- Home

- »

- Medical Devices

- »

-

Electroretinogram Market Size, Share & Growth Report, 2030GVR Report cover

![Electroretinogram Market Size, Share & Trends Report]()

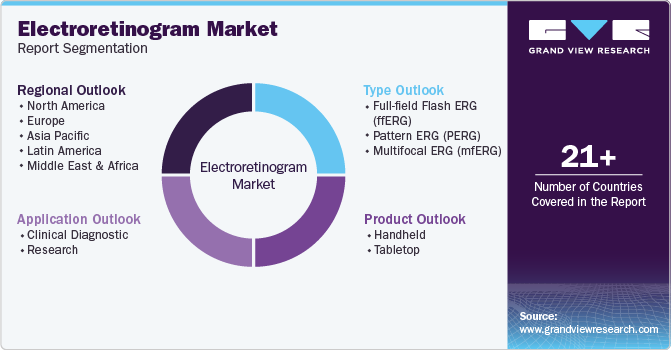

Electroretinogram Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Full-field flash ERG, Pattern ERG, Multifocal ERG), By Product (Handheld, Tabletop), By Application (Clinical Diagnostic, Research), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-944-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electroretinogram Market Size & Trends

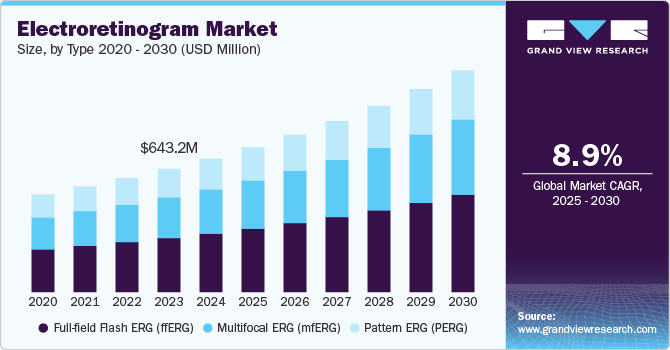

The global electroretinogram market size was valued at USD 696.4 million in 2024 and is projected to grow at a CAGR of 8.9% from 2025 to 2030. Ongoing innovation and the increasing number of ophthalmology clinics and research centers are driving the demand for electroretinograms in the market. Additionally, the growing prevalence of eye disorders, including diabetic retinopathy, glaucoma, retinitis pigmentosa, macular degeneration, and cone-rod dystrophy, is anticipated to boost market growth in the forecast period. Factors such as a preference for early disease diagnosis, heightened screen time during the pandemic, and a rapidly aging population are also expected to contribute to market expansion.

The electroretinogram (ERG) is a clinical ophthalmic diagnostic test that measures the electrical activity of the retina in response to a light stimulus. The electroretinogram ascends from currents generated directly by retinal neurons in combination with contributions from retinal glia. Ophthalmologists use these electroretinograms to determine the need for retinal surgery or other eye surgeries such as cataract surgery. It is used to diagnose patients with several symptoms, such as photophobia, nyctalopia, reduced visual acuity, and field defects.

The rising prevalence of diabetic retinopathy is anticipated to significantly drive market growth in the coming years. A recent study published by the CDC highlights that diabetes is a leading cause of new blindness cases among adults, with diabetic retinopathy affecting nearly one-third of adults with diabetes aged 40 and older. In 2021, it was estimated that approximately 9.6 million individuals in the United States were living with diabetic retinopathy (DR), of which around 1.84 million experienced vision-threatening forms of the condition. The prevalence of DR varies significantly across age groups, with the lowest rate of 13.0% observed in individuals younger than 25, while the highest rate of 28.4% was found among those aged 65 to 79.

Electroretinograms are crucial in diagnosing various inherited and acquired retinal disorders, further underscoring their importance in the ophthalmology market. Conditions such as retinitis pigmentosa, which leads to a gradual loss of peripheral and night vision, and retinoblastoma, a type of retinal cancer, can be effectively assessed using this technology. Additionally, electroretinograms are valuable in diagnosing macular degeneration, characterized by the deterioration of macular cells and resulting vision loss, as well as retinal detachment and cone-rod dystrophy, which involves the weakening of cone and rod cells. The growing recognition of these disorders and the utility of electroretinograms in their diagnosis will likely contribute to increased demand in the market.

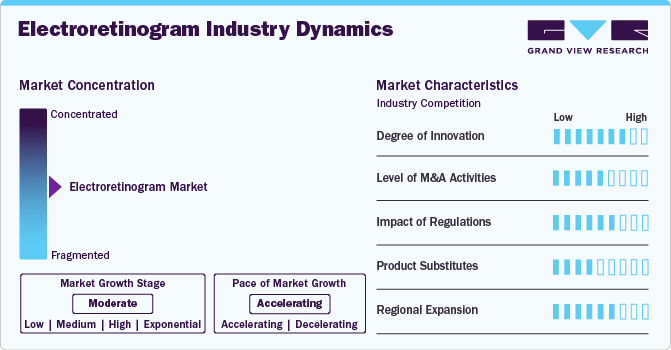

Market Concentration & Characteristics

The electroretinogram industry is characterized by moderate concentration, with several key players leading the market. Established manufacturers dominate through technological advancements and extensive distribution networks while emerging companies focus on niche products and innovative solutions. The industry encompasses a range of devices designed for diagnosing retinal disorders, emphasizing precision and reliability. Regulatory compliance is crucial, influencing product development and market entry. Additionally, the increasing prevalence of eye disorders and a growing emphasis on early diagnosis drive competitive dynamics, prompting ongoing innovation and collaboration among stakeholders to enhance diagnostic capabilities and improve patient outcomes.

The industry exhibits a high degree of innovation, driven by advancements in technology and a growing understanding of retinal diseases. Innovations include the development of portable and compact electroretinogram devices, enhancing accessibility and ease of use in various clinical settings. Enhanced imaging techniques and digital signal processing have improved the accuracy and reliability of test results. Furthermore, ongoing research into new diagnostic algorithms and the integration of artificial intelligence are paving the way for more precise assessments of retinal function. This focus on innovation is essential for addressing the rising demand for effective diagnostics in retinal disorders.

Regulations significantly impact the electroretinogram industry, ensuring the safety, efficacy, and quality of diagnostic devices. Regulatory bodies, such as the FDA and EMA, impose stringent requirements for device approval, including comprehensive clinical trials and robust documentation. Compliance with these regulations can increase development costs and timelines but ultimately enhance consumer trust and promote innovation. Additionally, evolving regulatory standards encourage manufacturers to adopt advanced technologies and improve product designs. This regulatory framework shapes market dynamics, influencing competition and market entry while ensuring that electroretinogram devices meet the highest standards of safety and performance for patient care.

Strategic acquisitions allow firms to integrate innovative technologies, access new customer segments, and strengthen their research and development capabilities. Recent M&A deals often focus on integrating advanced diagnostic solutions and expanding portfolios to include complementary devices. Additionally, collaborations between established manufacturers and emerging startups foster innovation and accelerate the development of cutting-edge electroretinogram technologies.

In the electroretinogram industry, product substitutes can significantly influence market dynamics. Alternatives such as optical coherence tomography (OCT) and fundus photography are increasingly used for retinal assessments, offering different imaging capabilities and insights into eye health. Additionally, visual field-testing devices serve as substitutes for diagnosing certain retinal disorders by evaluating peripheral vision. While these alternatives provide valuable information, they may not fully replace the need for electroretinograms, which specifically measure retinal electrical responses. As technology advances, the integration of these diagnostic tools can enhance patient care, but the unique capabilities of electroretinograms remain essential for certain conditions.

The electroretinogram industry is witnessing significant regional expansion, driven by increasing healthcare demands and advancements in surgical techniques. Emerging markets in Asia-Pacific and Latin America are experiencing rapid growth due to rising investments in healthcare infrastructure and a growing number of surgical procedures. For instance, in May 2024, B. Braun Melsungen AG opened a new factory in Switzerland, expanding its production capabilities for advanced medical devices. The facility is designed to enhance efficiency and quality in manufacturing, aligning with the company’s commitment to innovation in the healthcare sector. This expansion reflects B. Braun’s growth strategy in the MedTech industry.

Type Insights

The full-field flash ERG (ffERG) segment accounted for the largest revenue share of 43.8% in 2024. The full-field flash ERG (ffERG) is the most accurate and commonly used method and provides an assessment of general retinal function, can distinguish between the various cell types, right and left eyes, and can show functional discrepancies from systemic conditions to advanced degeneration. However, it cannot provide specific information about individual sectors of the retina. Increasing preference toward full-field flash ERG among healthcare professionals is expected to fuel the segment growth.

The multifocal ERG (mfERG) segment in the electroretinogram market is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period. The multifocal ERG allows clinicians to measure the retinal response from each of a large number of sections on the retina. The mfERG is an important clinical method as it is used to detect localized abnormalities, and it also provides a medium to evaluate central and peripheral function separately. Hence, increasing the advantages of multifocal ERG is expected to augment the market growth during the forecast period.

Application Insights

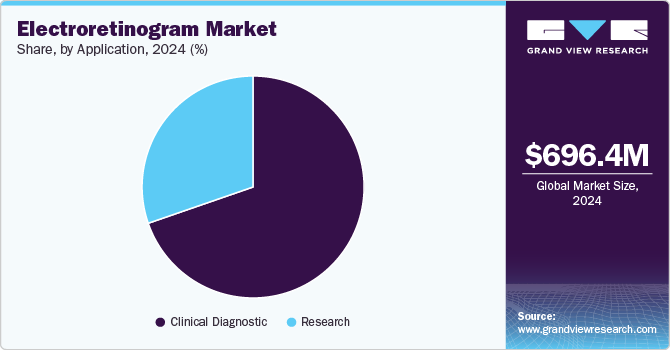

The clinical diagnostic segment accounted for the largest revenue share of 69.7% in 2024 and is projected to witness the fastest CAGR over the forecast period, driven by the increasing demand for accurate and reliable retinal assessments. As awareness of eye disorders, such as diabetic retinopathy and retinitis pigmentosa, rises, healthcare providers are prioritizing advanced diagnostic tools to improve patient outcomes. Electroretinograms are essential for evaluating retinal function and diagnosing various conditions, leading to their widespread adoption in clinical settings. Additionally, the growth of specialized ophthalmology clinics and research institutions further fuels demand for these diagnostic devices, ensuring the clinical segment remains a dominant force in the electroretinogram market.

The research segment of the electroretinogram market is expected to experience a notable increase in compound annual growth rate (CAGR) over the forecast period. This growth is driven by the rising focus on understanding retinal diseases and advancing treatment options. Increased funding for research initiatives and collaboration among academic institutions, healthcare organizations, and industry players are contributing to the demand for electroretinogram technologies. Furthermore, ongoing studies aimed at exploring novel therapies for retinal disorders enhance the need for precise diagnostic tools. As researchers seek to uncover new insights into retinal health, the research segment is poised for significant expansion.

Product Insights

The tabletop electroretinogram segment held the largest share of 60.4% in 2024. Tabletop electroretinograms are the traditional type of non-invasive device used to measure the electrical activity in the retina in response to light stimulus. According to studies, the eye diagnosis conducted by tabletop electroretinogram devices was found to be more precise and accurate than any other device. Moreover, companies are largely focusing on developing tabletop electroretinograms to cater to its increasing demand in the market. However, tabletop ERG devices require proper set-up, and they cannot move.

The handheld electroretinogram devices segment is expected to grow at the fastest CAGR during the forecast period. Many companies are involved in the R&D and production of handheld/portable ERG machines. For instance, LKC Technologies, a leading player in the area of visual diagnostics, has launched RETEVAL, which is a non-mydriatic, handheld, full-field ERG device. The handheld devices are light in weight and portable. However, a lower number of products in the market space justifies the lower market share.

Regional Insights

North America electroretinogram market dominated the global industry and accounted for 44.2% revenue share in 2024 owing to the growing geriatric population, rising prevalence of eye disorders, increasing approvals and R&D investments, and inclination toward adopting newer products in the US. Additionally, several factors, such as the expansion of hospitals and the presence of well-established healthcare infrastructure along with research facilities, are expected to boost the growth of the overall North America market to a greater extent.

U.S. Electroretinogram Market Trends

The electroretinogram market in the U.S. held a significant share of the North American market in 2024. High awareness of retinal disorders and an established healthcare infrastructure facilitate the adoption of advanced diagnostic technologies. The increasing prevalence of conditions such as diabetic retinopathy and age-related macular degeneration further fuels the demand for electroretinograms. Additionally, significant investments in research and development, along with the presence of key market players, enhance innovation in diagnostic tools.

Europe Electroretinogram Market Trends

The electroretinogram market in Europe is experiencing growth, largely driven by demographic trends. According to Eurostat data released in February 2024, over 21% of Europe's 448.8 million population was aged 65 and older as of January 2023. This aging population often faces vision issues related to age, such as presbyopia, which can be effectively addressed with advanced refractive surgery devices. This trend presents a significant market opportunity for companies in the sector. As the elderly population continues to grow, the demand for innovative and effective refractive treatments is expected to rise, boosting the need for these devices in Europe.

The UK electroretinogram market is experiencing notable growth, driven by increasing screen time among the population. According to data from Independent UK published in June 2024, Brits spend an average of 1 hour and 52 minutes daily on social media. This prolonged exposure to screens raises concerns about digital eye strain and exacerbates existing vision issues. As a result, there is a growing demand for effective diagnostic tools like electroretinograms to assess and address these vision-related problems.

The electroretinogram market in France is expanding, driven by a rising awareness of retinal disorders and the aging population. The increasing incidence of conditions like diabetic retinopathy and macular degeneration is fueling demand for advanced diagnostic tools. Enhanced research initiatives and improved healthcare infrastructure further support market growth in the country. According to World Bank data, France’s healthcare expenditure was around 12.31% of its GDP in 2021.

Germany electroretinogram market is experiencing robust growth, primarily driven by increasing awareness of retinal health and a significant rise in eye disorders. Notably, Staar Surgical reports that the EuroEyes clinic group performed the highest number of ICL surgeries in Germany in 2021. The aging population, coupled with a high prevalence of conditions such as diabetic retinopathy and macular degeneration, intensifies the demand for precise diagnostic tools. Germany's well-established healthcare system, supported by advanced research and technological innovations, facilitates the adoption of electroretinogram devices in clinical settings.

Asia Pacific Electroretinogram Market Trends

The electroretinogram market in Asia Pacificis witnessing significant growth attributed to various factors such as the rising prevalence of chronic disorders such as diabetes, high adoption of advanced technologies, and the presence of a large geriatric population. Furthermore, the increasing knowledge regarding eye disorders is further anticipated to propel the growth of the electroretinogram market in the region during the forecast period. Countries like China, India, and Japan are key contributors, with growing adoption of advanced medical technologies and improving healthcare infrastructure. The APAC electroretinogram market is expected to expand due to the region's numerous FDA, TGA, and EMA-approved facilities.

Japan electroretinogram market is set for significant growth, primarily driven by the country's aging population. As of 2023, approximately 30% of the population is aged 65 and older, making them more susceptible to eye disorders. This demographic shift is anticipated to boost demand for electroretinograms in the coming years.

The electroretinogram market in China is expected to grow as China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the electroretinogram market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

India electroretinogram market is growing rapidly, driven by increasing awareness of eye disorders and advancements in diagnostic technologies. The rising prevalence of conditions like diabetic retinopathy and retinal diseases, combined with a growing healthcare infrastructure, is enhancing the demand for electroretinogram devices in clinical settings across the country.

Latin America Electroretinogram Trends

The electroretinogram market in Latin America is fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for refractive surgery devices as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

Key Electroretinogram Company Insights

The competitive scenario in the electroretinogram market is highly competitive, with key players such as Diagnosys LLC, BD; and LKC Technologies, Inc. holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Electroretinogram Companies:

The following are the leading companies in the electroretinogram market. These companies collectively hold the largest market share and dictate industry trends.

- LKC Technologies, Inc.

- Diagnosys LLC

- Electro-Diagnostic Imaging, Inc.

- Diopsys, Inc.

- Metrovision

- Roland-consul

- CSO Italia

Recent Developments

-

In May 2024, Researchers from Japan unveiled an innovative soft multi-electrode system for electroretinography (ERG). This new device can simultaneously measure electrical potentials from various retinal locations, improving the diagnosis of eye diseases. Built on soft contact lenses, it offers enhanced comfort and biocompatibility, advancing ERG capabilities significantly.

-

In July 2024, Christopher Tyler, a Senior Scientist at SKERI, proposed a new model of electroretinogram (ERG) kinetics, advancing previous efforts initiated in the 1990s. This comprehensive model integrates computational studies of rod (night) vision responses, aiming to enhance diagnostic capabilities for retinal disorders by developing specific biomarkers for both rod and cone vision.

Electroretinogram Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 755.2 million

Revenue forecast in 2030

USD 1.15 billion

Growth Rate

CAGR of 8.9% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

LKC Technologies, Inc.; Diagnosys LLC; Electro-Diagnostic Imaging, Inc.; Diopsys, Inc.; Metrovision; Roland-consult; CSO Italia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electroretinogram Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electroretinogram market report on the basis of type, product, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Full-field flash ERG (ffERG)

-

Pattern ERG (PERG)

-

Multifocal ERG (mfERG)

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Tabletop

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Diagnostic

-

Research

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electroretinogram market size was estimated at USD 696.45 million in 2024 and is expected to reach USD 755.24 million in 2025.

b. The global electroretinogram market is expected to grow at a compound annual growth rate of 8.93% from 2025 to 2030 to reach USD 1.15 billion by 2030.

b. North America dominated the electroretinogram market with a share of 44.2% in 2024. This is attributable to the growing geriatric population, rising prevalence of eye disorders, increasing approvals and R&D investments, inclination towards adopting newer products in the US, expansion of hospitals, and the presence of well-established healthcare infrastructure along with the research facilities are boosting the growth of the overall North America market to a greater extent.

b. Some key players operating in the electroretinogram market include LKC Technologies, Inc., Diagnosys LLC, Electro-Diagnostic Imaging, Inc., Diopsys, Inc., Metrovision, Roland-consult, and CSO Italia

b. Key factors that are driving the electroretinogram market growth include constant innovation and growth in the number of ophthalmology clinics and research centers leading to the rising demand for electroretinograms in the market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.