- Home

- »

- Medical Devices

- »

-

Electro-medical And Electrotherapeutic Apparatus Market, 2030GVR Report cover

![Electro-medical And Electrotherapeutic Apparatus Market Size, Share & Trends Report]()

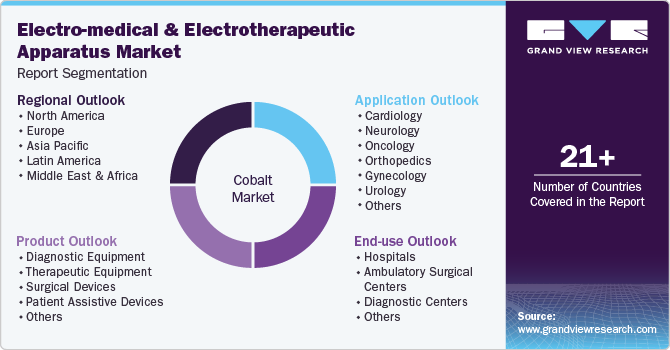

Electro-medical And Electrotherapeutic Apparatus Market Size, Share & Trends Analysis Report By Product (Diagnostic, Therapeutic), By Application (Cardiology, Oncology), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-491-3

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

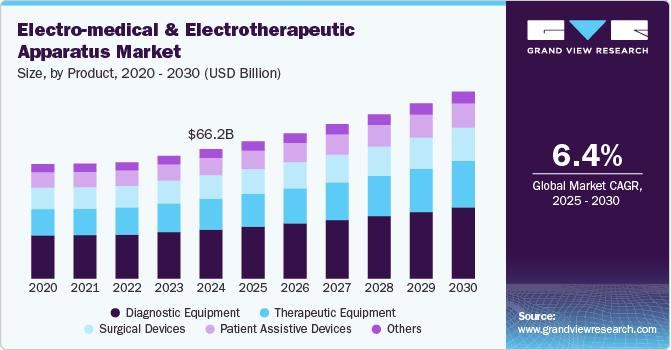

The global electro-medical and electrotherapeutic apparatus marketsize was estimated at USD 66.2 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. Major factors contributing to the electro-medical and electrotherapeutic apparatus industry growth are the increasing prevalence of chronic conditions such as cancer, diabetes, and cardiovascular diseases (CVDs), advancements in technology, growing awareness of treatment and diagnostic options among the public, and a rising elderly population. For instance, according to WHO, by 2030, one in six people globally will be aged 60 or older. The number of people aged 60 and above is expected to rise from 1 billion in 2020 to 1.4 billion. The global population of individuals aged 60 and older is projected to double, reaching 2.1 billion by 2050.

The electro-medical and electrotherapeutic apparatus industry includes a wide range of devices designed for various medical purposes, such as diagnostic imaging, patient monitoring, and therapeutic treatments. These devices are highly efficient and developed to meet the specific needs of healthcare providers, offering precise and reliable results in diagnosing and treating various conditions. The growing prevalence of chronic disorders, such as cancer, diabetes, cardiovascular diseases, and respiratory illnesses, plays a significant role in driving the demand for these devices. For instance, according to the WHO, CVDs are the leading cause of death worldwide, responsible for approximately 17.9 million deaths annually. Chronic conditions often require continuous monitoring, accurate diagnosis, and ongoing treatment, which can be managed with the use of advanced electro-medical and electrotherapeutic equipment. As the number of individuals affected by such disorders increases globally, the need for these devices is expected to rise accordingly, contributing to market growth.

In addition, technological advancements, including innovations in artificial intelligence, machine learning, and remote patient monitoring, are further enhancing the capabilities of electro-medical devices. These advancements not only improve the accuracy and efficiency of diagnoses and treatments but also expand the accessibility and affordability of healthcare services. For instance, the introduction of devices like home-use blood glucose monitors and insulin pumps allow patients to manage their glucose levels independently, reducing the need for frequent hospital visits and empowering individuals to take control of their health. By enabling more personalized care and remote monitoring, these advancements are improving patient outcomes.

Market Concentration & Characteristics

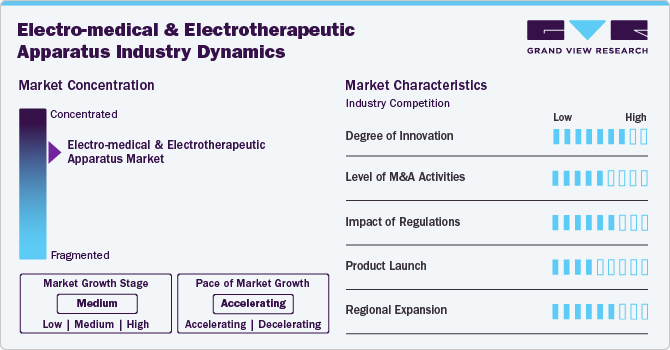

The electro-medical and electrotherapeutic apparatus industry is accelerating at significant growth, driven by a combination of factors, including the rising prevalence of chronic diseases, technological advancements, and the increasing demand for personalized and home-based healthcare solutions. As chronic conditions such as cardiovascular diseases, diabetes, and respiratory disorders continue to affect a larger segment of the population, there is a growing need for advanced diagnostic tools and therapeutic devices.

Companies are strategically focusing on launching new products and securing government approvals to strengthen their industry position and expand their competitive edge. By introducing innovative products, they aim to address emerging healthcare needs and capitalize on the growing demand for advanced electro-medical and electrotherapeutic devices. For instance, in July 2024, Fujifilm Holdings Corporation announced the U.S. launch of APERTO Lucent, a high-performance, open 0.4T MRI system designed to enhance imaging capabilities.

The degree of innovation in the electro-medical and electrotherapeutic apparatus industry is high, driven by continuous advancements in technology, materials, and digital health solutions. In August 2024, Medtronic announced FDA approval for its Simplera CGM, a disposable glucose sensor, and a global partnership with Abbott. This collaboration aims to integrate Abbott's CGM technology with Medtronic’s insulin delivery systems, enhancing diabetes management with advanced glucose monitoring and automated insulin delivery solutions.

Industry players are actively engaging in mergers and acquisitions as a key strategy to strengthen their position, diversify their product offerings, and stimulate growth. For instance, in April 2024, OMRON Healthcare Co., Ltd.announced its acquisition of Luscii Healthtech, a rapidly expanding scale-up specializing in digital health and remote consultation service platforms.

The impact of regulations on electro-medical and electrotherapeutic apparatus is significant, as regulatory requirements vary widely across different regions and agencies. These regulations govern everything from product development, manufacturing, and testing to marketing and post-market surveillance, ensuring that devices are safe, effective, and compliant with local standards. For example, the U.S. Food and Drug Administration (FDA) has stringent guidelines for approving medical devices, focusing on safety and efficacy through clinical trials and testing.

Manufacturers are actively involved in launching new products to meet evolving industry demands and technological advancements. In February 2024, Zimmer Biomet announced that the ROSA Shoulder System had been granted FDA clearance for use in robotic-assisted shoulder replacement surgery.

The geographical reach of the electro-medical and electrotherapeutic apparatus industry exhibits a moderate to high level of expansion, driven largely by strategic initiatives and cross-regional collaboration. For instance, in April 2024, the “Italian Healthcare Ecosystem for China” event was held during the China International Medical Equipment Fair (CMEF) in Shanghai. this event aimed to introduce Chinese companies to the Italian healthcare industry and foster cross-border collaboration and innovation. This reflects a broader trend where companies from different regions actively seek partnerships and industry expansion opportunities, promoting the exchange of knowledge, technology, and solutions across global healthcare ecosystems.

Product Insights

The diagnostic equipment segment dominated the market and held the largest revenue share of 37.9 % in 2024. The high demand for advanced diagnostic devices that enable accurate and early detection of diseases, which is essential for effective treatment planning, is a major contributor to the segment growth. In addition, continuous advancements in technology, such as MRI, CT, and ultrasound, are further contributing to the growth of this segment. As healthcare providers increasingly prioritize early and precise diagnostics, the demand for diagnostic equipment grows.

The therapeutic equipment segment is projected to grow at the fastest CAGR over the forecast period. This is owing to the rising demand for advanced treatment options and the increasing prevalence of chronic conditions that require ongoing therapy. Therapeutic devices, which include equipment such as electrotherapy units, ultrasound therapy devices, and neuromodulation systems, are crucial in managing a wide range of health conditions, including chronic pain, neurological disorders, cardiovascular diseases, and musculoskeletal issues. Technological advancements in these devices are further contributing to market growth. In April 2024, Magnus Medical, Inc. announced the commercial launch of the SAINT neuromodulation system, an innovative and fast-acting therapy designed to treat major depressive disorder (MDD) in patients who have not responded to other treatments.

End Use Insights

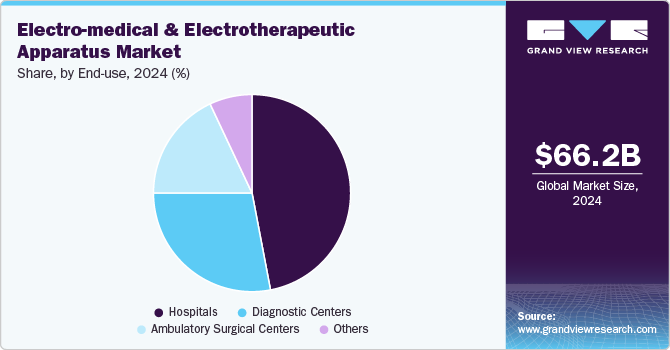

The hospitals segment held the largest revenue share of 46.5% in 2024. Hospitals are adopting electro-medical and electrotherapeutic apparatus at an increasing rate. For instance, in January 2024, Asensus Surgical, Inc., a medical device company focused on digitizing the interface between surgeon and patient, announced that Nagoya University Hospital in Japan had agreed to lease and implement the Senhance Surgical System in its Pediatric Surgery Department as of December 2023. This installation marks the first pediatric use of the Senhance system in Japan and the fourth such pediatric installation worldwide in 2023, highlighting the growing adoption of digital and robotic-assisted surgery tools in hospitals to improve precision, reduce invasiveness, and enhance surgical outcomes for even the most delicate procedures.

The diagnostic centers segment is expected to witness the fastest CAGR during the forecast period. The increasing need for accessible, high-quality diagnostic services, especially for the early detection and management of chronic diseases, are factors contributing to the segment growth. Advances in diagnostic equipment, including portable imaging devices and AI-enhanced analysis tools, are further supporting this growth by enabling these centers to deliver accurate and timely results. In addition, the trend toward outpatient services and the decentralization of healthcare are encouraging investment in diagnostic centers.

Application Insights

The cardiology segment dominated the market and held the largest revenue share of 26.9% in 2024. This is due to the growing prevalence of CVDs, which remain a leading cause of morbidity and mortality. As a result, there is a growing demand for advanced cardiac diagnostic and therapeutic devices, including electrocardiographs, defibrillators, pacemakers, and cardiac ablation systems, which are essential in diagnosing, monitoring, and managing heart conditions. In addition, continuous advancements in cardiology-related technology, such as remote monitoring systems and minimally invasive treatment options, are enhancing patient outcomes and increasing the adoption of these devices.

The neurology segment is projected to grow at the fastest CAGR during the forecast period. This is due to the rising prevalence of neurological disorders such as epilepsy, Parkinson's disease, Alzheimer's disease, and chronic migraines, which require specialized and ongoing treatment. Advances in neurostimulation and neuromodulation devices offering targeted and minimally invasive treatment options, innovations in imaging technology, and the integration of AI for enhanced diagnostics are improving the accuracy of neurological assessments, further fueling segment growth.

Regional Insights

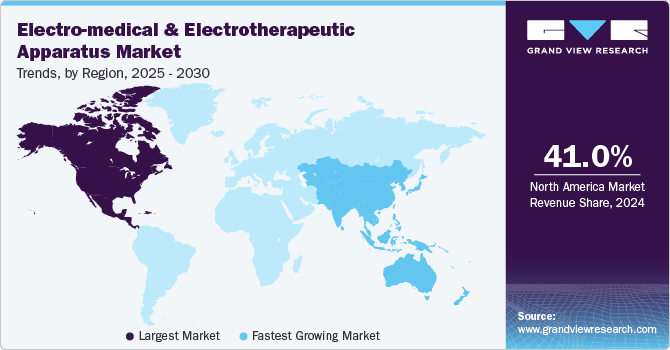

North America electro-medical and electrotherapeutic apparatus market held the largest share of 41.0% in 2024, driven by advanced healthcare infrastructure, high adoption of innovative medical technologies, and substantial investment in research and development. The region benefits from the strong presence of leading market players such as Medtronic, GE Healthcare, Siemens, and others, which are significantly engaged in developing and launching cutting-edge electro-medical devices.

U.S. Electro-medical And Electrotherapeutic Apparatus Market Trends

The U.S. electro-medical and electrotherapeutic apparatus market held the largest market share in 2024 in the North America region. This is attributed to the rising prevalence of chronic disorders in the country, including diabetes, as well as the development of new products by manufacturers to address these conditions. For instance, in August 2024, Medtronic announced FDA approval for its Simplera continuous glucose monitor (CGM), the company’s first disposable, all-in-one CGM that is half the size of previous Medtronic models.

Europe Electro-medical And Electrotherapeutic Apparatus Market Trends

Europe electro-medical and electrotherapeutic apparatus market held a significant market share in 2024. This is owing to the presence of both major global players and strong local companies competing to secure a significant portion of the market. In July 2024, AliveCor announced the launch of its InstantQT in Europe, enabling physicians to remotely record point-of-care ECG readings.

UK electro-medical and electrotherapeutic apparatus market is experiencing significant growth, driven by factors such as the increasing prevalence of chronic disorders, advancements in technology, and a rise in R&D activities in the region. For instance, in April 2024, the University of Nottingham announced the selection of suppliers to design and build the UK’s most powerful magnetic resonance imaging (MRI) scanner. This advanced scanner will provide researchers and doctors with unprecedented insights into brain function and the mechanisms behind human disease.

The France electro-medical and electrotherapeutic apparatus market is expected to grow over the forecast period. The increasing cancer burden in France has significantly impacted the market growth, as there is a rising demand for advanced diagnostic and therapeutic technologies to address this growing healthcare challenge.

Germany electro-medical and electrotherapeutic apparatus market is experiencing significant growth, driven by advancements in medical technology, particularly in the fields of diagnostic imaging, therapeutics, and patient monitoring. The introduction of new products in the German market is further boosting market growth. For instance, in October 2024, Roche announced that it would soon launch its Accu-Chek Smartguide in the Netherlands, Switzerland, and Germany. The company aims to differentiate itself from competitors by incorporating features designed to predict hypoglycemia, providing users with enhanced control over their diabetes management. This innovation is expected to offer patients more personalized and proactive care by alerting them to potential low blood sugar events before they occur, helping to prevent complications and improve overall health outcomes.

Asia Pacific Electro-medical And Electrotherapeutic Apparatus Market Trends

Asia Pacific electro-medical and electrotherapeutic apparatus market is expected to witness the fastest growth of CAGR of 7.8% over the forecast period. This is primarily due to rising demand for advanced medical technologies, increasing healthcare investments, and improving healthcare infrastructure across the region. The growing prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and cancer, is also contributing to the need for more sophisticated diagnostic and therapeutic devices. In addition, the expanding geriatric population in countries such as Japan and China is boosting the demand for medical devices that aid in the management of age-related health issues.

China electro-medical and electrotherapeutic apparatus market is expected to grow at a notable growth rate over the forecast period, driven largely by the increasing incidence of chronic diseases such as cardiovascular diseases, diabetes, and cancer. The rising demand for advanced diagnostic tools and therapeutic devices is further fueled by the country's aging population and growing healthcare awareness. In addition, China's ongoing investments in healthcare infrastructure and technology, coupled with government initiatives to improve medical services, are expected to accelerate the adoption of electro-medical devices.

Japan electro-medical and electrotherapeutic apparatus market is significantly driven by technological advancements, the growing adoption of advanced medical devices, and heightened awareness among both healthcare providers and patients. In September 2024, iRhythm Technologies, Inc. received regulatory approval from the Japanese Pharmaceutical and Medical Device Agency (PMDA) for its Zio fourteen-day, long-term continuous ECG monitoring system. With this approval, iRhythm plans to work towards securing a reimbursement decision for the Zio ECG monitoring system from the Japanese Ministry of Health, Labour, and Welfare (MHLW)

Latin America Electro-medical And Electrotherapeutic Apparatus Market Trends

Latin America electro-medical and electrotherapeutic apparatus market is expected to grow over the forecast period owing to the increasing awareness of medical technology and its effectiveness in improving patient outcomes. As healthcare providers and patients become more informed about the benefits of advanced medical devices, such as their role in accurate diagnostics and efficient treatment, the demand for these technologies is on the rise. In addition, the growing prevalence of chronic conditions, including cardiovascular diseases, diabetes, and neurological disorders, is significantly contributing to market growth, as these conditions often require ongoing monitoring and advanced therapeutic solutions. The combination of greater awareness and the increasing need for specialized medical devices to manage chronic diseases is fueling the demand for cancer in the region.

Middle East & Africa Electro-medical And Electrotherapeutic Apparatus Market Trends

Middle East & Africa electro-medical and electrotherapeutic apparatus market is experiencing notable growth, driven by the increasing adoption of advanced medical technologies and a growing focus on improving healthcare infrastructure. As healthcare systems in the region modernize, there is a rising demand for advanced diagnostic and therapeutic devices that offer more accurate and efficient patient care.In addition, governments in the region are making substantial investments to upgrade healthcare facilities and expand access to quality medical services. This is particularly evident in the Gulf Cooperation Council (GCC) countries, where there is a strong push to diversify healthcare capabilities and reduce reliance on medical tourism by developing advanced healthcare systems locally.

Key Electro-medical And Electrotherapeutic Apparatus Company Insights

The leading players in the electro-medical and electrotherapeutic apparatus industry are actively expanding their product portfolios through a variety of strategies to stay competitive and increase their market share. These strategies include regular product enhancements to integrate the latest technological innovations, forming strategic partnerships, and exploring acquisition opportunities. Furthermore, securing government approvals for their products is essential to meet regulatory requirements and ensure market compliance.

Key Electro-medical And Electrotherapeutic Apparatus Companies:

The following are the leading companies in the electro-medical and electrotherapeutic apparatus market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Medtronic

- Abbott

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

- Zimmer Biomet

- Nihon Kohden Corporation

- OMRON Healthcare, Inc.

- Invacare Corporation

Recent Developments

-

In October 2024, Nihon Kohden Corporation, announced the launch of the NKV-440 Ventilator System. Previously available exclusively through Nihon Kohden’s subsidiary, OrangeMed, this advanced ventilator is now accessible to a broader range of healthcare providers.

-

In June 2024, RevelAi Health and Zimmer Biomet Holdings, Inc. announced a multi-year co-marketing agreement to promote generative artificial intelligence (AI)-powered engagement solutions aimed at advancing value-based orthopedic care and promoting health equity.

-

In October 2024, Fujifilm Holdings Corporation announced the launch of the ECHELON Synergy 1.5T MRI System Software, which includes AI-powered workflow enhancements.

-

In February 2024, the FDA approved Boston Scientific's Spinal Cord Stimulator Systems for the treatment of non-surgical back pain.

Electro-medical And Electrotherapeutic Apparatus Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 70.0 billion

Revenue forecast in 2030

USD 95.5 billion

Growth Rate

CAGR of 6.4% from 2025 to 2030

Actual period

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers AG; Medtronic; Abbott; Boston Scientific Corporation; Fujifilm Holdings Corporation; Zimmer Biomet; Nihon Kohden Corporation; OMRON Healthcare, Inc.; Invacare Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electro-medical And Electrotherapeutic Apparatus Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electro-medical and electrotherapeutic apparatus market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Equipment

-

Therapeutic Equipment

-

Surgical Devices

-

Patient Assistive Devices

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Neurology

-

Oncology

-

Orthopedics

-

Gynecology

-

Urology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electro-medical and electrotherapeutic apparatus market size was estimated at USD 66.2 billion in 2024 and is expected to reach USD 70.0 billion in 2025.

b. The global electro-medical and electrotherapeutic apparatus market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 95.5 billion by 2030.

b. The diagnostic equipment segment dominated the electro-medical and electrotherapeutic apparatus market with a share of 37.9% in 2024. This is due to the rising prevalence of chronic disorders, which has led to an increased demand for advanced diagnostic tools and technologies.

b. Some key players operating in the electro-medical and electrotherapeutic apparatus market include GE HealthCare; Koninklijke Philips N.V.;Siemens Healthineers AG; Medtronic; Abbott; Boston Scientific Corporation; Fujifilm Holdings Corporation; Zimmer Biomet; Nihon Kohden Corporation; OMRON Healthcare, Inc.; Invacare Corporation

b. Key factors that are driving the electro-medical and electrotherapeutic apparatus market growth include expanding geriatric population, an increasing focus on non-invasive and minimally invasive treatment options, and the rising prevalence of chronic diseases

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."