Endoscope Reprocessing Market Size, Share & Trends Analysis Report By Product (High-Level Disinfectants And Test Strips, Detergents And Wipes), By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-265-5

- Number of Report Pages: 148

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Endoscope Reprocessing Market Trends

The global endoscope reprocessing market size was estimated at USD 1.55 billion in 2023 and is projected to grow at a CAGR of 9.2% from 2024 to 2030. The growing number of infections caused by contaminated endoscopes coupled with increasing preference for minimally invasive surgery is anticipated to boost market growth.

According to a study called "Cannulation rates and technical performance evaluation of commercially available single-use duodenoscopes for endoscopic retrograde cholangiopancreatography: A systematic review and meta-analysis" published in January 2024, the range of infections related to duodenoscopes was between 0.4% to 1%.

The increasing respiratory disease burden, mainly chronic obstructive pulmonary disorders (COPD), is driving market growth rapidly. According to the JAMA Network report, the global prevalence of COPD was estimated to be 10.6% in 2020, which equals 480 million cases across both genders. The report shows that the number of cases is expected to rise by 112 million to a total of 592 million by 2050, which is 9.5% of the population. This indicates a relative increase of 23.3% from 2020 to 2050. As a result, the demand for endoscopic devices is increasing significantly for early disease diagnosis and treatment, which is further propelling the market growth.

The convergence of endoscopy and robotics has revolutionized surgical possibilities, providing improved visualization, unparalleled precision, and better patient outcomes. For instance, the endoscopic surgical system from Virtuoso has two needle-sized manipulators that are robotically controlled and operate from the tip of an endoscopeto bring the stability and precision of robot-assisted surgery to rigid endoscopy. Moreover, increasing numbers of successful clinical trials are expected to boost the product approvals. In January 2023, Agilis Robotics, a prominent developer of flexible robotic instruments, successfully completed the second round of live animal testing with its proprietary robot for endoscopic surgery. The test results were satisfactory and demonstrated promising outcomes for the efficacy, accuracy, and safety of the firm's medical robotic system. Thus, increasing integration of robotics in endoscopic surgery will lead to a rise in the number of procedures, thereby driving market growth.

Rising funding and investments in R&D activities for improved endoscope products are anticipated to spur market growth. In January 2023, IQ Endoscopes, a medical device company, secured a USD 6.6 million investment in a funding round led by BGF. The investment will be used to support the development and launch of IQ Endoscope’s medical device, which is designed for early diagnosis of a range of cancers and other gastrointestinal conditions. Thus, the increasing launch of endoscopy devices will propel the use of endoscope reprocessing.

Regulatory bodies such as the FDA (Food and Drug Administration) and CDC (Centers for Disease Control and Prevention) have established guidelines and standards for reprocessing endoscopes to reduce the risk of infections associated with endoscopic procedures. Adherence to these regulations is a significant driver for the adoption of advanced endoscope reprocessing systems and solutions. In April 2022, the Food and Drug Administration issued a recall and instructed healthcare providers to use different reprocessing methods for certain urological endoscopes manufactured by Karl Storz.

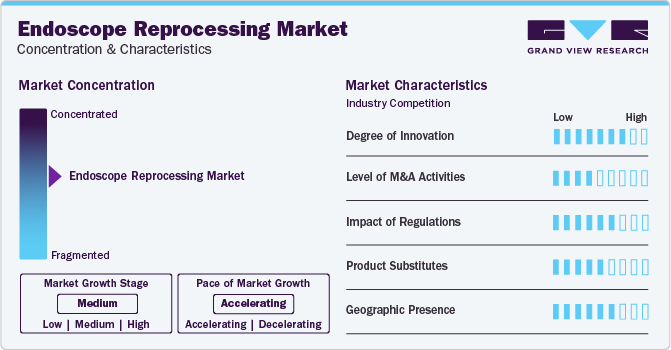

Market Concentration & Characteristics

The market has seen significant innovation in recent years due to technological advances, strict regulatory requirements, and concerns about infection control. There has been a shift towards the development of automated reprocessing systems with advanced features to improve efficiency and reduce the risk of human error. These systems use cutting-edge technologies like robotics, artificial intelligence (AI), and advanced sensors to streamline the reprocessing workflow and minimize the potential for contamination.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for endoscope reprocessing. In November 2023, HOYA Corporation acquired WASSENBURG Medical B.V., a global manufacturer of endoscope reprocessing systems, consumables, and services.

Regulations are crucial in shaping the global market, as they ensure patient safety and maintain the efficacy of medical devices. Endoscopes are essential tools in modern healthcare, used for diagnosing and treating various medical conditions. However, their intricate design and direct contact with bodily fluids pose significant challenges for effective cleaning and disinfection, making stringent regulations necessary.

Product substitutes refer to alternative methods or technologies that healthcare facilities can use instead of traditional reprocessing procedures. One notable substitute in the market is the use of single-use, disposable endoscopes. These devices are designed for one-time use and eliminate the need for reprocessing.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product launches create more opportunities for market players to enter new regions. In December 2021, Belimed Life Science Inc. established operations in North Charleston.

Product Insights

The high-level disinfectants and test strips segment held the market with the largest revenue share of 29.8% in 2023. The healthcare industry is focusing more on preventing and controlling infections in healthcare facilities, which is leading to market growth. Healthcare-associated infections (HAIs) continue to be a significant threat to patient safety, so healthcare facilities are prioritizing the implementation of strict disinfection protocols for endoscopes. An NIH article published in 2022 reports that after GI endoscopic procedures, the composite infection rate was found to be 0.2%, while it was 0.8% following Endoscopic retrograde cholangiopancreatography (ERCP), 0.123% following non-ERCP upper GI endoscopic procedures, and 0.073% following lower GI endoscopic procedures. High-level disinfectants play a crucial role in effectively eliminating microorganisms, such as bacteria, viruses, and fungi, from endoscopic instruments. This helps to reduce the risk of cross-contamination and transmission of infectious agents between patients, thereby supplementing segmental growth.

The automated endoscope reprocessors (AERs) segment is anticipated to witness at the fastest CAGR over the forecast period. Technological advancements in AERs contribute to market growth. Manufacturers are continuously improving AERs to enhance their functionality, efficiency, and safety features. Advanced AERs are equipped with features such as high-level disinfection cycles, endoscope-specific adapters, and compatibility with a wide range of endoscope models. For instance, ASP's AEROFLEX AER is an automated system specifically designed for endoscope reprocessing. The AER comes with an integrated minimum recommended concentration (MRC) monitor. This eliminates the need for test strips. The AER has a complete cycle time of only 22 minutes, making it a highly efficient solution for endoscope reprocessing.

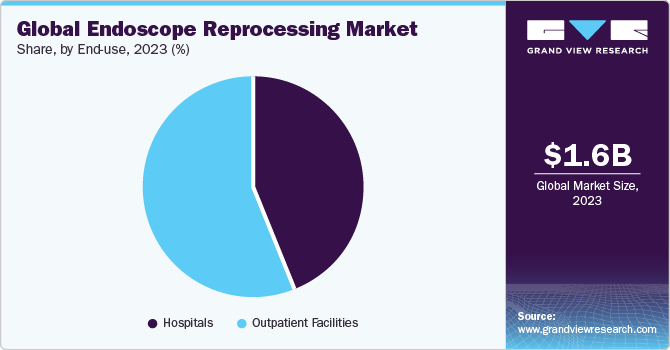

End-use Insights

Based on end-use, the outpatient facilities segment led the market with the largest revenue share of 55.9% in 2023. Outpatient settings, including ASCs, are witnessing a surge in the volume of endoscopic procedures, thereby escalating segmental growth. According to an article published by McMahon Publishing in 2024, the number of surgical procedures performed at ASCs is expected to increase by at least 25% in the next ten years. Moreover, the integration of artificial intelligence (AI) and digitalization into endoscopy procedures is driving segmental growth. In January 2024, Omega Healthcare and Sanjivani Gastro Liver Clinic introduced AI-enabled endoscopy in Odisha to aid in the diagnosis and treatment of gastrointestinal disorders.

The hospitals segment is anticipated to register at a significant CAGR over the forecast period. Hospitals play a crucial role in providing medical procedures, diagnostics, and treatments, which include a diverse range of endoscopic procedures. To ensure high standards of patient care and infection prevention, hospitals need reliable endoscope reprocessing solutions. In addition, the rising prevalence of chronic diseases coupled with the rising patient preference for hospitals are driving market growth in this area.

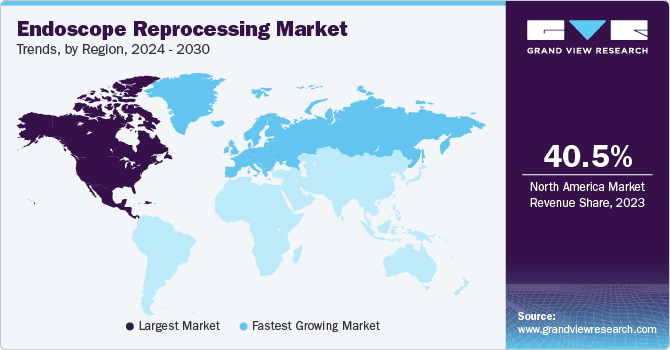

Regional Insights

North America dominated the endoscope reprocessing market with a revenue share of 40.45% in 2023, owing to a well-established healthcare infrastructure and high healthcare expenditure. In addition, the increasing prevalence of gastrointestinal diseases, cancer, and other medical conditions requiring endoscopic procedures contributes to the market growth in North America. For instance, according to the GI Alliance report, 62 million Americans are diagnosed with digestive disorders each year.

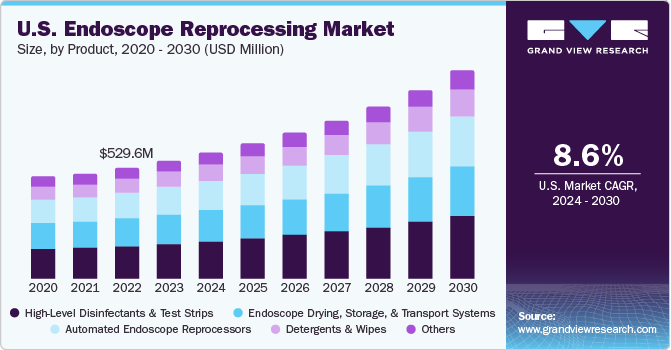

U.S. Endoscope Reprocessing Market Trends

The endoscope reprocessing market in the U.S. held the largest share of 89.7% in 2023. Increasing cases of gastrointestinal diseases and high volume of endoscopic procedures performed annually are driving the market growth. For instance, according to the ResearchGate article, in the U.S., more than 17.7 million gastrointestinal (GI) endoscopic procedures are performed every year, making up 68% of all endoscopic procedures.

The Canada endoscope reprocessing market is anticipated to register at the fastest CAGR during the forecast period. Growing demand for surgeries with fewer post-surgery infections, faster recovery, reduced scarring, better control of bleeding, and less pain is expected to boost the demand of endoscope devices, thereby fostering market growth.

Europe Endoscope Reprocessing Market Trends

The endoscope reprocessing market in Europe is anticipated to register at the fastest CAGR during the forecast period. Growing product launches and approval in the region are accelerating the market growth. In June 2023, PENTAX Medical Europe, a part of the HOYA Group, introduced a brushless automated pre-cleaning solution for endoscopes. This new solution is called AquaTYPHOON.

The Germany endoscope reprocessing market is anticipated to register at a considerable CAGR during the forecast period. Growing number of endoscopy procedures and increasing technological advancement in the field of endoscopy devices is anticipated to escalate market growth. As per the GlobalData report, in 2022, in Germany, the total number of endoscopy procedures was 315,002.

The endoscope reprocessing market in the UK is anticipated to register at a considerable CAGR during the forecast period. Rising investment from public and private investors in endoscopy services will escalate market growth. In October 2023, Clearview Endoscopy Limited, a company that provides maintenance, repair, and servicing of flexible endoscopes used for medical diagnosis in healthcare settings, received an investment of USD 7.7 million from Foresight.

The Spain endoscope reprocessing market is anticipated to register at the fastest CAGR during the forecast period. Increased prevalence of cancer, such as lung and stomach are boosting market growth. As per the Karger article, in 2021, 22,413 individuals died from lung cancer in Spain. The projected average for 2042 - 2046 is 25,549 deaths per year. Such increasing cases of death are anticipated to boost the early diagnosis and treatment of cancer, thereby fostering market growth.

Key Endoscope Reprocessing Company Insights

Key participants in the global market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Endoscope Reprocessing Companies:

The following are the leading companies in the endoscope reprocessing market. These companies collectively hold the largest market share and dictate industry trends.

- Cantel Medical

- Fortive Corporation (Advanced Sterilization Products)

- Olympus Corporation

- Ecolab

- Getinge AB

- STERIS

- Steelco S.p.A

- ARC Group of Companies Inc.

- Metrex Research, LLC.

- Shinva Medical Instrument Co. Ltd.

- Belimed

Recent Developments

-

In June 2023, Olympus launched the new Olympus ETD, an endoscope washer disinfector. It was introduced in two versions, ETD Premium and ETD Basic, and was developed for endoscope reprocessing as part of the company's Infection Prevention portfolio

-

In June 2022, Getinge launched an improved version of the ED-Flow automated endoscope reprocessor, providing advanced digital connectivity and data management to its endoscope reprocessing customers

-

In October 2020, Olympus announced the release of its latest automated endoscope reprocessor (AER) called the OER-Elite. This new product is capable of cleaning and disinfecting up to two endoscopes simultaneously within a time span of 28 minutes

Endoscope reprocessing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.67 billion |

|

Revenue forecast in 2030 |

USD 2.83 billion |

|

Growth rate |

CAGR of 9.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast data |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Cantel Medical; Fortive Corporation (Advanced Sterilization Products); Olympus Corporation; Ecolab; Getinge AB; STERIS; Steelco S.p.A; ARC Group of Companies Inc.; Metrex Research; LLC.; Shinva Medical Instrument Co. Ltd.; Belimed |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Endoscope Reprocessing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global endoscope reprocessing market report based on product, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

High-Level Disinfectants & Test Strips

-

Detergents & Wipes

-

Automated Endoscope Reprocessors

-

By Type

-

Single basin

-

Double basin

-

-

By Portability

-

Standalone

-

Portable

-

-

-

Endoscope Drying, Storage, and Transport Systems

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscope reprocessing market size was estimated at USD 1.55 billion in 2023 and is expected to reach USD 1.67 billion in 2024

b. The global endoscope reprocessing market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 2.83 billion by 2030.

b. North America dominated the market with a share of 40.5% in 2023. This is attributable to a well-established healthcare infrastructure and high healthcare expenditure.

b. Some key players operating in the market include Cantel Medical, Fortive Corporation (Advanced Sterilization Products), Olympus Corporation, Ecolab, Getinge AB, STERIS, Steelco S.p.A, ARC Group of Companies Inc., Metrex Research, LLC., Shinva Medical Instrument Co. Ltd., Belimed

b. Key factors that are driving the market growth include convergence of endoscopy and robotics has revolutionized surgical possibilities, providing improved visualization, unparalleled precision, and better patient outcomes.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."