- Home

- »

- Plastics, Polymers & Resins

- »

-

EMEA POP Packaging Market Size, Industry Report, 2030GVR Report cover

![EMEA POP Packaging Market Size, Share & Trends Report]()

EMEA POP Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Counter Display, Floor Display, Pallet Display), By Material (Paper, Foam, Plastic, Metal, Glass), By Application, By End Use, And Segment Forecasts

- Report ID: GVR-2-68038-754-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

EMEA POP Packaging Market Size & Trends

The EMEA POP packaging market was valued at USD 4.42 billion in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2030. The booming organized retail market, which includes hypermarkets, supermarkets, and convenience stores, drives this growth in emerging economies. These retail formats increasingly adopt point of purchase (POP) packaging to enhance product visibility and attract customers, as the primary goal of POP packaging is to influence consumer behavior.

In addition, the rising demand for effective and personalized marketing strategies has led to the increased use of POP displays, allowing for targeted marketing messages tailored to specific stores or regions. The pharmaceutical industry, fueled by the proliferation of drug specialty stores, also contributes significantly to the market, as strategic product displays are essential for optimizing store performance and efficient floor planning.

The EMEA POP packaging market is currently being shaped by the increasing emphasis on sustainability, with a growing demand for recyclable and eco-friendly materials. Both consumer preferences and regulatory pressures drive this shift. In addition, the rise of e-commerce has led to a greater need for innovative and durable packaging solutions that can withstand the rigors of shipping while still being visually appealing.

Another emerging trend is the integration of digital technologies, such as QR codes and augmented reality, into POP displays. This enhances customer engagement and provides interactive shopping experiences. The market is expected to see further advancements in personalized and targeted marketing strategies, leveraging data analytics to create more effective and customized POP displays.

Product Insights

The pallet display segment dominated the market in terms of revenue share of 27.7% in 2024 as they are favored for their versatility and efficiency in showcasing a wide range of products, from food and beverages to electronics and personal care items. These displays are designed to maximize product visibility and accessibility, often featuring interior support structures that enhance stability and product arrangement. Retailers highly value pallet displays for their capacity to optimize stocking procedures and minimize labor expenses. This is since products can be arranged in different configurations, such as alternating or chimney stacking, leading to streamlined processes and reduced costs.

The growing popularity of pallet skirts, which add aesthetic appeal and branding opportunities, further boosts the adoption of pallet displays across the region. As the organized retail sector continues to expand, the demand for pallet displays is expected to remain robust, driven by their practicality and cost-effectiveness.

The sidekick display segment is expected to grow at a CAGR of 4.8% over the forecast period. Sidekick displays are compact and strategically placed at eye level, making them ideal for impulse purchases and promotional items. Their ability to capture consumer attention in high-traffic areas, such as checkout counters and aisle endcaps, makes them a valuable tool for retailers aiming to boost sales of specific products.

The increasing focus on personalized and targeted marketing strategies also drives the demand for sidekick displays, as they allow for easy customization and frequent updates to align with promotional campaigns. Moreover, digital printing and materials technology advancements enhance the durability and visual appeal of sidekick displays, making them more attractive to retailers and consumers.

Material Insights

The paper segment dominated the EMEA POP packaging market in 2024. Paper-based materials, including cardboard and paperboard, are highly favored for their eco-friendly properties and recyclability, aligning with the growing consumer and regulatory emphasis on sustainability. Due to their lightweight nature and ease of customization, these materials are extensively used in various types of POP displays, such as counter displays, pallet displays, and dump bin displays.

The ability to print high-quality graphics on paper-based materials enhances their visual appeal, making them an attractive choice for brands aiming to create impactful in-store marketing campaigns. Moreover, the cost-effectiveness of paper materials compared to other options contributes to their dominance in the market.

The plastic segment is expected to grow fastest from 2025 to 2030. The demand for plastic in POP packaging is driven by its durability, flexibility, and ability to create intricate and eye-catching designs. Plastic materials, such as PET, PVC, and polypropylene, offer superior strength and resistance to damage, making them ideal for displays that need to withstand frequent handling and transportation.

The versatility of plastic allows for the creation of various display types, including gravity feed displays, clip strip displays, and side kick displays, which are essential for high-traffic retail environments. Moreover, advancements in plastic recycling technologies address environmental concerns, making recycled plastics a more viable option for sustainable packaging.

Application Insights

Hypermarkets contributed the largest share of total revenue in 2024. These large retail environments, known for their vast floor space and extensive product range, heavily rely on POP packaging to enhance product visibility and drive sales. Various POP displays, such as pallet displays, floor displays, and dump bin displays, help organize products efficiently and attract customer attention.

The ability to showcase a wide array of products in an appealing manner is crucial for hypermarkets, as it directly influences consumer purchasing decisions. In addition, the high foot traffic in hypermarkets provides ample opportunities for brands to implement targeted marketing strategies through POP displays, further boosting their effectiveness.

Convenience stores are expected to grow at a CAGR of 5.3% over the forecast period. Convenience stores, characterized by their smaller size and quick shopping experience, are increasingly adopting POP packaging to maximize their limited space and enhance product visibility. Sidekick displays, counter displays, and clip strip displays are particularly popular in convenience stores due to their compact size and ability to promote impulse purchases. The growing trend of urbanization and the increasing number of convenience stores in urban areas are key factors driving the demand for POP packaging in this segment.

End Use Insights

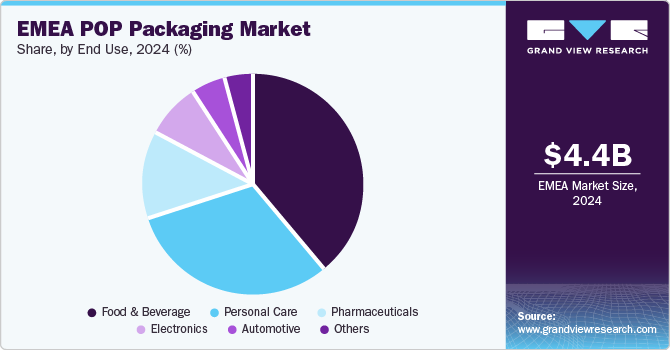

The food & beverage segment contributed 38.3% of total revenue in 2024 driven by the high demand for visually appealing and functional packaging solutions that enhance product visibility and attract consumer attention in a competitive retail environment. POP displays in this segment, such as pallet displays, counter displays, and floor displays, are extensively used to promote a wide range of products, including snacks, beverages, dairy products, and confectionery.

The ability to customize these displays with vibrant graphics and branding elements makes them an effective tool for driving impulse purchases and increasing brand recognition. In addition, the growing trend of health-conscious and convenience-oriented consumers is prompting brands to innovate their packaging designs to highlight product benefits and nutritional information.

The pharmaceuticals segment is expected to experience significant growth during the forecast period. The increasing number of drug specialty stores and the rising demand for over-the-counter (OTC) medications are key factors driving the need for effective POP packaging in this segment. POP displays in the pharmaceutical industry, such as sidekick displays, clip strip displays, and counter displays, are designed to maximize space utilization and enhance product accessibility in retail settings.

These displays are crucial in promoting new products, providing educational information, and ensuring compliance with regulatory requirements for product labeling and safety. The growing focus on personalized and targeted marketing strategies also contributes to segment growth, as POP displays can be easily customized to cater to specific consumer demographics and regional preferences.

Key EMEA POP Packaging Company Insights

Some of the key companies in the EMEA POP packaging market include International Paper, Menasha Packaging Company, Sonoco Products Company, Smurfit Westrock Limited, and DS Smith Plc, among others.

-

Menasha Packaging Company, LLC is known for its sustainable packaging and merchandising solutions. The company offers a wide range of custom shipping boxes, displays, and packs.

-

Felbro, Inc. specializes in designing and manufacturing custom POP displays. These products are manufactured with molded plastics, acrylic, wood, sheet metal, and tubing.

Key EMEA POP Packaging Companies:

- International Paper

- DS Smith Plc

- Smurfit Kappa Display

- Sonoco Products Company

- Menasha Packaging Company, LLC

- Georgia-Pacific LLC

- WestRock Company

- Felbro, Inc.

- Fencor Packaging Group Limited

- FFR Merchandising

Recent Developments

-

In July 2024, Smurfit Kappa Group Plc and Westrock Company merged to form a new entity, Smurfit Westrock Limited. This strategic merger has established the company's prominent position in the sustainable packaging industry, positioning the new entity as a key partner for clients worldwide.

-

In February 2023, International Paper announced an investment of over USD 22 million in its French operations to address the growing demand for sustainable corrugated packaging within the e-commerce sector. The company's facilities in Mortagne and Chalon were expected to undergo strategic upgrades to enhance their production capacity, aligning with the rapid growth of online retail and enabling the delivery of even more environmentally friendly packaging solutions to customers.

EMEA POP Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.66 billion

Revenue forecast in 2030

USD 5.60 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, end use, region

Region scope

North Europe, West Europe, South Europe, Central Europe, East Europe, Russia, Turkey, North Africa, West Africa

Key companies profiled

International Paper, DS Smith Plc, Smurfit Westrock Limited, Sonoco Products Company, Menasha Packaging Company, LLC, Georgia-Pacific LLC, Felbro, Inc., Fencor Packaging Group Limited, FFR Merchandising

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

EMEA POP Packaging Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the EMEA POP packaging market report based on product, material, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Counter Display

-

Floor Display

-

Gravity Feed Display

-

Pallet Display

-

Side Kick Display

-

Dump Bin Display

-

Clip Strip Displays Pouches

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper

-

Foam

-

Plastic

-

Glass

-

Metal

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket

-

Supermarket

-

Departmental Stores

-

Specialty Stores

-

Convenience Stores

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Personal Care

-

Pharmaceuticals

-

Electronics

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

North Europe

-

West Europe

-

South Europe

-

Central Europe

-

East Europe

-

Russia

-

-

Middle East & Africa

-

Turkey

-

North Africa

-

West Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.