- Home

- »

- Medical Devices

- »

-

Emergency General Surgery Services Market Report, 2030GVR Report cover

![Emergency General Surgery Services Market Size, Share & Trends Report]()

Emergency General Surgery Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Procedure (Abdominal Surgery, Trauma Surgery), By End Use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-441-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Emergency General Surgery Services Market Summary

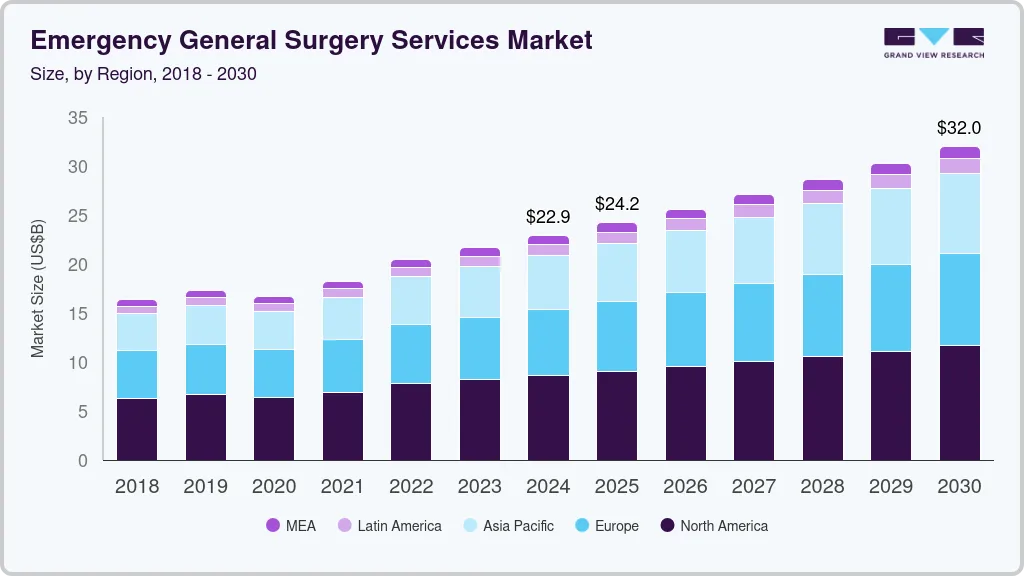

The global emergency general surgery services market size was estimated at USD 22.88 billion in 2024 and is projected to reach USD 32.0 billion by 2030, growing at a CAGR of 5.74% from 2025 to 2030. The market is driven by the rising prevalence of chronic and acute medical conditions, advancements in surgical technologies, an aging population, and increasing demand for enhanced emergency care infrastructure.

Key Market Trends & Insights

- North America emergency general surgery services market held the largest share of 37.73% in 2023.

- Based on procedure, the abdominal surgery segment held the largest revenue share of 29.7% in 2023.

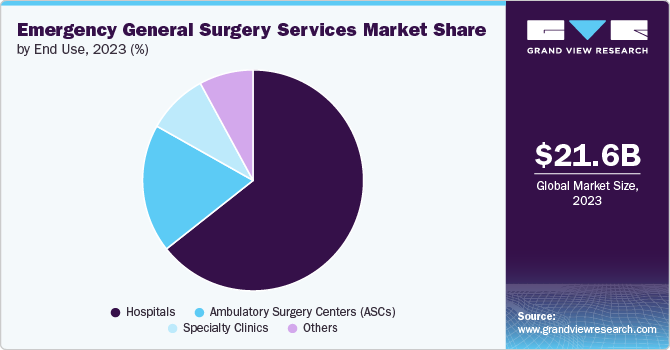

- Based on end use, the hospital segment held the largest revenue share of 64.8% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 22.88 Billion

- 2030 Projected Market Size: USD 32.0 Billion

- CAGR (2025-2030): 5.74%

- North America: Largest market in 2023

For instance, in July 2023, five hospitals became the inaugural facilities to receive verification under the new American College of Surgeons Emergency General Surgery Verification Program (ACS EGS-VP). This initiative, created in collaboration with the AAST, guarantees that hospitals maintain high standards in emergency general surgery.

One significant driver is the increasing prevalence of acute surgical conditions, such as appendicitis, trauma, and gastrointestinal emergencies. The World Health Organization reports that road traffic injuries alone account for approximately 1.19 million deaths annually, highlighting the urgent need for effective emergency surgical interventions. As the incidences of such conditions rise, healthcare systems must adapt to manage the growing demand for emergency surgeries, thereby driving market growth.

Advancements in surgical technologies also play a crucial role in propelling the market growth. Innovations such as robotic-assisted surgery and enhanced imaging techniques improve surgical precision and reduce recovery times. According to the National Centre for Biotechnology Information (NCBI), the use of robotic systems in surgery has increased, highlighting how these advancements enhance the quality and efficiency of emergency surgical interventions.

The demand for minimally invasive procedures in the emergency general surgery services market is increasing due to several factors, including reduced recovery times, lower risk of complications, and minimal postoperative pain compared to traditional open surgeries. These advantages are particularly appealing in emergency settings where rapid recovery is critical for patient outcomes. In addition, advancements in surgical technologies and techniques made minimally invasive options more accessible and effective, further driving their adoption among healthcare providers and patients.

Market Concentration & Characteristics

The degree of innovation in the market is high, with significant advancements in surgical techniques, including minimally invasive and robotic-assisted surgeries. Recent innovations, such as enhanced imaging technologies and improved surgical tools, lead to better patient outcomes and reduced recovery times. Integrating AI-driven diagnostic tools enhances precision in emergency surgeries. This continuous innovation is crucial for adapting to the growing complexity of emergency cases and improving overall care quality.

The level of merger and acquisition activities is considered high, and recent years witnessed substantial consolidation among healthcare providers, which enhanced service offerings and improved operational efficiencies. For instance, in February 2024, Tenet Healthcare Corporation concluded the transfer of three hospitals and their associated operations in South Carolina to Novant Health, with the deal valued at approximately USD 2.4 billion.

The impact of regulations is medium, as regulatory frameworks significantly influence operational practices and patient safety standards. Regulatory bodies, such as the FDA in the U.S., impose stringent guidelines on surgical devices and procedures, ensuring that innovations meet safety and efficacy criteria before they can be adopted in clinical practice. Regulations are essential for patient safety, and they can also pose challenges for rapid innovation and market entry, affecting how quickly new technologies can be implemented in emergency settings.

Product expansion in the emergency general surgery services industry is high, with a continuous introduction of new technologies and surgical tools. Companies are expanding their portfolios to include advanced diagnostic tools, innovative surgical devices, and improved patient monitoring systems. For instance, in February 2024, the Versius robotic surgical system was launched in Sweden, with the NU-hospital group becoming the first in the country to perform surgeries using this technology. This expansion aims to meet the diverse needs of emergency patients and improve surgical outcomes.

Theregional expansion is high, driven by efforts to extend healthcare services into underserved areas and emerging markets. Companies are actively opening new facilities and entering new geographic regions to enhance accessibility to emergency care. For instance, in February 2024, the University of Florida and UF Health created a 42.5-acre health and wellness campus at Durbin Park to improve healthcare services as part of their regional growth in Jacksonville and St. Johns County.

Procedure Insights

The abdominal surgery segment held the largest revenue share of 29.7% in 2023 due to its critical role in addressing many acute conditions and traumas. Key drivers of this segment include the high prevalence of abdominal emergencies such as appendicitis, gastrointestinal bleeding, and traumatic injuries, which necessitate immediate surgical intervention. According to NCBI, gastrointestinal bleeding is a prevalent issue, occurring at an annual rate of roughly 80 to 150 cases per 100,000 individuals, with a mortality rate estimated between 2% and 10%.

The trauma surgery segment is anticipated to experience the fastest CAGR over the forecast period due to the rising incidence of traumatic injuries from accidents, violence, and natural disasters. The expansion of specialized trauma centers and advancements in emergency care technologies, such as advanced imaging and real-time data analytics, enhance the efficiency and effectiveness of trauma surgeries. In addition, the adoption of integrated trauma care pathways and innovative surgical techniques are significantly improving patient outcomes and driving the rapid growth of this segment.

End Use Insights

The hospital segment held the largest revenue share of 64.8% in 2023 in the market due to several key drivers, including the increasing incidence of trauma cases, a rise in chronic diseases requiring surgical intervention, and advancements in surgical technologies that enhance patient outcomes. Hospitals are equipped with comprehensive facilities and specialized staff capable of handling complex emergencies, which further drives their utilization for emergency surgeries. The growing prevalence of conditions such as appendicitis and gallbladder diseases necessitates immediate surgical care, leading to higher patient volumes in hospital settings.

The ambulatory surgery centers (ASCs) segment is anticipated to experience the fastest CAGR over the forecast period due to several key drivers, including the increasing preference for outpatient procedures, advancements in surgical techniques and technology that enhance safety and efficiency, and a growing emphasis on cost-effective healthcare solutions. ASCs provide patients a convenient alternative to traditional hospital settings, allowing quicker recovery times and reduced hospital stays. For instance, procedures such as appendectomies and cholecystectomies are increasingly performed in ASCs, reflecting a shift towards outpatient care models catering to patient demand for less invasive options and lower costs.

Regional Insights

The emergency general surgery services market in North America saw significant advancements driven by innovations in minimally invasive surgical techniques and robotic surgery. The rise in trauma cases and a growing elderly population led to increased demand for emergency surgeries. Recent mergers and acquisitions among major healthcare providers, including integrating advanced surgical technologies and specialized care units, shape the market dynamics.

U.S. Emergency General Surgery Services Market Trends

The emergency general surgery services market in the U.S. is driven by rising demand for acute care due to an aging population and increased chronic disease prevalence. According to recent statistics, by 2040, the population of Americans aged 65 and over is forecasted to surpass 80 million, doubling from current figures. Additionally, the number of people aged 85 and older who generally need assistance with everyday activities is anticipated to grow four times from 2000 levels by 2040. Additionally, the market is advancing through innovations in surgical techniques and minimally invasive procedures, improving patient outcomes and recovery times alongside strategic mergers and acquisitions to enhance service offerings.

Europe Emergency General Surgery Services Market Trends

The emergency general surgery services market in Europe is driven by the implementation of new clinical guidelines and improvements in surgical technology in the region. The focus on integrating advanced imaging techniques and precision medicine is notable, with recent launches of innovative surgical tools to improve patient outcomes. European countries are also experiencing a rise in emergency cases related to chronic diseases and lifestyle-related conditions, which drives the demand for more efficient emergency care services. Additionally, there is a growing trend towards cross-border healthcare collaborations and sharing best practices among EU member states.

The emergency general surgery services market in the UK is experiencing transformation through the adoption of advanced surgical techniques and digital health solutions. The National Health Service (NHS) is investing in emergency care infrastructure and promoting initiatives such as enhanced recovery pathways and telemedicine to streamline surgical services. A recent focus on addressing surgical backlog and improving patient flow within the NHS is driving innovations and efficiency in emergency surgery. Additionally, there is ongoing discussion about integrating new technologies and improving patient care standards amid evolving healthcare policies.

The France emergency general surgery services market evolved with advancements in surgical techniques and enhanced trauma care. The French healthcare system invests in integrated technology, including robotic surgery and laparoscopic systems, to improve patient outcomes. There was a notable increase in collaborations between hospitals and research institutions to drive innovation. Additionally, the rise in chronic diseases and the aging population are contributing to a higher demand for emergency surgical services across the country.

Asia Pacific Emergency General Surgery Services Market Trends

The emergency general surgery services market in the Asia Pacific is growing due to rapid advancements in medical technology and increased healthcare spending. The expansion of healthcare infrastructure and improvements in emergency care protocols are also driving market growth. Regional healthcare access and quality disparities are prompting efforts to standardize emergency care practices and improve outcomes across diverse populations. The launch of new treatment protocols for conditions such as appendicitis and gastrointestinal bleeding is also notable, with several hospitals adopting enhanced recovery after surgery (ERAS) guidelines.

The emergency general surgery services market in Japan is driven by a strong emphasis on precision medicine and advanced surgical technologies. Integrating robotic-assisted surgeries and advanced imaging techniques enhances surgical outcomes and recovery times. Additionally, Japan’s aging population and the high incidence of lifestyle-related diseases are contributing to increased demand for emergency surgical interventions. According to an article published by the World Economic Forum in September 2023, over 10% of the population in Japan is now aged 80 or older, making it one of the countries with the highest proportion of elderly individuals globally.

The China emergency general surgery services market is experiencing rapid growth driven by substantial investments in healthcare infrastructure and technological advancements. The government’s initiatives to improve emergency care systems and the increasing prevalence of chronic diseases are significant factors. Launching new surgical technologies and expanding specialized emergency departments in urban areas enhance the quality of emergency care.

Latin America Emergency General Surgery Services Market Trends

The emergency general surgery services market in Latin America is evolving with improvements in healthcare infrastructure and increased access to advanced surgical technologies. Mexico and Argentina are seeing growth in emergency care services due to rising awareness of trauma and surgical needs. Efforts to enhance emergency care systems and address disparities in healthcare access are driving market development. Additionally, integrating new surgical techniques and technologies contributes to better patient outcomes across the region.

The emergency general surgery services market in Brazil is characterized by a growing focus on improving emergency care protocols and expanding healthcare access. The country invests in advanced surgical technologies and develops specialized emergency care centers to address the increasing demand for surgical interventions. The rise in trauma cases and lifestyle-related diseases are major factors driving the market. Collaborative efforts between the government and private sector are also contributing to modernizing emergency care services and adopting innovative solutions.

Middle East & Africa Emergency General Surgery Services Market Trends

The emergency general surgery services market in the Middle East and Africa is advancing with significant healthcare infrastructure and technology improvements. The region is witnessing an increase in emergency cases driven by rising chronic diseases and a growing population. Innovations in surgical techniques, including minimally invasive procedures and advanced imaging technologies, enhance patient outcomes. Additionally, government initiatives to upgrade healthcare facilities and increase funding for emergency services are contributing to the market's growth.

The Saudi Arabia emergency general surgery services market is characterized by rapid advancements due to government initiatives to enhance healthcare quality through Vision 2030. This includes investments in healthcare technology and infrastructure improvements. Unique factors, such as the launch of new treatment protocols for conditions such as appendicitis and gallbladder disease, emerged alongside mergers and acquisitions among local hospitals seeking to expand their service offerings.

Key Emergency General Surgery Services Company Insights

Key companies are distinguished by their extensive networks of hospitals and surgical centers, which allow them to capture significant market share. These leading players held a substantial portion of the market due to their comprehensive emergency care facilities, advanced surgical technologies, and strong regional presence. Their market dominance is further bolstered by strategic initiatives such as expanding service offerings through mergers and acquisitions, integrating innovative surgical techniques, and investing in state-of-the-art infrastructure.

Key Emergency General Surgery Services Companies:

The following are the leading companies in the emergency general surgery services market. These companies collectively hold the largest market share and dictate industry trends.

- HCA Management Services, L.P.

- TH Medical.

- Ascension

- Cleveland Clinic

- Mayo Clinic

- Banner Health

- Health Security Partners (HSP)

- Providence

- Universal Health Services

- MedStar Health

Recent Developments

-

In August 2024, MyMichigan Health acquired Ascension hospitals in Saginaw, Tawas, and Standish. It integrated them into its healthcare system to enhance service delivery and improve access to care in these communities.

-

In March 2024, Northern Health introduced orthopedic services to its surgical offerings in Terrace, enhancing the range of medical care available in the region.

-

In August 2024, the Northern Health and Social Care Trust is initiating a public consultation regarding a proposal to relocate all emergency surgical procedures to Antrim Hospital while scheduling planned surgeries at Causeway Hospital in Coleraine.

-

In January 2024, the American College of Surgeons received a $100,000 grant to improve diagnostic accuracy in clinical registries for older adults undergoing emergency general surgery as part of a UCSF-led initiative funded by the Moore and Hartford Foundations.

Emergency General Surgery Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.1 billion

Revenue forecast in 2030

USD 32.0 billion

Growth rate

CAGR of 5.74% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

HCA Management Services, L.P., TH Medical., Ascension, Cleveland Clinic, Mayo Clinic, Banner Health, Health Security Partners (HSP), Providence, Universal Health Services, MedStar Health

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Emergency General Surgery Services Market Report Segmentation

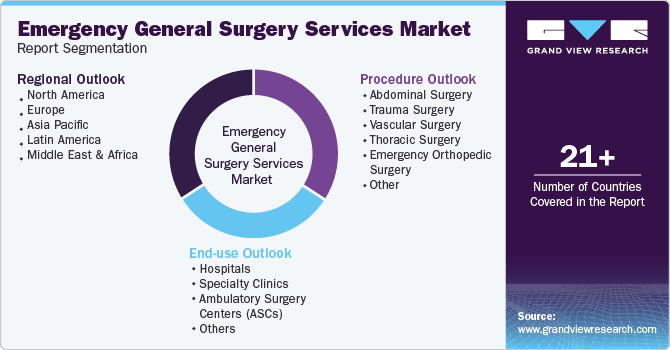

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global emergency general surgery services market report based on procedure, end use, and region:

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Abdominal Surgery

-

Trauma Surgery

-

Vascular Surgery

-

Thoracic Surgery

-

Emergency Orthopedic Surgery

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgery Centers (ASCs)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global emergency general surgery services market size was valued at USD 21.6 billion in 2023 and is projected to reach USD 22.9 billion in 2024.

b. The global emergency general surgery services market is projected to grow at a compound annual growth rate (CAGR) of 5.74% from 2024 to 2030 to reach USD 32.0 billion by 2030.

b. The hospital segment held the largest revenue share of 64.8% in 2023 in the market due to several key drivers, including the increasing incidence of trauma cases, a rise in chronic diseases requiring surgical intervention, and advancements in surgical technologies that enhance patient outcomes.

b. Some of the key players operating in this market include HCA Management Services, L.P., TH Medical., Ascension, Cleveland Clinic, Mayo Clinic, Banner Health, Health Security Partners (HSP), Providence, Universal Health Services, MedStar Health.

b. The market is driven by the rising prevalence of chronic and acute medical conditions, advancements in surgical technologies, an aging population, and increasing demand for enhanced emergency care infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.