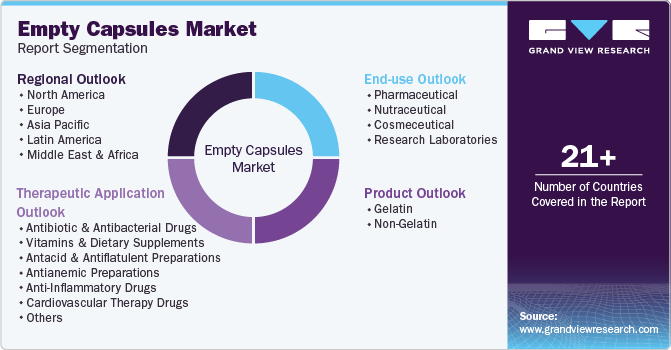

Empty Capsules Market Size, Share & Trends Analysis Report By Product, By Therapeutic Application, By End-use (Pharmaceutical, Nutraceutical, Cosmeceutical, Research Laboratories), By Region, And Segment Forecasts from 2024 - 2030

- Report ID: 978-1-68038-962-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Empty Capsules Market Size & Trends

The global empty capsules market size was valued at USD 3.82 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. The growth in the capsule market can be attributed to several key factors such as the rise in the geriatric population led to increased demand for medications. Growing consumers prefer capsules over tablets as they are easy to swallow and have faster dissolution rates than other medicines. The high demand for capsules in the pharmaceutical, nutraceutical, and cosmeceutical industries is also driving the market.

Many consumers prefer capsules as they disintegrate quickly, allowing for faster absorption. Additionally, the tasteless and odorless gelatin coating makes these capsules more edible. Most nutraceuticals and cosmeceuticals prefer medicine in capsule form, as encapsulated medications enhance the bioavailability of specific active ingredients by protecting them from the harsh conditions of the gastrointestinal tract. Furthermore, capsules can be custom-designed to release the active ingredient to a particular location in the body or slowly over a certain timeframe, enhancing drug absorption.

Another key factor driving the empty capsule market is that capsules act faster than tablets. Capsules can have a higher bioavailability, which means more medication enters the bloodstream, making it slightly more effective than tablets. Additionally, capsules deliver not only solid but also liquid medicine dosage, making it more favorable to consume.

Product Insights

Gelatin dominated the market and accounted for a revenue share of 73.5% in 2023. The gelatin-based empty capsule products include pig meat gelatin, bovine-derived gelatin, bone meal gelatin, and others. These capsules are pure protein, tasteless, gluten-free, and GMO-free. It can be customized by adjusting color, shape, or size to meet specific requirements and cater to different demographics.

The non-gelatin capsules segment is expected to grow at the fastest CAGR over the forecast period. There are two main types of non-gelatin capsules: HPMC, which is made from cellulose, and pullulan, which is extracted from tapioca roots. Non-gelatin capsules are becoming more popular as they are sourced from vegetable cellulose. It is an alternative to gelatin or non-vegetarian capsules, particularly when developing vegan or vegetarian products.

Therapeutic Application Insights

The antibiotic and antibacterial drugs segment dominated the market and accounted for the largest revenue share in 2023. Some commonly used antibacterial drugs are penicillin, tetracycline, sulfonamide, nitrofurantoin, and others. Increasing bacterial infections, tuberculosis, bladder infections, and gastrointestinal infections are expected to generate greater demand for antibiotic and antibacterial drugs. In addition, increasing research and development activities related to antibiotic and antibacterial drugs are assisting the market growth.

Vitamins and dietary supplements are expected to experience the fastest CAGR during the forecast period. This is primarily due to factors such as the growing consumption of vitamins and dietary supplements, the ease of use associated with them, increasing acceptance of dietary supplements, the rising need for vitamin products caused by lifestyle changes, and growing awareness about health and fitness, leading to an upsurge in demand for such products.

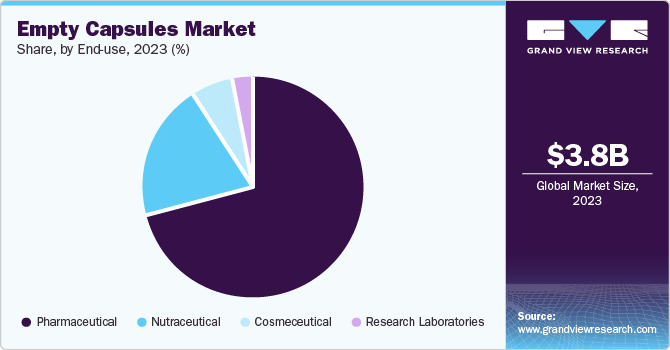

End use Insights

The pharmaceutical segment accounted for a revenue share of in 2023. Empty capsules are widely used in the pharmaceutical industry to treat infectious and chronic diseases. These capsules expand the shelf life of the drug's active ingredients. The pharmaceutical segment is growing as a huge variety of drugs are being made and used by health practitioners.

The nutraceutical segment is projected to grow at the fastest CAGR over the forecast period. These generic, non-specific biological drugs promote general well-being and control general deficiency symptoms. Probiotics, Green Tea Supplements, Vitamin B12 capsules, and omega-3 Fatty Acids are commonly used nutraceutical products. The cosmeceutical segment is also rapidly growing as customers seek products that offer both cosmetics and pharmaceutical benefits. Additionally, empty capsules are widely used in research laboratories to store chemicals.

Regional Insights

North America empty capsules market dominated the global market with a revenue share of 34.7% in 2023. North America has major capsule manufacturing units and a huge production capacity. The North American region has the presence of various pharmaceutical companies. The region has the most advanced technologies concerning the pharmaceutical industry, which is the major reason for propelling region growth.

U.S. Empty Capsule Market Trends

The U.S. empty capsule market dominated the North American market in 2023 due to increased health problems such as cancer, obesity, and arthritis, which created a high demand for nutraceuticals to prevent such major issues. Additionally, rising consumer preferences for customized dietary supplements and health solutions, which are easily formulated and consumed in capsules compared to tablets or powders, are further driving the market growth.

Europe Empty Capsules Market Trends

Europe's empty capsules market was identified as a lucrative region in 2023. The region's robust pharmaceutical sector and many multinational companies and research institutions significantly drive the empty capsules market. Europe has a strong regulatory system for pharmaceuticals, ensuring high-quality standards for the empty capsules market.

The UK empty capsules market is expected to grow rapidly in the coming years due to innovations in capsule technology, such as biodegradable and sustainable options, attracting consumer and manufacturer interest. The aging population and increasing prevalence of chronic diseases, such as diabetes and heart disease, are leading to a higher demand for medications, which often require empty capsules.

Asia Pacific Empty Capsules Market Trends

Asia Pacific's empty capsules market is expected to grow at the fastest CAGR over the forecast period. The factors driving the market growth are favorable government initiatives, the proliferation of pharmaceutical industries, and rapid development in the healthcare sector. Furthermore, the growing demand for healthy lifestyles and increasing trends in nutraceuticals and cosmeceuticals favor market growth.

The China empty capsules market held a substantial market share in 2023. China is a major manufacturing hub with a vast network of pharmaceutical and nutraceutical companies that rely heavily on empty capsules for their product formulations. Developing cost-effective, high-quality empty capsule manufacturing facilities drives the country's market. Furthermore, the Chinese government's supportive policies, such as incentives for pharmaceutical manufacturing and investments in healthcare infrastructure, have created a favorable environment for the empty capsules market to grow.

Key Empty Capsules Company Insights

Some key companies in the empty capsules market include Bright Pharma Caps, Lonza, Qualicaps, HealthCaps India Ltd, and others. These companies are implementing new technologies, mergers and acquisitions, and innovations to enhance their position in the global market for empty capsules.

Key Empty Capsules Companies:

The following are the leading companies in the empty capsules market. These companies collectively hold the largest market share and dictate industry trends.

- Bright Pharma Caps Inc.

- Lonza Group

- Qualicaps

- HealthCaps India Ltd

- Dun & Bradstreet, Inc. (Shanxi JC Biological Technology Co. Ltd)

- ACG

- Medi-Caps Ltd

- Suheung

- capsCanada Corporation

Recent Developments

- In March 2024, Lonza announced an agreement with Roche to acquire Genentech's biologics manufacturing site in California for over USD 1 billion. This is expected to significantly enhance Lonza's biologics manufacturing capability and make it one of the largest sites globally. Lonza plans to invest nearly USD 600 million in upgrading the facility and improving its capabilities to meet the demands of next-generation mammalian biologics therapies.

Empty Capsules Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.97 billion |

|

Revenue forecast in 2030 |

USD 4.97 billion |

|

Growth Rate |

CAGR of 3.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, therapeutic application, end use, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, UAE, and South Africa, Saudi Arabia, Kuwait |

|

Key companies profiled |

Bright Pharma Caps; Lonza; Qualicaps; HealthCaps India Ltd; Dun & Bradstreet, Inc. (Shanxi JC Biological Technology Co. Ltd); ACG; Medi-Caps Ltd; Suheung; capsCanada Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Empty Capsules Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global empty capsules market report based on product, therapeutic application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Pig Meat Gelatin

-

Bovine Derived

-

Bone Meal

-

Other Gelatin Capsule Products

-

-

Non-Gelatin

-

-

Therapeutic Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibiotic and Antibacterial Drugs

-

Vitamins and Dietary Supplements

-

Antacid and Antiflatulent Preparations

-

Antianemic Preparations (Hematenic Preparations)

-

Anti-Inflammatory Drugs

-

Cardiovascular Therapy Drugs

-

Cough and Cold Preparations

-

Other therapeutic applications

-

-

End Use Outlook (Revenue, USD Million, 2018- 2030)

-

Pharmaceutical

-

Nutraceutical

-

Cosmeceutical

-

Research Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."