- Home

- »

- Medical Devices

- »

-

EMEA Surgical Microscopes Market, Industry Report, 2030GVR Report cover

![EMEA Surgical Microscopes Market Size, Share, & Trends Report]()

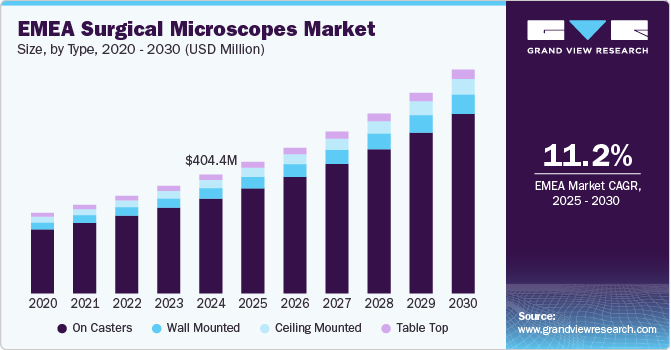

EMEA Surgical Microscopes Market Size, Share, & Trends Analysis Report By Type (On Casters, Wall Mounted), By Application (Ophthalmology, ENT Surgery), End Use (Hospital, Physician Clinics), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-399-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

EMEA Surgical Microscopes Market Trends

The EMEA surgical microscopes market size was estimated at USD 404.38 million in 2024 and is expected to grow at a CAGR of 11.23% from 2025 to 2030. The market is driven by several factors, including technological advancements, the rising demand for minimally invasive surgeries, the prevalence of chronic diseases, and the growth of outpatient surgical facilities. These drivers collectively enhance the capabilities and applications of surgical microscopes, making them indispensable tools in various medical specialties. According to the National Center for Biotechnology Information, these microscopes reduce blood loss during surgery, lower post-operative pain for patients, decrease the risk of infection and complications, and improve recovery times.

The EMEA surgical microscope industry is expected to witness significant growth, fueled by technological advancements. Innovations such as high-definition imaging, fluorescence guidance, and digital platform integration have revolutionized surgical practices. For instance, in January 2024, Leica Microsystems introduced an upgraded version of the ARveo 8 microscope specifically for neurosurgery. This model features a 3D view and augmented reality fluorescence capabilities, setting a new standard in surgical precision.

In addition, rising prevalence of chronic diseases. Conditions such as neurological disorders and eye diseases require advanced surgical interventions that depend on precise imaging tools. According to the World Health Organization (WHO), over one-third of the global population is affected by neurological conditions, making them the leading cause of illness and disability worldwide. This surge in chronic diseases has heightened the demand for surgical microscopes across various applications.

Furthermore, surgical microscopes are essential for minimally invasive surgeries, allowing surgeons to operate with remarkable precision while minimizing bleeding, tissue scarring, and muscle damage. These instruments are indispensable in fields such as neurosurgery, dental surgery, ophthalmic surgery, otorhinolaryngology, and cosmetic surgery. The continuous introduction of technologically advanced products enhances the demand for surgical microscopes due to their increased precision, superior illumination, and customizable features tailored to complex procedures.

International players such as Leica Microsystems and Zeiss are making significant contributions to the industry by offering automated, highly advanced, and robotic surgical microscopes with unparalleled precision. Ongoing product innovations have led to considerable enhancements in surgical microscopes. Key features such as illumination, magnification, optics, and video recording have drastically improved since their initial use in surgery. These advancements enable seamless integration with other operating tools, ensuring efficient visualization and illumination needed for micro incisional surgical techniques.

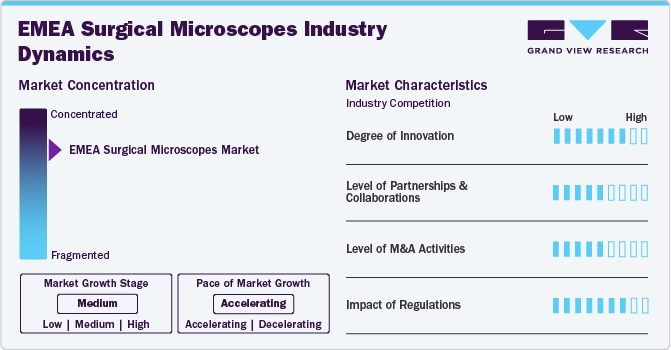

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various characteristics, including a degree of innovation, level of partnerships and collaborations, level of M&A activities, and impact of regulations. For instance, the market is consolidated, with many private and public players entering the market. The degree of innovation is high, the level of partnerships and collaborations is medium, the level of M&A activities is medium, and the impact of regulations is high.

Degree of innovation is high. This sector is witnessing significant advancements, particularly in digitalization and integration of advanced technologies such as artificial intelligence and augmented reality. Innovations improve visualization during surgeries and facilitate better preoperative assessments, indicating a solid commitment from manufacturers to push the boundaries of surgical technology.

The level of partnerships and collaborations is medium, as companies seek strategic alliances to enhance their product offerings and expand their market reach. Collaborations occur between manufacturers, healthcare institutions, or research organizations to develop or improve new technologies. For instance, in December 2022, Leica Microsystems and ASI announced a partnership to commercialize a customizable microscope designed for advanced users.

The level of M&A activities is medium. Over the past few years, several acquisitions have occurred as larger firms seek to expand their product offerings and technological capabilities. For instance, in April 2022, Carl Zeiss Meditec AG announced its acquisition of two surgical instrument manufacturers, Katalyst Surgical LLC and Kogent Surgical LLC, to strengthen its role as a provider of surgical microscope solutions within the medical technology industry.

The impact of regulations is high as stringent guidelines govern product safety, efficacy, and quality assurance processes. Many companies invest considerable resources in clinical trials and filing regulatory applications to gain approval for their upcoming products. The EMA implemented stringent regulations and standards for medical devices, which significantly influenced the development and commercialization of surgical microscopes.

Type Insights

The on-casters microscopes segment held the largest revenue share over 79% in 2024, driven by advancements in technology and increasing demand for minimally invasive surgical procedures. On-casters are designed to be mobile and versatile, allowing surgeons to easily maneuver them during operations, which enhances workflow efficiency and patient outcomes. The growing prevalence of conditions requiring surgical intervention, such as neurological disorders and ophthalmic surgeries, further drives this segment’s growth as healthcare facilities seek to improve their operational capabilities.

On-caster equipment offers several advantages, including easy repositioning and efficient maneuverability that require minimal effort, helping to shorten operation times. This functionality makes them applicable across various surgical fields, such as dental, ophthalmology, neurosurgery, cosmetic procedures, and ENT, resulting in high demand for these products. Ceiling-mounted devices, attached to the ceiling via a telescoping column, are typically installed in surgical rooms for procedures such as neurosurgery, microsurgery, and ophthalmology, as well as in dental surgery cabinets. These systems provide exceptional stability and vitality during neurosurgery and ophthalmic or plastic surgeries while offering similar flexibility to floor-mounted microscopes.

Application Insights

The ophthalmic surgery segment dominated the market with a revenue share of more than 37% in 2024 due to the increasing prevalence of eye disorders, technological advancements, rise in government initiatives and high volume of cataract surgeries. According to the World Health Organization (WHO), in August 2023, around 2.2 billion people experience near or distant vision impairment. Technological advancements in surgical microscopes, including improved optics, digital imaging capabilities, and integration with other surgical tools, have driven their adoption in ophthalmic surgeries.

The ENT surgery segment is expected to grow at the highest CAGR from 2025 to 2030 owing to the growing prevalence of otolaryngology & brain disorders and the penetration of advanced techniques involving microscopes. Enhanced visualization and precision provided by surgical microscopes are crucial in ENT surgeries, allowing for better outcomes and quicker recovery times. For instance, procedures such as tympanoplasty and sinus surgery benefit significantly from high-quality surgical microscopes, making them essential tools in modern ENT practices.

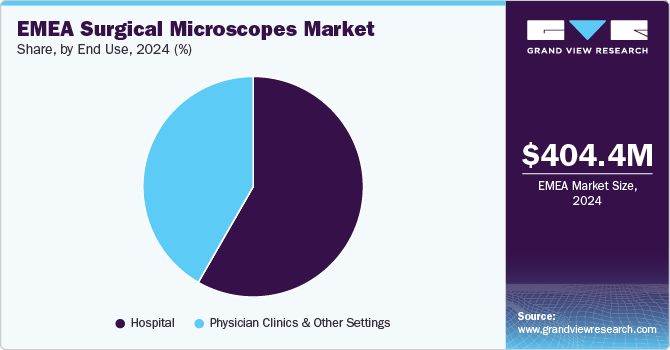

End Use Insights

The hospital segment held the largest revenue share over 58% in 2024. The segment is driven by the increasing demand for advanced surgical procedures and the growing prevalence of chronic diseases requiring complex surgeries. Hospitals are adopting these microscopes due to their ability to enhance precision and outcomes in various specialties, including neurosurgery and ENT procedures. The growing prevalence of chronic diseases requiring surgical intervention increased the demand for surgical microscopes in hospital settings.

The physician clinics & other settings segment is expected to grow at the fastest CAGR from 2025 to 2030. The market is driven by an increasing demand for advanced medical care and a shift towards outpatient procedures. Factors contributing to this growth include the rising preference for minimally invasive surgeries, which require precise visualization that surgical microscopes provide, allowing for quicker recovery times and reduced hospital stays.

Country Insights

The Europe surgical microscopes market is driven by technological advancements and increasing demand for minimally invasive surgeries. Innovations such as digital imaging, enhanced visualization capabilities, and ergonomic designs are becoming standard features in new product launches. Companies focus on integrating artificial intelligence (AI) into surgical microscopes to improve procedure precision and outcomes.

A focus on innovation and patient-centric solutions characterizes the surgical microscopes market in the UK. The National Health Service (NHS) is adopting advanced surgical technologies to enhance patient care, which led to a rise in demand for high-quality surgical microscopes. The ongoing training programs for surgeons on using these advanced systems contribute to their growing acceptance within the healthcare community.

Germany surgical microscopes market is due to its robust healthcare infrastructure and commitment to research and development. The product launches feature innovative technologies such as 3D visualization systems and integrated imaging solutions that enhance surgical precision. For instance, in March 2024, ZEISS Medical Technology presented its latest 3D visualization and surgical innovations at the ASCRS conference in Boston from April 5-8, 2024. These advancements enhance data integration and management across cataract and refractive workflows, setting a new standard for personalized ophthalmic care.

Middle East And Africa (MEA) Surgical Microscopes Market Trends

The surgical microscopes market in MEA is expected to witness steady growth over the forecast period, mainly due to the rising demand for advanced surgical tools in healthcare facilities across the region. Factors such as an increasing prevalence of chronic diseases requiring surgical interventions, growing investments in healthcare infrastructure, and an expanding medical tourism industry in countries such as the UAE and South Africa contribute to this growth. Technological advancements, including integration with robotics and AI for enhanced precision, are expected to drive the adoption. However, challenges such as limited access to advanced healthcare technologies in certain areas and cost constraints in low-income countries may hinder market growth. Key players focus on collaborations and product launches to address these barriers and tap into the region's growing healthcare needs.

Key EMEA Surgical Microscopes Company Insights

Product launches and research initiatives aimed at expanding product portfolios are crucial strategies for these companies to enhance their share in the industry. For instance, in March 2021, Olympus Corp. launched EASYSUITE, its advanced OR integration solution, in the EMEA region. This launch was intended to advance digitalization in surgical procedures and reinforce the company's leadership position in the EMEA market.

Key EMEA Surgical Microscopes Companies:

- Zeiss

- Olympus Corp.

- Leica Microsystems

- Alcon, Inc.

- Takagi Seiko Co., Ltd.

- Topcon Corp.

- Haag-Streit Surgical Gmbh

- ARI Medical Technology Co., Ltd.

- Synaptive Medical

- Chammed Co., Ltd.

- Atmos Medizintechnik GmbH & Company KG

- Intamed

- Al Amin Medical Instruments Co. Ltd.

Recent Developments

-

In January 2024, Leica Microsystems introduced an enhanced version of the ARveo 8 microscope designed for neurosurgery, featuring a 3D view and augmented reality fluorescence capabilities.

-

In June 2023, Olympus Corporation set up a series of digital excellence centers (DRCs) following its acquisition of Odin Vision. This initiative created AI-driven diagnosis and treatment solutions for chronic diseases, utilizing surgical microscopes to enhance medical fields such as endoscopy.

EMEA Surgical Microscopes Market Report Scope

Report Attribute

Details

Market Size in 2025

USD 447.52 million

Revenue Forecast in 2030

USD 761.89 million

Growth rate

CAGR of 11.23% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, application, end use, country

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; South Africa; Saudi Arabia; Egypt; UAE; Kuwait

Zeiss; Olympus Corp.; Leica Microsystems; Alcon, Inc.;

Takagi Seiko Co., Ltd.; Topcon Corp.; Haag-Streit Surgical Gmbh; ARI Medical Technology Co., Ltd.; Synaptive Medical; Chammed Co., Ltd.; Atmos Medizintechnik GmbH & Company KG; Intamed; Al Amin Medical Instruments Co. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

EMEA Surgical Microscopes Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the EMEA surgical microscopesindustry report based on type, application, end use, and country.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

On Casters

-

Wall Mounted

-

Tabletop

-

Ceiling Mounted

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgery and Spine Surgery

-

ENT Surgery

-

Dentistry

-

Gynecology

-

Urology

-

Ophthalmology

-

Plastic & Reconstructive Surgeries

-

Other Surgeries

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Physician Clinics and Other Settings

-

-

Europe Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

MEA Country Outlook (Revenue, USD Million, 2018 - 2030)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Egypt

-

Frequently Asked Questions About This Report

b. The EMEA surgical microscope market size was estimated at USD 404.38 million in 2024 and is expected to reach USD 457.52 million in 2025.

b. The EMEA surgical microscopes market is expected to grow at a compound annual growth rate of 11.23% from 2025 to 2030 to reach USD 761.89 million by 2030.

b. Europe dominated the EMEA surgical microscopes market with a share of 90% in 2024. This is attributable to European sophisticated healthcare facilities, technological advancements, and many hospitals offering advanced microsurgical procedures.

b. Some key players operating in the EMEA surgical microscopes market include Zeiss; Leica Microsystems; Alcon, Inc. (Novartis); Synaptive Medical; Haag-Streit Surgical GmbH; Topcon Corporation; Takagi Seiko Co., Ltd.; ATMOS MedizinTechnik GmbH & Co. KG.; ARI Medical Technology Co., Ltd.; Chammed Co. Ltd.; and Olympus Corporation.

b. Key factors that are driving the growth of EMEA surgical microscopes market include the introduction of technologically advanced products and the increasing demand for minimally invasive microsurgical procedures in developing countries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."