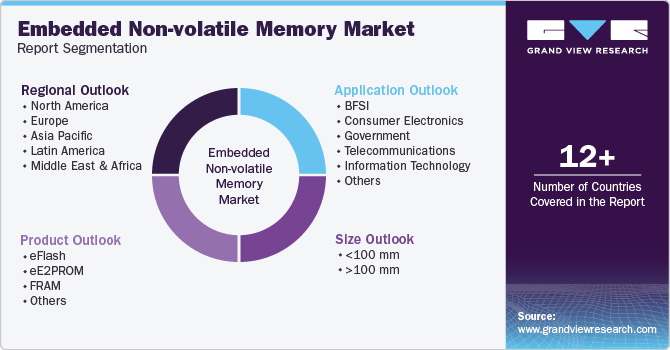

Embedded Non-volatile Memory Market Size, Share & Trends Analysis Report By Product (eFlash, eE2PROM, FRAM), By Wafer Size (>100mm, <100mm), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-333-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

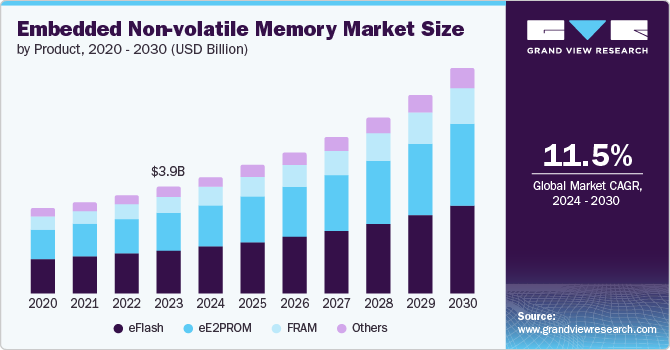

The global embedded non-volatile memory market size was valued at USD 3.88 billion in 2023 and is projected to grow at a CAGR of 11.5% from 2024 to 2030. The increasing use of embedded non-volatile memory (eNVM) in consumer electronics, such as smartphones, wearables, and IoT devices, drives the market growth. These devices require reliable storage solutions that can retain data even when power is turned off, making eNVM essential for their functionality.

Moreover, expanding artificial intelligence (AI) and machine learning (ML) technologies have fueled demand for eNVM. These technologies rely heavily on embedded memory for storing algorithm parameters, neural network weights, and other critical data. eNVM solutions provide the speed and efficiency required for real-time processing in AI applications, enabling faster decision-making and enhanced performance in devices ranging from smartphones to autonomous vehicles.

Furthermore, the consumer electronics sector continues to drive eNVM adoption. Smartphones, tablets, and wearable devices increasingly incorporate eNVM to support advanced features like augmented reality (AR), virtual reality (VR), and high-resolution multimedia content. The ability of eNVM to deliver high-speed data access and seamless user experiences is crucial in meeting consumer expectations for performance and reliability. The automotive industry is another significant contributor to the rising demand for eNVM. Modern vehicles integrate a multitude of electronic systems for navigation, infotainment, and driver assistance. eNVM enables automotive manufacturers to implement secure, fast-access storage solutions that enhance vehicle connectivity, safety features, and overall efficiency.

Product Insights

eFlash dominated the market and accounted for a share of 40.5% in 2023. eFlash memory offers faster read and write speeds than traditional NVM technologies; this makes it highly suitable for applications requiring frequent data storage and recovery, such as microcontrollers used in automotive electronics, IoT devices, and consumer electronics. Moreover, eFlash technology supports high endurance, allowing for many program/erase cycles without degradation, enhancing product longevity and reliability.

eE2PROM segment is expected to witness the fastest CAGR of 12.0% CAGR over the forecast period. eE2PROM offers distinct advantages, such as rewritability without requiring a UV light source, making it ideal for applications requiring frequent data updates or modifications. eE2PROM's capability to reliably store and update configuration data, user settings, and firmware over the product's lifecycle is highly valued in segments such as automotive electronics, consumer electronics, and industrial IoT devices. Additionally, advancements in semiconductor manufacturing technologies have enhanced eE2PROM's density, endurance, and speed, catering to modern embedded systems' growing complexity and performance demands.

Wafer Size Insights

The >100mm wafer segment held the largest market revenue share in 2023. Larger wafer sizes inherently offer higher manufacturing efficiency and economies of scale, which can significantly reduce production costs per chip. This cost-effectiveness is crucial in the semiconductor industry, where margins are often tight, and demand for cost-efficient solutions remains high. Larger wafers allow for greater semiconductor integration, enabling more memory capacity to be packed into a single chip. This is particularly advantageous in applications requiring high-density memory solutions, such as automotive, IoT, and consumer electronics.

<100 mm segment is expected to witness the fastest CAGR over the forecast period. Advancements in semiconductor manufacturing processes enable the production of eNVM on smaller nodes, making smaller wafer sizes feasible without compromising performance or reliability. Moreover, the growing integration of eNVM in IoT devices, automotive electronics, and wearable technologies necessitates smaller form factors and lower power consumption, driving the demand for smaller wafer sizes <100 mm.

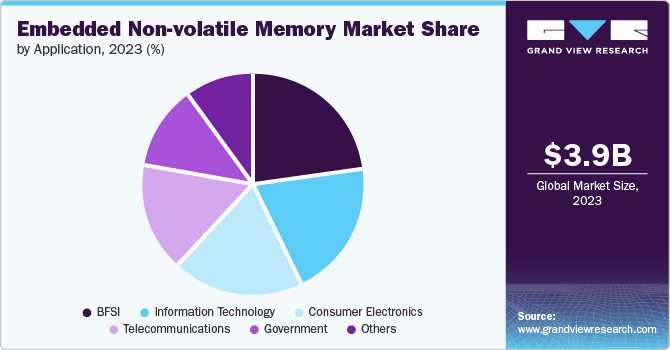

Application Insights

The BFSI segment held the largest market revenue share in 2023. BFSI applications require robust security measures to safeguard sensitive financial data, including transaction records, customer information, and compliance data. Embedded non-volatile memory provides essential capabilities such as secure storage, encryption keys, and boot mechanisms, ensuring data integrity and protection against cyber threats. The BFSI sector increasingly adopts IoT (Internet of Things) devices and smart technologies to enhance operational efficiency and customer service. eNVM enables these devices to store critical data locally, reducing latency and improving responsiveness in real-time transactions.

The telecommunication sector is projected to grow at the fastest CAGR over the forecast period. Telecommunications infrastructure requires robust memory solutions that can store and retrieve data reliably in various environments, including remote and high-traffic areas. eNVM provides a critical advantage by offering faster access times and lower power consumption than traditional memory options. It is ideal for enhancing the efficiency and performance of telecommunications equipment such as routers, base stations, and network switches. Moreover, as telecommunications networks expand to accommodate higher data volumes and faster transmission speeds demanded by technologies like 5G, the need for scalable and dependable memory solutions becomes even more pronounced.

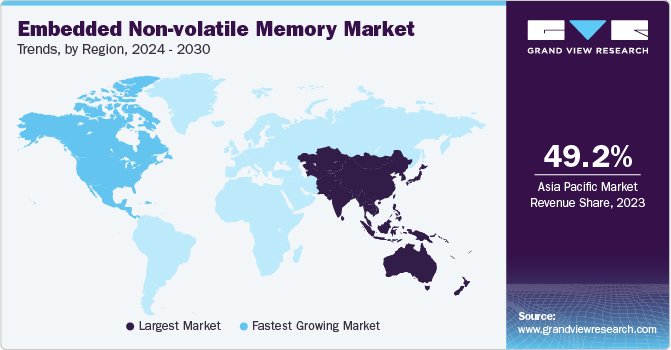

Regional Insights

North America embedded non-volatile memory market is anticipated to witness fastest growth during the forecast period. Advancements in Internet of Things (IoT) technologies have fueled the need for embedded memory solutions that can store data securely and reliably within devices. Additionally, expanding artificial intelligence (AI) and machine learning (ML) applications in North America have increased eNVM adoption, as these technologies rely heavily on fast and efficient memory solutions for data storage and recovery. Moreover, the region's strong semiconductor industry and robust research and development capabilities further drive innovation in eNVM technologies.

U.S. Embedded Non-volatile Memory Market Trends

The U.S. embedded non-volatile memory market dominated the market with a share of 84.7% in 2023. The rapid growth in connected devices, IoT (Internet of Things) applications, and the expanding automotive electronics sector drives the demand for embedded non-volatile memory. These industries require reliable and secure storage solutions that can retain data even when power is turned off, making eNVM crucial for storing firmware, configuration data, and user preferences. Additionally, advancements in artificial intelligence and machine learning applications drive the need for embedded memory with higher speed and lower power consumption, which eNVM technologies can fulfill. As more devices become interconnected and data-driven, the US market sees a rising demand for eNVM to support the functionalities of smart devices, autonomous vehicles, and other emerging technologies.

Europe Embedded Non-volatile Memory Market Trends

Europe embedded non-volatile memory market is expected to witness a significant growth in this industry. European industries, particularly automotive and industrial sectors, are rapidly adopting eNVM for applications ranging from advanced driver assistance systems (ADAS) to smart manufacturing. These applications require reliable, low-power memory solutions that withstand harsh environmental conditions, making eNVM ideal. Moreover, the push towards autonomous vehicles and IoT devices has fueled the need for secure and scalable memory solutions. As European manufacturers seek to enhance product reliability and performance while complying with stringent data protection regulations, the demand for eNVM continues to grow, driving innovation and adoption across the region's high-tech industries.

Embedded non-volatile memory market in UK is expected to grow significantly in the coming years. With the growing adoption of Internet of Things (IoT) devices across various sectors, such as healthcare, automotive, and smart infrastructure, there is an increasing requirement for reliable, low-power storage solutions. eNVM provides an ideal solution as it offers non-volatility and integration with System-on-Chip (SoC) designs. It enables compact, energy-efficient IoT devices crucial for the UK's push towards smart city initiatives and connected technologies. Additionally, the UK's strong presence in sectors like automotive and consumer electronics further drives the demand for eNVM, where data security, reliability, and performance are paramount.

Germany embedded non-volatile memory market has witnessed significant growth in 2023. Germany's robust industrial sector increasingly relies on eNVM for applications such as automotive electronics, industrial automation, and smart devices. These sectors require reliable and secure data storage solutions embedded within their devices to enhance performance and efficiency. Additionally, the push towards digitalization in manufacturing processes, known as Industry 4.0, drives the adoption of eNVM for storing critical operational data and facilitating real-time analytics. Moreover, Germany's emphasis on innovation and high-tech manufacturing necessitates advanced memory solutions that meet stringent performance and reliability standards.

Asia Pacific Embedded Non-volatile Memory Market Trends

Asia Pacific held the largest market revenue share in 2023.The proliferation of consumer electronics, such as smartphones, tablets, and wearables, is rapidly expanding markets such as China and India, driving the need for compact yet powerful memory solutions embedded within these devices. eNVM offers advantages such as lower power consumption, faster access speeds, and greater reliability compared to traditional non-volatile memory options. Additionally, the rise of IoT (Internet of Things) devices and automotive electronics in Asia-Pacific necessitates memory solutions that can withstand varying environmental conditions and provide secure storage capabilities.

India embedded non-volatile memory market is expected to grow significantly over the forecast period. One significant driver is the rapid expansion of the electronics manufacturing industry in India, bolstered by government initiatives like the "Make in India" campaign aimed at promoting local manufacturing. This growth is fueling demand for eNVM components, which are essential for storing critical data and program code in embedded systems such as IoT devices, automotive electronics, and consumer electronics. Additionally, the rise of smart cities and digital infrastructure projects across India necessitates reliable and secure data storage solutions, further boosting the need for eNVM technologies.

Embedded non-volatile memory market in China witnessed a significant market share in 2023. The rapid expansion of the Internet of Things (IoT) sector in China, which relies heavily on eNVM for storing data locally on devices, drives the market growth. This trend is fueled by the increasing deployment of smart devices, such as wearables, smart home appliances, and industrial sensors, all requiring reliable and energy-efficient memory solutions.

Key Embedded Non-volatile Memory Company Insights

Some key companies in the embedded non-volatile memory market include Samsung Electronics; Toshiba Electronic Devices & Storage Corporation;Japan Semiconductor Corporation; and HDD Manufacturers

-

Samsung Electronics has initiated the large-scale manufacturing of its inaugural embedded magnetic random access memory (eMRAM) product, utilizing the company's advanced 28-nanometer (nm) fully depleted silicon-on-insulator (FD-SOI) process technology, known as 28FDS.

-

Toshiba Electronic Devices & Storage Corporation and Japan Semiconductor Corporation have collaborated to create an advanced analog platform with embedded non-volatile memory specifically designed for automotive applications. The 0.13-micron generation analog platform is tailored for analog integrated circuits (ICs), providing an exceptional blend of processes and devices that cater to the requirements of rated voltage, performance, reliability, and cost for automotive analog circuits and eNVM, all integrated into a single chip.

Key Embedded Non-volatile Memory Companies:

The following are the leading companies in the embedded non-volatile memory market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung Electronics Co. Ltd

- Micron Technology, Inc.

- Rohm Co. Ltd

- Toshiba Electronic Devices & Storage Corporation

- Western Digital Technologies, Inc.

- Honeywell International Inc.

- Crossbar Inc.

- Fujitsu Ltd.

- Japan Semiconductor Corporation

- HDD Manufacturers

Recent Developments

-

In August 2023, Fujitsu Semiconductor announced the launch of a new automotive-grade 512KB Ferroelectric Random Access Memory (FeRAM), designed to meet the stringent reliability and performance requirements of automotive applications. This FeRAM will offer high-speed read and write operations, low power consumption, and robust operation in harsh environmental conditions for use in automotive systems such as advanced driver-assistance systems (ADAS), infotainment, and powertrain control units.

Embedded Non-volatile Memory Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.23 billion |

|

Revenue forecast in 2030 |

USD 8.13 billion |

|

Growth rate |

CAGR of 11.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, wafer size, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa |

|

Key companies profiled |

Samsung Electronics Co. Ltd; Micron Technology, Inc.; Toshiba Electronic Devices & Storage Corporation; Western Digital Technologies, Inc.; Honeywell International Inc.; Crossbar Inc.; Fujitsu Ltd.; Japan Semiconductor Corporation; HDD Manufacturers |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Embedded Non-volatile Memory Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global embedded non-volatile memory market report based on product, wafer size, application, and region.

-

Embedded Non-volatile Memory Product Outlook (Revenue, USD Million, 2018 - 2030)

-

eFlash

-

eE2PROM

-

FRAM

-

Others

-

-

Embedded Non-volatile Memory Wafer Size Outlook (Revenue, USD Million, 2018 - 2030)

-

<100 mm

-

>100 mm

-

-

Embedded Non-volatile Memory Application Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Consumer Electronics

-

Government

-

Telecommunications

-

Information Technology

-

Others

-

-

Embedded Non-volatile Memory Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."