Endometrial Ablation Market Size, Share & Trends Analysis Report By Product (Radiofrequency Ablation, Cryoablation), By End-use (Hospitals, Clinics), By Region (North America, APAC, Europe), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-608-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Endometrial Ablation Market Size & Trends

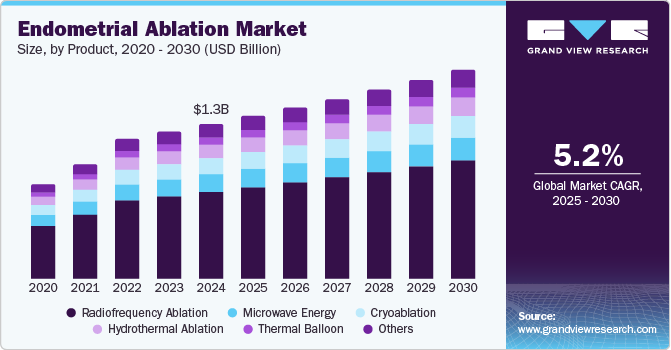

The global endometrial ablation market size was estimated at USD 1.25 billion in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2030. This can be attributed to the increasing demand for endometrial ablation devices owing to the rising prevalence of gynecological disorders, such as PCOD, and menorrhagia, and rising public awareness about the procedure. Furthermore, the competitive advantage of endometrial ablation over other surgical procedures, such as minimal invasiveness, is expected to boost the demand for devices in the coming years.

Endometrial ablation is a minimally invasive procedure that removes the inner lining of the uterus to treat heavy menstrual bleeding. The global endometrial ablation market is experiencing significant growth, driven by several key factors. The rising prevalence of gynecological disorders, such as PCOS and abnormal uterine bleeding, has led to an increased demand for less invasive treatment options. Women are seeking alternatives to traditional surgeries that offer quicker recovery times and less discomfort. This patient-centered approach aligns with the global trend towards minimally invasive medical interventions, improving overall quality of life for those affected by these conditions.

The growing percentage of patients affected by menorrhagia, also known as heavy or abnormal menstrual bleeding, is anticipated to boost market growth during the forecast period. Heavy menstrual bleeding (AUB) affects 20-30% of women annually, with 53 per 1,000 women experiencing it each year. Some of its causes include fibroids, polyps, coagulopathies (e.g., 13% of women with AUB have Von Willebrand disease), and hormonal disorders. Treatments include endometrial ablation, which can significantly reduce bleeding in many cases.

Women's coverage plans are one of the primary elements projected to drive industry growth in developed countries. For instance, in India, numerous tax benefits and exemptions are available to women under various sections of the income tax legislation; one is the income tax deduction, which can be claimed on premiums paid for health insurance policies. Such initiatives concerning women’s health may increase the adoption of treatment options available for them, including endometrial ablation, thus boosting the market growth.

Furthermore, the market is benefiting from growing awareness about endometrial ablation procedures and a shift in patient preferences. As information becomes more readily available through healthcare professionals and online resources, women are becoming more informed about their treatment options. This empowerment has led to a preference for procedures like endometrial ablation, which offers shorter hospital stays, reduced pain, and faster recovery compared to traditional surgeries. The improved patient experience associated with these procedures has contributed to their increasing popularity.

Product Insights

The radiofrequency ablation segment dominated the global endometrial ablation industry andaccounted for the largest revenue share of 56.0% in 2024. The growth is driven by the product’s convenience, speed of treatment, efficacy, and cost-efficiency compared to other ablation devices. In addition, the growth is further boosted by its convenience, rapid treatment process, high effectiveness, cost-efficiency, and widespread accessibility. These attributes make it an appealing option for both patients and healthcare providers. Furthermore, the increasing number of regulatory approvals for advanced devices is accelerating the expansion of this market segment. For instance, in February 2023, Hologic Inc. secured approval for its NovaSure V5 global endometrial ablation device in Canada and Europe. This next-generation device incorporates innovative features designed to enhance patient outcomes and procedural efficiency, contributing to its adoption across these regions.

The cryoablation segment is expected to grow at a CAGR of 5.4% from 2025 to 2030, owing to technological advancements that enhance precision and effectiveness. Its ability to treat complex cases with minimal tissue damage is particularly appealing. In addition, the procedure's adaptability to various clinical settings and compatibility with existing infrastructure contribute to its adoption. Furthermore, as healthcare systems focus on innovative treatments, cryoablation's unique benefits are driving its expansion.

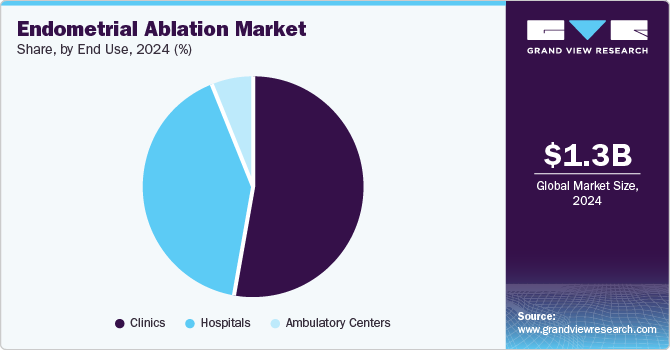

End Use Insights

The clinics led the market and accounted for the largest revenue share of 53.4% in 2024, primarily driven by the implementation of innovative technologies for treating menorrhagia, increasing awareness about the use of endometrial ablation devices, expanding clinical trials on endometrial ablation methods, and increased government research allocations for the widespread availability of healthcare devices. Furthermore, the rising availability of advanced devices in clinics, coupled with increasing awareness about minimally invasive treatments, contributes to their expansion. Moreover, the convenience of localized care and shorter procedure times further solidify clinics as a preferred choice for endometrial ablation procedures.

The hospitals segment is expected to grow at a CAGR of 5.5% over the forecast period. This can be attributed to a rise in the number of patients being hospitalized for gynecological disorders, as hospitals provide excellent care as well as reimbursements. In addition, hospitals possess advanced treatment devices, which contributes to the expansion of this segment. Furthermore, due to the ease of managing any problems that may develop during surgical procedures and the availability of a wide range of treatment options in the facility, hospitals see a substantially higher inflow of patients for gynecological treatments than other healthcare settings.

Regional Insights

North America endometrial ablation market dominated the global market with the highest revenue share of 31.8% in 2024, attributed to rising cases of gynecological disorders, the presence of key market players, and rising preference for minimally invasive surgical procedures. In addition, increasing awareness about minimally invasive procedures and the availability of reimbursement policies are encouraging more patients to opt for endometrial ablation. Furthermore, the presence of leading market players and government initiatives promoting affordable healthcare further accelerate growth. Moreover, the rising adoption of outpatient procedures and technological advancements in ablation devices make North America a dominant region in the global market.

U.S. Endometrial Ablation Market Trends

The endometrial ablation market in the U.S., led the North American market and held the largest revenue share in 2024, driven by a large patient pool suffering from gynecological conditions, such as menorrhagia, affecting millions annually. High disposable incomes and comprehensive insurance coverage make this procedure more accessible to patients. In addition, the introduction of next-generation devices by key industry players and government support through policies like the Affordable Care Act enhance market expansion. Furthermore, growing awareness campaigns and precision medicine initiatives are improving treatment accessibility, solidifying the U.S. as a leader in this segment.

Asia Pacific Endometrial Ablation Market Trends

The Asia Pacific endometrial ablation market is expected to grow at the fastest CAGR of 5.6% over the forecast period. A growing prevalence of gynecological disorders, coupled with an expanding middle-class population, drives demand for cost-effective procedures. Improved access to healthcare facilities and government initiatives supporting advanced medical technologies further contribute to market growth.

The endometrial ablation market in China led rhea Asia Pacific market and held the largest revenue share in 2024, primarily driven by its large population base and increasing cases of gynecological disorders such as abnormal uterine bleeding. In addition, rising disposable incomes and improvements in healthcare infrastructure are enabling greater access to advanced treatments. Furthermore, government efforts to modernize medical facilities and promote minimally invasive procedures are further fueling demand. Moreover, local manufacturers developing affordable ablation devices are enhancing accessibility, while growing patient awareness contributes to the adoption of this procedure across both urban and rural regions.

Europe Endometrial Ablation Market Trends

The Europe endometrial ablation market is expected to grow significantly over the forecast period, driven by a robust healthcare system and rising incidences of gynecological conditions such as menorrhagia. In addition, increased adoption of innovative technologies, such as radiofrequency ablation, enhances procedural efficiency and patient outcomes. Favorable reimbursement policies across countries such as Germany, France, and the UK make these treatments more accessible. Furthermore, growing awareness campaigns by healthcare providers and support from regulatory bodies for advanced devices contribute to market expansion.

Key Endometrial Ablation Company Insights

Key companies in the global endometrial ablation industry include Medtronic, The Cooper Companies, Inc., Boston Scientific Corporation, and others. These players are employing strategies focused on innovation, expansion, and collaboration to strengthen their market position. In addition, they are investing in research and development to introduce advanced devices with enhanced safety and efficiency. Furthermore, partnerships and acquisitions are being pursued to expand geographical reach and product portfolios.

-

Medtronic manufactures advanced medical devices and minimally invasive technologies designed to address gynecological conditions like heavy menstrual bleeding. Operating within the broader medical device industry, the company focuses on providing cutting-edge ablation systems that improve patient outcomes. Its products are widely utilized in hospitals, clinics, and outpatient settings, emphasizing efficiency, safety, and precision to meet the growing demand for minimally invasive procedures.

-

Boston Scientific Corporation develops and manufactures medical devices for multiple therapeutic areas, including gynecology. The company provides advanced ablation devices for effectively treating abnormal uterine bleeding. Operating within the medical technology segment, Boston Scientific focuses on delivering innovative solutions that enhance procedural outcomes and patient care.

Key Endometrial Ablation Companies:

The following are the leading companies in the endometrial ablation market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- The Cooper Companies, Inc.

- Boston Scientific Corporation

- Johnson & Johnson Service Inc.

- Olympus Corporation

- Richard Wolf GmbH

- AngioDynamics

- Hologic, Inc.

- Minerva Surgical, Inc.

View a comprehensive list of companies in the Endometrial Ablation Market

Recent Developments

-

In November 2024, Olympus Corporation of the Americas showcased its comprehensive range of gynecological solutions at the AAGL World Congress. The display included hysteroscopy systems featuring Plasma Hysteroscopic Resection and Vaporization Electrodes, and the VERSAPOINT II Bipolar Electrosurgery System. These systems can be utilized in procedures such as Endometrial ablation.

-

In October 2024, Minerva Surgical, partnered with Blackmaple Group to offer minimally invasive gynecologic technologies to WHAAPA physician members. The agreement includes the Minerva ES Ablation System and Medical Endoscopy Image Processing System for detecting and treating abnormal uterine bleeding (AUB).

Endometrial Ablation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.32 billion |

|

Revenue forecast in 2030 |

USD 1.70 billion |

|

Growth rate |

CAGR of 5.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait |

|

Key companies profiled |

Medtronic; The Cooper Companies, Inc.; Boston Scientific Corporation; Johnson & Johnson Service Inc.; Olympus Corporation; Richard Wolf GmbH; AngioDynamics; Hologic, Inc.; Minerva Surgical, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Endometrial Ablation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global endometrial ablation market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cryoablation

-

Radiofrequency ablation

-

Hydrothermal ablation

-

Thermal Balloon

-

Microwave energy

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."