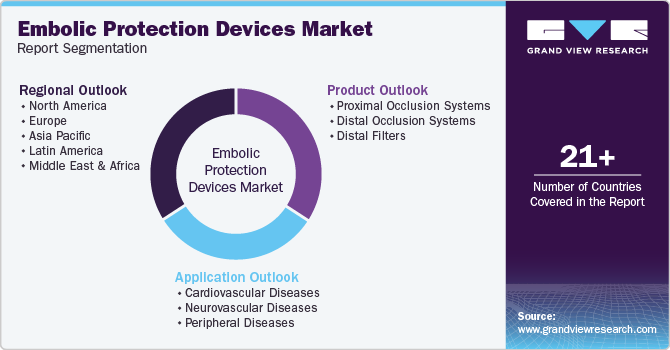

Embolic Protection Devices Market Size, Share & Trends Analysis Report By Product (Proximal Occlusion Systems, Distal Occlusion Systems, Distal Filters), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-483-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Embolic Protection Devices Market Trends

The global embolic protection devices market size was estimated at USD 658.1 million in 2024 and is projected to grow at a CAGR of 8.9% from 2025 to 2030. The rising prevalence of cardiovascular diseases has emerged as a leading catalyst in this market. In 2023, cardiovascular diseases accounted for approximately 17.9 million deaths globally, establishing them as a predominant cause of mortality. Projections indicated that by 2024, roughly one in three adults in the U.S. would be affected by some form of heart disease. This alarming trend heightens the urgency for effective interventions, increasing demand for embolic protection devices that prevent complications during cardiovascular procedures.

The growing preference for minimally invasive surgical techniques has further bolstered market dynamics. In 2023, an estimated 1.5 million minimally invasive cardiovascular procedures, including angioplasty and stenting, were conducted in the U.S. Since these procedures inherently carry risks of debris entering the bloodstream, embolic protection devices have become vital for ensuring patient safety and enhancing recovery times. Consequently, the shift towards minimally invasive options is expected to propel market demand for these devices significantly.

Technological advancements also significantly influence the embolic protection devices market. Several hospitals in developed regions reported employing advanced embolic protection devices during procedures, fueled by continuous innovations and improved device efficacy. These advancements enhance patient outcomes and encourage healthcare institutions to adopt best practices, driving the market’s growth trajectory.

Furthermore, the aging global population is a compelling driver for the market of embolic protection devices. The number of individuals aged 65 and older was approximately 1 billion in 2023, with projections indicating an increase to around 1.2 billion by 2024. This demographic is notably vulnerable to cardiovascular diseases, further underscoring the demand for effective embolic protection solutions. It is evident that the confluence of these factors will shape a robust and expanding market for embolic protection devices, highlighting their critical role in contemporary cardiovascular care.

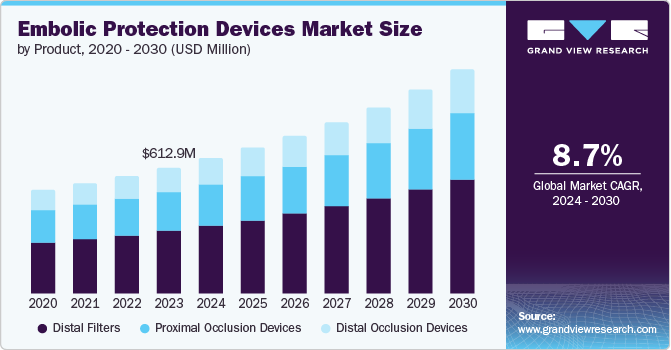

Product Insights

Distal filters accounted for the largest share of 48.0% in 2024 due to their ability to offer efficient protection against embolization during interventional procedures. These devices are designed to block the vessel at the end, preventing debris from moving downstream and leading to possible blockages. Moreover, distal occlusion devices improve navigability and traceability, allowing accurate placement and removal. The growing demand for less invasive procedures and the rising incidence of cardiovascular diseases fuel the penetration of distal occlusion devices.

Distal occlusion systems are projected to witness the fastest growth of 9.3% over the forecast period. Distal occlusion systems effectively prevent embolization during invasive cardiovascular procedures, thereby reducing the risk of complications such as myocardial infarction and stroke. Their growing adoption is driven by increasing cardiovascular disease prevalence, technological advancements, a trend toward minimally invasive surgeries, and strong regulatory support from medical associations advocating their use.

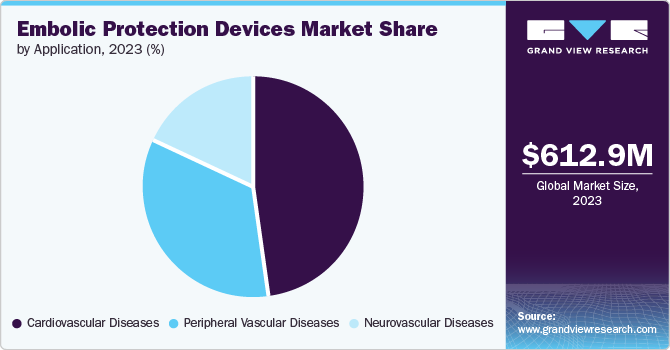

Application Insights

Cardiovascular diseases held the highest revenue share of 43.1% in 2024. The escalating prevalence of cardiovascular diseases, including peripheral arterial disease and coronary artery disease, is significantly driving the demand for embolic protection devices. Ongoing advancements in device technology, coupled with a strong shift toward minimally invasive surgical techniques, an aging population, and supportive healthcare expenditure and reimbursement policies, further facilitate the adoption of these essential medical solutions in cardiovascular interventions.

Neurovascular diseases are projected to grow at a CAGR of 7.9% over the forecast period. The growing incidence of neurovascular conditions, such as ischemic stroke and transient ischemic attacks, drives demand for embolic protection devices. Technological advancements, an aging population susceptible to neurovascular diseases, and increased awareness among healthcare professionals promote the adoption of these devices in minimally invasive neurovascular interventions, enhancing patient safety and treatment outcomes.

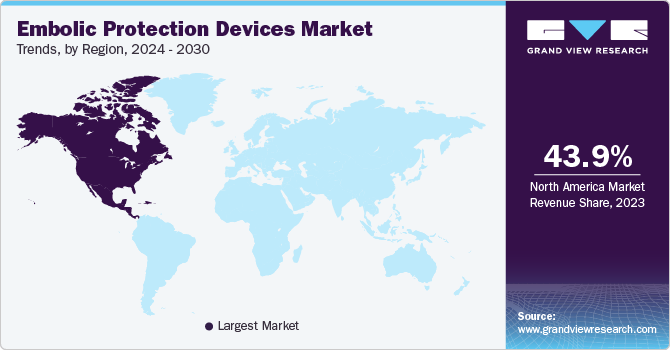

Regional Insights

North America embolic protection devices market dominated the global market with a revenue share of 29.1% in 2024. The high prevalence of cardiovascular and neurovascular diseases in North America, with around 805,000 heart attacks occurring annually in the U.S., significantly drives the demand for effective embolic protection devices during surgical interventions. The region’s advanced healthcare infrastructure, equipped with cutting-edge technologies, enhances the adoption of these devices. Continuous technological innovations improve safety features and efficacy, while the growing aging population increases demand for effective interventions. Moreover, favorable reimbursement policies promote accessibility, encouraging healthcare providers to utilize advanced embolic protection solutions for better patient outcomes.

U.S. Embolic Protection Devices Market Trends

The embolic protection devices market in the U.S. dominated the North America embolic protection devices market with a revenue share of 77.7% in 2024. Industry growth in the country is attributed to the rising incidences of neurovascular and cardiovascular diseases and the growing demand for technologically advanced products. According to the U.S. Centers for Disease Control and Prevention, every year, about 805,00 people suffer from heart attack, and coronary heart disease is the most common heart disease that led to the death of 375,476 people in 2021.

Europe Embolic Protection Devices Market Trends

Europe embolic protection devices market held substantial market share in 2024. Cardiovascular diseases represent nearly 45% of all deaths in Europe, driving significant demand for effective embolic protection devices during surgical procedures to reduce complications and enhance patient outcomes. Europe’s advanced healthcare infrastructure supports adopting these devices, particularly in the context of rising minimally invasive procedures like angioplasty and stenting. Continuous technological innovations and a favorable regulatory environment that ensures quality and safety further bolster market growth. Moreover, increasing healthcare expenditures facilitate broader access to advanced medical technologies for patients across the region.

The embolic protection devices market in Germany is expected to grow in the forecast period. The market is propelled by a robust healthcare infrastructure and a high prevalence of cardiovascular diseases. With approximately 1.8 million hospital admissions for heart disease in 2023 and growing awareness of embolic protection devices, the market is poised for expansion through advancements in medical technology and a focus on minimally invasive procedures.

Latin America Embolic Protection Devices Market Trends

Latin America embolic protection devices market is expected to register the fastest CAGR of 11.0% in the forecast period, fueled by the rising incidence of cardiovascular and neurovascular diseases, creating a demand for effective treatment options. Enhanced healthcare access and a trend towards minimally invasive procedures further amplify the need for these devices. Moreover, increased investments in healthcare infrastructure and growing awareness of the benefits of embolic protection drive market expansion.

The embolic protection devices market in Brazil dominated the Latin America embolic protection devices market in 2024. In Brazil, the embolic protection devices market is bolstered by a high prevalence of cardiovascular diseases, with approximately 400,000 heart attacks occurring annually. The evolving healthcare system, characterized by increased investments in medical technology and a growing number of interventional procedures, fosters the adoption of embolic protection devices to enhance patient safety during surgical interventions.

Key Embolic Protection Devices Company Insights

Some key companies operating in the market include Boston Scientific Corporation, Edwards Lifesciences Corporation, Abbott, and Medtronic. Key players are prioritizing innovation and strategic partnerships and enhancing product offerings through technological advancements and collaborations to meet the growing demand for effective embolic protection.

-

Edwards Lifesciences Corporation specializes in advanced medical technologies, particularly heart valve replacement. They focus on the Embrella Embolic Deflector System to prevent embolic debris during transcatheter procedures, enhancing patient outcomes significantly.

-

Cardinal Health is pivotal in distributing medical products, including embolic protection devices. They offer comprehensive healthcare solutions that improve supply chain efficiencies and facilitate access to essential medical devices for effective cardiovascular interventions.

Key Embolic Protection Devices Companies:

The following are the leading companies in the embolic protection devices Market. These companies collectively hold the largest market share and dictate industry trends:

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- Abbott

- Medtronic

- Cardinal Health

- Innovative Cardiovascular Solutions, LLC

- Transverse Medical Inc.

- W. L. Gore & Associates, Inc.

Recent Developments

-

In November 2024, Arsenal Medical launched the EMBO-02 study for NeoCast, assessing its safety and feasibility for treating chronic subdural hematomas through middle meningeal artery embolization, enrolling patients at multiple sites.

-

In October 2024, Transverse Medical appointed Professor Ian T. Meredith, MD, to its Board of Directors, leveraging his 35 years of cardiology experience to advance the POINT-GUARD Cerebral Embolic Protection device.

-

In April 2024, Emboline, Inc. acquired SWAT Medical’s intellectual property portfolio on embolic protection, enhancing its existing technologies to mitigate stroke risk during procedures like Transcatheter Aortic Valve Replacement (TAVR).

-

In March 2024, CERENOVUS launched the TRUFILL n-BCA Liquid Embolic System Procedural Set, enhancing hemorrhagic stroke treatment by streamlining procedure preparation and addressing real-world clinical challenges for physicians.

Embolic Protection Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 709.0 million |

|

Revenue forecast in 2030 |

USD 1.1 billion |

|

Growth rate |

CAGR of 8.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Boston Scientific Corporation; Edwards Lifesciences Corporation; Abbott; Medtronic; Cardinal Health; Innovative Cardiovascular Solutions, LLC; Transverse Medical Inc.; W. L. Gore & Associates, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Embolic Protection Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global embolic protection devices market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Proximal Occlusion Systems

-

Distal Occlusion Systems

-

Distal Filters

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Diseases

-

Neurovascular Diseases

-

Peripheral Diseases

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."