- Home

- »

- Medical Devices

- »

-

Endoscope Sterilization Market Size, Industry Report, 2030GVR Report cover

![Endoscope Sterilization Market Size, Share & Trends Report]()

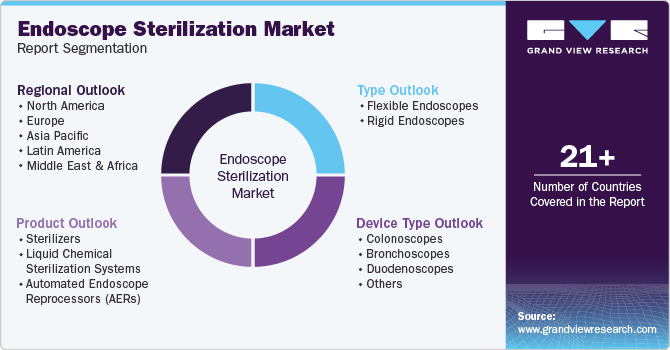

Endoscope Sterilization Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sterilizers, Liquid Chemical Sterilization Systems, Automated Endoscope Reprocessors), By Type, By Device Type (Colonoscopes, Bronchoscopes), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-486-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endoscope Sterilization Market Summary

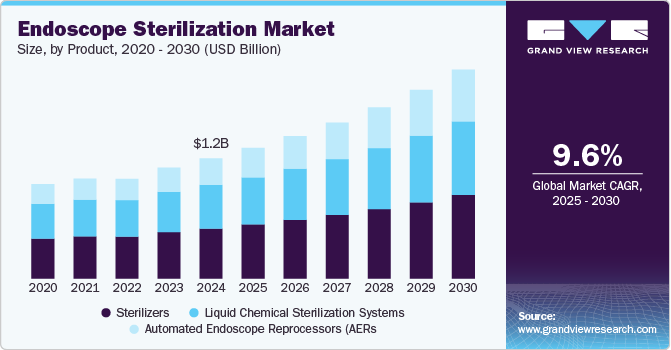

The global endoscope sterilization market size was estimated at USD 1.20 billion in 2024 and is projected to reach USD 2.09 billion by 2030, growing at a CAGR of 9.64% from 2025 to 2030. This growth can be attributed to the increasing volume of surgical procedures conducted annually, which contributes to a rise in healthcare-associated infections (HAIs) associated with endoscopes.

Key Market Trends & Insights

- North America dominated the endoscope sterilization market with the largest revenue share of 34.44% in 2024.

- The endoscope sterilization market in the U.S. held a significant share of the market in 2024.

- Based on product, the sterilizers segment led the market with the largest revenue share of 41.6% in 2024.

- Based on type, the flexible endoscopes segment led the market with the largest revenue share of around 78.34% in 2024

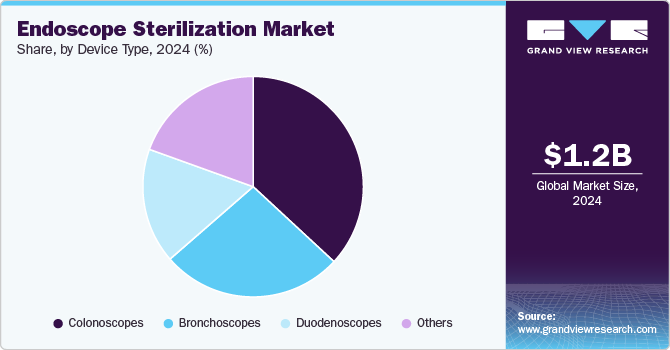

- Based on device type, the colonoscopes segment led the market with the largest revenue share of 36.9% in 2024

Market Size & Forecast

- 2024 Market Size: USD 1.20 Billion

- 2030 Projected Market Size: USD 2.09 Billion

- CAGR (2025-2030): 9.64%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The data published by the ASP International GmbH indicates that between January 2017 and February 2021, the FDA obtained 450 medical device reports related to patient infections or contaminations associated with urological endoscopes in the U.S., including three deaths caused by subsequent bacterial infections. As a result, Karl Storz temporarily recalled over 24 models of urological endoscopes, recommending sterilization procedures outlined only in the Instructions for Use due to concerns that chemical disinfection was insufficient for adequate decontamination. Such incidents of inadequate disinfection are expected to drive demand for low-temperature sterilization for endoscopes in the coming years.

The convergence of endoscopy and robotics has revolutionized surgical possibilities, providing improved visualization, unparalleled precision, and better patient outcomes. For instance, the endoscopic surgical system from Virtuoso has two needle-sized manipulators that are robotically controlled and operate from the tip of an endoscope to bring the stability and precision of robot-assisted surgery to rigid endoscopy. Moreover, increasing numbers of successful clinical trials are expected to boost product approvals. In January 2023, Agilis Robotics, a prominent developer of flexible robotic instruments, successfully completed the second round of live animal testing with its proprietary robot for endoscopic surgery. The test results were satisfactory and demonstrated promising outcomes for the efficacy, accuracy, and safety of the firm's medical robotic system. Thus, increasing the integration of robotics in endoscopic surgery will lead to a rise in the number of procedures, thereby driving market growth.

Growing investments and funding for developing sterilization devices for endoscopes are expected to drive segment growth in the coming years. For instance, in 2020, Brighton Development secured approximately USD 0.99 million for Phase 2 of their project aimed at generating the necessary backup data to meet FDA requirements for commercializing the inside-out sterilization method. Once approved by the FDA, this technique can offer a cost-effective low-temperature sterilization solution suitable for plastic endoscopic devices that cannot be autoclaved due to the risk of melting plastic components. As a result, increasing investments in such initiatives are likely to bolster market growth throughout the forecast period.

In addition, the increasing prevalence of chronic diseases and the aging population further contribute to market growth. For instance, according to the data published by Statistics Sweden in May 2022, 8% of the Swedish population is anticipated to be 80 years or older by 2040, compared to 5% in 2022. Moreover, the WHO estimates that the number of individuals aged 80 years or older worldwide will triple within 30 years, i.e., from 2020 to 2050, to reach 426 million.

The increasing launch of novel products by industry participants is anticipated to propel the market growth. For instance, in May 2023, Ahlstrom launched the next-generation simultaneous sterilization wrap, Reliance Fusion, which would enhance the efficiency of sterilizing surgical equipment trays at hospitals. Such novel product launches by industry players are expected to drive market growth in the coming years.

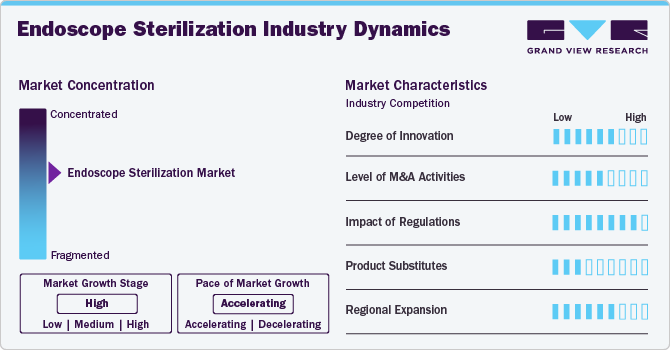

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is characterized by a high degree of growth due to increasing demand for minimally invasive/noninvasive procedures, and advanced endoscope sterilization systems/devices propel scientific advancements and encourage collaboration between researchers, medical professionals, and technology developers.

The market is witnessing significant innovations driven by the increasing demand for advanced medical technologies and the necessity for stringent infection control protocols in healthcare facilities. Key developments include the integration of advanced robotic systems that enhance the precision and efficiency of sterilization processes. These automated systems minimize human error and ensure consistent sterility across a wide range of endoscopic instruments. Furthermore, the use of advanced low-temperature sterilants offers safer and more expedited methods for decontaminating delicate endoscopic equipment.

Regulatory bodies play a critical role in shaping the market growth. Compliance with safety and performance standards is essential for product approvals. As regulations evolve to ensure better patient outcomes, companies are focusing on meeting these stringent requirements to maintain market access and build trust with healthcare providers. For instance, in January 2023, the U.S. FDA announced that the FDA’s Center for Devices and Radiological Health (CDRH) recently issued two warning letters to Olympus Medical Systems Corporation, a prominent endoscope manufacturer, and its subsidiary, Aizu Olympus Co., Ltd., following inspections of their facilities. The warning letters address violations concerning medical device reporting (MDR) requirements and quality system regulations regarding endoscopes and their accessories, including surgical and gastrointestinal endoscopes and automated endoscope reprocessors. These devices undergo reprocessing, which includes both cleaning and high-level disinfection and sterilization to allow for reuse. Further, in April 2022, Karl Storz started a voluntary recall and distributed an urgent field safety notice to inform users to discontinue all high-level disinfection procedures for the identified urological endoscopes and to discontinue liquid chemical sterilization on most of these devices. Users are advised to sterilize the affected urological endoscopes after each use employing a suitable sterilization method as outlined in the instructions for use.

The market is moderately poised to experience robust mergers and acquisitions (M&A) activity as companies look to expand their product portfolios and strengthen their competitive positioning.

Emerging substitutes and alternative monitoring technologies present both challenges and opportunities for the global market. Companies must continuously innovate to retain their market share and demonstrate the unique advantages of their offerings compared to these alternatives.

The global market is expanding across various regions, driven by factors like increasing healthcare expenditure, rising prevalence of chronic diseases, and growing adoption of minimally invasive procedures. For instance, in September 2024, Olympus Australia, a global MedTech company dedicated to enhancing health and safety, introduced "Sapphire," its first flexible endoscope sterilization facility. Situated in Melbourne, this facility is part of the newly launched Olympus On-Demand solution, tailored for Australian healthcare providers. Sapphire aims to minimize the risks, costs, and complexities involved in managing endoscopy services. This initiative reflects Olympus's commitment to improving healthcare outcomes and streamlining processes for medical facilities across Australia.

Product Insights

The sterilizerssegment led the market with the largest revenue share of 41.6% in 2024. The sterilizers segment includes ethylene oxide sterilizers, hydrogen peroxide sterilizers, and others that play a critical role in ensuring the safety and efficacy of endoscopes. As endoscopic procedures become increasingly prevalent, there is a rising demand for efficient sterilization methods to prevent healthcare-associated infections. Advanced sterilizers, including steam, hydrogen peroxide, and ethylene oxide systems, are being adopted for their efficacy in eliminating pathogens from reusable endoscopes.Innovations in sterilization technology are shaping this segment, with manufacturers focusing on developing automated systems that enhance reliability, reduce human error, and streamline workflows in busy medical environments. These advanced sterilizers not only improve turnaround times for endoscopes but also help healthcare facilities comply with stringent regulatory standards.

The automated endoscope reprocessors (AERs) segment is expected to grow at the fastest CAGR of 11.67% during the forecast period,driven by an increasing emphasis on infection control and patient safety within healthcare facilities. AERs streamline and enhance the cleaning and disinfection process of flexible endoscopes, ensuring that they are properly sterilized before being reused. The rise in minimally invasive procedures and the subsequent demand for endoscopic technologies have significantly fueled the adoption of automated systems, as they not only improve efficiency but also reduce the risk of human error in the reprocessing workflow.

Type Insights

Based on type, the flexible endoscopes segment led the market with the largest revenue share of around 78.34% in 2024 driven by an increasing emphasis from various organizations on maintaining the sterility of these devices. Many organizations are issuing documents and guidance on the sterilization of flexible endoscopes. For instance, a May 2024 article published by STERIS noted that standards organizations like the Association for the Advancement of Medical Instrumentation (AAMI) and the American National Standards Institute (ANSI) recommend sterilizing flexible endoscopes prior to use in semi-critical applications.

In addition, the companies operating in the market offer numerous methods for sterilizing flexible endoscopes at low temperatures. For instance, automated Liquid Chemical Sterilant Processing Systems are provided by STERIS for low-temperature liquid chemical sterilization (LCS) of complex heat-sensitive endoscopes. Such presence of products from industry players is expected to propel the segment growth over the forecast period.

Device Type Insights

Based on device type, the colonoscopes segment led the market with the largest revenue share of 36.9% in 2024, driven by the growing prevalence of colorectal diseases and an increasing emphasis on preventive healthcare. Colorectal cancer is one of the leading causes of cancer-related deaths globally, leading to heightened awareness and a rise in routine screening procedures, particularly colonoscopies. As more individuals undergo these life-saving examinations, the demand for effective sterilization of colonoscopes has surged. Moreover, the complexity of colonoscope design-with its intricate channels and components-necessitates specialized reprocessing techniques to ensure thorough disinfection and prevent cross-contamination. This has prompted healthcare facilities to invest in advanced sterilization solutions, further bolstering the segment's growth. The stringent regulations enforced by health authorities concerning infection control and patient safety also contribute to the increasing focus on the proper sterilization of colonoscopes.

The duodenoscope segment is expected to grow at the fastest CAGR during the forecast period. This growth can be attributed to driven by increasing usage of these specialized instruments in complex procedures such as endoscopic retrograde cholangiopancreatography (ERCP). As the prevalence of gastrointestinal diseases rises, healthcare facilities are performing more duodenoscopies, thereby amplifying the demand for effective sterilization solutions. In addition, heightened awareness of HAIs and strict adherence to infection control protocols have further fueled growth in this segment. Innovations in sterilization technologies specifically tailored for duodenoscopes, such as automated endoscope reprocessors and enhanced chemical disinfection methods, are also contributing to market expansion.

Regional Insights

North America dominated the endoscope sterilization market with the largest revenue share of 34.44% in 2024, driven by increasing awareness of infection control and advancements in reprocessing technologies. With a rising number of endoscopic procedures performed for diagnostic and therapeutic purposes, the demand for effective sterilization practices has become paramount. Hospitals and healthcare facilities are under constant pressure to maintain high standards of patient safety, leading to increased investments in state-of-the-art sterilization systems. The aging population in North America, coupled with a rise in chronic diseases, is driving a higher volume of endoscopic procedures, thereby increasing the demand for robust sterilization methods. The presence of major healthcare players and a strong emphasis on research and development contribute to the dynamic market growth. Overall, the North America market is set for continued expansion as healthcare systems prioritize patient safety, regulatory compliance, and operational efficiency in their sterilization protocols.

U.S. Endoscope Sterilization Market Trends

The endoscope sterilization market in the U.S. held a significant share of the market in 2024. The increased utilization of surgical procedures, and the high incidence of HAIs, are some of the major factors fueling market expansion. Moreover, WHO identifies HAIs as the most frequent adverse events in healthcare, estimating that at any given time, over 1.4 million patients worldwide are affected. In the U.S., there are over one million occurrences of HAIs within the healthcare system annually, leading to substantial morbidity and mortality. Regulatory approval in the U.S. is important in driving the market by ensuring that sterilization technologies meet strict safety, efficacy, and quality standards. The U.S. Food and Drug Administration (FDA) sets strict guidelines for sterilization equipment to ensure they effectively eliminate pathogens while maintaining the integrity of heat-sensitive medical devices. In January 2024, the FDA updated its medical device sterilization guidance and recognized vaporized hydrogen peroxide (VHP) as an Established Category sterilization process. This change reduces the regulatory burden for manufacturers using VHP.

The Canada endoscope sterilization market held a significant share in 2024. Growing investments in healthcare and rising surgical procedures are supporting market growth.

Europe Endoscope Sterilization Market Trends

The endoscope sterilization market in Europe is anticipated to grow at the significant CAGR during the forecast period. The European Union implements strict sterilization and infection control guidelines in healthcare settings. These regulations ensure that medical instruments meet high hygiene standards, boosting the adoption of advanced sterilization methods. The growing preference for minimally invasive procedures, which use delicate instruments, requires low-temperature sterilization to avoid heat damage to surgical tools. The rising awareness of HAIs has increased the need for effective sterilization methods, prompting healthcare facilities to adopt low-temperature sterilization, which is effective against a wide range of pathogens. Furthermore, expanding healthcare infrastructure across Europe, especially in developing regions, drives demand for advanced sterilization solutions to ensure patient safety. Europe has a rapidly aging population, leading to a higher demand for medical procedures and, subsequently, the sterilization of endoscopes.

The UK endoscope sterilization market is likely to show significant growth. The UK operates a universal healthcare system that extends free healthcare services to most of its population through national healthcare centers. The increasing elderly demographic in the UK is poised to drive market expansion. For instance, as per the Centre for Ageing Better, in 2023, there are 11 million people aged over 65 in England. This is projected to increase by 10% in the next five years and by 32% by 2043. As the geriatric population is more susceptible to various chronic disorders, some require hospitalization for surgeries and related procedures. This hospitalization surge is expected to improve the demand for endoscope sterilization as a preventive measure against HAIs.

The endoscope sterilization market in Germany is likely to show significant growth. The prevalence of HAIs in Germany significantly drives the market. With increased awareness of HAIs, regulatory influences, economic pressures, and a strong emphasis on patient safety, healthcare institutions are investing in advanced endoscope sterilization solutions. As the focus on infection prevention continues to evolve, the demand for high-quality sterilization methods is expected to grow, making them an essential component of modern healthcare practices to reduce HAIs and improve patient outcomes. As per the Robert Koch Institute study in February 2024, in Germany, an estimated 400,000 to 600,000 patients suffer HAIs each year; 10,000 to 20,000 of them die.

Asia Pacific Endoscope Sterilization Market Trends

The endoscope sterilization market in Asia Pacific is anticipated to grow at the fastest CAGR of 11.85% during the forecast period, because of healthcare infrastructure and rising awareness about HAIs. China is emerging as a lucrative market within the region, demonstrating strong growth potential due to increased government support and rising surgical procedures volume. Furthermore, the presence of several notable players, such as Steelco S.p.A., Andersen Sterilizers, AURORA, and ASP (Fortive Corporation), could potentially boost market growth.

The China endoscope sterilization market is growing at a lucrative growth rate. The rise in Methicillin-resistant Staphylococcus aureus (MRSA) cases is a significant driver of China's market. MRSA is a hospital-acquired infection that poses serious challenges for healthcare facilities due to its resistance to common antibiotics. The increasing prevalence of MRSA in China has prompted healthcare institutions to adopt stringent sterilization practices, creating a higher demand for reliable low-temperature sterilization solutions to ensure the safety of medical instruments and reduce infection risks. The growing number of MRSA cases has led to a more intense focus on infection prevention and control measures in hospitals and healthcare facilities. Sterilization plays a crucial role in maintaining sterile conditions for endoscopes, mainly in operating rooms and intensive care units where the risk of MRSA transmission is high. To minimize the spread of MRSA, healthcare institutions in China are required to adhere to stricter sterilization protocols. This includes using low-temperature sterilization methods that can withstand repeated sterilization cycles, helping to ensure that endoscopes remain free of harmful pathogens. According to the NIH update of January 2024, the MRSA detection rate in Macau increased from 30.1% in 2017 to 45.7% in 2022.

Latin America Endoscope Sterilization Market Trends

The endoscope sterilization market in Latin Americais experiencing significant growth. The growth is supported by expanding healthcare services and greater adoption of advanced medical technologies. Countries in the region are focusing on enhancing surgical outcomes, further driving demand for endoscope sterilization solutions.Latin America is tightening sterilization standards and guidelines. Compliance with these regulations drives healthcare facilities to adopt low-temperature sterilization technologies that meet or exceed these requirements, boosting market demand.

Middle East and Africa Endoscope Sterilization Market Trends

Theendoscope sterilization market in MEAis experiencing growth driven by healthcare modernization efforts and the adoption of advanced surgical practices. Saudi Arabia, in particular, is driving market expansion, backed by increased healthcare investments and government initiatives aimed at improving patient care standards.

The Saudi Arabia endoscope sterilization market is anticipated to grow at the fastest CAGR during the forecast period. The Saudi government has significantly invested in healthcare infrastructure, including hospitals, clinics, and medical facilities. This expansion increases the need for sterilization processes to maintain safety and prevent infections. The government has increased its annual healthcare and social development spending from USD 46.6 billion in 2018 to USD 68.2 billion in 2023. The Vision 2030 initiative aims to enhance healthcare services, establishing more healthcare facilities that require effective sterilization methods to ensure patient safety.In addition, there is a notable shift towards minimally invasive surgical techniques, such as laparoscopy and robotic-assisted surgeries, which utilize delicate instruments sensitive to heat and moisture.

Key Endoscope Sterilization Company Insights

The intensifying competition is leading to rapid technological advancements, and companies are constantly working to improve their product with a strong focus on research and development. Factors such as investments in R&D, compliance with regulatory policies, and technological advancements are constantly driving the introduction of novel techniques. In addition, market players are adopting strategies such as mergers & acquisitions, partnerships, product launches, and innovations to strengthen their foothold in the market. These advancements in the global market are anticipated to boost the market growth over the forecast period.

Key Endoscope Sterilization Companies:

The following are the leading companies in the endoscope sterilization market. These companies collectively hold the largest market share and dictate industry trends.

- Andersen Sterilizers

- ASP (Fortive Corporation)

- Getinge

- Steelco S.p.A.

- AURORA

- Nanosonics

- H.W.Andersen Products Ltd.

- Ecolab

- Tuttnauer

- Stryker

Recent Developments

-

In September 2024, Olympus announced the launch of "Sapphire," its inaugural flexible endoscope sterilization facility in Australia. This facility is part of the newly introduced Olympus On-Demand solution, aimed at Australian healthcare providers. The initiative seeks to minimize the risks, costs, and complexities associated with the management of endoscopy services.

-

In August 2024, PENTAX Medical, a division of the HOYA Group announced that the DEC Duodenoscope has received FDA clearance for compatibility with the STERRAD 100NX Sterilizer, a leading product from Advanced Sterilization Products (ASP), part of Fortive.

-

In January 2023, the FDA’s Center for Devices and Radiological Health (CDRH) announced that it has recently issued two warning letters to Olympus Medical Systems Corporation, along with its subsidiary Aizu Olympus Co., Ltd., following inspections of their facilities. These warning letters highlight violations pertaining to medical device reporting (MDR) requirements and quality system regulations specific to endoscopes and their accessories. The issues identified encompass a range of products, including surgical and gastrointestinal endoscopes, as well as automated endoscope reprocessors.

Endoscope Sterilization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.30 billion

Revenue forecast in 2030

USD 2.09 billion

Growth rate

CAGR of 9.64% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segment scope

Product, type, device type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; & MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Andersen Sterilizers; ASP (Fortive Corporation); Getinge; Steelco S.p.A.; AURORA; Nanosonics; H.W.Andersen Products Ltd; Ecolab; Tuttnauer; Stryker.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscope Sterilization Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global endoscope sterilization market report based on the product, type, device type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterilizers

-

Ethylene oxide sterilizers

-

Hydrogen peroxide sterilizers

-

Others

-

-

Liquid Chemical Sterilization Systems

-

Automated Endoscope Reprocessors (AERs)

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible Endoscopes

-

Single-channel Flexible Endoscopes

-

Dual-channel Flexible Endoscopes

-

Triple-channel Flexible Endoscopes

-

-

Rigid Endoscopes

-

Single-channel Rigid Endoscopes

-

Dual-channel Rigid Endoscopes

-

-

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Colonoscopes

-

Bronchoscopes

-

Duodenoscopes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscope sterilization market size was valued at USD 1.20 billion in 2024 and is expected to reach USD 1.30 billion by 2025.

b. The global endoscope sterilization market is anticipated to grow at a CAGR of 9.64% from 2025 to 2030 to reach USD 2.09 billion by 2030.

b. Flexible endoscopes held the largest market share of around 78.34% in 2024 driven by an increasing emphasis from various organizations on maintaining the sterility of these devices.

b. Andersen Sterilizers, ASP (Fortive Corporation), Getinge, Steelco S.p.A., AURORA, Nanosonics, H.W.Andersen Products Ltd. , Ecolab, Tuttnauer, and Stryker

b. Increasing number of surgical procedures conducted annually and growing prevalence of healthcare-associated infections (HAIs).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.