- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Europe, Middle East, And Africa Sports Nutrition Products Market Report, 2030GVR Report cover

![Europe, Middle East, And Africa Sports Nutrition Products Market Size, Share & Trends Report]()

Europe, Middle East, And Africa Sports Nutrition Products Market Size, Share & Trends Analysis Report By Category (Sports Protein Products, Sports Non Protein Products), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-464-8

- Number of Report Pages: 142

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

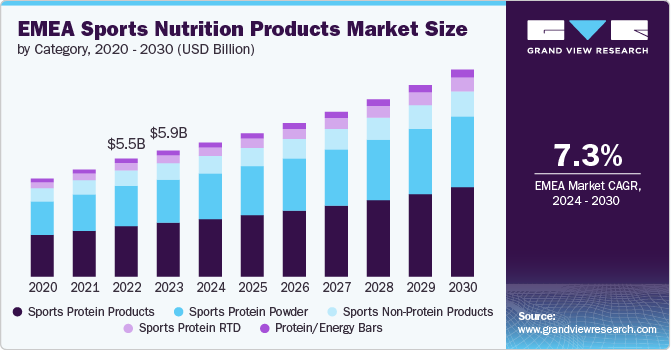

TheEurope, Middle East & Africa sports nutrition products market size was estimated at USD 5.88 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. Growing awareness of health and fitness among consumers has led to a significant shift toward healthier lifestyles, with more individuals engaging in regular physical activity, whether for professional sports, fitness, or general well-being. As people become more health conscious, the demand for sports nutrition products to enhance performance, aid in recovery, and support overall health goals is increasing. This trend is expected to be the primary driver for the demand and growth of the sports nutrition products market in the region during the forecast period.

Rising consumer awareness and adoption of healthier and active lifestyles are significant drivers for the market, influencing both demand and market dynamics. As consumers become increasingly informed about the benefits of nutrition and exercise, their preferences shift toward products that support a healthy, active lifestyle. This trend is fueled by a variety of factors, including increased access to health information, growing awareness of lifestyle-related health issues, and the influence of fitness culture.

The expansion of digital media and health information sources has played an important role in raising consumer awareness. With the proliferation of health blogs, fitness apps, and social media platforms, consumers are now more knowledgeable about nutrition, exercise, and wellness. For example, the rise of fitness influencers on Instagram and YouTube has created a culture where individuals actively seek advice on healthy living and sports nutrition. This accessibility to information empowers consumers to make informed choices about their diets and exercise routines, driving demand for sports nutrition products that align with their health goals.

The 2023 Sports Nutrition and Weight Management Report by Nutrition Business Journal (NBJ) revealed that 63% of sports nutrition consumers prioritize overall health improvement, while only 39% are primarily focused on enhancing sports performance. In addition, the report identifies the growing interest in healthy aging as a key factor driving market demand.

A growing awareness of lifestyle-related health issues, such as obesity, cardiovascular disease, and diabetes, has also contributed to the increasing adoption of healthier lifestyles. In the EMEA region, the prevalence of these health conditions has led to a heightened focus on preventive health measures. For instance, the new WHO European Regional Obesity Report 2022 reveals that almost two-thirds of adults and 1 in 3 children in the WHO European region live with overweight or obesity, and these rates are growing, prompting consumers to seek out products that support weight management and overall health. As a result, sports nutrition products are becoming integral to the diets of individuals, aiming to improve their health and prevent disease.

Fitness culture and the popularity of physical activities further drive the demand for sports nutrition products. The growing participation in sports and exercise activities, from casual workouts to competitive athletics, has created a substantial market for products designed to enhance performance, recovery, and overall fitness. Events such as marathons, triathlons, and fitness expos have become increasingly popular across the EMEA region, highlighting the rising interest in active lifestyles. This trend is reflected in the success of sports nutrition brands catering to amateur and professional athletes, offering products such as pre-workout supplements, recovery formulas, and energy bars.

Market Concentration & Characteristics

Manufacturers in the EMEA sports nutrition products market are actively engaged in various initiatives to meet evolving consumer demands and market trends.

The market has witnessed a surge in innovation, driven by advancements in ingredient science, product formulations, and packaging. Companies are focusing on developing functional products with clean labels, natural ingredients, and added benefits like protein blends, plant-based nutrition, and enhanced bioavailability. Consumer preferences for personalized nutrition and wellness solutions have also led to the development of customized sports supplements, creating a competitive edge for brands that prioritize innovation.

Mergers and acquisitions have been pivotal in shaping the market. Leading players are actively acquiring smaller brands to expand their portfolios, gain market share, and enhance their presence in niche categories like vegan and organic sports nutrition. Strategic acquisitions have also enabled companies to penetrate untapped markets, access new distribution channels, and strengthen their R&D capabilities, contributing to the overall growth of the industry.

Regulatory frameworks across the EMEA region have played a crucial role in shaping the market. Stricter guidelines on health claims, product labeling, and ingredient safety have forced manufacturers to comply with regional standards, ensuring product quality and consumer safety. Regulatory bodies such as EFSA (European Food Safety Authority) have stringent approval processes for novel ingredients, impacting the speed of product launches. However, the alignment of regulations across different countries has also facilitated easier market entry for global brands.

The EMEA market faces growing competition from a variety of product substitutes. Consumers are increasingly opting for whole foods, functional beverages, and plant-based alternatives that offer similar benefits to traditional sports supplements. Products like protein-enriched snacks, ready-to-drink shakes, and fortified meal replacements are gaining popularity as convenient, health-focused options. This shift in consumer preferences poses a challenge to traditional sports nutrition products,

Product launches in the market have accelerated, with brands introducing new offerings tailored to evolving consumer demands. Recent launches focus on plant-based proteins, clean-label products, and supplements catering to specific dietary needs, such as keto, paleo, and gluten-free. Innovations in product formats, including ready-to-drink options, energy bars, and protein powders, are driving market growth. The introduction of technologically advanced supplements aimed at enhancing athletic performance and recovery is also gaining traction, appealing to a broader audience beyond professional athletes.

Category Insights

Sports protein products accounted for a revenue share of 76.6% in 2023. The increasing awareness of the important role that protein plays in muscle building, recovery, and overall fitness has significantly increased the demand for sports protein products. Protein is essential for muscle repair and growth, especially after strenuous physical activity. As more people engage in regular exercise, whether for bodybuilding, endurance sports, or general fitness, the need for adequate protein intake has become widely recognized. This has made sports protein products-such as powders, bars, and ready-to-drink (RTD) shakes-more popular as they offer a convenient way to meet these nutritional needs.

The sports non-protein products market is expected to grow at a CAGR of 6.4% from 2024 to 2030. Consumers are becoming more knowledgeable about their specific nutritional needs beyond protein intake, leading to growing interest in products that offer energy, hydration, recovery, endurance, and cognitive benefits. Non-protein products, such as energy gels, electrolyte drinks, and pre-workout supplements, cater to these varied needs, driving growth in this segment.

Distribution Channel Insights

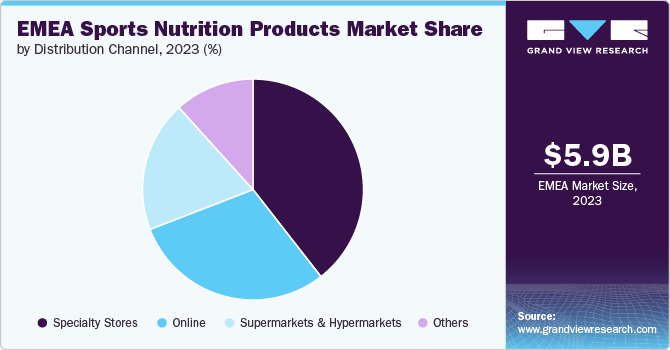

The sales of sports nutrition products through specialty stores accounted for a 39.5% share in 2023. Specialty stores dedicated to sports nutrition and fitness products offer a curated selection tailored specifically to athletes and fitness enthusiasts. These stores provide a focused product range that includes niche items and high-quality supplements often unavailable in general retail channels.

They frequently carry exclusive or premium sports nutrition brands not commonly found in hypermarkets, supermarkets, or convenience stores. Moreover, specialty stores in the sports nutrition market typically employ staff with specialized knowledge in fitness and nutrition, enabling them to offer personalized advice and recommendations tailored to individual customer needs. As a result, specialty stores are expected to remain the dominant sales channel during the forecast period.

The sales of sports nutrition products through online channels are expected to grow at a CAGR of 8.5% from 2024 to 2030. Online platforms often offer a much wider variety of sports nutrition products than physical stores. This includes international brands, niche products, and hard-to-find items that may not be available in local specialty stores or hypermarkets. Furthermore, online channels offer unparalleled convenience, allowing consumers to purchase sports nutrition products from the comfort of their homes, thus driving sales through this channel during the forecast period.

Regional Insights

The Europe sports nutrition products market accounted for an 80.3% share of the EMEA market in 2023. Furthermore, the regional market is expected to grow at a CAGR of 4.9% from 2024 to 2030. In Europe, there is a growing awareness of the importance of health and fitness. More people are engaging in regular physical activities such as running, cycling, and gym workouts. This trend is particularly strong in Western Europe, where a significant portion of the population is prioritizing active lifestyles. According to the European Commission, nearly 38% of the EU population engages in physical exercise at least once a week, driving demand for sports nutrition products that enhance performance and recovery in the region during the forecast period.

The leading claim in performance nutrition product launches across Europe is "high/added protein." While whey remains the dominant ingredient in sports nutrition products, there is a noticeable increase in interest in plant-based proteins. According to a survey published by Glanbia in 2022, 89% of sports nutrition consumers in the UK and France and 90% in Germany have experimented with sports nutrition products containing plant proteins.

The sports nutrition products market in the UK is experiencing growth, partly driven by a steady increase in gym memberships. According to a study published by Pure Gym Limited, 16% of the population in the UK held a gym membership in 2023, with a 2% increase from the previous year, reflecting that there is a clear trend of growing interest in fitness and wellness. This increase signifies a larger base of consumers who are likely to invest in sports nutrition products to enhance their workout results and improve recovery times. In addition, the segment of the population planning to join a gym in the next year remained significant at 16%, indicating a sustained demand for sports nutrition supplements, protein powders, and performance enhancers in the coming months.

MEA Sports Nutrition Products Market Trends

The Middle East & Africa sports nutrition products market is expected to grow at a CAGR of 5.5% from 2024 to 2030. In the Middle East, particularly in countries like the UAE and Saudi Arabia, there is a rising interest in fitness and wellness. Gym memberships have been growing rapidly, with many people adopting fitness regimes to combat lifestyle-related health issues such as obesity and diabetes. This trend is driving demand for sports nutrition products that support workout routines, such as protein powders, bars & RTDs.

Cultural and dietary preferences play a crucial role in shaping the MEA sports nutrition market. In the Middle East, there is a preference for halal-certified products, which influences product formulation and marketing strategies. Brands are adapting by offering sports nutrition products that meet these dietary requirements while aligning with local taste preferences. In Africa, the market is seeing a rise in demand for locally sourced and traditional ingredients incorporated into sports nutrition products, reflecting a preference for familiar and culturally relevant options.

Economic factors play a crucial role in shaping the sports nutrition market in South Africa. While there is a growing middle class with increased disposable income, there are still significant disparities in economic status across the country. This economic diversity influences purchasing behavior, with a segment of the population seeking premium sports nutrition products while others prefer more affordable options. Brands are adapting by offering a range of products at different price points to cater to various consumer segments.

Key Europe, Middle East, And Africa Sports Nutrition Products Company Insights

The competitive landscape of the market is characterized by a mix of global and regional players striving to capture a share of the growing demand for convenient and high-quality EMEA sports nutrition products. The market is also witnessing increased competition from private-label brands, especially as supermarkets and hypermarkets expand their in-house EMEA sports nutrition product offerings at competitive prices. Mergers and acquisitions are common strategies in this market as companies look to strengthen their market position and expand their geographical reach.

Key Europe, Middle East, And Africa Sports Nutrition Companies:

- Glanbia Plc

- The Hut Group (Myprotien)

- KRÜGER GROUP

- PepsiCo

- Abbott

- RAUCH SPORT Isotonic

- Herblife

- Olvi Plc

- United Soft Drinks

- USN - ultimate sports nutrition

Recent Developments

-

In July 2024, Myprotein announced an extension of its exclusive multi-year partnership with HYROX, the sport focused on fitness racing. As the official global nutrition partner, Myprotein aims to enhance its presence in all international races. This initiative aims to bring together the fitness community through various activations led by a diverse group of ambassadors and athletes. To celebrate this collaboration, Myprotein launched a unique product line developed in conjunction with HYROX, specifically designed to cater to the needs of hybrid athletes. The Myprotein x HYROX product range is curated to support various phases of a hybrid workout regimen, ensuring optimal training performance before, during, and after workouts.

-

In July 2024, THG collaborated with WH Smith to allow its online sports nutrition brand Myprotein to provide a selection of its products in more than 300 WH Smith locations across the U.K. These products will be available in WH Smith’s high street outlets as well as in its travel stores located at airports, train stations, hospitals, workplaces, and motorway service areas.

-

In March 2024, Optimum Nutrition, a brand under Glanbia, launched a new global communications campaign titled “Unlock More You” in partnership with TBWA, an advertising agency. The campaign aims to resonate with the company’s audience and promote the idea of unlocking one’s full potential through its products and the right mindset.

-

In March 2024, Optimum Nutrition announced that it is significantly boosting its investments in the Middle East, Turkey, and Africa. The company is broadening its presence by promoting holistic fitness awareness, collaborating with government-led initiatives, and engaging athletic communities with expert and credible guidance.

-

In January 2024, Myprotein announced its role as the official nutrition partner for HYROX, the global fitness racing sport, for the upcoming 2024 season. This collaboration will enable both brands to deliver comprehensive nutritional support for HYROX participants. The innovative fitness racing competition has seen remarkable growth, expanding to over 20 countries and engaging 175,000 participants during the ‘'23/‘24 season.

Europe, Middle East, And Africa Sports Nutrition Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.26 billion

Revenue forecast in 2030

USD 9.57 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, distribution channel, region

Regional scope

Europe; Middle East & Africa

Country scope

Germany; UK; France; Spain; Italy; South Africa; Saudi Arabia; UAE

Key companies profiled

Glanbia Plc; The Hut Group (Myprotien); KRÜGER GROUP; PepsiCo; Abbott; RAUCH SPORT Isotonic; Herblife; Olvi Plc; United Soft Drinks; USN - ultimate sports nutrition

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe, Middle East, And Africa Sports Nutrition Products Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the latest industry trends and opportunities in each segment from 2018 to 2030. For this study, Grand View Research has segmented the EMEA sports nutrition products market report based on the category, distribution channel, and region.

-

Category Outlook (Revenue, USD Billion; Volume, Units, 2018 - 2030)

-

Sports Protein Products

-

Protein/Energy Bars

-

Sports Protein Powder

-

Sports Protein RTD

-

-

Sports Non-Protein Products

-

-

Distribution Channel Outlook (Revenue, USD Billion; Volume, Units, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Online

-

Specialty Stores

-

Others

-

-

Regional Outlook (Revenue, USD Billion; Volume, Units, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the market include Glanbia Plc, The Hut Group (Myprotien), KRÜGER GROUP, PepsiCo, Abbott, RAUCH SPORT Isotonic, Herblife, Olvi Plc, United Soft Drinks, and USN - ultimate sports nutrition

b. Growing awareness of health and fitness among consumers has led to a significant shift toward healthier lifestyles, with more individuals engaging in regular physical activity, whether for professional sports, fitness, or general well-being. As people become more health conscious, the demand for sports nutrition products to enhance performance, aid in recovery, and support overall health goals is increasing.

b. The Europe, Middle East & Africa sports nutrition products market size was estimated at USD 5.88 billion in 2023 and is expected to reach USD 6.26 billion in 2024.

b. The Europe, Middle East & Africa sports nutrition products market is expected to grow at a compounded growth rate of 7.3% from 2024 to 2030 to reach USD 9.57 billion by 2030.

b. The Europe sports nutrition products market accounted for an 80.3% share of the EMEA market in 2023. More people are engaging in regular physical activities such as running, cycling, and gym workouts. This trend is particularly strong in Western Europe, where a significant portion of the population is prioritizing active lifestyles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."