2024. The rising demand for disposable endoscopes due to the growing burden of bacterial infections transmitted through contaminated endoscopes in hospitals is positively impacting the market growth. Furthermore, many industry players in the U.S. initially pursued approval from the FDA to introduce their products in the country, promoting market growth. Moreover, increasing awareness of cost-effective single-use endoscopes and the high per capita health expenditure are contributing to market growth in the country.

Europe Endoscopic Retrograde Cholangiopancreatography Market Trends

The endoscopic retrograde cholangiopancreatography market in Europe is expected to witness significant growth over the forecast period. The ongoing technological advancements in endoscopy, the increase in the geriatric population, and the rise in demand for minimally invasive procedures are among the factors driving the European market.

The UK endoscopic retrograde cholangiopancreatography market is anticipated to register a considerable CAGR during the forecast period. Rising cancer cases and favorable macro environment factors are driving key players to revise their market entry strategies through mergers & acquisitions and technological collaborations to expand their footprint. According to Macmillan Cancer Support, in October 2022, there were approximately 3 million patients suffering from cancer in the UK, and 5.3 million patients are expected to be diagnosed with cancer in the country by 2040.

Asia Pacific Endoscopic Retrograde Cholangiopancreatography Market Trends

Asia Pacific endoscopic retrograde cholangiopancreatography market is anticipated to be the fastest-growing region owing to the improved healthcare infrastructure, the presence of a less stringent regulatory framework, and economic development attracting foreign investments. Key market players are developing strategies for expanding their business in this region.

Japan endoscopic retrograde cholangiopancreatography market is anticipated to register a considerable growth rate during the forecast period. Growth in the country is expected to be driven by favorable initiatives undertaken by private players, such as training healthcare professionals and increasing Research & Development (R&D) investments to develop advanced endoscopes. For instance, Olympus Corporation opened a Thai Training and Education Centre to raise awareness about surgical & Gastrointestinal (GI) endoscopes and train healthcare professionals in Southeast Asia.

Latin America Endoscopic Retrograde Cholangiopancreatography Market Trends

The endoscopic retrograde cholangiopancreatography market in Latin America is expected to witness considerable growth over the forecast period. The growing preference for minimally invasive surgeries over open surgeries and increasing awareness about the use of endoscopy for various diagnostic and therapeutic procedures are expected to drive the market growth.

Argentina endoscopic retrograde cholangiopancreatography market is anticipated to register a considerable growth rate during the forecast period. The market growth is driven by an increasing preference for minimally invasive surgeries and the implementation of pivotal screening programs for effective cancer diagnosis. The availability of training centers for educating healthcare professionals about recent advancements in endoscopes is also boosting market growth.

Middle East & Africa Endoscopic Retrograde Cholangiopancreatography Market Trends

The endoscopic retrograde cholangiopancreatography market in the Middle East and Africa is anticipated to register a considerable growth rate during the forecast period. Growing healthcare expenditures, infrastructure advancements, and awareness of available diagnostic and therapeutic solutions drive the regional market's growth.

Saudi Arabia endoscopic retrograde cholangiopancreatography market is anticipated to register a considerable growth rate during the forecast period. The market growth is expected to be driven by increasing awareness to promote endoscopy and highlight the benefits of early cancer screening. Hospitals in the country are actively taking steps to raise awareness about various endoscopy techniques through symposiums and other media channels.

Key Endoscopic Retrograde Cholangiopancreatography Company Insights

Key participants in the global endoscopic retrograde cholangiopancreatography industry are focusing on devising innovative business growth strategies in the form of partnerships & collaborations, product portfolio expansions, mergers & acquisitions, and geographical expansions.

Key Endoscopic Retrograde Cholangiopancreatography Companies:

The following are the leading companies in the endoscopic retrograde cholangiopancreatography market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- CONMED Corporation

- Boston Scientific Corporation

- Medtronic PLC

- Telemed System, Inc.

- AMBU, Inc.

- FUJIFILM Holdings Corporation

- Hobbs Medical, Inc.

- Cook Group

- Streis PLC

- HOYA Group

- Karl Storz SE & Co. KG

Recent Developments

-

In March 2024, NTT Corporation (NTT) and Olympus Corporation embarked on a joint venture to conduct a demonstration experiment of a cloud endoscopy system. This innovative system facilitates image processing through cloud computing, marking a significant advancement in the field of medical technology.

-

In November 2023, HOYA Corporation acquired the remaining shares of WASSENBURG Medical B.V. This acquisition made HOYA the sole shareholder of WASSENBURG and strengthened its position in the medical equipment industry, particularly in endoscope reprocessing. The combined capabilities of HOYA Corporation, PENTAX Medical, and WASSENBURG Medical are likely to drive advancements in endoscope reprocessing technology & services.

-

In January 2024, Canon Medical Systems Corporation and Olympus Corporation announced a collaboration agreement to work together on endoscopic ultrasound systems. In this partnership, Canon Medical is expected to be responsible for developing and manufacturing diagnostic ultrasound systems specifically designed for Endoscopic Ultrasonography (EUS).

Endoscopic Retrograde Cholangiopancreatography Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.36 billion |

|

Revenue forecast in 2030 |

USD 3.51 billion |

|

Growth Rate |

CAGR of 8.26% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast data |

2025 - 2030 |

|

Report updated |

January 2025 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, procedure, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Olympus Corporation, CONMED Corporation, Boston Scientific Corporation, Medtronic PLC, Telemed System, Inc., Ambu A/S, FUJIFILM Holdings Corporation, Hobbs Medical, Inc., Cook Group, Streis PLC, HOYA Group, Karl Storz SE & Co. KG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Endoscopic Retrograde Cholangiopancreatography Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global endoscopic retrograde cholangiopancreatography market report based on product, procedure, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Endoscopes

-

Endotherapy Devices

-

Sphincterotomes

-

Lithotripter

-

Stents

-

Cannulas

-

Forceps

-

Snares

-

Catheters

-

Guiding Wires

-

Balloons

-

Baskets

-

-

Visualization Systems

-

Energy Devices

-

Others

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Biliary Sphincterotomy

-

Biliary Stenting

-

Biliary Dilatation

-

Pancreatic Sphincterotomy

-

Pancreatic Duct Stenting

-

Pancreatic Duct Dilation

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopic retrograde cholangiopancreatography market size was estimated at USD 2.17 billion in 2024 and is expected to reach USD 2.36 billion in 2025.

b. The global endoscopic retrograde cholangiopancreatography market is expected to grow at a compound annual growth rate of 8.26% from 2025 to 2030 to reach USD 3.51 billion by 2030.

b. The endotherapy devices segment accounted for the largest market share of 37.1% in 2024. The growth is attributed to its the less invasive properties and affordable post and pre-procedure cost of endoscopy devices are the major factors anticipated to boost the market growth over the forecast period.

b. Some key players operating in the market include Olympus Corporation; CONMED Corporation; Boston Scientific Corporation; Medtronic PLC; Telemed System, Inc.; AMBU, Inc.; FUJIFILM Holdings Corporation; Hobbs Medical, Inc.; Cook Group; Streis PLC; HOYA Group; Karl Storz SE & Co. KG

b. Market growth is majorly driven by the rising incidence of pancreatic and biliary diseases such as gallstones, pancreatitis, and bile duct obstructions are fueling the demand for ERCP procedures.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."