- Home

- »

- Electronic Devices

- »

-

Emergency Lighting Market Size, Share, Growth Report,2030GVR Report cover

![Emergency Lighting Market Size, Share & Trends Report]()

Emergency Lighting Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Light Type (Fluorescent, LED, Incandescent), By Power System, By End Use (Self-Contained Power System), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-392-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Emergency Lighting Market Summary

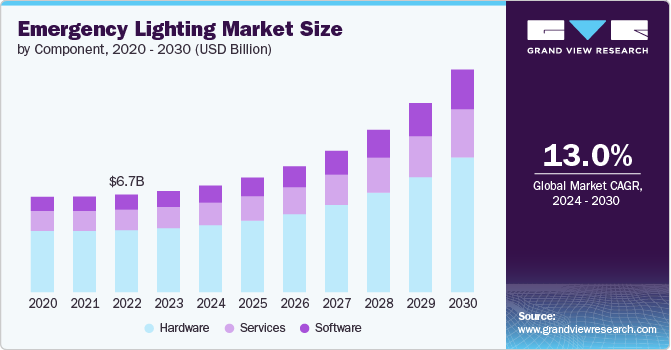

The global emergency lighting market size was estimated at USD 6.89 billion in 2023 and is projected to reach USD 15.18 billion by 2030, growing at a CAGR of 13% from 2024 to 2030. The adoption of better safety standards and the incorporation of smart technologies are significant market growth drivers.

Key Market Trends & Insights

- North America held the major share of 38.1% of the emergency lighting market in 2023.

- The emergency lighting market in Asia Pacific is growing significantly at the highest CAGR of 15.6% from 2024 to 2030.

- Based on component, the hardware segment accounted for the largest market share of 63.3% in 2023.

- Based on light type, the fluorescent segment accounted for the largest market share above 56 % in 2023.

- Based on power system, the self-contained power system segment accounted for the largest market share of above 55% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.89 Billion

- 2030 Projected Market Size: USD 15.18 Billion

- CAGR (2024-2030): 13.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

As global safety regulations become more stringent, there is a rising demand for advanced emergency lighting solutions that comply with these enhanced standards, ensuring greater safety and reliability during power outages and emergencies.The integration of smart technologies, such as IoT-enabled systems and automated monitoring, enhances the functionality and efficiency of emergency lighting. These advancements facilitate real-time monitoring and maintenance but also improve energy efficiency and user control. IoT-enabled LED fixtures are emerging as a significant growth driver for the emergency lighting market. These advanced fixtures offer enhanced functionality through real-time monitoring and automated control, allowing for proactive maintenance and improved energy efficiency. The integration of IoT technology facilitates seamless communication between lighting systems and centralized control units, ensuring optimal performance during emergencies.

The growing frequency of natural disasters is a significant market growth driver, as communities and organizations increasingly recognize the critical need for reliable lighting solutions during such events. Natural disasters, such as hurricanes, earthquakes, and floods, often lead to power outages and compromised infrastructure, making dependable emergency lighting essential for ensuring safety and facilitating effective evacuation. This heightened awareness and demand for robust emergency lighting systems are pushing investments in advanced technologies that provide reliable illumination, enhance visibility, and improve response times in crisis situations. Consequently, the surge in natural disasters is fueling the market expansion, as stakeholders seek to enhance preparedness and resilience in the face of unpredictable and often devastating events.

As smart buildings become more prevalent, integrating sophisticated emergency lighting systems that can seamlessly communicate with other building management systems is increasingly important. These advanced solutions offer enhanced capabilities such as automated testing, real-time monitoring, and predictive maintenance, ensuring higher reliability and efficiency during emergencies. The ability to remotely control and monitor emergency lighting improves safety standards and reduces operational costs and enhances energy efficiency.

For instance, in February 2024, Siemens and its subsidiary Enlighted partnered strategically with the Zumtobel Group to advance smart building technologies by integrating its advanced smart sensors into Zumtobel's premium lighting products. This collaboration aims to create an attractive IoT lighting bundle for customers, offering benefits such as effective prefabricated solutions, adaptable technology, efficient wireless deployment, and enhanced insights. The partnership aims to focus on commercial buildings, higher education, and smart hospitals, setting new standards for efficiency and sustainability in building operations.

Component Insights

The hardware segment accounted for the largest market share of 63.3% in 2023. The increasing awareness of safety and emergency preparedness across various sectors, including commercial, industrial, and residential spaces contributes significantly to the growth of hardware segment. Regulatory mandates and stringent building codes are enforcing the installation of emergency lighting systems, thereby boosting demand for hardware components such as LED lighting fixtures, control systems, and batteries.

The software segment is anticipated to grow at the fastest CAGR over the forecast period driven by the increasing adoption of smart technologies and the rising demand for energy-efficient solutions. This segment includes software for managing, monitoring, and controlling emergency lighting systems, ensuring they function optimally during power outages or emergencies. Advancements in Internet of Things (IoT) technologies, which enable real-time monitoring and control of lighting systems through connected devices drives the growth of the software segment. For instance, in February 2023, ABB a Switzerland-based technology company introduced NaveoPro Wireless solution that allows users to manage entire emergency lighting system through a user-friendly mobile app. The fully automated system offers real-time status updates for all monitored buildings, displayed on a digital floorplan, enhancing safety and aiding in maintenance planning.

Light Type Insights

The fluorescent segment accounted for the largest market share above 56 % in 2023 owing to the ongoing urbanization and infrastructural development across various regions. As cities expand and new commercial complexes, residential buildings, and industrial facilities are constructed, the need for effective emergency lighting systems becomes paramount. Fluorescent lights, known for their energy efficiency and long lifespan, are often preferred in these installations, further boosting the market for fluorescent emergency lighting.

The LED segment is anticipated to grow at the fastest CAGR over the forecast period due to the increasing demand for energy-efficient lighting solutions. LEDs consume significantly less power compared to traditional incandescent and fluorescent bulbs, which has led to widespread adoption in both residential and commercial sectors. Moreover, advancements in LED technology have resulted in improved brightness, longer lifespan, and reduced costs, making them more accessible and appealing to a broader market.

Power System Insights

The self-contained power system segment accounted for the largest market share of above 55% in 2023. Innovations in battery technology, such as the development of long-lasting and energy-efficient lithium-ion batteries, have significantly improved the reliability and performance of these systems. Additionally, advancements in LED lighting technology have enhanced the efficiency and lifespan of emergency lighting solutions, making self-contained systems more useful to end-users.

The hybrid power system segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing frequency of power outages and the need for reliable emergency lighting solutions in both residential and commercial buildings have propelled the demand for hybrid power systems. These systems, which combine traditional power sources with renewable energy options such as solar and wind, offer enhanced reliability and sustainability, ensuring that emergency lighting remains operational during power failures.

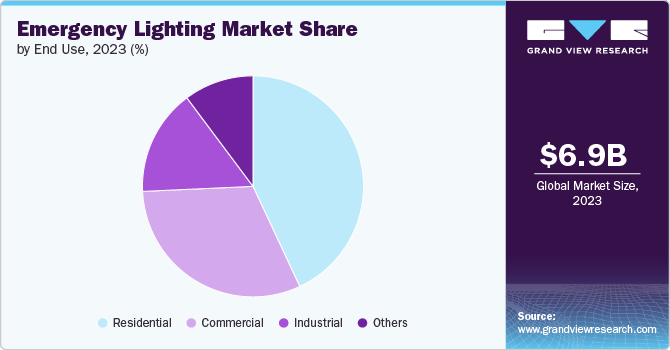

End Use Insights

The commercial segment accounted for the largest market share of nearby 43% in 2023. The rising focus on workplace safety and compliance with fire safety regulations is pushing businesses to invest in advanced emergency lighting systems. Additionally, technological advancements, such as the development of energy-efficient LED lights and smart lighting solutions, are enhancing the effectiveness and appeal of emergency lighting products. The increasing adoption of green building practices and energy-efficient solutions also contributes to market growth, as businesses seek to reduce operational costs and environmental impact.

The industrial segment is anticipated to grow at the fastest CAGR over the forecast period. The rise in industrial activities, especially in emerging economies, is driving the demand for emergency lighting systems. As new industrial facilities are established, the need for comprehensive safety measures, including emergency lighting, becomes necessary. There is a heightened awareness among industrial operators regarding the importance of workplace safety. This awareness is fueling investments in emergency lighting systems to ensure that employees have safe routes during emergencies.

Regional Insights

North America held the major share of 38.1% of the emergency lighting market in 2023. The increasing adoption of smart technologies in building infrastructure is significantly boosting the regional market growth. The rise of smart buildings, which integrate IoT-enabled devices and automated systems, is leading to the incorporation of sophisticated emergency lighting solutions. These advanced systems offer features such as real-time monitoring, automated testing, and predictive maintenance, enhancing overall safety and operational efficiency. The growing emphasis on energy efficiency and sustainability also drives the market, as modern emergency lighting systems are designed to be more energy-efficient and environmentally friendly.

U.S. Emergency Lighting Market Trends

The emergency lighting market in the U.S. is expected to grow significantly from 2024 to 2030 due to the stringent safety regulations and building codes enforced by agencies such as the Occupational Safety and Health Administration (OSHA) and the National Fire Protection Association (NFPA). These regulations mandate the installation of reliable emergency lighting systems in commercial, industrial, and residential buildings to ensure occupant safety during power outages and emergencies.

Europe Emergency Lighting Market Trends

The emergency lighting market in Europe is growing significantly at a CAGR of 11.6% from 2024 to 2030 due to the rising adoption of energy-efficient and environmentally sustainable technologies. This has led to a growing preference for LED-based emergency lighting systems, which offer significant energy savings, longer lifespan, and reduced environmental impact compared to traditional lighting solutions. Furthermore, the integration of smart technologies in building management systems is enhancing the functionality and efficiency of emergency lighting. Smart emergency lighting solutions, equipped with IoT capabilities, enable automated testing, real-time monitoring, and predictive maintenance, ensuring optimal performance and compliance with safety standards. Such technological advancement is driving the demand for innovative emergency lighting solutions across the European market.

Asia Pacific Emergency Lighting Market Trends

The emergency lighting market in Asia Pacific is growing significantly at the highest CAGR of 15.6% from 2024 to 2030 due to the rapid urbanization and industrialization in emerging economies such as China, India, and Southeast Asian countries. As these regions experience substantial economic growth, there is an increased demand for commercial and residential infrastructure, which in turn boosts the need for reliable emergency lighting solutions. Governments in these countries are also implementing stringent safety regulations and building codes, mandating the installation of emergency lighting systems in new constructions and existing buildings.

Key Emergency Lighting Company Insights

Key players operating in the emergency lighting market include ABB, Signify Holding, Honeywell International Inc., General Electric, Emerson Electric Co., Hubbell, and Legrand. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In July 2024, Signify Holding introduced a new over-the-counter lighting brand called Ecolink. This brand offers a competitively priced range of LED luminaires designed in the UK to cater specifically to the needs of electrical professionals. Ecolink aims to provide high-quality, energy-efficient lighting solutions, leveraging Signify's of innovation and expertise in lighting.

-

In October 2023, Emerson unveiled the Appleton HEX LED Series, a range of emergency lighting solutions that includes exit signs, exit sign/emergency light combinations, and lamps-only emergency systems. These systems come with a 90-minute battery backup to meet OSHA, NFPA, and NEC requirements. Designed for use in challenging industrial environments such as oil refineries, LNG plants, chemical processing areas, and water treatment facilities, the robust lighting ensures critical illumination during evacuations, helping employees to safely exit dangerous situations.

Key Emergency Lighting Companies:

The following are the leading companies in the emergency lighting market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- ACUITY BRANDS, INC.

- Eaton

- Emerson Electric Co.

- General Electric

- Honeywell International Inc.

- Hubbell

- Legrand

- Panasonic Corporation

- Schneider Electric

- Signify Holding

- Zumtobel Group

Emergency Lighting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.27 billion

Revenue forecast in 2030

USD 15.18 billion

Growth rate

CAGR of 13.0% from 2024 to 2030

Actual data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, light type, power system, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ABB; ACUITY BRANDS, INC.; Eaton; Emerson Electric Co.; General Electric; Honeywell International Inc.; Hubbell; Legrand; Panasonic Corporation; Schneider Electric; Signify Holding; Zumtobel Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Emergency Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global emergency lighting market report based on component, light type, power system, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Light Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fluorescent

-

LED

-

Incandescent

-

Others

-

-

Power System Outlook (Revenue, USD Billion, 2018 - 2030)

-

Self-Contained Power System

-

Central Power System

-

Hybrid Power System

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global emergency lighting market size was estimated at USD 6.89 billion in 2023 and is expected to reach USD 7.27 billion in 2024.

b. The global emergency lighting market is expected to grow at a compound annual growth rate of 13.0% from 2024 to 2030 to reach USD 15.18 billion by 2030.

b. The hardware segment accounted for the largest market share of 63.3% in 2023. The increasing awareness of safety and emergency preparedness across various sectors, including commercial, industrial, and residential spaces contributes significantly to the growth of hardware segment.

b. Some key players operating in the emergency lighting market include ABB, ACUITY BRANDS, INC., Eaton, Emerson Electric Co., General Electric, Honeywell International Inc., Hubbell, Legrand, Panasonic Corporation, Schneider Electric, Signify Holding, and Zumtobel Group

b. As global safety regulations become more stringent, there is a rising demand for advanced emergency lighting solutions that comply with these enhanced standards, ensuring greater safety and reliability during power outages and emergencies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.