Electrical Insulator Market Size, Share & Trends Analysis Report By Type (Ceramic, Glass, Composite), By Application (Transformer, Cable, Busbars), By Voltage, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-379-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Electrical Insulator Market Size & Trends

“2030 electrical insulator market value to reach USD 18.37 billion.”

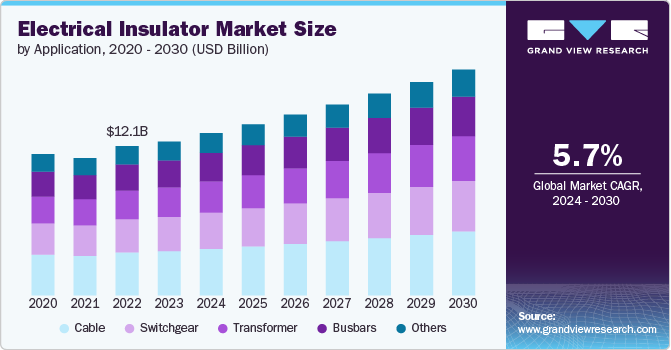

The global electrical insulator market size was estimated at USD 12.52 billion in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The market's expansion is driven by increasing infrastructural development and electrification projects worldwide, particularly in emerging economies. Rising investments in renewable energy infrastructure also contribute significantly to market growth, boosting demand for electrical insulators across various applications.

Unlike traditional ceramic insulators, composite materials offer higher resistance to pollution, reducing the risk of electrical flashovers and maintaining operational reliability in adverse conditions. These attributes make composite insulators particularly suitable for high-voltage applications such as power transmission lines and substations, where reliability and longevity are critical.

Drivers, Opportunities & Restraints

The demand for composite insulators is experiencing robust growth primarily due to their lightweight characteristics and exceptional performance in challenging environments contaminated with pollutants. As global electrification efforts expand and infrastructural investments increase, the adoption of composite insulators is expected to accelerate, driving the market's upward trajectory.

Ceramic insulators face performance challenges in polluted environments, affecting market growth. The demand for high performance in all conditions, driven by strict regulations, pushes the industry towards innovative solutions and the use of more durable materials like composites. This shift is fostering ongoing technological progress and enhancements in reliability.

Regulatory frameworks worldwide emphasize the need for sustainable and efficient electricity transmission solutions, driving demand for insulators capable of supporting modern grid infrastructures. The transition towards smart grids and renewable energy sources further amplifies the demand for advanced insulator technologies that can enhance grid reliability and efficiency.

Type Insights

“Composite insulator segment is anticipated to grow at fastest CAGR over the forecast period ranging from 2024-2030.”

The electrical insulators market is segmented into ceramic, composite, and glass insulators. Ceramic insulators are traditional and valued for their robustness and reliability in high-voltage applications, making them prevalent in transmission lines and substations.

Composite insulators, on the other hand, are increasingly favored for their lightweight properties and resistance to contamination, enhancing performance in harsh environments such as coastal areas or industrial sites. Glass insulators, known for their excellent mechanical strength and insulating properties, find application in both low and high voltage scenarios, including railway electrification and utility pole applications.

Application Insights

“Cable segment held the largest revenue share of electrical insulator market in 2023.”

The application segment of electrical insulators covers transformers, switchgear, cables, busbars, and other critical electrical applications. Insulators play a crucial role in electrical systems by ensuring safe electricity distribution and operation. They are key applications in transformers, where they maintain insulation between voltage levels, and in switchgear, for circuit isolation and fault protection. Insulators also prevent leakage currents in cables and busbars, supporting uninterrupted power transmission across industrial and infrastructure projects. Additionally, they are vital in surge arrestors, capacitors, and electronic devices, where insulation and reliability are paramount.

The transformer segment is experiencing rapid growth due to increasing global emphasis on energy efficiency and renewable energy integration. The demand for transformer insulators is driven by the need to integrate fluctuating renewable energy sources such as wind and solar power into the grid, necessitating advanced insulation systems that ensure stable power distribution and support sustainable energy initiatives worldwide.

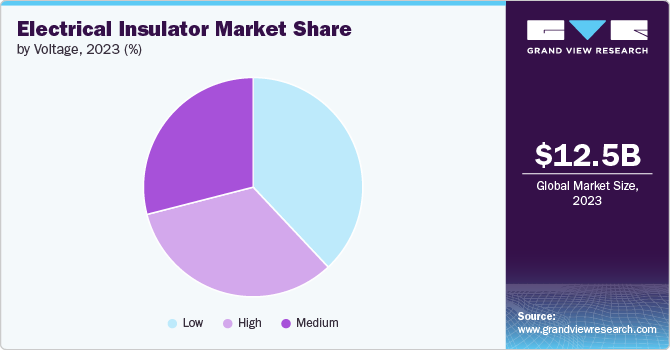

Voltage Insights

“Low voltage held the largest revenue share of the electrical insulator market in 2023.”

Insulators are categorized based on voltage requirements into low, medium, and high voltage segments. Low-voltage insulators are crucial for residential and small-scale commercial applications, providing insulation and safety for local power distribution networks.

Medium voltage insulators are commonly used in industrial settings and urban power distribution grids, ensuring reliable electricity supply to factories and urban centers. High voltage insulators play a pivotal role in long-distance power transmission, facilitating the efficient transfer of electricity over vast distances with minimal loss.

Regional Insights

“U.S. dominated the revenue share of the North America electrical insulator market.”

North America electrical insulator market emerges as a dominant force in the global industry, propelled by substantial investments in smart grid technologies and extensive modernization initiatives across the region. These efforts are driven by the pressing need to enhance grid efficiency, reliability, and resilience against natural disasters and cyber threats. The deployment of smart grid technologies, including advanced metering infrastructure (AMI), distribution automation, and grid-scale energy storage systems, has significantly bolstered the demand for high-performance electrical insulators.

U.S. Electrical Insulator Market Trends

The electrical insulator market of the U.S.is highlydriven by strict regulations aimed at ensuring power transmission reliability and safety. The Federal Energy Regulatory Commission (FERC) and the North American Electric Reliability Corporation (NERC) enforce rigorous standards to maintain grid reliability and prevent disruptions.

The resurgence of the manufacturing sector has further increased this demand. Efforts to modernize the grid and integrate renewable energy nationwide underline the ongoing need for advanced electrical insulators, supported by substantial investments in infrastructure upgrades.

Asia Pacific Electrical Insulator Market Trends

Asia Pacific electrical insulator market is witnessing significant economic growth, necessitating an enhanced demand for continuous and dependable electricity supply, a consequence of the burgeoning population. In response to the escalating demand driven by rapid industrialization and urbanization, China is strategically augmenting investments in the development of its existing electrical insulator sector.

Europe Electrical Insulator Market Trends

The electrical insulator market of Europe is witnessing significant growth as emphasis on renewable energy integration and the electrification of transportation systems boost demand for advanced insulators. The region's automotive sector, transitioning towards electric vehicles, requires robust insulators to support efficient charging infrastructure and grid stability.

Key Electrical Insulator Company Insights

Some of the key players operating in the market include LAPP Insulators and NGK Insulators.

-

LAPP Insulators, headquartered in Germany, specializes in high-voltage ceramic and composite insulators, serving diverse utility and industrial applications globally. Known for robust and durable ceramic insulators, It emphasizes innovation through extensive R&D to meet evolving industry standards. Strategic partnerships and a commitment to quality reinforce its market presence and drive advancements in electrical insulation technology.

-

NGK Insulators, based in Japan, is a renowned supplier of ceramic insulators for high-voltage transmission lines and infrastructure projects worldwide. Leveraging deep expertise in ceramic technology, it ensures reliability and stability in electricity transmission, supporting critical sectors like utilities and industrial manufacturing. Through continuous R&D and a focus on quality, it maintains leadership in the global electrical insulators market, adapting to market demands and technological advancements to sustain growth and competitiveness.

Key Electrical Insulator Companies:

The following are the leading companies in the electrical insulator market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- General Electric

- Siemens

- Bharat Heavy Electricals Limited

- Toshiba

- Aditya Birla Nuvo

- LAPP Insulators

- Maclean-Fogg

- NGK Insulators

- Hubbell

- Seves Group

- TE Connectivity

Recent Developments

-

In April 2024, CRP Technology, a leading 3D printing service provider, announced that their Windform thermoplastic composites reinforced with glass fibers, utilized in Selective Laser Sintering, have shown outstanding electrical insulation performance. This achievement was confirmed through recent testing that assessed both dielectric constant and dielectric strength.

-

In November 2023, Whirlpool Corporation launched SlimTech insulation, featuring the first vacuum-insulated structure (VIS) technology in refrigerators for the North American market. This proprietary material, sealed in a vacuum within the refrigerator door or sides, allows for a significant reduction in wall thickness-up to 66%-while increasing internal capacity by up to 25%.

-

In July 2021, General Electric secured multiple contracts from Power Grid Corporation of India Limited (PGCIL), India’s largest state-owned transmission company, to supply 13 units of 765 kV transformers and 32 units of 765 kV reactors. This agreement underscores GE's significant role in enhancing India's transmission infrastructure.

-

In April 2021, GE and Hitachi ABB Power Grid entered into a non-exclusive cross-licensing agreement concerning the adoption of an environmentally friendly alternative gas to sulfur hexafluoride (SF6) in high-voltage equipment. The newly developed fluor nitrile-based gas mixture offers reduced environmental impact compared to SF6, aligning with global sustainability initiatives in the power transmission sector.

Electrical Insulator Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 13.20 billion |

|

Revenue forecast in 2030 |

USD 18.37 billion |

|

Growth rate |

CAGR of 5.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, voltage, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

ABB; Maclean-Fogg; Siemens; Toshiba; Aditya Birla Nuvo; Bharat Heavy Electricals Limited; LAPP Insulators; Hubbell; NGK Insulators; General Electric; TE Connectivity; Seves Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Electrical Insulator Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrical insulator market report based on type, voltage, application, and region:

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Ceramic Insulator

-

Composite Insulator

-

Glass Insulator

-

-

Voltage Outlook (Revenue, USD Billion; 2018 - 2030)

-

Low

-

Medium

-

High

-

-

Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Cable

-

Transformer

-

Switchgear

-

Busbars

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electrical insulator market size was estimated at USD 12.52 billion in 2023 and is expected to reach USD 13.20 billion in 2024.

b. The global electrical insulator market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 18.37 billion by 2030.

b. By voltage, low dominated the market with a revenue share of over 38.0% in 2023.

b. Some of the key vendors in the global electrical insulator market are ABB, Maclean-Fogg, Siemens, Toshiba, Aditya Birla Nuvo, Bharat Heavy Electricals Limited, LAPP Insulators, Hubbell, NGK Insulators, General Electric, Seves Group, and TE Connectivity.

b. The key factor driving the growth of the global electrical insulator market is attributed to the significant growth driven by increasing infrastructural development and electrification projects worldwide, particularly in emerging economies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."