- Home

- »

- Healthcare IT

- »

-

Electronic Health Record Apps Market Size Report, 2030GVR Report cover

![Electronic Health Record Apps Market Size, Share & Trends Report]()

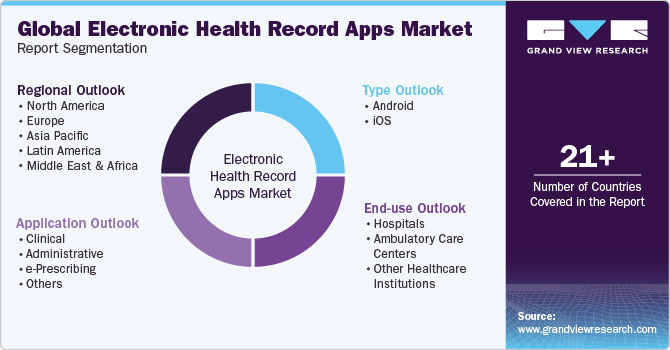

Electronic Health Record Apps Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Android, iOS), By Application (Clinical, Administrative), By End-use (Hospitals, Ambulatory Care Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-314-6

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Health Record Apps Market Trends

The global electronic health record apps market size was estimated at USD 783.22 million in 2023 and is expected to grow at a CAGR of 8.87% from 2024 to 2030. The market is poised for significant growth, driven by increasing demand for efficient healthcare management and rising digitalization. Key drivers include the need for streamlined patient data access, regulatory mandates, and growing adoption of telemedicine. COVID-19 pandemic accelerated this trend, highlighting the importance of digital health solutions. As healthcare continues to prioritize technology integration, the market is expected to substantially expand over the forecast period.

Widespread use of electronic health records (EHRs) in medical practices has facilitated rapid adoption of mobile EHR solutions. According to GSM Association's "Mobile Economy 2024" report, more than 5 billion people were connected to mobile services in 2023, with unique mobile subscribers projected to reach 6.3 billion by 2030. Smartphone penetration, which was 69% in 2023, is expected to rise to 74% by 2030. This increasing adoption of smartphones is a significant driver for the growth of EHR applications, as improved network infrastructure and expanded coverage enhance the usability and accessibility of these apps.

Furthermore, the Hospital Vision Study by Zebra in 2022 revealed that 62% of nursing staff at surveyed hospitals access patient EHRs on their mobile devices, with 57% using them for diagnostic lab results. By leveraging mobile devices and predictive analytics, hospital staff aim to enhance diagnostic accuracy and personalize patient care.

Hospitals have already experienced productivity gains by equipping key personnel with mobile devices. The Zebra study highlighted that in 2022, 97% of nurses used mobile devices at the bedside, a trend anticipated to extend to other medical disciplines, including emergency room nurses, pharmacists, and lab technicians. This is driven by the integration of advanced applications, remote patient monitoring, and artificial intelligence. These advancements are expected to empower clinicians with greater insights and information, transforming the daily work experience and enhancing patient treatment.

Market Concentration & Characteristics

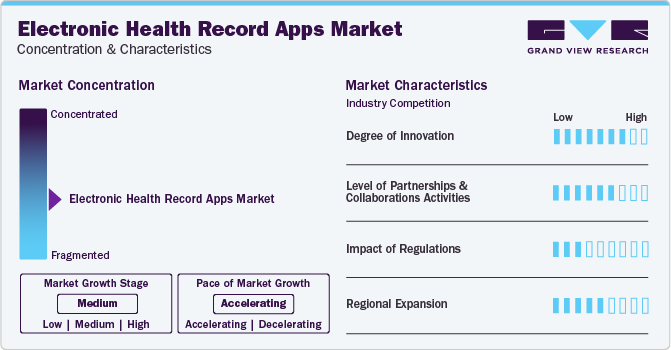

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, level of mergers & acquisitions activities, impact of regulations, and geographic expansion. The electronic health record apps market is fragmented, with many small players entering the market and offering new services. The degree of innovation is high, and the level of partnerships & collaborations activities is high. The impact of regulations on the market is moderate and the regional expansion of the market is medium.

The market is experiencing significant innovation, with various market players offering new products to enhance their market presence. Companies like DrChrono AdvancedMD, Inc., eClinicalWorks, Networking Technology, Inc., and others are offering advanced mobile EHR applications that not only streamline clinical workflows but also enhance overall practitioner performance. For instance, DrChrono's iOS mobile EHR app is designed to ensure that practitioners’ clinical workflows are optimized and run smoothly. This mobile EHR app enables faster patient charting, which is important for maintaining accurate and up-to-date patient records.

The impact of partnership & collaborations on the market is high due to several key market players, including Epic Systems Corporation, Meditab, CompuGroup Medical, AdvancedMD, Inc., eClinicalWorks, EverHealth Solutions Inc. (DrChrono), and others, are involved in partnership & collaborations activities to expand their market presence. For instance, in April 2023, Epic embraced generative AI's role in healthcare by expanding its collaboration with Microsoft. It is integrating OpenAI services, like GPT-4, into Epic's EHR. Pilot programs for these services have already commenced at select health systems, including UC San Diego Health, UW Health, and Stanford Health Care.

Impact of regulations on the market is moderate. However, market is expected to experience growth due to favorable government policies and laws that ensure safety and efficacy of EHR apps. Market players need to consider regulations such as HIPAA (Health Insurance Portability and Accountability Act) during EHR apps development to protect privacy and security of patient health information in U.S. healthcare system.

Regional expansion in the market is moderate, influenced by regulatory changes and specific demands of target customers in low- and medium-income countries. However, some market players extend their presence in different regions to capture market share. For instance, in January 2022, Vanderbilt University Medical Center launched a smartphone application called mUzima. App is compatible with Google's Android operating system and is tailored to integrate smoothly with OpenMRS, an EHR system widely used in low- and middle-income countries (LMICs).

Type Insights

Based on the type, the Android segment dominated the market with a revenue share of 85.48% in 2023. This is attributed to Android's widespread availability across various smartphone and tablet manufacturers, unlike iOS, which is exclusive to Apple products. Additionally, the cost-effectiveness and rising usage of Android smartphones have fueled this segment's growth. For instance, in February 2023, Business of Apps reported that Android is the most popular operating system worldwide, with over 3 billion active users across more than 190 countries. The expanding base of Android users is expected to further propel this segment's growth during the forecast period.

However, the iOS segment is anticipated to experience the fastest growth in the coming years. This projected growth is driven by the increasing adoption of iPhone devices among consumers. Data from BankMyCell.com indicated that the iOS smartphone market share in the U.S. grew from 58.10% in 2023 to 61.45% in 2024. Such trends show the potential for substantial growth in the iOS segment, contributing to the overall expansion of the market.

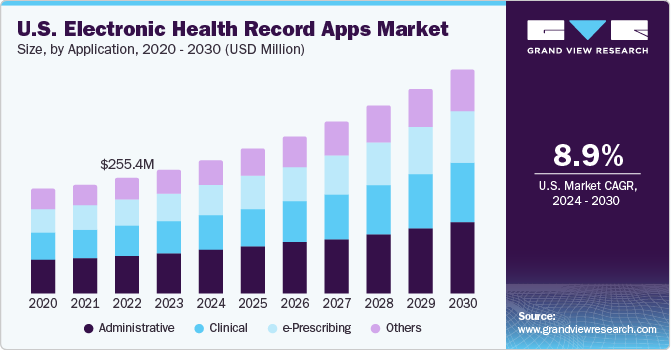

Application Insights

Based on application, administrative segment accounted for largest revenue share of 32.55% in 2023. The segment includes appointment management, billing management, document management, patient portals, and scheduling. These functions streamline healthcare operations, enhance patient engagement, and improve efficiency. By simplifying administrative tasks, EHR apps reduce errors, save time, and facilitate better patient care. Demand for integrated, user-friendly solutions is fueling market expansion, making administrative capabilities a key driver of EHR app adoption.

Clinical segment is expected to experience the fastest growth during the forecast period. EHR apps enhance clinical workflows by providing real-time access to patient data, supporting decision-making, and improving diagnostic accuracy. Features such as lab results integration, and clinical documentation streamline patient care processes. By improving efficiency, reducing errors, and enhancing patient outcomes, clinical segment's advancements in EHR are expected to drive segment growth.

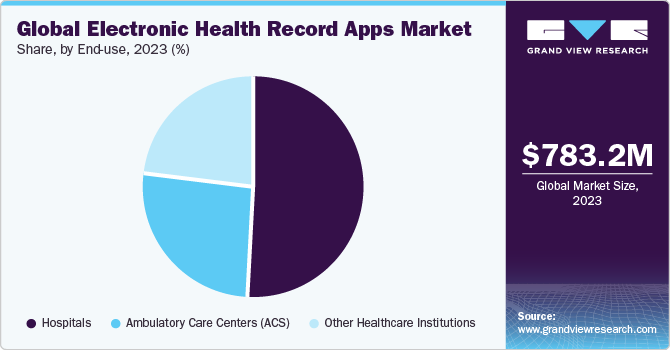

End-use Insights

Based on end-use, the hospital segment accounted for the largest revenue share of 53.10% in 2023. This is attributed to the large amount of medical data generated daily by hospitals, which EHRs efficiently manage. The use of EHRs helps large-scale hospitals save both costs and time, thereby fueling market growth. Additionally, the ease of EHR deployment in small and midsized hospitals contributes to their high adoption rates, further driving the market growth.

Ambulatory care centers are projected to witness the highest CAGR over the forecast period. This growth is driven by the global increase in chronic diseases and the rising adoption of healthcare IT services in these centers. Ambulatory care centers offer significant convenience to both patients and healthcare providers, making them an attractive option for medical care. The increasing number of ambulatory care centers in both developed and developing economies is expected to drive the market growth over the forecast period.

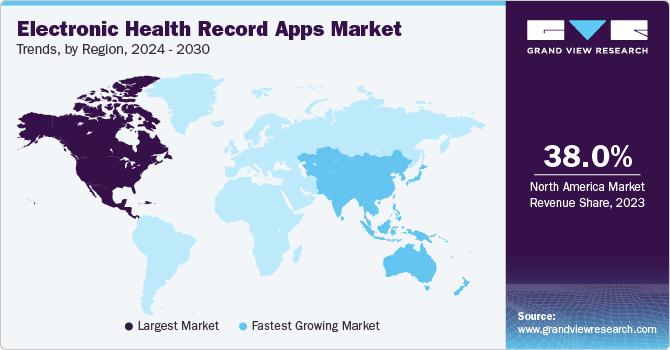

Regional Insights

North America held the largest market share of 38% in 2023. This is attributed to robust healthcare infrastructure, increased adoption of digital health technologies, and favorable government policies that support the adoption of EHRs & the availability of infrastructure with high digital literacy. Furthermore, improving support for the adoption of HCIT by payers and healthcare providers is expected to boost regional growth.

U.S. Electronic Health Record Apps Market Trends

The U.S. market is anticipated to grow significantly over the forecast period. Favorable government regulations for monitoring the safety of healthcare IT solutions are expected to fuel the market in the U.S. For instance, in May 2020, the federal government proposed the Federal Health IT Strategic Plan 2020-2025, which mandates meaningful usage of EHR by healthcare providers.

Europe Electronic Health Record Apps Market Trends

The Europe market is anticipated to grow significantly over the forecast period. The presence of developed economies such as Germany, the UK, France, Spain, and Italy is expected to fuel the market in Europe during the forecast period. Strong regulatory frameworks, widespread digitalization initiatives, and substantial investments in healthcare IT are favorable for market growth. Additionally, robust support from governmental bodies and increasing awareness of digital health benefits contribute to Europe's significant role in expanding the market.

The UK electronic health record apps market is expected to grow significantly over the forecast period. This can be attributed to the country's healthcare sector rapidly digitizing, supported by government initiatives and increased healthcare expenditure. The National Health Service (NHS) is committed to digitizing patient records and driving the adoption of electronic health records and related platforms.

Electronic health record apps market in Germany is expected to grow at a substantial pace over the forecast period. This is attributed to the goal of having 80% of statutorily insured patients using EHRs by 2025, the Federal Ministry of Health is focusing on key initiatives. This includes developing telematics infrastructure, implementing an opt-out principle for EHRs, and establishing a competence center for digitization and care, ensuring a robust expansion of EHR apps adoption across the country.

Asia Pacific Electronic Health Record Apps Market Trends

Asia Pacific market is expected to witness the fastest growth during the forecast period. Healthcare organizations are focusing on deliv ering quality healthcare treatment for patients amid resource and cost restraints. Such factors are fueling the incorporation of smart technologies, such as EHRs, which can leverage integration and interoperability. This region’s growth can also be attributed to R&D investments specifically in the field of AI to produce technologically advanced healthcare solutions.

Japan electronic health record apps market is expected to grow significantly over the forecast period. The country's healthcare system is shifting towards digitization, with the government promoting the adoption of EHRs. The market players are involved in strategic development activities, including new product launches, strategic collaborations, and regional expansion for instance, in January 2023, Fujitsu and Sapporo Medical University collaborated to develop EHR systems. With this collaboration, Fujitsu is expected to develop a mobile app that enables users to view healthcare data on their iPhones.

India electronic health record apps market is expected to witness the fastest growth during the forecast period. This is attributed due to the Government of India enhancing digital health through initiatives like the Integrated Health Information Platform (IHIP). Significant investments in healthcare IT infrastructure aim to create standard compliant EHRs, ensuring integration and interoperability. This initiative seeks to reduce healthcare costs, involve patients in care management, and optimize information exchange for better health outcomes.

Latin America Electronic Health Record Apps Market Trends

Latin America market is anticipated to grow significantly over the forecast period. Major countries contributing to the growth of the market are Brazil and Argentina. Rapid economic growth in these countries is one of the key factors propelling growth during the forecast period.

Brazil electronic health record apps market is expected to grow significantly over the forecast period. The country has made significant progress in digitizing its healthcare system, with the number of primary care units using EHR systems increasing by 61% from 2016 to 2019 according to the OECD. Key factors driving this growth include government initiatives to promote EHR adoption, rising demand for digital health solutions, and increasing use of ICT devices.

MEA Electronic Health Record Apps Market Trends

The market is comparatively underdeveloped in the Middle East and Africa. The market is hindered by the lack of affordability and availability of EHR systems in countries including Turkey and Kuwait. However,the Saudi Arabian government has undertaken various efforts to implement IT systems in the healthcare sector. Several hospitals in the country use these information systems to improve patient care. Improvements in the healthcare sector and an increase in the integration of IT in healthcare are expected to drive the market growth during the forecast period.

South Africa electronic health record apps market is growing at a slower pace, majorly due to lack of established healthcare infrastructure and awareness regarding technological advancements. Although the South African market is in the nascent stage, an increase in the adoption of IT in healthcare is expected in the coming years.

Key Electronic Health Record Apps Company Insights

The market is fragmented, with the presence of many country-level players. The key participants in the market are undertaking various strategic initiatives to expand their business footprint and gain a competitive edge in the global market. Some of the emerging players in the market include Quest Diagnostics Incorporated., AssureCare LLC, Qualifacts, Valant, ChiroTouch, and Practice Fusion, Inc.

Key Electronic Health Record Apps Companies:

The following are the leading companies in the electronic health record apps market. These companies collectively hold the largest market share and dictate industry trends.

- Epic Systems Corporation.

- Meditab

- CompuGroup Medical

- AdvancedMD, Inc.

- eClinicalWorks

- EverHealth Solutions Inc. (DrChrono)

- Athenahealth

- Oracle

- Networking Technology, Inc.

- Altera Digital Health Inc.

Recent Developments

-

In February 2024, Oracle launched the Oracle Identity Governance integration for Oracle Health EHR, previously known as Cerner Millennium. This integration intended to empower healthcare institutions to oversee user access to EHR, synchronize data, and bolster security & operational effectiveness. The connector facilitates automated data exchange, streamlines provisioning processes, and aids in meeting regulatory standards.

-

In April 2023, eClinicalWorks integrated ChatGPT, cognitive services, and machine learning models into its EHR and Practice Management Solution. This integration aimed to enhance value for customers by leveraging advanced AI capabilities for improved functionality & efficiency.

-

In January 2022, athenahealth expanded its mobile EHR voice capabilities for healthcare providers. This voice assistant is designed to help healthcare professionals enhance the patient experience, improve documentation accuracy, and save time.

Electronic Health Record Apps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 844.23 million

Revenue forecast in 2030

USD 1.41 billion

Growth rate

CAGR of 8.87% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Epic Systems Corporation.; Meditab; CompuGroup Medical; AdvancedMD, Inc.; eClinicalWorks; athenahealth; Oracle; Networking Technology, Inc.; Altera Digital Health Inc.; Practice Fusion, Inc.; EverHealth Solutions Inc. (DrChrono)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Health Record Apps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electronic health record apps market report based on type, application, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

iOS

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Administrative

-

e-Prescribing

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Care Centers

-

Other Healthcare Institutions

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electronic health record apps market size was estimated at USD 783.22 million in 2023 and is expected to reach USD 844.23 million in 2024.

b. The global electronic health record apps market is expected to grow at a compound annual growth rate of 8.87% from 2024 to 2030 to reach USD 1.41 billion by 2030.

b. North America dominated the market, with a share of 38.49% in 2023. This is attributable to the region's increasing healthcare expenditures, growing awareness of effective management in the healthcare industry, and growing technological adoption in clinical and hospital settings.

b. Some key players operating in the electronic health record apps market include Epic Systems Corporation., Meditab, CompuGroup Medical, AdvancedMD, Inc., eClinicalWorks, athenahealth, Oracle, Networking Technology, Inc., Altera Digital Health Inc., Practice Fusion, Inc., EverHealth Solutions Inc. (DrChrono)

b. Key factors that are driving the EHR apps market growth include rising demand of health and medical apps for smartphones, increasing use of mobile device for accessing healthcare data, and technological advancement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.