- Home

- »

- Homecare & Decor

- »

-

Europe, Middle East & Africa Wax Melt Market Report, 2030GVR Report cover

![Europe, Middle East & Africa Wax Melt Market Size, Share & Trends Report]()

Europe, Middle East & Africa Wax Melt Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Pressed Wax Melt, Poured Wax Melt), By Pack (Single Pack, Multi-Pack), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-337-3

- Number of Report Pages: 67

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

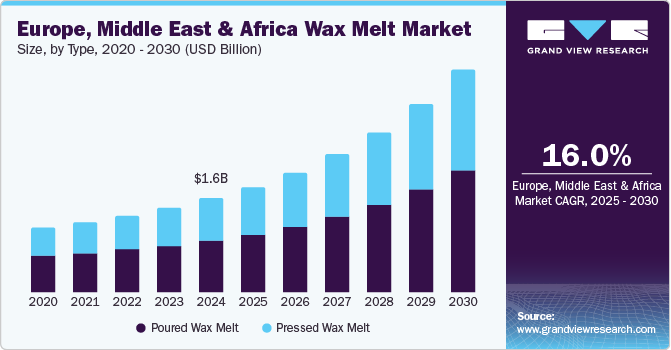

The Europe, Middle East & Africa wax melt market size was valued at USD 1.59 billion in 2024 and is expected to grow at a CAGR of 16.0% from 2025 to 2030. This growth is attributed to the increasing consumer preference for safer, flame-free alternatives to candles, coupled with growing demand for personalized home fragrances. The popularity of DIY crafts and customizable wax melts further fuels market expansion. Furthermore, the hospitality sector’s adoption of scented wax melts enhances customer experience. Seasonal scents and eco-friendly options attract millennials, while advancements in product innovation and infrastructure development in countries such as Germany drive overall market growth.

Wax melts are a wickless alternative to candles, are heated to release fragrance, offering a safer and flame-free solution for enhancing indoor environments. The market for wax melts in Europe, the Middle East, and Africa is expanding due to rising demand for cost-effective, efficient, and safe products in both residential and commercial spaces. Post-pandemic lifestyle changes, such as increased remote work, have amplified the need for clean and pleasant home settings. As a result, consumers are seeking products that can create a welcoming atmosphere without the risks associated with traditional candles.

Wax melts are becoming more and more popular and now many consumers favor them over candles to make their homes smell beautiful. Wax melts do not have a wick, nor do they require a flame, like candles. Wax melts are usually warmed in an electric wax melt warmer containing a small 15-watt light bulb that is included at the base of the warmer. The light bulb provides just enough heat to warm the wax melts, tarts, or cubes, releasing the scent in as little as 5 to 10 minutes.

Type Insights

Poured wax melts led the market and accounted for the largest revenue share of 49.1% in 2024, primarily driven by their widespread popularity due to their smooth texture and aesthetic appeal. In addition, poured wax melts are often associated with heritage craftsmanship, particularly in Europe, where traditional pouring methods are valued. They offer a longer-lasting fragrance release, making them ideal for households and commercial spaces. Furthermore, their versatility in scent customization and compatibility with electric warmers enhances consumer satisfaction, contributing significantly to their market dominance.

Pressed wax melts are expected to grow at a CAGR of 16.6% over the forecast period, owing to their compact design and ease of handling. These melts are favored for their durability and uniform shape, which ensures consistent fragrance diffusion. In addition, their lightweight nature makes them convenient for packaging and transport, appealing to eco-conscious consumers seeking minimal waste. Furthermore, the increasing demand for innovative designs and seasonal scents further boosts their popularity. Pressed wax melts cater to consumers looking for practical yet visually appealing home fragrance solutions.

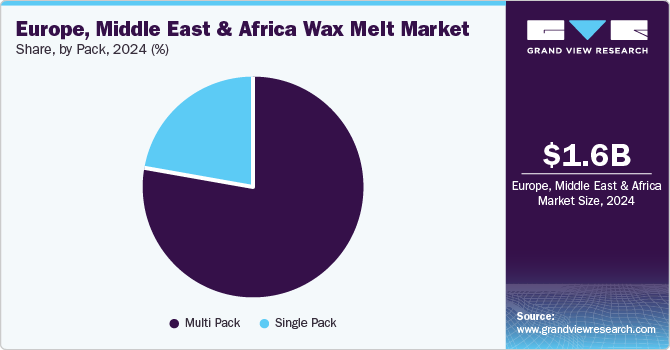

Pack Insights

The multi-pack segment dominated the Europe, Middle East, and Africa wax melt market with the largest revenue share of 68.0% in 2024. This growth is attributed to its cost-effectiveness and suitability for bulk purchases. Furthermore, multi-packs are particularly popular among hospitality businesses like hotels, spas, and restaurants, which require large quantities to create consistent aromatic environments. Moreover, the growing trend of aromatherapy and spa treatments has increased demand for multi-packs to cater to relaxation needs. Their convenience and variety of scents make them appealing for both commercial and household use.

The single-pack segment is expected to grow at a CAGR of 15.3% from 2025 to 2030, due to its appeal among consumers seeking to explore new fragrances without committing to larger quantities. This format is especially favored by millennials who prefer environmentally friendly and minimalistic packaging. Furthermore, single packs allow for experimentation with different scents, aligning with the trend of personalized home fragrance experiences. Moreover, their compact size also makes them ideal for gifting or travel purposes, further boosting their demand in the Europe, Middle East, and Africa wax melt market.

Country Insights

The UK wax melt market dominated the EMEA market and held the largest revenue share of 22.4% in 2024, attributed to innovative product offerings and increasing consumer demand for diverse home fragrances. Manufacturers are introducing unique scent combinations and eco-friendly packaging, enhancing appeal among environmentally conscious buyers. In addition, the launch of budget-friendly ranges such as MiniPot Wax Melts with over 120 premium fragrances has further fueled growth. Furthermore, the rising trend of personalized home decor and seasonal scents contributes to the popularity of wax melts, making them a preferred choice for creating pleasant indoor environments.

Spain Wax Melt Market Trends

The wax melt market in Spain is expected to grow at a significant CAGR of 16.4% over the forecast period, driven by the growing adoption of home fragrances as part of lifestyle enhancements. In addition, the emphasis on Mediterranean-inspired scents and seasonal aromas aligns with local preferences for creating warm and inviting spaces. Furthermore, the rising interest in DIY and customizable wax melts also appeals to consumers seeking unique fragrance experiences. Moreover, the Spanish tourism industry’s focus on improving hospitality environments drives demand for wax melts in hotels and resorts, adding to their market expansion.

Germany Wax Melt Market Trends

Germany's wax melt market is expected to grow significantly, driven by strict safety regulations and consumer preference for non-flammable alternatives to candles. The popularity of eco-friendly and sustainable wax melts aligns with Germany’s environmental consciousness. Furthermore, the demand for high-quality fragrances that complement modern interiors contributes to market expansion. Innovations in scent customization and packaging further attract consumers seeking premium products. Moreover, the robust residential sector and increasing use of wax melts in commercial spaces like offices and retail stores enhance their appeal.

South Africa Wax Melt Market Trends

The wax melt market in South Africa is expanding due to growing awareness of affordable home fragrance solutions. The tropical climate encourages demand for fresh and vibrant scents that enhance indoor comfort. In addition, increasing urbanization and rising disposable incomes drive adoption among middle-class households. Furthermore, the preference for safer alternatives to traditional candles appeals to families with children or pets. Seasonal collections and innovative designs tailored to local tastes further boost the popularity of wax melts across South Africa’s diverse consumer base.

Key Europe, Middle East & Africa Wax Melt Company Insights

Key players in the Europe, Middle East, and Africa wax melt market include P&G, Arran Aromatics, Aroma Works, Charles Farris, and others. These companies implement strategies such as product innovation to cater to diverse consumer preferences, focusing on eco-friendly and sustainable solutions. In addition, they leverage targeted marketing campaigns and expand distribution networks to enhance accessibility. Furthermore, partnerships with hospitality sectors and retailers strengthen market presence.

-

Kerax Limited manufactures and supplies wax products, specializing in solutions for various industries, including candle production and wax melts. The company operates in segments such as industrial waxes, surface protection, and personal care. Kerax blends bespoke wax formulations tailored to meet diverse applications, ensuring high-quality performance and reliability.

-

Aroma Works specializes in the production of natural and luxurious home fragrance products, including wax melts. The company operates within the aromatherapy and wellness segment, offering eco-friendly solutions crafted from organic ingredients. Aroma Works focuses on delivering high-quality products that combine therapeutic benefits with elegant designs.

Key Europe, Middle East, And Africa Wax Melt Companies:

- Kerax

- Procter & Gamble (febreze)

- ARRAN

- AromaWorks London

- Best Kept Secrets

- Canova

- Charles Farris Ltd

- Sonneborn

- Cereria Ronca

Europe, Middle East, and Africa Wax Melt Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.79 billion

Revenue forecast in 2030

USD 3.76 billion

Growth rate

CAGR of 16.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, pack, and country

Regional scope

Europe, MEA

Country scope

UK, Germany, France, Italy, Spain, South Africa

Key companies profiled

Kerax Limited; P&G; Arran Aromatics; Aroma Works; Best Kept Secrets; Breeze Candles; Canova; Charles Farris; Sonneborn; Cereria Ronca

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe, Middle East & Africa Wax Melt Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe, Middle East, and Africa wax melt market report based on type, pack, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pressed Wax Melt

-

Poured Wax Melt

-

-

Pack Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Pack

-

Multi Pack

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

South Africa

-

Frequently Asked Questions About This Report

b. The EMEA wax melt market size was estimated at USD 1,102.7 million in 2020 and is expected to reach USD 1,189.8 million in 2021.

b. The EMEA wax melt market is expected to grow at a compound annual growth rate of 11.9% from 2021 to 2028 to reach USD 2,712.8 million by 2028.

b. Poured wax melt dominated the EMEA wax melt market with a share of 57.2% in 2020. This is attributable to more prominent across Europe than in other parts of the world due to local heritage associated with the pouring and rolling process of wax melts.

b. The EMEA wax melt market is characterized by the presence of various well-established players such as Kerax Limited, P&G, Aroma Works, and Sonneborn, in addition to several small and medium players such as Arran Aromatics, Best Kept Secrets, Breeze Candles, Canova, Charles Farris, and Cereria Ronca Srl.

b. Key factors that are driving the EMEA wax melt market growth include rapid development of the residential and commercial sectors leads to an increased demand for wax melts to add instant warmth and aroma to the atmosphere of any room.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.