- Home

- »

- Clinical Diagnostics

- »

-

Endocrine Testing Market Size & Share, Growth Report, 2030GVR Report cover

![Endocrine Testing Market Size, Share & Trends Report]()

Endocrine Testing Market (2024 - 2030) Size, Share & Trends Analysis Report By Test Type (TSH, hCG Hormone), By End-use (Hospitals, Commercial Laboratories), By Technology (Immunoassay, Clinical Chemistry), And Segment Forecasts

- Report ID: 978-1-68038-862-6

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endocrine Testing Market Size & Trends

The global endocrine testing market size was estimated at USD 12.19 billion in 2023 and is projected to grow at a CAGR of 8.5% from 2024 to 2030. Growing prevalence of endocrine disorders is a major factor contributing to market growth. According to the Springer Nature Limited article published in May 2023, thyroid cancer is the most common type of endocrine cancer and was evaluated to have caused about 11,860 new cases in men and 31,940 new cases in women in the U.S. in 2022. Rising demand for home health care and awareness of routine testing, advancements in product technologies, and increasing investments in research activities for disease understanding are expected to drive market growth during the forecast period.

Advancements in the product technologies fuel the demand for the endocrine testing market. According to the Cureus, Springer Nature Group article published in October 2023, remarkable progress has been made in the treatment of endocrine system diseases and arrhythmia in recent years. Endocrine system disorders include a variety of diseases, such as diabetes, thyroid dysfunction, and adrenal gland disease. Advances in biomarker identification and genomic profiling have made it possible to make more accurate diagnoses and develop individualized treatment plans. In addition, modern drugs and advanced delivery systems represent greater progress in achieving improved glycemic control and minimizing the adverse effects of endocrine disorders in individuals characterized by improper heart rhythms.

Arrhythmia poses a significant risk to cardiovascular health. Strategies to treat arrhythmia include wearable cardiac monitors, catheter-based ablation techniques, and artificial intelligence (AI)-based predictive algorithms. These advances facilitate early detection, risk stratification, and execution of targeted interventions, ultimately leading to improved patient outcomes. The demand for endocrine testing is increasing as adults become more health conscious and the number of lifestyle-related diseases increases. This increased awareness is contributing to the rise in demand for home health care and point-of-care (POC) devices that deliver faster and more efficient results.

They are easy to use and cost-effective alternative for adults and elderly. According to the article published by the WHO in March 2022, more than 1 billion people around the world were obese out of which 650 million were adults, 340 million were youngsters, and 39 million were children. This number was expected to continue to grow. The WHO estimates that by 2025, about 167 million people, including adults and children, will be in poor health due to being overweight or obese. The prediction of these diseases is likely to impact the market and result in significant growth during the forecast period. Increasing health complications in the elderly population is expected to drive market growth.

According to the National Council on Aging article in August 2023, 94.9% of adults aged 60 years and older have at least one disease, and 78.7% have two or more. Obesity, which affects approximately 42% of individuals aged over 60 years, can also increase the risk of diseases, such as heart disease, type 2 diabetes, and cancer. With a rise in the affected population, the number of tests used in endocrinology has increased substantially. These factors are expected to boost market growth.

Market Concentration & Characteristics

The market has experienced a significant degree of innovation, advanced technologies to enhance diagnostic accuracy and patient care. The landscape has evolved significantly from traditional hormone level assessments to innovative molecular and genetic analyses. Novel biomarkers, sophisticated imaging techniques, and integrated data analytics have revolutionized endocrine diagnostics, allowing for earlier detection and personalized treatment approaches. Integrating artificial intelligence and wearable devices further drives innovation, providing real-time insights into hormonal fluctuations.

Several market players, such as Abbott Laboratories, AB Sciex, and Agilent Technologies Inc., have not been extensively involved in mergers and acquisitions, indicating a relatively limited engagement in expanding their geographic presence for endocrine testing.

Market leaders are diversifying their product portfolios to include innovative testing solutions, providing to the increasing demand for accurate and efficient diagnostics in endocrinology. This expansion encompasses a range of thyroid, adrenal, and reproductive hormone tests, addressing the growing need for endocrine health.

Expanding the product line involves introducing complementary offerings that cater to evolving customer needs. This includes developing new features, variations, or accessories for existing products or venturing into related markets. Diversifying the product portfolio, a company can tap into different consumer segments and enhance its market presence.

Test Type Insights

The thyroid stimulating hormone (TSH) test segment led the market and accounted for the largest revenue share of 28.0% in 2023. The increasing prevalence of thyroid disorders and rising awareness of early detection drive the demand for TSH tests. According to the NCBI article published in May 2023, TSH is an important regulator of the immune response and is also involved in maintaining the levels of several hormones, such as progesterone and human chorionic gonadotropin (hCG), in the human body. These tests assist in diagnosing thyroid dysfunction, a common endocrine issue. TSH tests play a pivotal role in assessing thyroid function by measuring the levels of thyroid-stimulating hormone. As thyroid disorders affect a significant global population, the TSH test becomes helpful in diagnosing and monitoring these conditions.

The human chorionic gonadotropin (hCG) hormone test segment is anticipated to witness a significant growth over the forecast period. The evolving landscape of reproductive health, coupled with advancements in fertility treatments, contributes to the expansion of hCG hormone tests. According to the NCBI article published in August 2023, the increasing prevalence of assisted reproductive technologies further boosts demand. These hCG hormone tests are crucial for detecting pregnancy and assessing fertility-related issues. As more individuals opt for fertility treatments and personalized reproductive health solutions, the demand for accurate hCG testing continues to rise. These factors are fueling the needles market growth.

End-use Insights

The hospitals segment dominated the market with a share of 69.3% in 2023. The increasing patient population and demand for comprehensive healthcare services drive endocrine testing demand in hospitals. The trend towards integrated healthcare solutions reinforces the significance of hospitals as key contributors to this market. Hospitals serve as central hubs for endocrine testing, offering a diverse range of diagnostic services under one roof. The accessibility and promptness of testing in a hospital setting make it a preferred choice for individuals seeking comprehensive healthcare solutions.

The commercial laboratories segment is estimated to register the fastest CAGR from 2024 to 2030. The outsourcing of diagnostic services, cost-effectiveness, and specialized testing capabilities contribute to the growth of endocrine testing in commercial laboratories. The emphasis on efficient and tailored testing solutions supports the expansion of this segment. Commercial laboratories specialize in providing a wide array of diagnostic testing services, including endocrine testing. Their ability to offer specialized and efficient testing, coupled with the flexibility of outsourcing, positions them as crucial players in the evolving landscape of endocrine diagnostics.

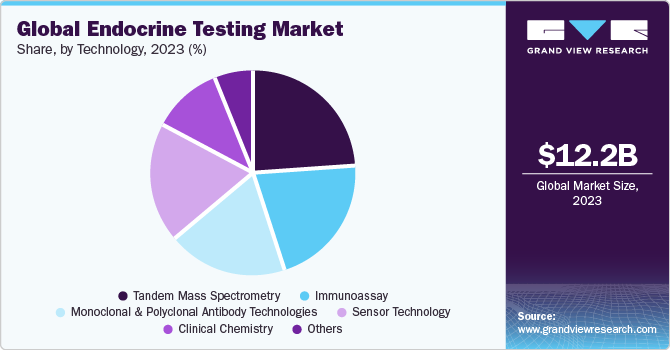

Technology Insights

The tandem mass spectrometry segment accounted for the largest revenue share of 24.5% in 2023. This is because it is often used in conjunction with liquid chromatography, helping in obtaining more accurate results. According to the National MagLab article published in August 2023, the growing need for precision in hormone measurement drives the adoption of tandem mass spectrometry. Its ability to provide high sensitivity and specificity in analyzing multiple analytes simultaneously, enhances the accuracy of endocrine testing. Tandem mass spectrometry stands out as a sophisticated technology that excels in measuring hormones with exceptional precision. Its applications extend to complex endocrine assessments, offering a valuable tool for clinicians seeking detailed insights into hormonal profiles.

The clinical chemistry segment is estimated to register a significant CAGR from 2024 to 2030. The cost-effectiveness and versatility of clinical chemistry technologies make them attractive for routine endocrine testing. According to the AZoNetwork article published in July 2023, the continuous development of innovative assays within this technology further propels its adoption. Clinical chemistry encompasses various testing methods, including immunoassays and enzymatic assays, providing a broad range of biochemical analyses. Widely used in routine diagnostics, it offers a cost-effective and versatile approach to endocrine testing.

Regional Insights

North America dominated the market and accounted for a 40.8% share of the overall revenue in 2023 due to high disease burden & awareness among patients, technological advancements, proactive government measures, and improvements in healthcare infrastructure.

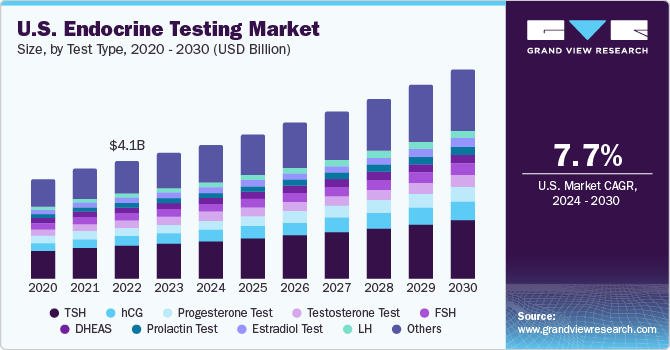

U.S. Endocrine Testing Market Trends

The U.S. dominated the North America regional market due to a high number of thyroid cancer cases. According to an American Cancer Society article published in January 2023 , approximately 43,720 new cases of thyroid cancer were reported, with 12,540 cases in men and 31,180 in women in the U.S. Out of these cases, 4,444 have resulted in death, including 970 men and 1,150 women. Thyroid cancer is generally diagnosed at a relatively young age compared to other adult cancers, with an average age at the time of diagnosis being 51 years.

Asia Pacific Endocrine Testing Market Trends

Asia Pacific is anticipated to witness the fastest growth from 2024 to 2030. The primary factors driving this growth are an increase in the geriatric population, a high number of patients with obesity, and developing healthcare infrastructure.

The Endocrine testing market in China dominated the Asia Pacific region due to high number of obesity cases. According to the NCBI article published in July 2023, the proportion of overweight and obese adults in China has reached to 50.7% in the year 2022. Genetic inheritance is an important risk factor for children being overweight and obese. Children are two to three times more likely to be obese, if one of the parents is obese, and 15 times more likely to be obese if both parents are obese. All these factors are boosting the regional market growth.

Key Endocrine Testing Company Insights

Abbott Laboratories, AB Sciex, and Agilent Technologies Inc. are some of the dominant players operating in the endocrine testing market. Abbott Laboratories focuses on collaborative ventures and innovative diagnostic solutions to improve accessibility for endocrine testing. AB Sciex prioritizes precision with continuous research and development, addressing the evolving needs of laboratories and clinicians. Agilent Technologies Inc. adopts a comprehensive strategy by integrating hardware and software solutions, expanding market presence through strategic acquisitions, and providing efficient endocrine diagnostic platforms globally.

Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, and Ortho Clinical Diagnostics are the emerging market players functioning in the endocrine testing market. Laboratory Corporation of America Holdings enhances diagnostic service accessibility through strategic healthcare provider alliances. Quest Diagnostics Inc. focuses on data analytics integration to streamline diagnostic processes, ensuring efficiency. Ortho Clinical Diagnostics prioritizes sustainability, integrating eco-friendly practices and technologies within its operations to minimize environmental impact.

Key Endocrine Testing Companies:

The following are the leading companies in the endocrine testing market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- AB Sciex

- Agilent Technologies Inc

- bioMerieux SA

- Bio-Rad Laboratories Inc.

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Laboratory Corporation of America Holdings

- Quest Diagnostics Incorporated

- Ortho Clinical Diagnostics

Recent Developments

-

In April 2023 , Eli Health raised USD 3.6 million to improve women's health with saliva-based continuous hormone monitoring technology. The initial focus of the business will be on the areas, such as menopause, fertility, and general health needs. In later stages, expansion will include other areas, such as contraception and endocrine diseases,, once the necessary additional regulatory and clinical work is completed

-

In October 2023 Eli Lilly and Company announced results from LIBRETTO-431 and LIBRETTO-531 Phase 3 trials at ESMO Congress 2023. Assessing Retevmo (selpercatinib), LIBRETTO-431 studied its efficacy in RET fusion-positive NSCLC, while LIBRETTO-531 focused on RET-mutant MTC. Compared to chemotherapy and MKIs, respectively, Retevmo showcased promising outcomes in these advanced cancers

-

In November 2023 , the FDA approved Eli Lilly’s and Company's Zepbound (tirzepatide) injection as the first obesity treatment activating both GIP and GLP-1 hormone receptors. It is indicated for obese or overweight adults and individuals with related medical problems, aiding in weight loss when used with a reduced-calorie diet and increased physical activity

Endocrine Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.15 billion

Revenue forecast in 2030

USD 21.42 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott Laboratories; AB Sciex; Agilent Technologies Inc.; bioMerieux SA; Bio-Rad Laboratories Inc.; DiaSorin S.p.A.; F. Hoffmann-La Roche Ltd.; Laboratory Corporation of America Holdings; Quest Diagnostics Inc.; Ortho Clinical Diagnostics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endocrine Testing Market Report Segmentation

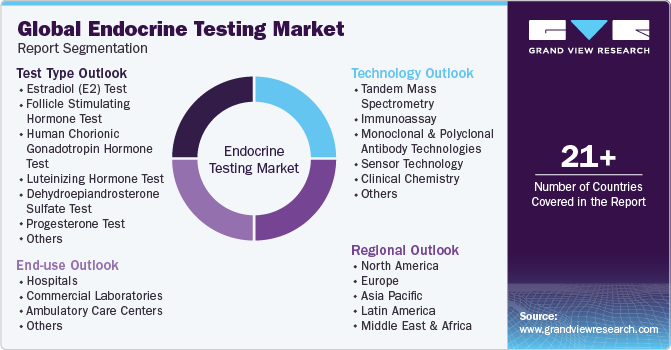

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global endocrine testing market report based on test type, technology, end-use, and region:

-

Test Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Estradiol (E2) Test

-

Follicle Stimulating Hormone (FSH) Test

-

Human Chorionic Gonadotropin (hCG) Hormone Test

-

Luteinizing Hormone (LH) Test

-

Dehydroepiandrosterone Sulfate (DHEAS) Test

-

Progesterone Test

-

Testosterone Test

-

Thyroid Stimulating Hormone (TSH) Test

-

Prolactin Test

-

Cortisol Test

-

Insulin Test

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Tandem Mass Spectrometry

-

Immunoassay

-

Monoclonal & Polyclonal Antibody Technologies

-

Sensor Technology

-

Clinical Chemistry

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Commercial Laboratories

-

Ambulatory Care Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endocrine testing market size was estimated at USD 12.19 billion in 2023 and is expected to reach USD 21.42 billion in 2024.

b. The global endocrine testing market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 21.42 billion by 2030.

b. North America dominated the endocrine testing market with a share of 40.80% in 2023. This is attributable to the presence of well-established healthcare infrastructure, rising prevalence of diabetic & obese population and favorable healthcare reimbursement scenarios in the North American region.

b. Some key players operating in the global endocrine testing market include Abbott Laboratories; AB Sciex; Agilent Technologies, Inc.; bioMerieux SA, Bio-Rad Laboratories, Inc.; DiaSorin S.p.A; F. Hoffmann-La Roche Ltd.; Ortho Clinical Diagnostics; Laboratory Corporation of America Holdings (LabCorp); and Quest Diagnostics Incorporated.

b. Key factors that are driving the global endocrine testing market growth include growing incidences of life style diseases, endocrine disorders & awareness of reproductive functions such as obesity, hyperthyroidism, diabetes, infertility and adrenal insufficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.