Encoder Market Size, Share & Trends Analysis Report By Type (Rotary Encoder, Linear Encoder), By Signal Type (Incremental, Absolute), By Technology, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-337-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Encoder Market Size & Trends

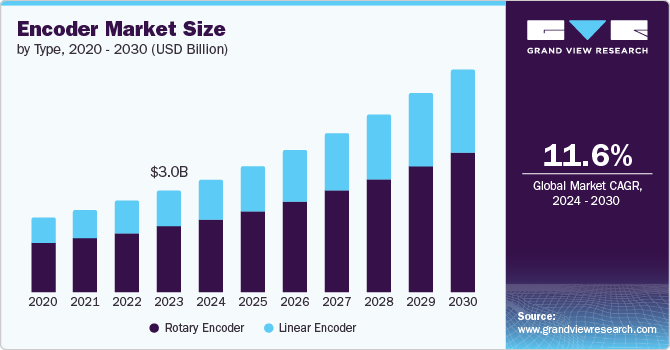

The global encoder market size was estimated at USD 3.01 billion in 2023 and is projected to grow at a CAGR of 11.6% from 2024 to 2030. The increasing adoption of industrial automation, advancements in encoder technology, and rising demand for consumer electronics are significantly boosting the market. In addition, the automotive industry's shift towards electric and autonomous vehicles, the healthcare sector's growing use of encoders in medical devices, the expansion of renewable energy, and the proliferation of IoT devices are further propelling market growth. These factors collectively enhance the demand for precise control and measurement, contributing to the encoder market's robust expansion.

The market is experiencing significant growth, driven by rapid industrialization and urbanization in emerging markets, mainly in Asia Pacific, leading to increased demand in manufacturing, automotive, and consumer electronics. Trends towards miniaturization and integrating components in electronic devices, especially medical and consumer electronics, are boosting the need for smaller, more efficient encoders. Enhanced connectivity and networking capabilities, such as industrial ethernet and wireless technologies, are expanding encoder applications in smart manufacturing and Industry 4.0 environments. In addition, increasing regulatory requirements and industry standards for safety, precision, and performance are driving the adoption of advanced encoders across various industries.

Further fueling market growth is the rise of smart factories, significant investments in R&D by major players, and the ability to provide customized, application-specific encoder solutions. The growing use of robotics and automation in logistics, healthcare, and manufacturing also increases the demand for encoders. In addition, the emphasis on energy efficiency and sustainable practices drives the adoption of energy-efficient systems and machinery. The ongoing digital transformation across industries fosters the adoption of high-precision encoders as companies seek to enhance operational efficiency and productivity.

Type Insights

The rotary encoder segment led the market and accounted for 64.57% of the global revenue in 2023, driven by its extensive applications across various industries, including manufacturing, automotive, aerospace, electronics, and healthcare. The increasing adoption of automation and robotics, advancements in rotary encoder technology, and rising demand in the automotive sector, especially with the shift towards electric and autonomous vehicles, have significantly contributed to its growth. The renewable energy sector, mainly wind energy, and the healthcare industry's reliance on rotary encoders for precise positioning and control in medical devices have further boosted demand. In addition, the segment benefits from high precision and reliability requirements in industries such as aerospace and defense, ease of integration into existing systems, and rapid industrialization in emerging markets.

The linear encoder segment is poised for significant growth due to its high precision and accuracy in measuring linear displacement, which is essential for semiconductor manufacturing, CNC machining, and precision metrology. The ongoing trend towards automation and Industry 4.0 technologies drives the demand for linear encoders, which provide precise positioning and feedback in automated systems. The semiconductor industry's expansion, associated with the growing adoption of CNC machines and machine tools, further boosts the market. In addition, the use of linear encoders in robotics and material handling applications is rising, driven by the growth in logistics, warehousing, and industrial automation. Advancements in linear encoder technology, such as improved resolution and durability, along with the increasing demand for high-performance industrial equipment, are propelling market growth.

Signal Type Insights

The incremental segment accounted for the largest market revenue share in 2023, driven by its cost-effectiveness, simplicity in integration, and high performance across diverse applications. Incremental encoders are favored for their affordability compared to absolute encoders, making them suitable for applications constrained by budget considerations. They excel in providing accurate speed measurement and position feedback, essential for industries ranging from automotive, where they are vital for motor control and automation, to renewable energy sectors, such as wind turbines and solar tracking systems. Their versatility allows them to be used in rotary and linear applications, supporting various industrial automation needs. The expanding consumer electronics market further boosts demand for incremental encoders, emphasizing their essential role in precise control and feedback systems.

The absolute encoder segment is positioned for substantial growth due to its unique advantages in precision, reliability, and integration capabilities. Absolute encoders provide a distinct digital code for each position within their range, eliminating the need for initialization and ensuring accurate position retention during power loss or system restarts, which is necessary for CNC machines, robotics, and medical devices. Their high precision and accuracy make them ideal for applications requiring exact positional feedback in metrology, aerospace, and semiconductor manufacturing industries. Absolute encoders also meet stringent safety and redundancy requirements in sectors such as transportation and defense, enhancing system reliability.

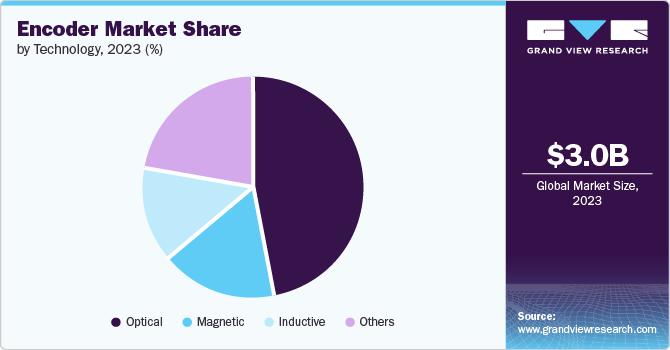

Technology Insights

The optical segment dominated the market in 2023 due to its versatility, reliability, and suitability for demanding industrial environments. Optical encoders are adaptable for rotary and linear applications, offering incremental and absolute configurations to meet diverse industrial needs effectively. Known for their robust construction, they withstand harsh conditions, including dust, moisture, and vibrations, ensuring long-term reliability. Their fast response times enable real-time feedback in dynamic settings, essential for high-speed machinery and automation systems. Moreover, while operating on a non-contact sensing principle, optical encoders minimize wear and maintenance needs while offering wide temperature tolerance, making them essential across automotive and steel manufacturing industries. Their seamless integration with digital systems supports advanced industrial automation requirements, enhancing their applications for Industry 4.0.

The inductive segment is poised for significant growth driven by its contactless operation, which ensures long-term reliability and durability in harsh industrial environments through electromagnetic induction sensing. This non-contact method enhances operational safety, mainly in hazardous settings where sparks or flammable materials are present, meeting stringent safety standards. Inductive encoders excel in high-temperature resistance, making them ideal for demanding applications in foundries, smelting operations, and industrial ovens. They offer high precision and accuracy in position detection, vital for precise motion control in CNC machines, robotics, and automated assembly lines. Emerging applications in renewable energy, electric vehicles, and smart grid infrastructure further emphasize their versatility and growing importance in advanced technological sectors.

Application Insights

The automotive segment accounted for the largest market revenue share in 2023. The shift towards Electric Vehicles (EVs) has significantly increased the need for precise motor control and position feedback systems, where encoders play a vital role in applications such as battery management and vehicle dynamics. Advancements in autonomous driving technology further amplify this demand, requiring accurate sensors such as encoders for steering control, navigation, and obstacle detection. Encoders also improve vehicle efficiency by optimizing engine performance and transmission systems, enhancing fuel efficiency, and reducing emissions.Integrating advanced safety features and driver assistance systems in modern vehicles relies on encoders for essential feedback, ensuring the effective operation of functions such as adaptive cruise control and collision avoidance.

The industrial segment is poised for significant growth driven by adopting Industry 4.0 principles and smart manufacturing initiatives, emphasizing automation, data exchange, and efficiency improvements. Encoders provide precise motion control, feedback, and data that optimize manufacturing processes across various industries. Increasing integration of robotics and automated systems further boosts demand for encoders, supporting precise positioning and feedback in assembly lines, material handling, and quality control applications. In aerospace, automotive, and electronics sectors, the expansion of CNC machining and advanced machine tools relies on encoders for accurate position feedback, enhancing manufacturing accuracy. Encoders also contribute to energy efficiency by optimizing motor control systems and other equipment.

Regional Insights

North America held a significant market share of 39.51% in 2023, driven by strong automotive and aerospace industries that heavily rely on encoders for precise control and monitoring. The region is a leader in technological advancements and innovation in encoder technology, with substantial investments in research and development enhancing performance across industries. Increasing adoption of automation and robotics in sectors such as manufacturing and healthcare further boosts demand for encoders, facilitating accurate position feedback and enhancing operational efficiency. The region's emphasis on high precision and quality standards in manufacturing processes favors advanced encoders, mainly optical and magnetic types, in crucial applications such as semiconductor manufacturing and medical devices.

U.S. Encoder Market Trends

The encoder market in the U.S. is expected to grow substantially over the forecast period. The aerospace and defense sectors are major consumers of encoders for critical applications such as aircraft navigation and military vehicles, supported by ongoing investments in defense modernization and aerospace innovation. The U.S. also leads globally in industrial automation adoption, utilizing encoders extensively in automated machinery and robotics across manufacturing, logistics, and healthcare industries to enhance efficiency. Technological innovation is vital, with U.S.-based manufacturers pioneering advanced encoder solutions through continuous R&D efforts focused on improving resolution, accuracy, and durability.

Europe Encoder Market Trends

The encoder market is gaining traction in Europe. Europe's automotive sector is leading innovation in encoder applications, mainly in EVs and autonomous driving systems, emphasizing precise motor control and navigation. Industrial automation expansion across European industries, spurred by Industry 4.0 initiatives, increases the demand for encoders in robotics, CNC machining, and automated machinery to enhance productivity. The region's leadership in renewable energy adoption further boosts encoder demand, with applications in wind turbines, solar panels, and hydroelectric systems optimizing energy production efficiency.

Asia Pacific Encoder Market Trends

The encoder market in Asia Pacific is poised for significant growth. Rapid industrialization across the region, mainly in countries such as China, India, Japan, and South Korea, is fueling demand for encoders in automotive, electronics, semiconductor manufacturing, and consumer goods industries for automation and precision control. The region's strong automotive and electronics sectors, serving as global manufacturing hubs, are major consumers of high-precision encoders for applications in motor control, robotic automation, and semiconductor manufacturing processes. In addition, Asia Pacific's focus on emerging technologies and innovation, including robotics, artificial intelligence (AI), Internet of Things (IoT), and smart manufacturing, further boosts demand for encoders that support these advancements.

Key Encoder Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives are vital for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in April 2024, VITAC, a Verbit Company, partnered with ENCO Systems, Inc., a broadcast solution provider, to enhance broadcasters' access to comprehensive captioning tools. This partnership combines VITAC's extensive experience in high-standard media captioning, Enco Systems, Inc.'s advanced encoder technology, and Verbit's AI-driven speech recognition solutions. Together, they aim to deliver unparalleled reliability, accuracy, efficiency, and innovative solutions in caption encoding and delivery for broadcasters.

Key Encoder Companies:

The following are the leading companies in the encoder market. These companies collectively hold the largest market share and dictate industry trends.

- Balluff Automation India Pvt. Ltd.

- Fortive

- HEIDENHAIN

- ifm electronic gmbh

- maxon

- Mitutoyo Corporation

- Pepperl+Fuchs SE

- Pilz GmbH & Co. KG

- Renishaw plc.

- Sensata Technologies, Inc.

Recent Developments

-

In November 2023, Nikon introduced the MAR-M700MFA, the first external, multi-turn, battery-free absolute encoder that utilizes an all-solid-state battery. This encoder offers an extended operating temperature range and is maintenance-free due to its solid-state battery. It includes new features such as predictive maintenance and angular precision self-correction, enhancing industrial robot applications with improved operational consistency and motion control precision.

-

In August 2023, Dynapar, a manufacturer of encoders, introduced the HS35iQ Encoder with PulseIQ Technology, a programmable shaft encoder featuring self-diagnosing capabilities through digital output and color-coded LEDs. This innovation provides OEMs and end-users in heavy-duty machine applications with real-time access to encoder health status, simplifying troubleshooting faulty encoders.

-

In January 2023, SICK AG introduced a new linear encoder product family tailored for precise piston position detection in monitoring linear movements in machines and hydraulic cylinders. The family features three designs with industry-specific measuring ranges and includes an online configurator to easily select the appropriate DAX. The product's smart and flexible system architecture enables efficient customization to meet specialized application needs.

Encoder Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.37 billion |

|

Revenue forecast in 2030 |

USD 6.50 billion |

|

Growth rate |

CAGR of 11.6% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, signal type, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa |

|

Key companies profiled |

Balluff Automation India Pvt. Ltd.; Fortive; HEIDENHAIN; ifm electronic gmbh; maxon; Mitutoyo Corporation; Pepperl+Fuchs SE; Pilz GmbH & Co. KG; Renishaw plc.; Sensata Technologies, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Encoder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global encoder market report based on type, signal type, technology, application, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Rotary Encoder

-

Linear Encoder

-

-

Signal Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Incremental

-

Absolute

-

-

Technology Outlook (Revenue, USD Billion, 2017- 2030)

-

Magnetic

-

Optical

-

Inductive

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Industrial

-

Healthcare & Life Sciences

-

Automotive

-

Consumer Electronics

-

Power

-

Food & Beverage

-

Aerospace

-

Printing

-

Textile

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global encoder market size was estimated at USD 3.01 billion in 2023 and is expected to reach USD 3.37 billion in 2024.

b. The global encoder market is expected to grow at a compound annual growth rate of 11.6% from 2024 to 2030 to reach USD 6.50 billion by 2030.

b. North America dominated the market in 2023, accounting for over 39% share of the global revenue driven by strong automotive and aerospace industries that heavily rely on encoders for precise control and monitoring.

b. Some key players operating in the encoder market include Balluff Automation India Pvt. Ltd.; Fortive; HEIDENHAIN; ifm electronic gmbh; maxon; Mitutoyo Corporation; Pepperl+Fuchs SE; Pilz GmbH & Co. KG; Renishaw plc.; Sensata Technologies, Inc.

b. Key factors driving the encoder market growth include the growing adoption of Industry 4.0 and IoT and surging demand for advanced automation across industries

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."