- Home

- »

- Medical Devices

- »

-

Endodontic Files Market Size & Share, Industry Report, 2030GVR Report cover

![Endodontic Files Market Size, Share & Trends Report]()

Endodontic Files Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Manual, Rotary), By Material (Stainless Steel, Nickel-titanium), By Distribution Channel (Offline, Online), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-413-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endodontic Files Market Size & Trends

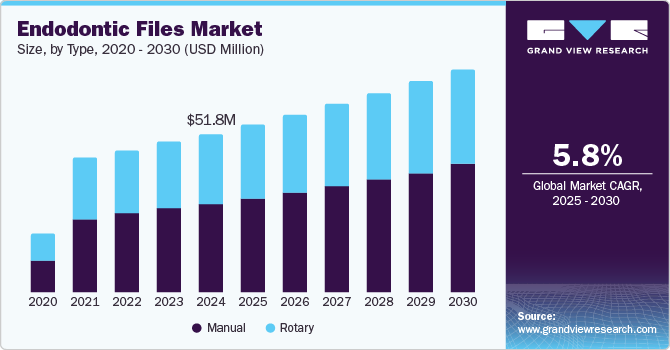

The global endodontic files market size was valued at USD 51.8 million in 2024 and is expected to grow at a CAGR of 5.8% from 2025 to 2030, attributed to rising awareness about oral health and the surging prevalence of dental diseases. As individuals become more conscious of the importance of oral hygiene, there is an increase in early detection and treatment of dental issues, such as tooth decay and pulp infections, which often require root canal procedures. This shift toward preventive care and early intervention is fueling the demand for endodontic treatments. Besides, a surge in the incidence of dental diseases, especially in aging populations, further boosts the need for effective endodontic tools such as files.

Growing dental tourism and favorable regulatory support are also accelerating the market growth. The demand for advanced endodontic tools increases as patients seek affordable, high-quality dental treatments abroad, especially root canal procedures. Countries with well-established dental tourism hubs benefit from a rise in treatment volumes, directly boosting the need for endodontic files. Furthermore, regulatory bodies ensuring the safety and effectiveness of dental products, coupled with dental reimbursement policies that cover endodontic procedures, further encourage the adoption of these tools, expanding market size globally.

Type Insights

The manual endodontic files segment dominated the market with the largest revenue share of 54.6% in 2024, propelled by their simplicity, cost-effectiveness, and reliability in performing root canal procedures. These files are widely preferred by dentists, particularly in regions with limited access to advanced technology. Their ergonomic design and ease of use allow for precise and controlled movement during treatment, ensuring effective cleaning and shaping of the root canal. Manual endodontic files continue to dominate the market, largely due to their established reliability and cost-effectiveness, even with the growing popularity of mechanized alternatives.

Moreover, the rotary endodontic files segment is anticipated to emerge as the fastest-growing segment and grow at a CAGR of 4.7% between 2025 and 2030 owing to their superior efficiency and precision in root canal treatments. These motorized files reduce treatment time and enhance the accuracy of cleaning and shaping the root canal system, leading to better clinical outcomes. With escalating demand for minimally invasive procedures and faster recovery times, rotary systems are gaining popularity among dental professionals. As technological advancements continue to improve the performance and affordability of rotary files, their adoption is anticipated to drive significant market growth.

Material Insights

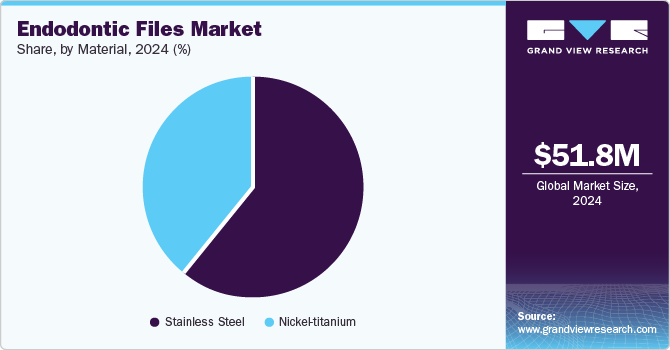

The stainless steel-based endodontic files segment secured the largest revenue share of 61% in 2024, attributed to their strength, reliability, and cost-effectiveness. These files are favored for their robust construction, providing excellent resistance to breakage and corrosion during root canal procedures. Their consistent performance in shaping and cleaning the root canal system has made them a staple in dental practices worldwide. Also, stainless steel files are more affordable than other materials, making them accessible to a broader range of dental professionals, further driving their widespread adoption and market share.

The nickel-titanium-based endodontic files segment is expected to stand out as the fastest-growing segment and capture a CAGR of 6.6% during the forecast period, fueled by its superior flexibility, durability, and resistance to fracture. NiTi files can navigate complex root canal anatomies with greater ease and precision, reducing the risk of procedural errors. The shape-memory properties of these files allow them to revert to their original form after bending, enhancing treatment outcomes. As dentists increasingly seek tools that improve patient comfort and procedural efficiency, the demand for NiTi-based files is projected to rise, driving significant market growth.

Distribution Channel Insights

The offline segment secured the largest revenue share of 39.9% in 2024, driven by the strong preference of dental professionals for in-person purchases and direct interactions with suppliers. Dentists value the ability to physically examine the quality and features of endodontic files before buying. In addition, offline channels often provide personalized customer service, which is crucial for making informed decisions about specialized dental tools. The established network of dental distributors, local supply chains, and trusted relationships between dental practices and suppliers further contribute to the dominance of the offline segment in the market.

The online segment is expected to stand out as the fastest-growing segment and capture a CAGR of 10.5% during the forecast period, spurred by the growing adoption of e-commerce in healthcare. Online platforms offer dental professionals the convenience of purchasing products anytime, anywhere, with access to various endodontic files, often at attractive prices. Furthermore, comparing brands, reading reviews, and accessing detailed product descriptions enhances decision-making. With the increasing trend of digitalization and improved online supply chain logistics, the online segment will witness significant growth soon.

End-use Insights

The hospitals & OPDs segment secured the largest revenue share of 52.1% in 2024, owing to the high volume of dental procedures performed in these settings. Hospitals and OPDs offer comprehensive dental care, including root canal treatments, which require the use of endodontic files. The escalating demand for dental treatments, advancements in dental technologies, and growing awareness about oral health have led to a higher adoption of specialized instruments. Moreover, the ability to handle complex cases and provide specialized care in these environments drives significant market growth.

The dental clinics segment is expected to stand out as the fastest-growing segment and capture a CAGR of 7.0% during the forecast period, fueled by the increasing number of root canal procedures performed worldwide. As dental clinics expand their offerings and invest in advanced dental equipment, the demand for high-quality endodontic files grows. These clinics cater to a large number of patients seeking effective and affordable treatment options, driving the need for precision instruments. The rising prevalence of dental conditions and a focus on patient-centric care are further fueling the growth of this segment in the market.

Regional Insights

North America endodontic files market secured the largest market share of 40.8% in 2024, attributed to the increase in preventive dentistry and rising dental awareness. As more patients prioritize oral health, there is a burgeoning demand for advanced endodontic treatments, including root canal therapy. Moreover, the rise in the adoption of laser-assisted endodontics, known for its precision and minimally invasive nature, is further propelling the market growth. These innovations in dental care are boosting the demand for high-quality, efficient endodontic files as practitioners and patients seek enhanced outcomes, reduced discomfort, and faster recovery times.

U.S. Endodontic Files Market Trends

The U.S. held a commendable position in the endodontic files industry in 2024 due to the rise of single-use endodontic files. With increasing concerns over hygiene and infection control, disposable files offer a safer, more convenient option for dental practices. In addition, the surging prevalence of root canal treatments, driven by factors such as aging populations and heightened awareness of dental health, is boosting demand for high-quality endodontic instruments. As more patients seek effective treatments, the market for advanced, single-use endodontic files continues to expand, ensuring improved patient outcomes and operational efficiency.

The adoption of advanced materials, such as flexible Nickel-Titanium (NiTi) alloys, is projected to fuel the growth of the Canada endodontic files market. These materials improve the flexibility, strength, and precision of root canal treatments, enabling more accurate procedures. Besides, the increased focus on minimally invasive dentistry to preserve natural tooth structure and reduce recovery times is fueling demand for specialized, efficient endodontic files. As Canadian dental professionals adopt these advanced techniques and materials, the demand for high-performance files grows, leading to improved patient outcomes and satisfaction.

Europe Endodontic Files Market Trends

Europe is set to expand at the fastest-growing CAGR of 5.3% from 2025 to 2030, propelled by the growth of digital endodontics and the increasing preference for automatic and rotary files. Digital technologies, such as 3D imaging and Cone Beam CT, enhance precision in root canal procedures, leading to greater demand for advanced files that complement these tools. In addition, rotary and automatic file systems, known for their efficiency, speed, and reduced risk of procedural errors, are becoming increasingly popular. As European dental professionals adopt these innovations, the market for high-performance endodontic files is projected to grow significantly.

The rising focus on biocompatibility in dental treatments is expected to drive the growth of the UK endodontic files industry. As patients and dental professionals prioritize materials that minimize adverse reactions and promote healing, demand for biocompatible files is increasing. Furthermore, the surge in aesthetic and cosmetic dentistry, where preserving the natural tooth structure is essential, is further fueling this trend. Dentists are seeking endodontic files that offer precision, minimal invasiveness, and excellent performance, which is anticipated to propel the demand for advanced, biocompatible endodontic files in the UK.

The adoption of rotary and reciprocating systems in Germany is transforming endodontic treatments by enhancing efficiency and precision and reducing treatment time, thereby driving the demand for advanced endodontic files. These systems, favored for their ability to navigate complex root canal anatomies, are gaining popularity among dental professionals. Besides, the increasing focus on patient-centered care, emphasizing comfort, faster recovery, and minimally invasive procedures, is further fueling the market. As more patients seek effective, efficient, and comfortable treatments, the Germany endodontic files industry is projected to expand with these innovations at the forefront.

Asia Pacific Endodontic Files Market Trends

The adoption of Nickel-Titanium (NiTi) files is accelerating the growth of the Asia Pacific endodontic files industry, as these files offer superior flexibility, strength, and resistance to fracture, making them ideal for complex root canal treatments. Also, increased investment in dental healthcare infrastructure across the region is improving access to advanced dental technologies and treatments. As dental professionals adopt more efficient and durable tools, especially NiTi files, the demand for high-quality endodontic products is expected to rise, fueling market expansion and enhancing overall treatment outcomes in Asia Pacific.

Japan is projected to grow at a commendable CAGR over the forecast period, owing to the integration of digital dentistry with endodontic procedures. Advanced technologies, such as 3D imaging and computer-assisted systems, enhance precision and efficiency in root canal treatments, boosting the demand for high-performance endodontic files. Furthermore, the rising preference for minimally invasive procedures, which focus on preserving natural tooth structure and reducing recovery times, is further fueling market growth. As dental professionals adopt these innovations to improve patient outcomes, the demand for cutting-edge endodontic files in Japan is set to rise.

China is anticipated to achieve a noteworthy share during the forecast period, spurred by the growing preference for global and high-quality endodontic file brands. Chinese dental professionals are increasingly prioritizing reliable, advanced products that ensure better outcomes and patient safety. Moreover, increasing government initiatives and regulations focused on improving healthcare standards and promoting dental care is further fueling market growth. As regulatory frameworks become more stringent and dental practices modernize, the demand for premium endodontic files will rise, contributing to the continued development of the market in China.

Key Endodontic Files Company Insights

Some of the key companies in the endodontic files market include Dentsply Sirona; Envista Holdings Corporation; Coltene; EdgeEndo; META-BIOMED CO., LTD; Brasseler USA; DiaDent Group International; FKG Dentaire Srl; VDW GmbH; Planmeca Oy.

-

Dentsply Sirona provides a wide range of dental products and technologies, including diagnostic, restorative, and preventive solutions, equipment, endodontic tools, CAD/CAM systems, and digital imaging for dental professionals.

-

EdgeEndo offers innovative endodontic solutions, specializing in high-performance rotary and reciprocating files, irrigation systems, obturation tools, and other advanced products designed to enhance root canal procedures and improve treatment outcomes.

Key Endodontic Files Companies:

The following are the leading companies in the endodontic files market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona

- Envista Holdings Corporation

- Coltene

- EdgeEndo

- META-BIOMED CO., LTD

- Brasseler USA,

- DiaDent Group International

- FKG Dentaire Srl

- VDW GmbH

- Planmeca Oy

Recent Developments

-

In October 2024, Kerr Dental introduced ZenFlex CM, an advanced rotary file designed to enhance endodontic procedures. Featuring innovative technology and a proprietary heat-treatment process, ZenFlex CM delivers exceptional performance and reliability, setting a new benchmark in root canal treatments.

-

In August 2024, Dentsply Sirona launched the U.S. X-Smart Pro+ and Reciproc Blue, offering a streamlined one-file endodontic solution. The X-Smart Pro+ motor includes an integrated apex locator and features genuine reciprocating motion, while the flexible Reciproc Blue file is designed for efficient one-file endodontic procedures.

Endodontic Files Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 54.8 million

Revenue forecast in 2030

USD 72.7 million

Growth Rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dentsply Sirona; Envista Holdings Corporation; Coltene; EdgeEndo; META-BIOMED CO., LTD; Brasseler USA; DiaDent Group International; FKG Dentaire Srl; VDW GmbH; Planmeca Oy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endodontic Files Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global endodontic files market report on the basis of type, material, distribution channel, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Rotary

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Nickel-titanium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & OPDs

-

Dental Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endodontic files market size was estimated at USD 18.0 million in 2020 and is expected to reach USD 36.3 million in 2021.

b. The global endodontic files market is expected to grow at a compound annual growth rate of 4.8% from 2021 to 2028 to reach USD 50.5 million by 2028.

b. The manual files segment dominated the global endodontic files market and accounted for the largest revenue share of over 53% in 2020.

b. The stainless steel type segment led the global endodontic files market in 2020 accounting for the highest revenue share of more than 61%.

b. The hospitals & OPDs segment led the global endodontic files market and accounted for the largest revenue share of over 52% in 2020.

b. The offline distribution channel segment dominated the global endodontic files market and accounted for the maximum share of more than 89%.

b. North America dominated the endodontic files market with a share of 41.3% in 2020. This is attributable to the rising number of root canal procedures, continuous technological development for improved efficiency, and growing awareness regarding dental care in the country.

b. Some of the key players operating in the endodontic files market are Dentsply Sirona, Henry Schein, Ultradent Products, FKG Dentaire, Ivoclar Vivadent, Coltene, Micro-Mega, and Brasseler Holdings, LLC.

b. Key factors that are driving the endodontic files market growth include the rise in awareness concerning dental care, growing demand for dental care in the geriatric & pediatric population, rise in dental expenditure, government initiatives, and insurance coverage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.