Europe, Middle East & Africa Outdoor Candle Market Size, Share & Trends Analysis Report By Wax Type (Paraffin, Soy Wax), By Distribution Channel (Online, Offline), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-338-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Europe, MEA Outdoor Candle Market Trends

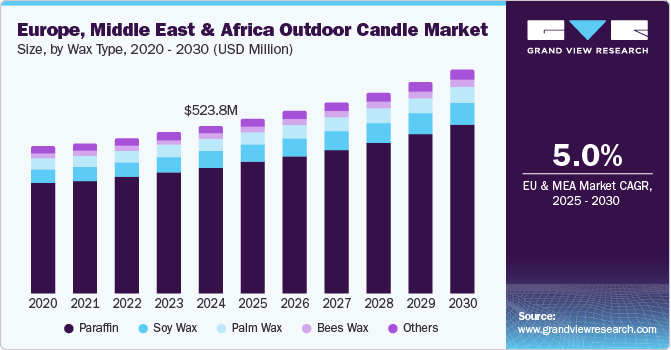

The Europe, Middle East & Africa outdoor candle market size was valued at USD 523.8 million in 2024 and is expected to grow at a CAGR of 5.0% from 2025 to 2030. This growth is attributed to the growing consumer interest in outdoor living spaces, and ambiance enhancement has led to a surge in demand for candles designed for outdoor use. In addition, the rising trend of eco-friendly products, including natural wax options such as soy and beeswax, aligns with health-conscious consumer preferences. Furthermore, seasonal festivities and social gatherings further boost sales, as outdoor candles often create inviting atmospheres during events and celebrations.

An outdoor candle, also known as a pitch torch or garden candle, is designed for outdoor use and provides both illumination and ambiance in various settings. The increasing popularity of outdoor spas and aromatherapy reflects a consumer desire to connect with nature, driving demand for related products. Candle therapy has emerged as a preferred choice due to its potential benefits in alleviating ailments such as back pain and anxiety. Restaurants and upscale dining venues increasingly incorporate outdoor candles to enhance their atmosphere.

Outdoor candles play a vital role in celebrations, religious events, and social gatherings, offering lighting and a calming effect that enriches the experience. Their usage rises significantly during the festive season, creating inviting environments for various occasions. Furthermore, themed outdoor parties and weddings contribute significantly to market demand.

Moreover, expanding spas and wellness centers throughout Europe, the Middle East, and Africa further propels market growth. Hotels and resorts' investments in outdoor wellness treatments present new opportunities for outdoor candle sales.

Wax Type Insights

The paraffin wax led the market and accounted for the largest revenue share of 75.2% in 2024, driven by its cost-effectiveness and versatility. Paraffin wax is widely used in candle manufacturing because it holds fragrance well and provides a consistent burn. Furthermore, its availability and established supply chains make it a preferred choice for manufacturers. Moreover, the increasing demand for decorative and functional outdoor candles, especially for events and gatherings, further fuels the consumption of paraffin wax in this segment.

Soy wax is expected to grow at a CAGR of 5.7% over the forecast period, owing to rising consumer awareness regarding sustainability and health. Soy wax is derived from renewable resources, making it an eco-friendly alternative to paraffin wax. In addition, as consumers increasingly seek clean-burning candles free from harmful chemicals, soy wax has become a popular choice for those prioritizing environmental impact. Furthermore, the growing trend of aromatherapy and wellness also contributes to the demand for soy wax candles, as they are often infused with essential oils, enhancing their appeal in the outdoor candle market.

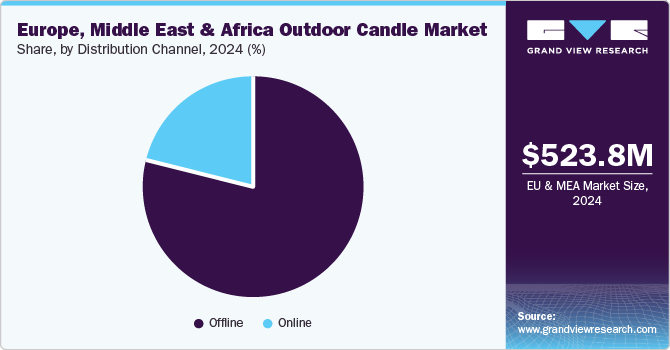

Distribution Channel Insights

Offline distribution channels dominated the market and accounted for the largest revenue share of 78.6% in 2024. This growth is attributed to the sensory experience they offer. Physical retail locations allow customers to see and smell candles before purchasing, which is crucial for many buyers seeking specific scents or aesthetics. In addition, stores such as supermarkets, specialty shops, and home decor retailers provide immediate gratification and a tactile shopping experience that online platforms cannot replicate. Furthermore, local community support and personalized customer service in these venues foster trust and brand loyalty, driving continued demand for outdoor candles in traditional retail settings.

The online distribution channels are expected to grow at a CAGR of 6.0% from 2025 to 2030, owing to the increasing convenience and accessibility of e-commerce platforms. Consumers appreciate the ability to browse various products from the comfort of their homes, often leading to impulse purchases. Furthermore, the rise of social media and influencer marketing further enhances online visibility, attracting more customers. Moreover, subscription services and direct-to-consumer models are gaining traction, providing personalized shopping experiences that cater to individual preferences.

Country Insights

Germany Outdoor Candle Market Trends

The outdoor candle market in Germany dominated the Europe and MEA market and accounted for the largest revenue share of 25.5% in 2024. This growth is attributed to the rising demand for artisanal and designer candles. Consumers are increasingly seeking high-quality, hand-poured options that enhance the aesthetic appeal of outdoor spaces. In addition, the strong cultural appreciation for craftsmanship and sustainability influences purchasing decisions, as many prefer eco-friendly materials. Furthermore, the popularity of outdoor gatherings and events further boosts candle sales, as they are often used to create inviting atmospheres during social occasions and celebrations.

UK Outdoor Candles Market Trends

The outdoor candle market in the UK is expected to grow at a CAGR of 6.1% over the forecast period, owing to a growing trend towards home wellness and relaxation. Consumers are increasingly investing in outdoor candles as part of their efforts to create serene environments in gardens and patios. In addition, the influence of social media also plays a crucial role, with lifestyle influencers promoting outdoor living spaces adorned with candles. Furthermore, seasonal festivities drive demand, as consumers seek decorative options that enhance their outdoor experiences during holidays and summer gatherings.

South Africa Outdoor Candles Market Trends

The growth of South Africa outdoor candle market is largely attributed to the increasing popularity of outdoor entertainment and socializing. Candles are essential for creating ambiance during barbecues, parties, and family gatherings, making them a staple in many households. In addition, the rise in eco-consciousness among consumers also drives interest in natural wax options, such as soy or beeswax candles. Furthermore, the vibrant local culture that celebrates various festivals encourages the use of candles for both decorative and functional purposes, further fueling market expansion.

Key Europe, Middle East & Africa Outdoor Candle Company Insights

Key players in the outdoor candle industry in Europe, the Middle East, and Africa include Yankee Candle, Scentsy, and IKEA. These companies are adopting various strategies to enhance their market presence. These include focusing on sustainability by developing eco-friendly products, such as plant-based waxes, to meet consumer demand for environmentally conscious options. Furthermore, companies are innovating by integrating smart technology into their products, offering features such as remote control and programmable settings. Moreover, strategic partnerships and collaborations with retailers are crucial in expanding distribution channels and increasing brand visibility.

-

IKEA offers a variety of products designed to enhance outdoor living spaces. The company manufactures outdoor candles that focus on functionality and aesthetic appeal, catering to consumers looking to create inviting atmospheres in gardens, patios, and balconies. Operating primarily in the home decor and furnishings segment, the company’s outdoor candle range includes options that are environmentally friendly, emphasizing sustainability and design.

-

Bolsius focuses on creating products that enhance the ambiance of outdoor settings, offering candles made from various wax types, including paraffin and natural options. The company operates within the candle manufacturing segment, providing products for both residential and commercial use. Their outdoor candle offerings are designed to meet consumer demands for durability, aesthetics, and eco-friendliness, making them suitable for various outdoor occasions and celebrations.

Key Europe, Middle East & Africa Outdoor Candle Companies:

- Yankee Candle

- Scentsy

- IKEA

- Bolsius

- PartyLite

- Cire Trudon

- La Jolíe Muse

- Diptyque

- Nest Fragrances

- WoodWick

Recent Developments

-

In November 2024, Yankee Candle launched its Passport to the Holidays" collection, featuring six festive fragrances inspired by global holiday traditions. This collection includes scents such as Big Apple Christmas and Parisian Holiday Brunch, designed to create inviting atmospheres for both indoor and outdoor candle settings. Furthermore, the brand introduces the Après Ski collection, evoking cozy ski lodge vibes. Both collections are part of Yankee Candle's campaign to enhance meaningful moments through fragrance, available at various retailers and online.

Europe, Middle East & Africa Outdoor Candle Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 569.8 million |

|

Revenue forecast in 2030 |

USD 696.7 million |

|

Growth rate |

CAGR of 5.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Wax type, distribution channel, country. |

|

Regional scope |

Europe, Middle East & Africa. |

|

Country scope |

UK, Germany, France, South Africa |

|

Key companies profiled |

Yankee Candle; Scentsy; IKEA; Bolsius; PartyLite; Cire Trudon; La Jolíe Muse; Diptyque; Nest Fragrances; WoodWick. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe, Middle East & Africa Outdoor Candle Market Report Segmenation

This report forecasts revenue growth at regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Europe, Middle East & Africa outdoor candle market report based on wax type, distribution channel, and country.

-

Wax Type Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Paraffin

-

Soy Wax

-

Bees Wax

-

Palm Wax

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe, Middles East & Africa

-

UK

-

Germany

-

France

-

South Africa

-

Rest of EMEA

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."