Embedded Software Market Size, Share & Trends Analysis Report By Operating System (General Purpose Operating System, Real-time Operating System), By Vertical (Automotive, Manufacturing), By Functionality, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-429-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Embedded Software Market Size & Trends

The global embedded software market size was estimated at USD 17.91 billion in 2024 and is projected to grow at a CAGR of 9.5% from 2025 to 2030. The rapid expansion of IoT devices, such as smart home products and industrial sensors, has driven the demand for embedded software capable of handling real-time processing, connectivity, and data management. In addition, industries like automotive and telecommunications require advanced embedded software to power autonomous vehicles, Advanced Driver Assistance Systems (ADAS), and 5G-enabled devices. The widespread adoption of smart city initiatives, including traffic management and energy systems, further underscores the importance of embedded software in managing complex urban infrastructure efficiently.

The increasing digitization across industries and advancements in AI and machine learning enhance the capabilities of embedded systems, making them more intelligent and efficient. The growing adoption of Electric Vehicles (EVs) also contributes to this growth, as embedded software is essential for battery management systems, motor control, and vehicle-to-grid communication. Furthermore, the adoption of 5G technology is expected to accelerate demand for embedded software in connected devices, enabling real-time data processing and seamless communication.

The embedded software industry is positioned for sustained growth due to its critical role in enabling innovation across multiple sectors. Industries such as healthcare are leveraging embedded software for medical devices that require precision and reliability, while consumer electronics manufacturers rely on it to enhance device functionality and user experience. For instance, GlobalLogic develops industry-specific embedded software and hardware solutions that seamlessly integrate IT with industrial systems. As industries continue to embrace automation and connectivity, the demand for robust and scalable embedded software solutions is expected to grow significantly, supporting technological advancements globally.

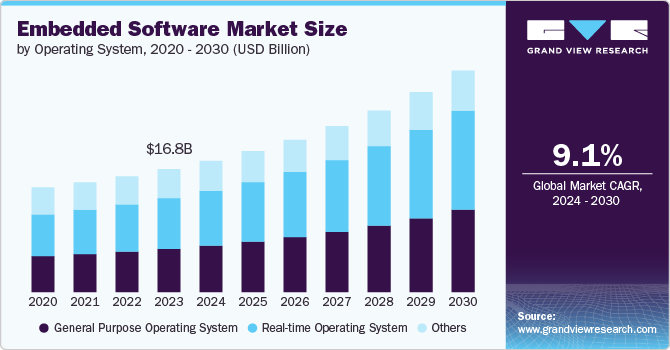

Operating System Insights

The Real-Time Operating System (RTOS) segment led the market in 2024, accounting for over 40.0% share of the global revenue. RTOS is essential for applications requiring precise timing and reliability, such as aerospace, automotive control systems, and industrial automation. The need for systems to perform real-time processing and handle critical tasks drives RTOS adoption.The growth of IoT and connected devices requires efficient and responsive systems to handle real-time data processing and communication. RTOS is crucial for managing the real-time requirements of these devices.

The General Purpose Operating System (GPOS) segment is anticipated to exhibit a significant CAGR over the forecast period. GPOS is used in various applications, such as consumer electronics, computing devices, and general-purpose embedded systems. This broad applicability drives its widespread adoption.GPOS provides a rich set of APIs and development tools that simplify software development and support a wide range of applications, making it a preferred choice for developers in the embedded software industry. The need for advanced multimedia capabilities and connectivity in devices such as smartphones, tablets, and smart TVs drives demand for GPOS, which can efficiently handle these requirements.

Functionality Insights

The real-time embedded systems segment held the largest market revenue share in 2024. The increasing need for automation and precise control in various industries, such as manufacturing, automotive, and aerospace, drives the demand for real-time embedded systems to manage complex processes and operations. For instance, Tesla’s Autopilot utilizes embedded systems, including radar, cameras, ultrasonic sensors, and AI-driven algorithms, to enable semiautonomous driving capabilities. Moreover, the rise of Industrial Internet of Things (IIoT) technologies, which require real-time data processing and analytics, propels the growth of real-time embedded systems for effective monitoring and control in industrial environments.Real-time embedded systems are essential for applications requiring high reliability and safety, such as medical devices, automotive safety systems, and aerospace systems, where timely and accurate responses are critical.

The mobile embedded systems segment is anticipated to exhibit a significant CAGR over the forecast period. The increasing adoption of smartphones, tablets, and wearable devices drives demand for mobile embedded systems. These systems are essential for managing various functions and user experiences in mobile devices. Continuous advancements in mobile technology, including higher processing power, improved battery life, and enhanced connectivity, drive the need for advanced embedded systems to support these features. Users expect advanced functionality, better performance, and richer multimedia experiences from mobile devices. Mobile embedded systems are crucial for providing enhanced user experience.

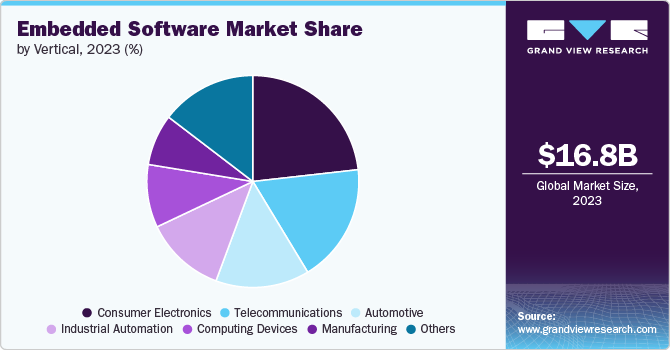

Vertical Insights

The consumer electronics segment held the largest revenue share in 2024. The growing use of smart devices, such as smartphones, tablets, smart TVs, and home appliances, drives demand for embedded software to support their functionality and user interfaces. Ongoing technological advancements, including faster processors, higher resolution displays, and improved connectivity, require advanced embedded software to leverage these capabilities. The integration of voice assistants and AI in consumer electronics requires advanced embedded software to handle natural language processing, voice recognition, and intelligent features.

The automotive segment is expected to experience significant growth due to the increasing demand for advanced embedded software supporting Vehicle-to-Infrastructure (V2I) and Vehicle-to-Vehicle (V2V) communications and the rise of electric and autonomous vehicles. These technologies require specialized software for energy management, autonomous driving algorithms, and Vehicle-to-Everything (V2X) connectivity. In addition, the growing complexity of systems like Advanced Driver-Assistance Systems (ADAS), infotainment, and connected vehicles further drives the need for sophisticated embedded solutions. For instance, in February 2025, Intron Technology partnered with eSOL to advance next-generation Software-Defined Vehicles (SDVs) in China, reflecting the industry's focus on innovation to meet evolving demands.

Regional Insights

North America embedded software market dominated globally with a 38.3% revenue share in 2024. Rapid innovations in various fields, such as IoT, AI, and machine learning, create new opportunities and applications for embedded software. Supportive government policies and funding for technological research and development drive the growth of the embedded software industry in the region.

U.S. Embedded Software Market Trends

The U.S. embedded software market is anticipated to exhibit a significant CAGR over the forecast period. Increasing awareness and the growing implementation of cybersecurity measures for embedded systems drive the development of more secure software solutions. Moreover, the growing market for smart home devices, wearables, and entertainment systems demands advanced embedded software to deliver enhanced features and user experiences.

Europe Embedded Software Market Trends

Europe embedded software market is expected to witness significant growth over the forecast period. The European Union's strict regulations related to safety, environmental impact, and data protection necessitate the development of highly reliable and compliant embedded software, especially in industries such as automotive, healthcare, and industrial automation. In addition, the growing adoption of Industry 4.0, which focuses on smart factories, automation, and data exchange in manufacturing technologies, is a significant driving force for the embedded software industry in Europe.

Asia Pacific Embedded Software Market Trends

Asia Pacific embedded software market is anticipated to grow at a CAGR of 12.2% during the forecast period. The region's rapid industrialization and increase in adoption of advanced technologies across the automotive, healthcare, and consumer electronics industries are key drivers. In addition, the integration of 5G technology in embedded systems is transforming industries like telecommunications and manufacturing, enabling real-time applications and large-scale IoT deployments. Countries such as China, India, and South Korea are experiencing a surge in smart device adoption due to improved economic conditions and digitization efforts, further fueling the demand for embedded software.

China embedded software market dominated the regional market in 2024. The country is the largest global producer of mobile phones and consumer electronics, which heavily rely on embedded software for their functionality. Moreover, China's focus on smart city projects and IoT-based solutions has created a significant market for embedded software in urban development initiatives. Leading companies in China are also investing heavily in embedded system development to cater to both domestic and international markets, further solidifying their dominance in this sector.

Key Embedded Software Company Insights

Some key companies in the embedded software industry include Intel Corporation, Microsoft, and Wind River Systems, Inc. Companies active in the embedded software industry focus aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/technology development. For instance, in January 2024, BlackBerry Limited launched QNX Everywhere, a new initiative to meet the increasing worldwide need for skilled developers in embedded systems. It includes various features such as autonomous access to QNX software, on-demand training, open-source projects optimized for QNX, and straightforward entry to development tools supported by the cloud. Furthermore, to facilitate developers in designing and experimenting with their software on embedded devices, QNX Everywhere offers support for widely accessible, economical CPU boards.

Key Embedded Software Companies:

The following are the leading companies in the embedded software market. These companies collectively hold the largest market share and dictate industry trends.

- Green Hills Software

- Intel Corporation

- Microchip Technology Inc.

- Microsoft

- NXP Semiconductors

- Renesas Electronics Corporation

- Siemens

- STMicroelectronics

- Texas Instruments Incorporated

- Wind River Systems, Inc.

Recent Developments

-

In May 2024, Wind River Systems, Inc. collaborated with Elektrobit, an automotive software provider, to exhibit core software for autonomous, electric, software-centric vehicles. Wind River Systems, Inc. contributed VxWorks as the real-time operating system, whereas Elektrobit offered its second-generation EB corbos AdaptiveCore software and EB corbos Studio tools and developed a software framework based on the AUTOSAR Adaptive Platform.

-

In April 2024, Microsoft signed an 8-year partnership agreement with Cloud Software Group Inc. The agreement would enhance the collaborative efforts in marketing for the virtual application and desktop platform offered by Citrix, as well as bolster the creation of innovative cloud and AI solutions through a unified product strategy. Moreover, Cloud Software Group Inc. invested USD 1.65 billion to support the Microsoft cloud and its advanced generative AI features.

-

In February 2024, Intel Corporation announced the launch of Altera, its new standalone Field-Programmable Gate Array (FPGA) company. Altera's offerings are optimized to target a wide spectrum of markets and applications, from networking and communications infrastructure to energy-efficient embedded systems.

Embedded Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 19.24 billion |

|

Revenue forecast in 2030 |

USD 30.23 billion |

|

Growth rate |

CAGR of 9.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Operating system, functionality, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

Green Hills Software; Intel Corporation; Microchip Technology Inc.; Microsoft; NXP Semiconductors; Renesas Electronics Corporation; Siemens; STMicroelectronics; Texas Instruments Incorporated; and Wind River Systems, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Embedded Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global embedded software market report based on operating system, functionality, vertical, and region:

-

Operating System Outlook (Revenue, USD Million, 2017 - 2030)

-

General Purpose Operating System (GPOS)

-

Real-time Operating System (RTOS)

-

Others

-

-

Functionality Outlook (Revenue, USD Million, 2017 - 2030)

-

Standalone Systems

-

Real-Time Embedded Systems

-

Mobile Embedded Systems

-

Networked Embedded Systems

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Computing Devices

-

Consumer Electronics

-

Industrial Automation

-

Automotive

-

Manufacturing

-

Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global embedded software market size was estimated at USD 17.91 billion in 2024 and is expected to reach USD 19.24 billion in 2025.

b. The global embedded software market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030 to reach USD 30.23 billion by 2030.

b. North America dominated the embedded software market with a share of 38.3% in 2024. Rapid innovations in various areas, such as IoT, AI, and machine learning, are creating new opportunities and applications for embedded software. Supportive government policies and funding for technological research and development drive the growth of the embedded software market in the region.

b. Some key players operating in the embedded software market include Green Hills Software, Intel Corporation, Microchip Technology Inc., Microsoft, NXP Semiconductors, Renesas Electronics Corporation, Siemens, STMicroelectronics, Texas Instruments Incorporated, and Wind River Systems, Inc.

b. The rapid expansion of IoT devices, such as smart home products and industrial sensors, drives demand for embedded software that can handle real-time processing, connectivity, and data management.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."