- Home

- »

- Medical Devices

- »

-

Empty IV Bags Market Size, Share And Growth Report, 2030GVR Report cover

![Empty IV Bags Market Size, Share & Trends Report]()

Empty IV Bags Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (PVC, Non-PVC), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-3-68038-494-9

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Empty IV Bags Market Size & Trends

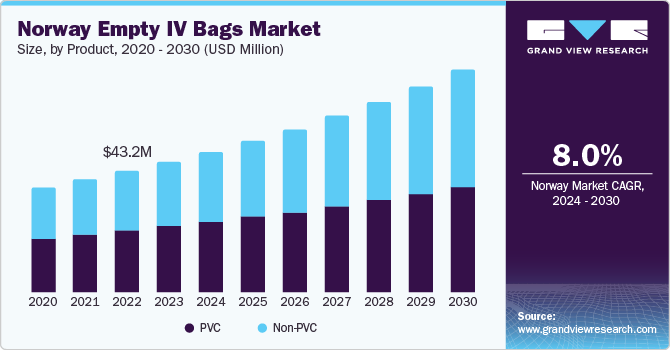

The global empty IV bags market size was estimated at USD 4.92 billion in 2023 and is expected to grow at a CAGR of 8.7% from 2024 to 2030. The growth of the market is attributed to the increasing prevalence of chronic conditions, technological advancements, increasing demand for sterile packaging solutions, and expansion of home healthcare services.The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders necessitates frequent administration of intravenous therapies and medications.

With the growing number of cancer patients undergoing chemotherapy, empty IV bags are gaining prominence as a safer option, reducing the potential risk of releasing harmful substances during drug administration. Furthermore, the chemical compatibility of non-PVC materials with a diverse array of chemotherapy medications and their environmentally friendly characteristics resonates with the heightened focus on safety and sustainability in the healthcare sector. This synergy is fueling the widespread adoption of non-PVC IV bags for cancer treatments. For instance, according to statistics published by American Cancer Society in 2023, cancer is a leading cause of death worldwide, with nearly 609,820 cancer deaths estimated to occur in the U.S. Moreover, the prevalence of cancer is estimated to increase by 70.0% over the next couple of decades. Thus, increasing prevalence of cancer globally is a high impact-rendering driver for the market.

The growing risk of malnutrition is another major driver of the market. The risk of malnutrition is a serious concern in healthcare, and the use of empty IV bags in nutritional support can play a role in addressing this issue. Malnutrition can result from various factors such as illness, surgery, or difficulty in oral intake, and IV nutrition becomes crucial for patients unable to obtain adequate nutrients through traditional means. Although the empty IV bags themselves do not directly mitigate the risk of malnutrition, their adoption is part of a broader strategy to enhance patient care and safety.

According to the United States Department of Agriculture’s (USDA) recent Household Food Insecurity in the U.S. report, an estimated 12.8% (17.0 million) of U.S. households were food insecure in 2022. To improve the situation, an organization called Feeding America offers food assistance to young children through free breakfast and lunch programs. Moreover, the U.S. government spends around USD 51.3 billion each year to prevent malnutrition in community-dwelling elder adults. These proactive efforts to tackle malnutrition highlight the significance of reliable and effective medical solutions, such as non-PVC IV bags, in supporting the nutritional needs of diverse populations. The growing awareness and commitment to addressing health challenges, including malnutrition, contribute to an increased demand for advanced and eco-friendly medical solutions, which is expected to propel the growth of the market.

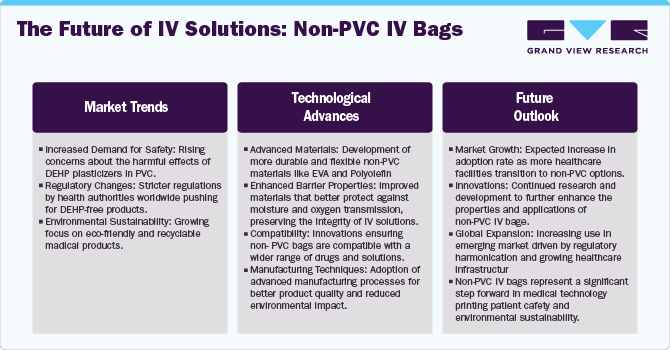

Many researches in medical field have concluded that PVC made empty IV bags are hazardous to human health and to the environment due to phthalates leaching from equipment. In addition, disposal of PVC products through incineration process results in production of toxic Hydrogen Chloride (HCL). This further contributes to acid rains. Hence, companies such as Baxter, Hospira, and B. Braun Melsungen AG are manufacturing IV bags made of PVC-free material, which has thermal stability, moisture-barrier properties, inertness required for IV medications, and are environment friendly. For instance, Hospira launched the VISIV line of PVC/DEHP-free IV bags that have no overwrap, thereby reducing the amount of plastic that has to be discarded.

PVC-free empty IV bags are usually made of Ethylene-Vinyl Acetate (EVA), multilayer polyethylene, or polypropylene, which are compatible with the drug solution and have high seal strength. Pactiv LLC manufactures polypropylene-based bags, known as Propyflex bags, which have won the 2000 Medical Design Excellence Award in a program sponsored by Canon Communications LLC.

Non-PVC IV bags commonly utilize several alternative materials, such as Ethylene-Vinyl Acetate (EVA), multilayer polyethylene, or polypropylene, selected for their environmentally sustainable characteristics, including biodegradability or recyclability, which distinguish them from PVC. The manufacturing process of non-PVC IV bags is deliberately structured for enhanced energy efficiency in contrast to conventional PVC production. This commitment to energy conservation measures plays a pivotal role in minimizing the environmental footprint associated with the production of IV bags. For instance, in April 2022, Fresenius Kabi introduced Calcium Gluconate in Sodium Chloride Injection in ready-to-administer freeflex bags in the U.S. These packs, made of polyolefin, are devoid of Di-2-ethylhexyl phthalate (DEHP) plasticizers and are non-PVC.

Non-PVC IV bags are often biodegradable or recyclable, reducing the ecological impact of their disposal. Non-PVC bags are also more environmentally friendly because they do not contain any hazardous ingredients and are produced using less energy. Eco-friendly choices are becoming increasingly important to healthcare professionals and customers as environmental challenges become more widely known. Non-PVC IV bags are an appealing and ethical option for the healthcare sector because of regulatory compliance, corporate social responsibility programs, and continuous research investments in enhancing non-PVC materials. These factors also propel market growth.

In addition, several firms are turning to plasticizer-free biologically inert materials to substitute the use of PVC. In the past five years, B. Braun spent around USD 500.00 million in developing PVC- and DEHP-free products. The development and availability of modern materials in different designs are expected to boost growth through replacement of glass & PVC containers. Similarly, in March 2021, Fagron Sterile Services U.S. (FSS), a 503B outsourcing leader, announced the addition of a new platform, Intravenous (IV) bags, to its product portfolio. Lately, in June 2022, Gufic Biosciences launched high-quality dual chamber bags made of polypropylene (DEHP free) with peelable aluminum foil. These bags enable for the storage of unstable medications that require reconstitution right before patient administration. Hence, with the adoption of PVC-free empty IV bags, the healthcare industry can make significant progress in protecting the health and safety of the patient population globally. Such factors are anticipated to drive the adoption of non-PVC empty IV bags, thereby contributing to the growth of market.

Growing global population and increasing birth rates in emerging & underdeveloped economies with large untapped opportunities are expected to drive the market. The natality rate indicates the total number of births per 1,000 people. The increasing population leads to the growth in healthcare and food expenditure for a household as well as the nation. Hence, a higher birth rate is expected to increase the demand for parenteral nutrition, thereby leading to market growth. According to the data published by The World Factbook in 2023, the total fertility rate in the U.S. was 1.84 children per woman, which is expected to boost the demand for parenteral nutrition products for pediatric patients.

Natality rate across the globe (2020 - 2023)

Year

Natality Rate

2020

18.07

2021

17.87

2022

17.66

2023

17.46

The majority of premature babies suffer from underdeveloped immune systems and low weight, which increases the risk of developing infections. As per a WHO report, over 60% of preterm births occur in South Asia and Africa. On average, in lower-income countries, 12% of babies are born untimely, as compared to 9% in higher-income countries. Parenteral nutrition reduces the risk of infection and underdevelopment. The demand for parenteral nutrition is higher in newborns with Very Low Birth Weight (VLBW). The use of parenteral nutrition in premature infants leads to faster neurological development, improved intrauterine nutrient deposition, and minimized risk of complications, thereby improving the chance of survival. Thus, increase in the number of preterm births is expected to strengthen the market in the coming years.

Individuals and healthcare authorities around the world are undertaking extensive efforts to limit mortality due to early birth, which is propelling the use of parenteral nutrition. Hence, the presence of a large number of neonates requiring supplementary nutrition post-birth is expected to boost the demand for empty IV bags over the forecast period.

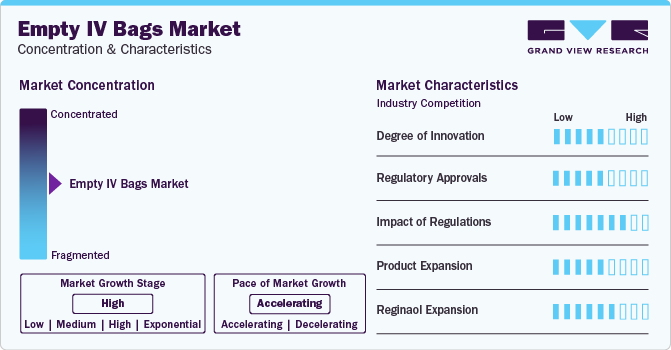

Market Concentration & Characteristics

The market growth stage is medium and pace of the market growth is accelerating. The empty IV bags market is characterized by a high degree of growth owing to increasing prevalence of chronic diseases, rising natality rate, surge in government initiatives coupled with technological advancements.

Key strategies implemented by players in the market are new product launches, expansion, acquisitions, partnerships, and other strategies. For instance, in April 2022, Fresenius Kabi launched Calcium Gluconate in Sodium Chloride Injection in ready to administer freeflex bags in the U.S. The freeflex packs are comprised of polyolefin, which is Di-ethylhexyl-phthalate (DEHP) plasticizer-free and non-PVC.

The market demonstrates a moderate degree of innovation driven by advancements in materials, manufacturing processes, and sustainability initiatives. Innovations include the development of non-PVC materials to enhance patient safety and reduce environmental impact, as well as improvements in bag design to minimize contamination risks and enhance ease of use. Additionally, manufacturers are exploring smart IV bags equipped with sensors for real-time monitoring of fluid levels and infusion rates, which aim to improve accuracy and efficiency in clinical settings. These innovations collectively contribute to the evolution and growth of the market.

In this market, obtaining approvals from regulatory bodies such as the FDA (U.S. Food and Drug Administration) and CE marking in the European Union is essential for manufacturers. These approvals validate that empty IV bags are made from safe materials, are free from contaminants, and are capable of maintaining sterility and integrity when used in various medical settings. The rigorous approval process helps maintain high-quality standards in the market, instilling confidence in healthcare providers and patients regarding the use of these essential medical supplies.

Regulations significantly impact the market by ensuring product safety, quality, and environmental compliance. Stringent regulatory standards, such as those imposed by agencies like the FDA in the U.S. and the CDSCO in India, mandate rigorous testing and quality control measures for manufacturing IV bags. These regulations ensure that the bags are free from contaminants and safe for medical use. Additionally, environmental regulations push manufacturers to adopt sustainable practices, such as using recyclable materials and reducing plastic waste. Compliance with these regulations is crucial for market entry and maintaining product credibility, influencing production processes and market dynamics in the empty IV bags industry.

Product expansion in the empty IV market involves the introduction of new products or the enhancement of existing ones to meet evolving clinical needs, technological advancements, and market demands.

The market is moderately fragmented, with numerous manufacturers and suppliers competing globally. This fragmentation results from a diverse range of companies, including large multinational corporations and smaller regional players, each offering various products to meet different healthcare needs and regulatory requirements. The competitive landscape is characterized by continuous innovation, advancements in materials, and efforts to meet stringent safety and environmental regulations. While major players hold significant market shares due to their extensive distribution networks and brand recognition, smaller companies contribute to market diversity by offering specialized and cost-effective solutions.

Regional expansion scenarios in the market are propelled by factors such as population growth, healthcare expenditure, regulatory environments, and the overall development of healthcare infrastructure.

Product Insights

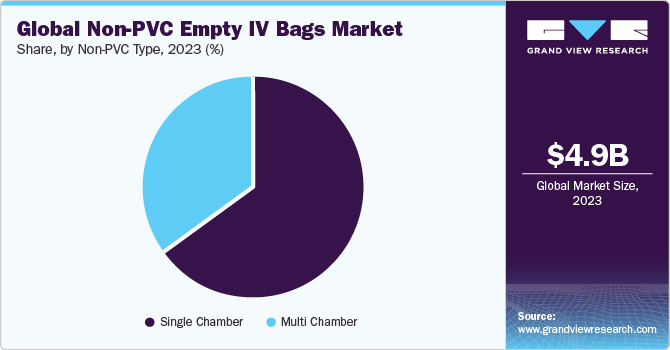

The non-PVC empty IV bags led the market and accounted for more than 50.4% share of the global revenue in 2023. PVC is one of the main polymers used in fabrication of films for flexible parenteral packages. It is a popular material as it has a number of useful technical properties, is comparatively cheap to manufacture, and is easy to work with. For instance, according to a report by the European Union that was released in 2020, PVC is the fourth most popular form of plastic in Europe, and about 6.5 million T of PVC products are produced each year.

In addition, PVC empty IV bags find extensive application in packaging of rehydration solutions that comprise sodium chloride, lactated Ringer’s solution, glucose, sterile water, parenteral nutrition, antibiotics & analgesics for hospital and veterinary usage, among others. Moreover, large number of key market players such as RENOLIT SE and Technoflex offer PVC empty IV bags. Thus, owing to such factors the segment dominated the market.

The non-PVC empty IV bags segment is expected to expand at the highest CAGR during the forecast period. Demand for non-PVC material is likely to increase owing to rising demand for non-toxic IV containers and stringent legislation prohibiting the use of PVC. These bags helps to reduce the risks associated with traditional PVC empty IV bags, such as transportation difficulties, interaction between drug-packaging material, and disposable containers. These materials can be used for a variety of applications, including cold or frozen storage and customized mixtures. As a result, the broad application of non-PVC empty IV bags is projected to drive market expansion over the projection period.

In addition, regulatory agencies such as the U.S FDA have advocated for the use of packaging that is free of di-2-ethylhexyl phthalate (DEHP). DEHP is reported to be incompatible with certain devices. Thereby, market players at present are inventing IV bags made of materials such as Ethyl Vinyl Acetate (EVA), Polypropylene, Copolyester-Ether (COPE), and others.

In 2023, the single-chambered bag category accounted for the largest market share. Numerous factors, including high usage and a lack of alternatives, are anticipated to fuel category growth during the forecast period. The existence of separate storage for various components is likely to increase the demand for multi-chambered bags. Consequently, during the projected period, the segment is anticipated to develop at the fastest rate.

In 2023, ethylene-vinyl acetate category accounted for the largest market share.EVA non-PVC bags are gaining popularity due to their superior chemical stability, flexibility, and lower risk of leaching harmful substances compared to traditional PVC bags. Key drivers include increasing regulatory pressures to eliminate DEHP and other plasticizers found in PVC, which are linked to adverse health effects. Additionally, the growing demand for more environmentally friendly and recyclable medical products is fueling the adoption of EVA-based bags. Trends such as advancements in material technology, heightened focus on patient safety, and the push for sustainable healthcare practices are further propelling the market for EVA non-PVC IV bags.

Regional Insights

North America dominated the market with the largest revenue share of over 47.2% in 2023. The ease of access to healthcare technologies and presence of strong distribution channels are among the factors contributing to the increasing adoption of empty IV bags in the region. High disease prevalence, supportive reimbursement policies, and well-defined regulatory framework are further expected to boost the adoption of empty IV bags in the region.

In addition, factors such as higher healthcare expenditure and rapid adoption of safe IV solutions are boosting the market in the country. Moreover, the country is anticipated to witness an increase in the adoption of non-PVC bags due to various benefits offered by these products such as easy recycling and availability of cost-effective alternatives such as presence of softeners.

Increasing number of people suffering from chronic conditions, such as cancer, gastrointestinal disease, and others, has led to need for empty IV bags in the healthcare settings. Moreover, demand for empty IV bags has increased in the country due to the high prevalence of stomach cancer. For instance, the American Cancer Society estimated that in 2021 there were about 26,560 new cases of stomach cancer and accounts for about 1.5% of all new cancers cases diagnosed each year. Patients suffering from stomach cancer are incapable of ingesting food through mouth and thus have to entirely rely on total parenteral solutions for dietary needs and survival. This might surge the demand for empty IV bags, which, in turn, is expected to boost the regional market growth.

U.S. Empty IV Bags Market Trends

The market in the U.S. is expected to grow significantly over the forecast period. The rising prevalence of cancer is anticipated to boost the market growth over the forecast period. For instance, as per the American Cancer Society report, in 2022, there were an estimated 268,490 newly diagnosed cases of prostate cancer and 34,500 associated deaths in the U.S. This is expected to boost demand for empty IV bags because cancer treatment causes the body to become malnourished and may cause reduced physical functioning, affect taste, smell, appetite, gastrointestinal disorders, and ulcers. As a result, patients are likely to require more parenteral nutrition, which is expected to drive market expansion.

Europe Empty IV Bags Market Trends

The Europe market is driven by increasing prevalence of cancer, and supportive government initiatives. For instance, as per WHO, more than 3.7 million new cancer cases are diagnosed, and 1.9 million deaths occur due to cancer every year. Moreover, it reported that cancer is the second major cause of morbidity and death in the region. Thus, the increasing burden of cancer among the population is projected to surge the demand for IV bags for drug delivery during chemotherapy and targeted treatment of cancer patients, thereby fueling market growth.

The UK empty IV bags market is experiencing lucrative growth. The country operates a universal healthcare system that extends free healthcare services to most of its population through national healthcare centers. The increasing elderly demographic in the UK is expected to drive market expansion. For instance, as per The House of Commons Library, approximately one-fifth (12.3 million people or 19%) of the UK’s population was 65 or older in 2019. Furthermore, it stated that there would be a rapid increase in the elderly population, potentially reaching up to 24% of the total population by 2043. The geriatric population is more susceptible to various chronic disorders, some of which may require hospitalization for surgeries and related procedures. This increase in hospitalization is expected to drive the market growth.

The empty IV bags market in France is witnessing increased demand owing to surging cases of cancer.

The increasing prevalence of chronic diseases and the use of parenteral nutrition across the country are majorly driving the market growth. Parenteral nutrition has several benefits such as the fact that it helps in the administration of vital nutrients, thereby maintaining strength, energy, and hydration levels in patients suffering from a disease. Cancer is one of the major causes of death in France. For instance, as per a WHO report, there were around 467,965 new cancer cases in 2020, accounting for 185,621 deaths in the country. IV bags are mainly designed for the packaging of rehydration solutions (glucose, sodium chloride, and lactated Ringer’s solution), parenteral nutrition, and certain antibiotics & analgesics for cancer and other cardiovascular diseases. Thus, increasing incidence of cancer in France is expected to drive the market.

The Germany empty IV bags market is driven by the increasing use of safe medical consumables. The German Federal Institute for Drugs and Medical Devices has recommended the use of alternatives to PVC-based medical devices. Moreover, according to this recommendation, manufacturers are expected to develop safer alternatives to PVC-based products. In addition, they are expected to inform patients about the risk of phthalate exposure through PVC products and provide well-labeled devices with levels of DEHP present in a PVC-based product. Furthermore, the use of PVC-based products for neonatal care is strictly prohibited, thus driving the growth of the market.

Asia Pacific Empty IV Bags Market Trends

Asia Pacific market is anticipated to witness the fastest growth over the forecast period, owing to increasing healthcare expenditure, rising patient awareness, and growing need for technologically advanced & cost-efficient healthcare solutions. Moreover, rising elderly population and subsequently growing burden of chronic diseases is expected to boost the demand for empty IV bags in Asia Pacific in the coming years.

As per United Nations Sexual and Reproductive Health Agency (UNFPA) report, the number of aging population in the APAC region is rising at an unprecedented rate and by 2050, one in four people in this region will be over 60 years, reaching close to 1.3 billion people. It was also reported that cardiovascular diseases, diabetes, and cancer are the most common diseases in this region. The presence of a large patient base and growing need for technologically advanced & cost-efficient healthcare solutions is expected to present significant regional growth opportunities for the market.

The China empty IV bags market is expected to witness considerable growth over the forecast period due to growing geriatric population. For instance, according to 2020 census estimates, there are about 264 million (18.7% of total population) people in China in the age group of 60 and above. The elderly population is estimated to increase up to 300 million by 2025 and over 400 million by 2033. Older people are more susceptible to develop chronic wounds, as they are most likely to suffer from chronic illnesses.

The empty IV bags market in India is experiencing significant investments in healthcare infrastructure. The expansion and development of hospitals and healthcare facilities are likely to contribute to the growing demand for modern and advanced empty IV Bags.Moreover, the presence of several local players in the country helps multinational market players secure a strong market position. Multiple companies are entering into partnerships & collaborations in the region to gain a competitive advantage. Thus, such factors are expected to enhance competition in India market.

The Japan empty IV bags market is expected to grow modestly over the forecast period. In Japan, the healthcare sector is renowned for its adoption of cutting-edge medical technologies. The advancements in the empty IV bags depends on their design, materials, and manufacturing techniques. The industry's key players are investing in R&D to improve their product features and distinguish themselves from competitors by enhancing their product portfolios with novel product launches. The competition is largely influenced by major pharmaceutical and healthcare corporations, along with specialized medical device manufacturers. The market in Japan is competitive, with the presence of well-established industry leaders and emerging players. These companies are actively contributing to the evolution of the market.

Key Empty IV Bags Company Insights

Baxter, B. Braun Medical Inc., BD are some of the major players in the market Manufacturers of empty IV bags are working more quickly to obtain licenses for their products so that mass production may start. Additionally, the market participants are utilizing a variety of tactics, including partnerships, product launches, product releases, and innovations like the development of empty IV bags products, to improve their position in the market.

Key Empty IV Bags Companies:

The following are the leading companies in the empty intravenous (IV) bags market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter

- B. Braun Medical Inc.

- ICU MEDICAL, INC.

- Wipak

- RENOLIT SE

- TECHNOFLEX

- Sippex IV bags

- JW Life science Corp

- POLYCINE GmbH

- BAUSCH Advanced Technology Group

- BD

Recent Developments

-

In June 2022, Gufic Biosciences launched high-quality Dual Chamber bags that are made up of polypropylene (DEHP free) with a peelable aluminum foil allowing the storage of unstable drugs which need reconstitution just before the administration to the patient.

-

In May 2022, Fresenius Kabi acquired Ivenix, Inc. The combination established a leading position in the U.S. market for infusion therapies.

-

In January 2022, the U.S. FDA gave its final permission to B. Braun Medical Inc. (B. Braun) for the company's new pharmaceutical production facility in Daytona Beach, Florida. The facility will produce 500 mL and 1,000 mL Excel Plus IV Bags with 0.9% Sodium Chloride for Injection from B. Braun. The Excel Plus IV bags are created without DEHP, PVC, or natural rubber latex in keeping with B. Braun's long-standing commitment to safeguarding patients from exposure to hazardous chemicals.

Empty IV Bags Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.33 billion

Revenue forecast in 2030

USD 8.76 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea;Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Baxter; B. Braun Medical Inc.; ICU MEDICAL; INC.; Wipak; RENOLIT SE; TECHNOFLEX; Sippex IV bags; JW Life science Corp; Fresenius Kabi AG; POLYCINE GmbH; BAUSCH Advanced Technology Group; BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Empty IV Bags Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global empty IV bags market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

PVC

-

Non-PVC

-

By Type

-

Single Chamber

-

Multi Chamber

-

-

By Material

-

Polypropylene

-

Copolyester Ether

-

Ethylene-Vinyl Acetate

-

Others

-

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global empty IV bags market size was estimated at USD 4.92 billion in 2023 and is expected to reach USD 5.33 billion in 2023.

b. The global empty IV bags market is expected to grow at a compound annual growth rate of 8.65% from 2024 to 2030 to reach USD 8.76 billion by 2030.

b. North America dominated the empty IV bags market with a share of 47.20% in 2023. This is attributable to rising acceptance of innovative healthcare technologies, better reimbursement policies, and increasing investments for improving healthcare infrastructure.

b. Some key players operating in the empty IV bags market include Baxter, B. Braun Medical Inc., ICU MEDICAL, INC., Wipak, RENOLIT SE, TECHNOFLEX, Sippex IV bags, JW Life science Corp, Fresenius Kabi AG, POLYCINE GmbH, BAUSCH Advanced Technology Group, BD.

b. Key factors that are driving the market growth include environment-friendly nature of non-PVC IV bags, increasing government initiatives, risk of malnutrition, and increasing incidence of cancer across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.