- Home

- »

- Clinical Diagnostics

- »

-

ELISpot And Fluorospot Assay Market Size Report, 2030GVR Report cover

![ELISpot And Fluorospot Assay Market Size, Share & Trends Report]()

ELISpot And Fluorospot Assay Market Size, Share & Trends Analysis Report By Product (Assay Kits, Analyzers), By Application (Research Applications, Diagnostics Applications), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-349-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

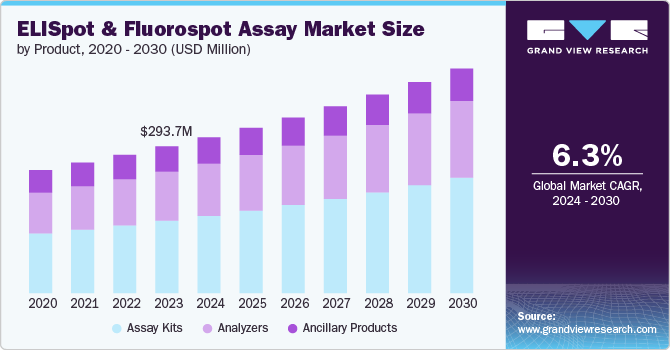

The global ELISpot and fluorospot assay market size was valued at USD 293.75 million in 2023 and is projected to grow at a CAGR of 6.31% from 2024 to 2030. This growth can be attributed to the rising incidences of chronic and infectious diseases, increasing drug discovery activities, rising adoption in research and diagnostics, and expanding pre-clinical and clinically regulated bioanalysis. The ELISpot and Fluorospot assays are used to access immune responses, increasing their importance in understanding the effect of various diseases on the immune system, including cancer.

ELISpot and Fluorospot assay are used to detect and characterize naturally occurring tumor-reactive T-cells, which serve as suitable mediators of cancer immunotherapy. Moreover, these assays are also being used for epitope mapping, identification of tumor antigens, and monitor vaccine-induced T and B-cell responses. Moreover, the development of hepatocellular carcinoma (HCC) and cervical cancer is closely linked to high-risk infections with human papillomavirus (HPV) and hepatitis B virus (HBV), respectively. Tumor-specific vaccines are frequently tested in animal models and cell lines; for example, the HPV vaccine was assessed in mice and cell lines using the IFN-γ and IL-2 ELISPOT assay.

Detection of antigen-specific T cell responses via the IFN-γ ELISPOT assay in a patient with metastatic cervical cancer aids researchers in developing new treatment strategies. Researchers are working to halt cancer progression by inducing tumor-specific cytotoxic T lymphocytes (CTLs) through dendritic cells loaded with tumor DNA or tumor homogenate. Another approach involves generating virus-vectored genetic vaccines, such as using an Adenovirus vector encoding tumor antigens. The response of tumor-specific CTLs can be determined by the ELISPOT assay.

The IFN-γ ELISPOT assay is also used to evaluate the immunological efficacy of high-dose IL-2 treatment in patients with metastatic melanoma and renal cell carcinoma. These increasing applications of ELISpot and Fluorospot assays in cancer research are anticipated to drive their demand with increasing cancer incidences. According to National Cancer Institute data, the number of cancer cases per year is anticipated to increase to 29.9 million and cancer-related deaths to reach 15.3 million. This surge in cancer cases is anticipated to drive the market growth over the forecast period.

These assays provide a powerful tool for assessing a potential drug substance’s effect on the immune system. ELISpot is emerging as a critical tool in vaccine development for various conditions, such as immunodeficiency syndrome (AIDS), malaria, tuberculosis, cancer, and flu. The ELISpot test is widely utilized in clinical studies to evaluate vaccines. According to the World Health Organization’s (WHO) International Clinical Trials Registry Platform (ICTRP) data, 54,952 clinical trials were performed globally in 2022 alone. These increasing clinical trials and drug discovery activities are expected to increase the demand for ELISpot and Fluorospot assay, thereby driving market growth.

Moreover, several market players are increasing their efforts to develop advanced solutions based on ELISpot and Fluorospot assays for various health conditions, which is further driving the market growth. For instance, in November 2023, Revvity announced the launch of its FDA-approved ELISPOT technology-based T-SPOT test in India for latent TB screening. The test uses a standardized sample, which reduces the influence of blood factors that can impact the test performance and normalization for T-cell count.

Product Insights

The assay kits segment accounted for the largest revenue share of 49.34% in 2023 and is expected to witness fastest growth over the forecast period. The enzyme-linked immunospot (ELISpot) assay is a highly sensitive and effective immunoassay tool for the monitoring of immune responses in vitro. It enables the ex vivo measurement of antibody-secreting cells or cytokine at the single-cell level. ELISpot Assay Kits utilize sandwich immuno-enzyme technology to detect and quantify secretory products from individually activated cells, ensuring precise and reliable results. These kits are applicable to various fields, including transplantation, T-cell regulation analysis, vaccine development, autoimmune diseases, cancer, viral and allergy, and infections. Their high sensitivity and ease of use make them valuable tools, driving market demand.

Analyzers are anticipated to witness lucrative growth over the forecast period. This can be attributed to the increasing availability of advanced analyzers and rising demand for high throughput analysis. In research fields like immunology, vaccine development, and drug discovery, there's a growing need to analyzes large numbers of samples. High-throughput analyzers cater to this demand by enabling researchers to process large datasets efficiently, thereby increasing their demand. For instance, ImmunoSpot Analyzers stand out as the most successful ELISPOT/FluoroSpot analyzers on the market. Their multifunctionality enables additional immune monitoring tests, including PBMC counting, cytotoxicity assays, serum neutralization assays, and cytokine array reading. CTL provides a variety of ImmunoSpot Analyzers to accommodate diverse needs and budgets.

Application Insights

The diagnostics application segment accounted for the largest revenue share of 65.94% in 2023 and is anticipated to witness the fastest growth over the forecast period. ELISpot and Fluorospot assays offer a highly sensitive and specific method for detecting immune responses to various pathogens and antigens. This allows more accurate diagnosis of infectious diseases such as tuberculosis, HIV, and certain viral infections. Additionally, these assays can be used to diagnose autoimmune diseases by identifying autoreactive immune cells. The growth in immunology and oncology and the focus on developing new diagnostic tools are further anticipated to improve the role of ELISpot and Fluorospot assays for diagnostics applications.

Research application is anticipated to witness significant growth over the forecast period. This can be attributed to the ability of these assays to screen potential drug candidates that modulate the immune system. The ELISPOT assay is widely used in research settings as a candidate immune monitoring tool. Its potential clinical applications include evaluating immune responses to infectious agents, transplant antigens, tumor antigens, and autoantigens, making it an invaluable tool for diverse clinical research contexts. Moreover, researchers can leverage the assays to analyze the effects of drugs on immune cell activation and cytokine production, which is also anticipated to increase their demand over the forecast period.

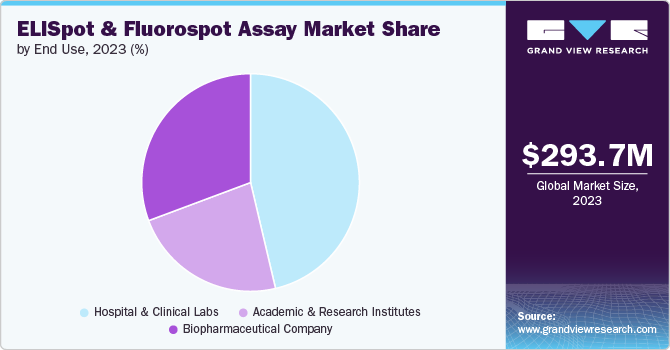

End Use Insights

Hospitals and clinical labs accounted for the largest revenue share of 46.31% in 2023 and are anticipated to witness the fastest growth over the forecast period. Hospitals and clinical labs serve as direct contact points for patients suffering from various diseases, increasing the pressure on these healthcare systems for rapid diagnosis. ELISpot and fluorospot assays, emerging as important tools for disease diagnosis, are thus anticipated to witness growth in the hospitals and clinical labs segment.

Biopharmaceutical companies are anticipated to witness the fastest growth of 6.6% over the forecast period. Biopharmaceutical companies are driven to use ELISpot and Fluorospot assays due to their high quantitative accuracy, ability to measure a wide range of immune responses, and versatility in evaluating T-cell functions, B cells, and innate immune cells. Their proven clinical relevance, particularly in predicting therapeutic outcomes in cancer vaccine trials, enhances their appeal in clinical applications.

Various assay formats, including flow cytometry, ELISpot, ELISA, multiplex bead arrays, and quantitative PCR, are commonly employed in the study of ex vivo T cell effector function. Among these, the enzyme-linked immunosorbent spot (ELISpot) assay stands out due to its distinct advantages. ELISpot is highly quantitative, capable of measuring a broad range of response magnitudes, and can assess critical immune functions such as granzyme B release and IFN-γ secretion. Its adaptability in evaluating various T-cell functions, B cells, and innate immune cells makes it a versatile tool that has transitioned from a research instrument to a clinical assay. Recent Phase I and II cancer vaccine studies have indicated that ELISpot can serve as a biomarker assay to calculate the clinical benefit after therapeutic immune modulation. This versatility and clinical relevance drive biopharmaceutical companies to use ELISpot and Fluorospot assays, focusing on standardizing the assays and applying them in human clinical trials, thereby developing a clinical-grade ELISpot.

Regional Insights

North America ELISpot and Fluorospot assay market dominated the global industry and accounted for a 35.44% share in 2023 owing to the established healthcare infrastructure, high R&D activities, and greater acceptance of advanced diagnostics. A significant percentage of the approximately 20 million individuals tested annually for TB infection in the U.S. fall into the two groups where an IGRA, like the T-SPOT.TB test, is now preferred. The usage of IGRA tests, such as T-SPOT.TB, is anticipated to reduce false positives and redundant treatments, and increase acceptance of treatment among those truly infected with TB. Additionally, new guidelines recommend that the T-SPOT.TB test can replace the tuberculin skin test (TST) in all situations where the CDC endorses tuberculin skin testing. Since receiving premarket approval from the FDA in July 2008, the T-SPOT.TB test has been widely used in hospitals, medical practices, and public health facilities across the United States. Supported by clinical evidence from over 200 peer-reviewed journals, it is the only IGRA with both specificity and sensitivity exceeding 95% in FDA pivotal trials. Thereby increasing the adoption of ELISpot technology in the study period.

U.S. ELISpot And Fluorospot Assays Market Trends

The ELISpot and Fluorospot assay market in the U.S. is anticipated to witness lucrative growth over the forecast period. This can be attributed to the high funding for biomedical research, high presence of various research institutions and strong presence of pharmaceutical and biotechnology companies investing in vaccine development, drug discovery, and clinical trials. U.S. accounts for the largest number of clinical trials performed globally. According to the WHO ICTRP data, 168,520 clinical trials were performed in the U.S. from 1999 to 2022. Such focus on R&D is anticipated to drive the demand for ELISpot and Fluorospot assays in the country.

Europe ELISpot And Fluorospot Assay Market Trends

The ELISpot and Fluorospot assay market in Europe is projected to witness significant growth driven by factors such as the growing burden of chronic and infectious diseases, increasing emphasis on early disease diagnosis, and high research focus. Europe has a robust research infrastructure and a strong commitment to scientific progress. These factors foster the development and application of ELISpot and Fluorospot assays in various research areas, such as vaccine development and immunology.

Asia Pacific ELISpot And Fluorospot Assay Market Trends

The ELISpot and Fluorospot assay market in Asia Pacific is anticipated to witness significant growth of 7.0% from 2024 to 2030. This can be attributed to the increasing prevalence of various diseases such as diabetes, cancer, tuberculosis, and hepatitis B. For instance, according to the WHO data, around 2.3 million people in Southeast Asia region are diagnosed with cancer each year, and it causes around 1.4 million mortalities each year. The rising prevalence has increased the need for the development of advanced treatments, leading to R&D activities in the region and thereby driving its growth.

Key ELISpot And Fluorospot Assay Company Insights

Key players operating in the ELISpot and Fluorospot assay market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key ELISpot And Fluorospot Assay Companies:

The following are the leading companies in the ELISpot and fluorospot assay market. These companies collectively hold the largest market share and dictate industry trends.

- Becton, Dickinson and Company

- U-Cytech Biosciences

- Cellular Technologies Limited

- Mabtech AB

- Abcam

- Autoimmun Diagnostika GmbH

- Lophius Biosciences GmbH

- Bio-Connect B.V.

- Oxford Immunotec

- Bio-Techne Corporation

Recent Developments

-

In September 2023, Virax Biolabs Group Limited launched a program offering researchers early access to its SARS-Cov-2 ViraxImmune T-cell-based test. This test assesses the activation of memory T-cells specifically to the SARS-Cov-2 by combining the company’s precoated ELISpot assay to a peptide pool covering a specific part of the virus.

ELISpot And Fluorospot Assay Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 311.77 million

Revenue forecast in 2030

USD 449.97 million

Growth Rate

CAGR of 6.31% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait

Key companies profiled

Becton; Dickinson and Company; U-Cytech Biosciences; Cellular Technologies Limited; Mabtech AB; Abcam; Autoimmun Diagnostika GmbH; Lophius Biosciences GmbH; Bio-Connect B.V.; Oxford Immunotec; Bio-Techne Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global ELISpot And Fluorospot Assay Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ELISpot and Fluorospot assay market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Assay Kits

-

Analyzers

-

Ancillary Products

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Applications

-

Vaccine Development

-

Clinical Trials

-

Cancer Research

-

-

Diagnostics Applications

-

Infectious Disease

-

Cancer

-

Autoimmune Disease

-

Allergy and Organ Transplantations

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital and Clinical Labs

-

Academic and Research Institutes

-

Biopharmaceutical Company

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include rising incidences of chronic and infectious diseases, increasing drug discovery activities, rising adoption in research and diagnostics, and expanding pre-clinical and clinically regulated bioanalysis

b. The global ELISpot and Fluorospot assay market size was estimated at USD 293.75 million in 2023 and is expected to reach USD 311.77 million in 2024.

b. The global ELISpot and Fluorospot assay market is expected to grow at a compound annual growth rate of 6.31% from 2024 to 2030 to reach USD 449.97 billion by 2030.

b. North America dominated the ELISpot and Fluorospot assay market with a share of 35.44% in 2023. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the ELISpot and Fluorospot assay market include Becton, Dickinson and Company; U-Cytech Biosciences; Cellular Technologies Limited; Mabtech AB; Abcam; Autoimmun Diagnostika GmbH; Lophius Biosciences GmbH; Bio-Connect B.V.; Oxford Immunotec; Bio-Techne Corporation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."