Electronic Skin Market Size, Share & Trends Analysis Report By Product Type, By Component (Stretchable Circuits, Photovoltaics Systems), By Sensors (Tactile Sensors, Chemical Sensors), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-037-3

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Electronic Skin Market Size & Trends

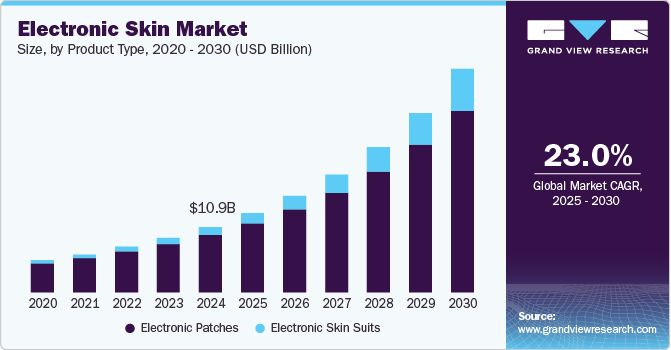

The global electronic skin market size was estimated at USD 10.9 billion in 2024 and is projected to grow at a CAGR of 23.0% from 2025 to 2030. Widening usage of electronic skin owing to its advantages such as self-healing and flexibility is a major driving factor. As the artificial skin mimics human sensing capabilities, it has wide applications in health monitoring technologies. The sensitivity and flexibility of human skin are some of the major factors that uniquely distinguish it from other wearable devices. The increasing number of product launches and speedy FDA approvals are also boosting the market growth. For instance, in February 2024, X-trodes obtained FDA 510(k) clearance for its wearable "skin" solution, enabling medical-grade electrophysiological monitoring in home settings.

Electronic skin, or e-skin, is a flexible, stretchable material embedded with sensors that can mimic human skin's properties. This technology finds applications in healthcare, robotics, and consumer electronics. One of the key drivers of this market is the rising prevalence of chronic diseases, leading to a greater need for continuous health monitoring. For example, wearable devices equipped with e-skin technology can monitor vital signs and glucose levels and even detect changes in skin conditions.

In the healthcare sector, e-skin can revolutionize patient monitoring. For instance, companies like MC10 have developed products like the BioStampRC, a flexible patch that adheres to the skin and monitors physiological signals. This device allows healthcare professionals to track patient data in real-time, leading to improved outcomes and more personalized care. The ability to gather data remotely is particularly beneficial for managing chronic conditions, where continuous monitoring is crucial.

Moreover, the rise of the Internet of Things (IoT) is propelling the e-skin market. As IoT devices become more prevalent, the integration of e-skin into consumer electronics is expanding. For instance, e-skin technology can enhance smart clothing, enabling garments to monitor physical activity and biometric data. Companies like Wearable X are pioneering smart apparel that incorporates e-skin sensors to provide real-time feedback to users.

The demand for e-skin technology is also evident in robotics. Soft robotics, which often require materials that can mimic human movements, benefit from e-skin applications. These robots can use e-skin to sense touch, temperature, and pressure, allowing for more nuanced interactions with their environment. For example, researchers at the University of California, Berkeley, developed a soft robot with an e-skin that enables it to recognize different textures and respond accordingly.

The advent of 3D printing and artificial intelligence has garnered interest in the field of health monitoring, drug delivery, and therapeutic uses. Increasing acceptance of electronic skin in a wide array of its applications such as cardiovascular, diabetes, detecting abnormality, and pregnancy is further developing the e-skin technology. A lot of ongoing studies are focused on studying these technologies, especially in combination.

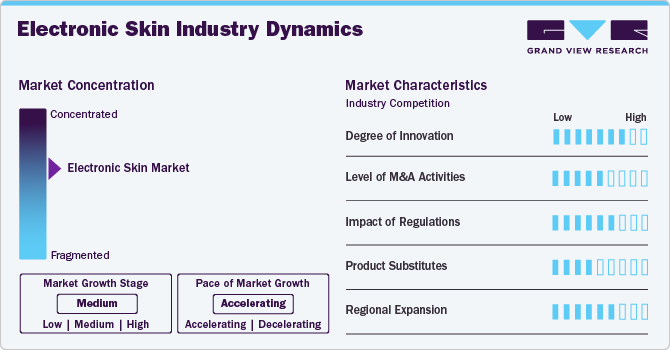

Market Concentration & Characteristics

The electronic skin market exhibits moderate concentration, with several key players dominating the market while allowing space for emerging startups. Major companies focus on innovative materials and technologies, such as flexible sensors and wireless communication. The industry is characterized by rapid advancements in biocompatibility and miniaturization, driven by growing demand in healthcare, robotics, and consumer electronics. Collaboration between tech firms and healthcare providers is common, enhancing the development of applications like health monitoring and prosthetics. As research progresses, regulatory considerations and ethical implications are becoming increasingly important in shaping the industry landscape.

The market is marked by significant innovation, particularly in the development of advanced materials and fabrication techniques. Recent advancements, such as the creation of multifunctional E-skin patches, enable continuous monitoring of various physiological parameters, including temperature, hydration, and metabolic biomarkers. For instance, in January 2023, scientists at the Terasaki Institute for Biomedical Innovation created a groundbreaking electronic skin (E-skin) patch for advanced health monitoring. This innovative patch simultaneously tracks multiple bodily parameters while ensuring breathability and managing temperature and moisture.

Regulations in the market significantly influence product development and market entry. Stringent guidelines from health authorities, such as the FDA and EMA, ensure safety and efficacy, fostering consumer trust. Compliance with biocompatibility standards and data privacy laws is essential for manufacturers. These regulations can accelerate innovation by setting clear benchmarks for performance, while also posing challenges due to lengthy approval processes. As the demand for wearable health technologies grows, regulatory bodies are adapting to incorporate new technologies, potentially streamlining pathways for approval. This balance between oversight and innovation is crucial for advancing the electronic skin market while ensuring patient safety.

Mergers and acquisitions (M&A) in the market are rapidly increasing as companies aim to bolster their technological capabilities and market reach. For instance, in September 2024, iRhythm Technologies entered a strategic license agreement with BioIntelliSense to utilize its patented multiparameter sensor technology for ambulatory cardiac monitoring. This collaboration aims to enhance iRhythm’s product offerings by integrating advanced sensing capabilities, enabling improved patient outcomes and operational efficiency in the electronic skin industry. This strategic acquisition aims to improve product offerings and accelerate the development of innovative health solutions. Additionally, partnerships between established firms and startups are becoming common, enabling knowledge sharing and resource pooling, which fuels growth and innovation within the electronic skin industry.

In the market, product substitutes include traditional health monitoring devices such as standalone heart rate monitors, thermometers, and blood pressure cuffs. These conventional devices often lack the continuous monitoring and multi-parameter capabilities offered by electronic skin solutions. Additionally, wearable fitness trackers and smartwatches serve as alternatives, but they typically provide limited medical-grade accuracy. While these substitutes can track basic health metrics, they do not offer the same level of integration, real-time data analysis, or advanced features like temperature regulation and breathability found in electronic skin technology. Consequently, electronic skin products are positioned as superior solutions for comprehensive health monitoring.

The market is experiencing notable regional growth, fueled by rising healthcare needs and technological advancements. In December 2023, robotics company Wootzano announced plans to expand its headquarters in Northeast England after entering the U.S. market. This expansion signifies the increasing demand for electronic skin technology and aims to bolster the company's research and development capabilities. By enhancing its presence in both the U.S. and the UK, Wootzano aims to capitalize on opportunities for collaboration, innovation, and market growth. This move is expected to support the creation of advanced electronic skin solutions, solidifying the company's leadership in this evolving sector.

Product Type Insights

The electronic patches segment held the largest revenue share accounting for around 88.1% in 2024. Electronic skin patches include actuators, and sensors with appropriate processing, communication, and energy storage. Electronic skin patches are gaining traction owing to their use in various applications of personal care. This technology keeps patients out of the hospitals, while still maintaining close contact with doctors. These electronic patches are used in diabetes self-monitoring, motion sensing, remote patient monitoring- both inpatient and outpatient, & temperature sensing.

The electronic skin suits segment is projected to experience the fastest CAGR over the forecast period. Electronic textiles are products that involve both textile and electronic components. Humans are in contact with textiles all the time and it acts as an excellent interface to connect sensors with the body. Electronic suits are a highly convenient and effective solution for patient monitoring if their action is based on feedback on temperature and pressure coming from the body. In addition, the electronic skin suit market is now shifting from sports to healthcare.

Component Insights

Electroactive polymers are among the leading segments, holding around 30.0% of the revenue share in 2024 and are projected to experience the fastest CAGR over the forecast period. These materials can change shape or size when an electrical voltage is applied, making them ideal for creating flexible, responsive electronic skin. EAPs are utilized in various applications, including healthcare monitoring, robotics, and prosthetics, where they enhance functionality and user experience. Their lightweight and adaptable nature allows for seamless integration into wearable devices, contributing to the growth of the electronic skin industry. As advancements in EAP technology continue, their importance in developing sophisticated electronic skin solutions will likely expand further.

Photovoltaic systems are expected to witness notable growth with CAGR from 2025 to 2030, driven by the increasing demand for sustainable energy solutions in wearable technology. As electronic skin devices require efficient power sources, integrating photovoltaic technology offers a viable solution for energy autonomy. Innovations in lightweight, flexible solar cells enhance the functionality of electronic skin applications, such as health monitoring and environmental sensing. This synergy between photovoltaic systems and electronic skin is further supported by advancements in materials and design, making these systems more accessible for manufacturers.

Sensors Insights

The electrophysiological sensors segment accounted for the largest revenue share of 40.1% in 2024. This is owing to the increasing use of these sensors in various applications of healthcare such as restoration therapies, chronic disease, and physiological monitoring. Moreover, the segment is witnessing a high adoption rate due to the increasing aging population. This sensor provides great assistance to the aging population which requires frequent medical interventions through telehealth, telemedicine, and home health monitoring.

The tactile sensors segment is projected to experience the fastest CAGR over the forecast period. The key drivers of the segment are the high adoption rate of this technology in the field of robotic operation, human-machine interface, and physiological monitoring. Technological advancement and innovation in the field of wearable devices using tactile sensors are expected to boost segment growth. However, the research of flexible tactile sensors on a wide sensing range, high sensitivity, and capability to detect 3D forces is still challenging the market.

Application Insights

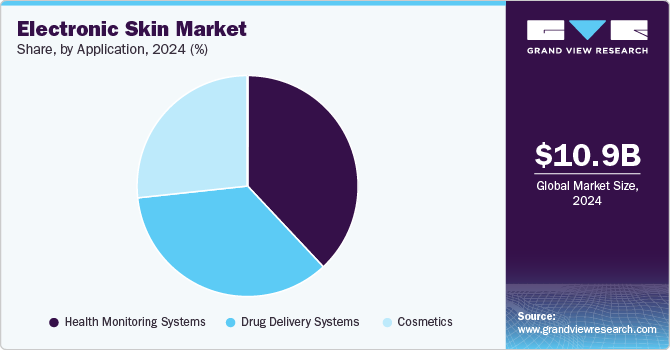

The health monitoring systems segment accounted for the largest revenue share of 38.0% in 2024 This is owing to its high usage in various healthcare applications such as diabetes, cardiology, and neurology. Furthermore, the user-friendly nature of this technology allows the patient to apply patches for muscle, heart, and brain activity tests on their own.

The drug delivery systems segment is projected to witness the fastest CAGR over the forecast period. The high growth rate of the segment is primarily due to its non-invasive, real-time dynamic therapy function. These electronic skins can store data, use muscle movement, and use stored data patterns to deliver medicine through the skin. Thus, the above-mentioned factors are accepted to boost the demand for the market.

Regional Insights

North America electronic skin market dominated the overall global market and accounted for the 37.2% revenue share in 2024. This can be attributed to increasing incidence of chronic diseases such as cardiovascular & neurological diseases, dermatology and orthopedic disorders is a major factor propelling the market growth in North America. In addition, the presence of major players in the industry is further augmenting the growth in the region.

U.S. Electronic Skin Market Trends

The electronic skin market in the U.S. held a significant share of North America's electronic skin market in 2024. This dominance can be attributed to advanced technological innovations, increasing demand for wearable health monitoring devices, and a growing focus on patient-centric healthcare solutions. The U.S. is home to key players and research institutions that drive innovation in electronic skin technology. Additionally, regulatory support and investment in healthcare technology contribute to market growth. As the adoption of electronic skin applications expands across various sectors, including medical, consumer electronics, and robotics, the U.S. market is poised for continued growth and development.

Europe Electronic Skin Market Trends

The European electronic skin market is witnessing growth, driven by increasing consumer awareness about health and wellness drives demand for e-skin patches that provide continuous monitoring and early detection of health issues. The rising prevalence of chronic conditions, such as diabetes and cardiovascular diseases, fuels the need for continuous health monitoring solutions provided by wearable e-skin patches. The IDF Diabetes Atlas reports that approximately 61 million people in Europe had diabetes in 2021, with this number anticipated to rise to around 67 million by 2030. The rising prevalence of chronic diseases, coupled with greater access to advanced skin patches, is anticipated to boost market growth in the region.

The electronic skin market in the UK is witnessing significant growth due to the rising incidence of chronic diseases like diabetes and the expanding elderly population. For instance, according to the Department of Health & Social Care in the UK, the population aged 85 and older is expected to increase by one million between 2021 and 2036.

France electronic skin market is experiencing notable growth due to the country’s emphasis on healthcare innovation and digital health technologies, which promote the advancement and adoption of these wearable devices. Significant investments in R&D by French companies and research institutions are fostering technological advancements and innovations in wearable skin patches. French government policies and programs aimed at advancing healthcare technology and improving patient care contribute to market expansion.

The electronic skin market in Germany is seeing significant growth, driven by the country’s advanced healthcare system, which facilitates the adoption and integration of cutting-edge wearable technologies, such as electronic skin patches. Germany's rapidly aging population, coupled with a high prevalence of chronic diseases like diabetes, heart disease, and cancer, is driving market growth. According to the World Bank, the number of people aged 65 and over in Germany rose from 17.1 million in 2015 to over 19.2 million in 2023. This expanding elderly demographic, along with the rising incidence of chronic conditions, is fueling the growth of the market in Germany.

Asia Pacific Electronic Skin Market Trends

The Asia Pacific electronic skin market is witnessing significant growth driven by rising healthcare investments, an expanding elderly population, and an increasing prevalence of chronic respiratory diseases. Countries like China, India, and Japan are key contributors, with growing adoption of advanced medical technologies and improving healthcare infrastructure. The APAC electronic skin market is expected to expand due to the region's numerous FDA, TGA, and EMA-approved facilities.

The electronic skin market in Japan is anticipated to experience significant growth due to the country’s rapidly aging population, which is driving a strong demand for advanced health monitoring solutions to address age-related health challenges. The World Bank reports that Japan's elderly population has risen from 34.7 million in 2015 to approximately 37.4 million in 2023. The growing elderly population is anticipated to further boost the demand for electronic skin patches in the country, driving market growth.

China electronic skin market is expected to grow in the Asia Pacific in 2023. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the electronic skin market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

The electronic skin market in India is expanding due to increasing public awareness of health and wellness, which is driving greater interest in preventive health monitoring devices, including wearable electronic skin patches. Innovations in electronic and sensor technologies are enhancing the functionality and accessibility of wearable e-skin patches, contributing to their adoption in India. Increased investment in healthcare technology and research by both government and private sectors is driving advancements and expansion in the market.

Latin America Electronic Skin Trends

The Latin American electronic skin market is anticipated to experience substantial growth in 2023. Various Latin American governments are investing in healthcare modernization and digital health technologies, which support the development and adoption of wearable electronic skin patches. Moreover, rapid urbanization and population growth are creating a greater need for advanced health management tools and technologies.

The electronic skin market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per the Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Electronic Skin Company Insights

The market is highly competitive, with key players such as MC10, Xenoma; and VivaLNK holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Electronic Skin Companies:

The following are the leading companies in the electronic skin market. These companies collectively hold the largest market share and dictate industry trends.

- MC10

- Xenoma

- VivaLNK

- GENTAG, Inc

- DIALOG Semiconductors

- Bloomlife

View a comprehensive list of companies in the Electronic Skin Market

Recent Developments

-

In May 2024,researchers at The University of Texas at Austin unveiled a groundbreaking stretchable electronic skin designed to provide robots with human-like touch sensitivity. This innovative e-skin maintains sensing accuracy even when stretched, overcoming a key limitation of previous technologies and enabling precise control in various applications.

-

In May 2024, Researchers from the University of Chicago and Columbia University, including Bozhi Tian, developed an innovative bioelectronic patch designed to monitor and treat chronic skin conditions. This device combines cutting-edge electronics, living cells, and hydrogel, and has demonstrated promising results in experiments with mice.

-

In July 2024, Zhenan Bao discussed her innovative work in creating wearable electronics by mimicking human skin's properties. Her research aims to develop soft, flexible devices that can assist in healing, managing anxiety, and enhancing sensory perceptions, potentially transforming applications in medicine and neuroscience.

Electronic Skin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.2 billion |

|

Revenue forecast in 2030 |

USD 37.1 billion |

|

Growth rate |

CAGR of 23.0% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, component, sensors, application |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

MC10; Xenoma; VivaLNK; GENTAG, Inc.; DIALOG Semiconductors; Bloomlife |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Electronic Skin Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electronic skin market report based on the product type, component, sensors, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic Patches

-

Electronic Skin Suits

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Stretchable Circuits

-

Photovoltaics Systems

-

Stretchable Conductors

-

Electroactive Polymers

-

-

Sensors Outlook (Revenue, USD Million, 2018 - 2030)

-

Tactile Sensors

-

Chemical Sensors

-

Electrophysiological Sensors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Health Monitoring Systems

-

Drug Delivery Systems

-

Cosmetics

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electronic skin market size was estimated at USD 10.9 billion in 2024 and is expected to reach USD 13.2billion in 2025.

b. The global electronic skin market is expected to grow at a compound annual growth rate of 23.0% from 2025 to 2030 to reach USD 37.1 billion by 2030.

b. North America dominated the electronic skin market with a share of 37.2% in 2024 This is attributable to the rising number of geriatric population and the increasing number of product launches.

b. Some key players operating in the electronic skin market include MC10, Xsensio, Xenoma, VivaLNK, IRhythm Technologies, Inc., Holst Center, QUAD Industries, Bloomlife, Feeligreen, GENTAG, Inc, Dialog Semiconductor, Philips, and Plastic Electronic GmbH.

b. Key factors that are driving the market growth include increasing technological development and increasing acceptance of electronic skin in a wide array of its application such as cardiovascular, diabetes, detecting abnormality, and pregnancy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."