- Home

- »

- IT Services & Applications

- »

-

Employee Engagement Software Market Size Report, 2030GVR Report cover

![Employee Engagement Software Market Size, Share, & Trends Report]()

Employee Engagement Software Market (2024 - 2030 ) Size, Share, & Trends Analysis Report By Deployment Mode, By Enterprise Size, By Function, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-466-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Employee Engagement Software Market Summary

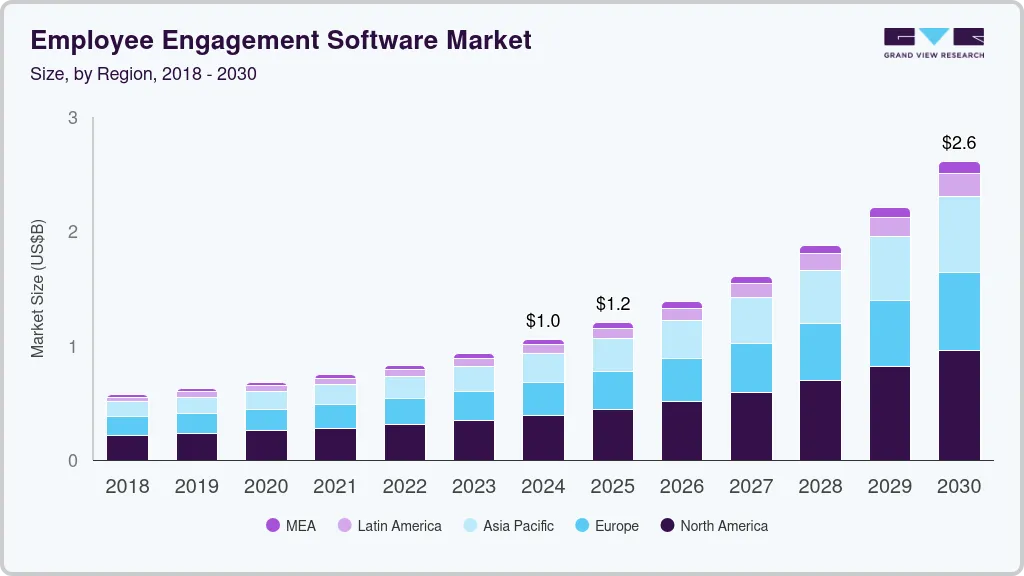

The global employee engagement software market size was estimated at USD 928.3 million in 2023 and is projected to reach USD 2,608.3 million by 2030, growing at a CAGR of 16.4% from 2024 to 2030. The market growth is driven by organizations which are increasingly recognize the importance of employee satisfaction and its direct impact on productivity and retention.

Key Market Trends & Insights

- North America employee engagement software market held the largest share of over 37% of the employee engagement software market in 2023.

- The employee engagement software market in the U.S. is expected to grow significantly from 2024 to 2030.

- By deployment mode, the cloud segment accounted for the largest market share of over 70% in 2023.

- By enterprise size, the large enterprise segment accounted for the largest market share in 2023.

- By function, the communication and collaboration segment accounted for the largest market share of nearly 30% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 928.3 Million

- 2030 Projected Market Size: USD 2,608.3 Million

- CAGR (2024-2030): 16.4%

- North America: Largest market in 2023

As businesses strive to foster a more connected and motivated workforce, the demand for tools that facilitate communication, recognition, and feedback has surged. The shift towards remote and hybrid working models has further accelerated the adoption of such software as companies seek to maintain strong engagement levels in a decentralized work environment. Additionally, advancements in technology, such as artificial intelligence and data analytics, are enhancing the capabilities of these platforms, allowing for more personalized and actionable insights into employee well-being and performance. As a result, the employee engagement software market is expected to continue its upward trajectory.

Remote employment is increasingly becoming a standard practice across various sectors, with a study from Upwork indicating that by 2025, around 22% of the workforce in the U.S. is expected to be working remotely. The shift towards remote and hybrid working models has significantly driven the demand for employee engagement software. Maintaining effective communication, collaboration, and connection has become more challenging with employees no longer consistently working in centralized office environments. As a result, organizations increasingly rely on digital tools to bridge these gaps, ensuring that remote and hybrid employees remain engaged, aligned with organizational goals, and connected with their teams. Employee engagement software facilitates this by offering features such as virtual feedback systems, recognition platforms, and real-time communication channels, which help sustain a sense of belonging and motivation. Furthermore, these platforms allow employers to monitor and assess engagement levels more effectively, providing insights critical to addressing the unique challenges of remote work. Consequently, shifting towards these flexible working models has been a key driver of adopting employee engagement solutions.

Organizations' growing recognition of employee satisfaction's critical role in enhancing productivity and retention is a significant driver of the employee engagement software market. Companies seeking to foster a positive work environment and ensure their workforce remains motivated to use technology to streamline and enhance engagement initiatives. Employee engagement software provides a structured and scalable approach to improving job satisfaction by enabling regular feedback, recognition, and communication, which is essential for maintaining morale and reducing turnover. Furthermore, these platforms empower organizations to create meaningful connections with their employees by directly addressing the factors influencing employee satisfaction, such as career development opportunities and workplace culture. This, in turn, boosts productivity, reduces attrition rates, and leads to a more engaged and committed workforce, driving the growing demand for such software solutions.

Deployment Mode Insights

The cloud segment accounted for the largest market share of over 70% in 2023 in the employee engagement software market. Cloud-based employee engagement software is increasingly preferred due to its scalability, flexibility, and cost-efficiency. Organizations benefit from the ease of deployment, as cloud solutions eliminate the need for extensive IT infrastructure and maintenance. Cloud platforms also offer remote accessibility, essential in the current landscape of hybrid and remote work models, allowing employees to stay connected from any location. Additionally, cloud-based solutions provide regular updates and enhancements without manual intervention, ensuring the software remains updated with the latest features and security protocols. The subscription-based pricing model also makes cloud solutions more attractive to businesses seeking to optimize costs.

The on-premise segment is anticipated to grow at a significant CAGR over the forecast period. On-premise employee engagement software appeals to organizations prioritizing control, security, and customization. On-premise deployment allows companies to completely oversee their data and software, which is crucial for industries with strict regulatory requirements or sensitive information. Additionally, the ability to tailor the software to specific organizational needs offers a degree of flexibility in functionality that may not be available with cloud solutions. However, the higher upfront costs, ongoing maintenance, and limited scalability of on-premise platforms have made them less favored than cloud alternatives, especially in a rapidly changing business environment.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2023. Large enterprises are adopting employee engagement software to manage the complexities of a vast and often dispersed workforce. With thousands of employees spread across multiple locations or working remotely, these organizations require sophisticated tools to ensure consistent communication, foster collaboration, and measure engagement at scale. Employee engagement software provides the necessary infrastructure for handling large amounts of data, automating feedback processes, and offering critical insights for decision-making. Moreover, large enterprises benefit from advanced features such as AI-driven analytics, customization, and integration with other enterprise systems, which enhance their ability to address engagement challenges efficiently and maintain high levels of productivity and retention.

The small & medium enterprise (SME) segment is anticipated to expand at a CAGR of over 17% during the forecast period. The adoption of employee engagement software among SMEs is driven by the need for cost-effective solutions to improve employee satisfaction and retention without the complexity of enterprise-grade systems. Employee engagement software allows SMEs to build a strong organizational culture by facilitating open communication, recognition, and feedback in a more streamlined manner. For smaller businesses, these tools are crucial for fostering a positive work environment and driving loyalty, as employee engagement directly influences their ability to compete for talent and maintain growth. The affordability and ease of implementation of cloud-based engagement solutions appeal to SMEs, enabling them to deploy engagement strategies quickly without significant financial or technical investments.

Function Insights

The communication and collaboration segment accounted for the largest market share of nearly 30% in 2023, in the employee engagement software market. Adopting employee engagement software for communication and collaboration is driven by the increasing need for seamless and efficient workplace interaction, particularly in remote and hybrid work environments. Organizations recognize that effective communication is vital for maintaining employee alignment, morale, and productivity. Employee engagement software offers instant messaging, video conferencing, and collaborative workspaces, enabling teams to stay connected and work together in real time, regardless of location. This fosters a sense of belonging and teamwork, ensuring employees can engage meaningfully with their colleagues and managers.

The performance management segment is anticipated to grow at the highest CAGR during the forecast period. The growing focus on data-driven decision-making and continuous feedback drives the use of employee engagement software for performance management. Traditional annual performance reviews are being replaced by more dynamic and frequent evaluations that provide real-time insights into employee progress. Employee engagement software enables organizations to track key performance indicators (KPIs), set goals, and offer regular feedback, which helps employees stay focused on their objectives and fosters professional development. Additionally, the software’s ability to provide analytics and reports allows managers to identify performance trends, address issues proactively, and recognize top performers.

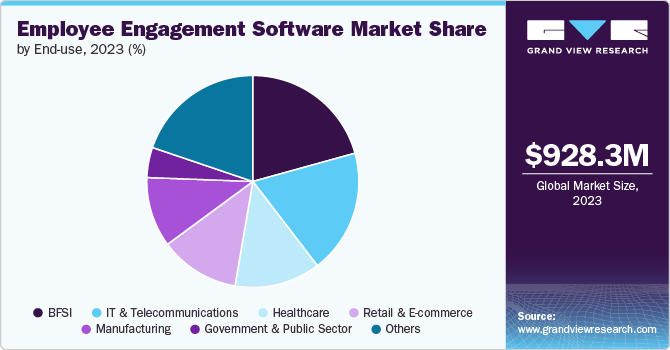

End-use Insights

The BFSI end use segment accounted for the largest market share in 2023. The adoption of employee engagement software in the BFSI sector is driven by the need to manage a large, distributed workforce while maintaining high compliance standards, security, and performance. Standards In this highly regulated industry, employee engagement software helps streamline communication, ensure adherence to compliance protocols, and foster a culture of accountability and transparency. Additionally, BFSI organizations face high levels of employee turnover and stress, making it essential to have tools that monitor and enhance employee well-being, satisfaction, and performance. The software allows for continuous feedback, recognition, and career development opportunities, critical in retaining talent and improving productivity in a highly competitive environment.

The IT and telecom segment is anticipated to grow at a CAGR of over 17% during the forecast period. In the IT and telecom sector, the adoption of employee engagement software is primarily driven by the need for agility, innovation, and employee retention in a fast-paced, technologically advanced industry. With a workforce that is often global and remote, these organizations require robust tools for effective communication, collaboration, and performance management. Employee engagement software helps IT and telecom companies foster a connected and motivated workforce by providing platforms for seamless interaction, virtual collaboration, and real-time feedback. The sector also faces intense competition for skilled talent, making employee engagement critical for attracting, developing, and retaining top performers. Moreover, the software’s ability to provide data-driven insights into employee performance and engagement levels helps companies in this sector remain agile and responsive to workforce needs.

Regional Insights

North America employee engagement software market held the largest share of over 37% of the employee engagement software market in 2023. In North America, the employee engagement software market is driven by the widespread adoption of cloud-based solutions and the increasing focus on employee well-being, particularly in the wake of remote and hybrid work models. Companies invest heavily in advanced analytics and AI-powered platforms to improve employee satisfaction, productivity, and retention.

U.S. Employee Engagement Software Market Trends

The employee engagement software market in the U.S. is expected to grow significantly from 2024 to 2030. In the U.S., large enterprises seek to enhance remote work experiences and maintain employee alignment. There is also a significant focus on performance management and personalized employee experiences, supported by data-driven insights and feedback mechanisms.

Europe Employee Engagement Software Market Trends

The employee engagement software market in Europe is growing significantly at a CAGR of over 15% from 2024 to 2030. In Europe, the market is shaped by strong regulatory frameworks surrounding data privacy, such as GDPR, which influence the adoption of employee engagement software. There is a growing emphasis on integrating sustainability and diversity initiatives into employee engagement strategies, alongside a focus on enhancing work-life balance.

Asia Pacific Employee Engagement Software Market Trends

The employee engagement software market in the Asia Pacific is growing significantly at a CAGR of over 17% from 2024 to 2030. The market is expanding rapidly due to the growing digitization of businesses and increasing awareness of the importance of employee engagement in improving productivity and organizational culture. Companies are adopting cost-effective, scalable solutions to meet the needs of a diverse and geographically dispersed workforce.

Key Employee Engagement Software Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2024, Qualtrics introduced new product innovations within its Experience Management (XM) for Employee Experience suite, leveraging advanced technology and machine learning to address critical employee engagement challenges. These innovations are designed to identify employees at risk of attrition, summarize employee feedback into personalized, actionable recommendations for managers, and detect significant behavioral patterns throughout the employee journey that affect engagement and productivity. Powered by Qualtrics AI, these solutions integrate the capabilities of generative AI with the world’s largest human sentiment database, empowering managers and leaders to enhance workforce engagement, improve retention, and drive productivity.

-

In May 2024, Workday, Inc. announced the expansion of its partnership with Saab, a Swedish defense and security company, focusing on enhancing Saab’s employee experience and driving business success. Since the collaboration began in 2017, Saab has utilized Workday Peakon Employee Voice and Workday’s Human Capital Management (HCM) suite to modernize its HR platform and strengthen employee engagement. The expanded partnership will leverage AI-powered Semantic search, enabling Saab to understand better and address employee sentiments while advancing its diversity, equity, inclusion (DEI), and sustainability goals. Through this technology, Saab will gain real-time insights into employee feedback, allowing for proactive actions to improve employee well-being and prevent burnout.

Key Employee Engagement Software Companies:

The following are the leading companies in the employee engagement software market. These companies collectively hold the largest market share and dictate industry trends.

- 15Five

- Bamboo HR LLC.

- Culture Amp Pty Ltd

- Lattice

- Leapsome

- Qualtrics

- SAP

- TINYpulse

- Workday, Inc.

- Workleap Platform Inc.

Employee Engagement Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,049.9 million

Revenue forecast in 2030

USD 2,608.3 million

Growth rate

CAGR of 16.4% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, enterprise size, function, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

15Five; Bamboo HR LLC; Culture Amp Pty Ltd; Lattice; Leapsome; Qualtrics; SAP; TINYpulse; Workday, Inc.; and Workleap Platform Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Employee Engagement Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the employee engagement software market report based on deployment mode, enterprise size, function, end-use, and region.

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication And Collaboration

-

Learning and Development

-

Performance Management

-

Onboarding and OffboardingOthers

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government And Public Sector

-

Healthcare

-

Retail And E-commerce

-

IT And Telecommunications

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Several key factors drive the growth of the employee engagement software market. Organizations are increasingly recognizing the importance of employee satisfaction and its direct impact on productivity and retention. As businesses strive to foster a more connected and motivated workforce, the demand for tools that facilitate communication, recognition, and feedback has surged. The shift towards remote and hybrid working models has further accelerated the adoption of such software as companies seek to maintain strong engagement levels in a decentralized work environment.

b. The global employee engagement software market size was estimated at USD 928.3 million in 2023 and is expected to reach USD 1,049.9 million in 2024

b. The global employee engagement software market is expected to grow at a compound annual growth rate of 16.4% from 2024 to 2030 to reach USD 2,608.3 million by 2030

b. North America dominated the employee engagement software market with a market share of 37.3% in 2023. In North America, the employee engagement software market is driven by the widespread adoption of cloud-based solutions and the increasing focus on employee well-being, particularly in the wake of remote and hybrid work models. Companies invest heavily in advanced analytics and AI-powered platforms to improve employee satisfaction, productivity, and retention.

b. Some key players operating in the employee engagement software market include 15Five, Bamboo HR LLC, Culture Amp Pty Ltd, Lattice, Leapsome, Qualtrics, SAP, TINYpulse, Workday, Inc., and Workleap Platform Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.