- Home

- »

- Medical Devices

- »

-

Electron Microscopes Market Size And Share Report, 2030GVR Report cover

![Electron Microscopes Market Size, Share & Trends Report]()

Electron Microscopes Market Size, Share & Trends Analysis Report By Type (Transmission, Scanning), By Application (Material Science, Nanotechnology, Life Science), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-469-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Electron Microscopes Market Size & Trends

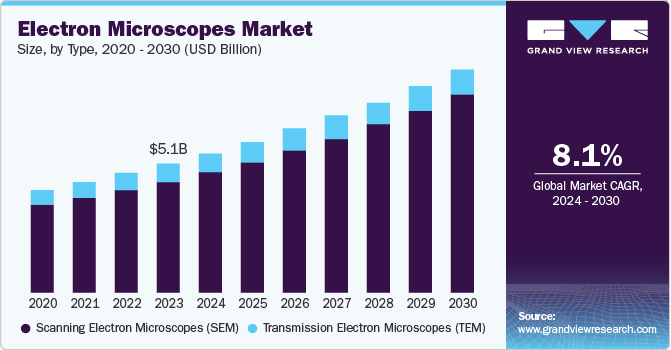

The global electron microscopes market size was valued at USD 5.05 billion in 2023 and is projected to grow at a CAGR of 8.1% from 2024 to 2030. Increasing research and development activities, rising government funding and industry investments, and expanding application areas of electron microscopes have acted as key growth drivers for this market. Moreover, innovations in electron microscope technology have led to significantly improved image resolution, enabling more detailed analysis at the nanoscale level. Furthermore, integrating electron microscopy with other analytical techniques, such as spectroscopy and tomography, has expanded the scope of applications. These advancements and parallel growth in nanotechnology have propelled a significant increase in the global market.

There has been a steady growth in the usage of electronic devices globally, aided by their improving functionality and competitive prices. The growing emphasis on developing novel materials and nanotechnology-based products to integrate these gadgets has fueled the demand for electron microscopes to characterize their properties. For instance, Critical Dimension Scanning Electron Microscopes (CD-SEM) are used extensively to measure the dimensions of semiconductor wafers used in manufacturing nanoscale-based microprocessors for high-end electronic devices such as smartphones, laptops, and tablets. Furthermore, collaborative efforts between governments and industries are driving investments in research infrastructure, including electron microscopy facilities.

The life sciences industry is another major end user of electron microscopes. Advancements in life sciences research, particularly in drug discovery, cellular biology, and pathology, rely significantly on electron microscopy for in-depth analysis. Governments are allocating substantial funds to support research in areas such as nanotechnology, materials science, and biotechnology, which are heavily dependent on electron microscopy. Additionally, an expanding area of application beyond traditional usages, such as environmental monitoring, pollution analysis, development of new energy sources, conducting crime scene investigation, and evidence analysis, have opened new avenues for market growth.

Type Insights

Scanning Electron Microscopes (SEM) accounted for the highest revenue share of 86.0% in 2023. SEMs offer a broad spectrum of applications across diverse industries, such as material sciences, semiconductor manufacturing, life sciences, and nanotechnology. Their ability to generate high-resolution, three-dimensional images of sample surfaces has made them essential tools for characterization, quality control, and research. Additionally, compared to Transmission Electron Microscopes (TEMs), SEMs are generally more accessible regarding costs, size, and operational requirements. These factors lead to a heightened demand for SEMs and a much larger market share.

The demand for Transmission Electron Microscopes (TEM) is expected to grow at a significant CAGR during the forecast period. TEMs offer exceptional image resolution capabilities, enabling researchers to observe and analyze materials at an atomic scale. This feature is vital in materials science, nanotechnology, and life sciences. Additionally, TEMs find applications across a wide spectrum of scientific disciplines, including metallurgy, chemistry, biology, and medicine. Researchers are striving to improve the application scope of TEMs that can help drive their demand. For instance, in April 2024, a team of material scientists from Manchester announced they were developing the ‘AutomaTEM’ microscope that combines advanced imaging and spectroscopy with automated workflows and AI. It is expected to expedite innovations in the materials science area for low-power electronics, quantum computing, and energy transition.

Application Insights

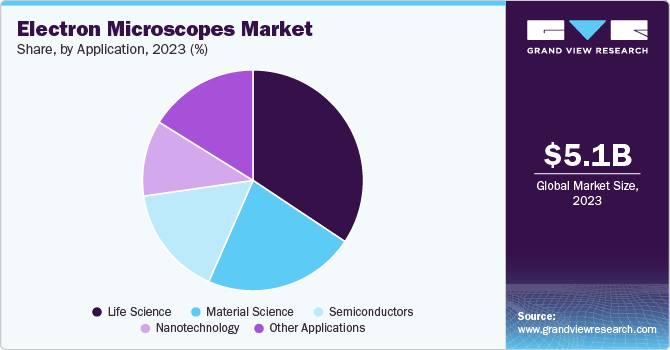

The life sciences sector accounted for the highest market share in 2023. The sector has witnessed unprecedented growth in research and development activities, driven by innovations in medicine, biotechnology, and genetics. Electron microscopes are indispensable tools for investigating biological structures at the nanoscale level, enabling deep insights into cellular processes, molecular interactions, and disease mechanisms. Furthermore, continuous advancements in electron microscopy technologies, such as cryogenic electron microscopy (cryo-EM), have expanded the capabilities of these instruments in biological research. These factors have collectively contributed to the large share of this sector.

The nanotechnology sector is expected to register the fastest CAGR of 9.4% over the forecast period. The sector is characterized by robust research and development (R&D) activities. Researchers rely on electron microscopy for detailed analysis to understand, develop, and optimize nanomaterials and nanostructures. Moreover, expanding nanotechnology applications across electronics, materials science, and healthcare industries drive the demand for advanced imaging techniques. Electron microscopy is pivotal in quality control, process optimization, and new material development in these sectors. These advancements are expected to drive substantial growth in this sector.

Regional Insights

The North America electron microscopes market accounted for a substantial revenue share of 63.7% in 2023. The region's strong emphasis on scientific research and technological innovations has created a fertile environment for developing and refining electron microscope technology. Additionally, the presence of prominent academic institutions, research laboratories, and technology hubs has aided in accelerating the advancements in electron microscopy. These factors and the presence of industry leaders in the region have helped enable steady market growth.

U.S. Electron Microscopes Market Trends

The U.S. accounted for a significant share of the regional market. It is attributed to the presence of a mature healthcare and life sciences industry in the country, along with a high demand for advanced imaging and analytical tools. Electron microscopes are essential for research, drug discovery, and quality control in these sectors, driving market demand. Additionally, a significant proportion of the world's prominent electron microscope manufacturers, such as Thermo Fisher Scientific Inc., Bruker, and Angstrom Advanced Inc., are headquartered in the U.S. These companies leverage skilled workforce, robust supply chain infrastructure, and access to capital, enabling them to drive market growth.

Europe Electron Microscopes Market Trends

Europe held a notable revenue share in the global market in 2023. Significant investments in basic and applied research in the region have led to innovations in electron microscopy technology and its applications. Europe possesses a highly skilled workforce and advanced manufacturing infrastructure, enabling the production of high-precision electron microscopes with superior performance. The presence of prominent industrial economies such as Germany, France, and the UK, with a focus on scientific achievements, has nurtured a culture of innovation in the region. These factors have contributed to a substantial share of the region in the global market.

The UK has historically been associated with a strong culture of research and scientific discoveries. Prominent industry players such as Oxford Instruments are headquartered in the country, which ensures an efficient distribution channel for the shipment of the latest electron microscopes to their desired facilities. Additionally, substantial demand comes from well-established research laboratories in the country. These factors have led to a substantial share of the country in the regional market.

Asia Pacific Electron Microscopes Market Trends

Asia Pacific is expected to register the fastest growth rate of 9.3% from 2024 to 2030. The region is experiencing significant progress in terms of scientific innovations from countries such as Japan, South Korea, China, and Australia. These economies are primarily engaged in scientific advancements in nanomaterial and nanotechnology instruments for microprocessors of high-end electronic components. These advancements have led to a steady rise in demand for sophisticated electron microscopes in this region.

Increased budgeted spending from government scientific laboratories and pharmaceutical companies' research and development efforts have positioned India as a promising market for electron microscopes. Furthermore, strong collaborations among academia, industry, and government have accelerated technological advancements and product development in the electron microscopy industry. Such public-private partnerships have fostered a conducive environment for innovation and market growth.

Key Electron Microscopes Company Insights

Some key companies involved in the electron microscopes market include Hitachi High-Tech Corporation, JEOL Ltd., and Delong Instruments, among others.

-

Hitachi High-Tech Corporation is a subsidiary of Hitachi Ltd., a multinational company offering a wide range of products in various critical fields. Hitachi High-Tech offers equipment in semiconductor manufacturing, analytical systems, and microscopy. The company offers an extensive collection of advanced electron microscopes such as Standard Electron Microscopes, Scanning Transmission Electron Microscopes (STEM), Variable-Pressure Scanning Electron Microscopes (VP-SEM), Biological and Analytical Transmission Electron Microscopes (TEM), Field-Emission Scanning Electron Microscopes (FE-SEM), and Tabletop Microscopes.

-

JEOL Ltd. is a Japan-based company offering products in electron microscopy, scientific analysis, semiconductor equipment, industrial instruments, and medical equipment. The company provides a variety of TEMs, such as the CRYO ARM 300 series of field emission cryo-electron microscopes, TEMs for semiconductors, and 120 kV, 200 kV, and 300 kV TEMs. Additionally, JEOL offers a wide range of SEMs in the JSM-IT series and various instruments related to microscopes, such as the miXcroscopy Linked Optical & Scanning Electron Microscopy System and SMILE VIEW Map software.

Key Electron Microscopes Companies:

The following are the leading companies in the electron microscopes market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Oxford Instruments

- Carl Zeiss AG

- Hitachi High-Tech Corporation

- JEOL Ltd.

- Angstrom Advanced Inc.

- Hirox Europe

- ADVANTEST CORPORATION

- Bruker

- Delong Instruments

View a comprehensive list of companies in the Electron Microscopes Market

Recent Developments

-

In July 2024, Oxford Instruments announced that it had acquired FemtoTools AG. With this strategic move, FemtoTools will join Oxford Instruments' imaging and analysis division. Its products are expected to be sold with Oxford Instruments' current material analysis tools portfolio, including electron microscope micro-analyzers and Raman microscopes.

-

In May 2024, Hitachi High-Tech Corporation launched the company’s SU3800SE and SU3900SE Series of High-Resolution Schottky Field Emission Scanning Electron Microscopes (FESEM), which enable nanoscale-level observation of large and heavy specimens weighing up to 5 kilograms. This breakthrough is expected to help researchers observe large specimens without cutting them, thus improving process efficiency.

Electron Microscopes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.46 billion

Revenue Forecast in 2030

USD 8.71 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, Australia, South Korea, India, Thailand, Brazil, Argentina, Colombia, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Oxford Instruments; Carl Zeiss AG; Hitachi High-Tech Corporation; JEOL Ltd.; Angstrom Advanced Inc.; Hirox Europe; ADVANTEST CORPORATION; Bruker; Delong Instruments

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electron Microscopes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electron microscopes market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Transmission Electron Microscopes (TEM)

-

Scanning Electron Microscopes (SEM)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Material Science

-

Nanotechnology

-

Life Science

-

Semiconductors

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."