- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Electrical Insulation Coatings Market Size, Share Report 2030GVR Report cover

![Electrical Insulation Coatings Market Size, Share & Trends Report]()

Electrical Insulation Coatings Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Liquid, Powder), By Raw Material (Epoxy, PTFE, Ceramic), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-278-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global electrical insulation coatings market size was valued at USD 2.6 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. Rising electricity demand has resulted in upcoming projects focused on capacity expansions, along with increasing investment in power generation projects. Positive growth of the global transmission and distribution market is another factor anticipated to play a vital role in supporting the growth. Unstable raw material costs and high cost of formulations are expected to pose a major challenge to market participants. China is a major producer of resin as well as powder coatings. Slow economic growth, regulations related to volatile organic compounds, and lack of government support are some of the key factors that have affected the supply of quality raw materials from China. These factors are likely to result in higher production costs of enamels.

The market is highly competitive due to the presence of a large number of industry participants. Divestiture of the coatings businesses by key market players is a major trend witnessed throughout the industry. Uncertain economic conditions and stringent regulations related to volatile organic compound emissions are likely to pose a major challenge to the majority of industry participants.

Market players are focusing on the development of various types of coatings, depending upon the application, dielectric properties desired, aesthetics, color, and regulatory compliance. Thus, developing new formulations that suit specific applications results in a high cost of formulation.

As raw material cost plays a key role in dictating the overall cost of coating formulation, coating formulators opt for extender pigments to cope with unstable raw material costs. Extender pigments include low-priced fillers that help reduce the cost of coatings by increasing coating volume with minimal impact on coating performance.

Product Insights

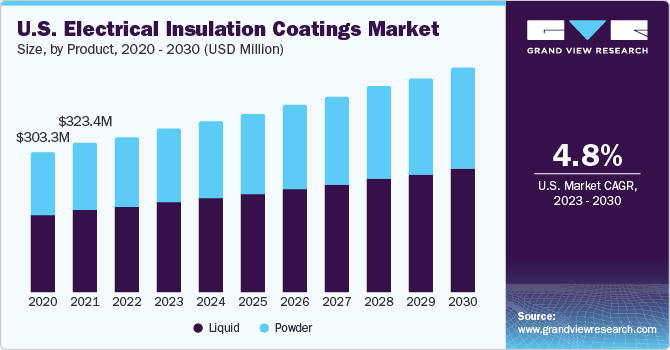

The liquid segment accounted for the largest revenue share of 56.1% in 2022. Electrical insulation coatings are largely available in liquid form. Liquid coatings offer ease of application, enabling efficient and consistent coverage on various surfaces. Their fluidity allows for seamless adhesion, reducing the risk of air gaps and ensuring better electrical insulation performance. However, the liquid-based coating is anticipated to lose its market share to powdered-based formulations over the forecast period owing to factors such as faster curing time, no requirement for solvents, and their ability to emit zero volatile organic compounds.

The powder segment is expected to grow at the fastest CAGR of 4.8% during the forecast period. Powder coatings offer superior durability and resistance to wear, making them ideal for applications in harsh environments. Additionally, they provide enhanced thickness, enabling better insulation performance. Epoxies are used in powdered as well as resin forms. Due to high dielectric properties, epoxy powder coatings help in negating high voltage spikes, especially when used in cable insulations.

Raw Material Insights

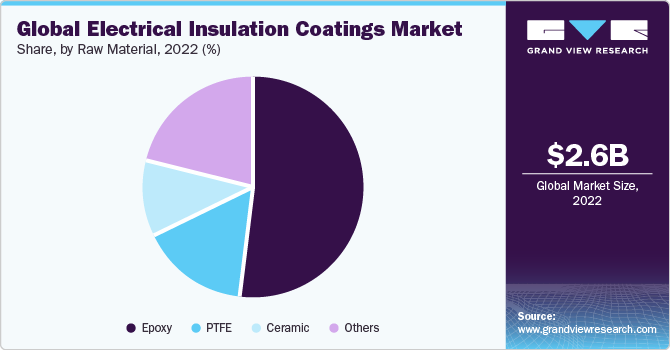

The epoxy segment accounted for the largest revenue share of 51.7% in 2022 and is estimated to register the fastest CAGR of 5.0% over the forecast period. This raw material is known to have excellent dielectric properties, dimensional stability, and good shock, and vibration resistance. Favorable properties such as high thermal stability, mechanical strength, moisture resistivity, adhesion, and electrical, mechanical, and heat resistance make them suitable for various applications.

The Polytetrafluoroethylene (PTFE) segment held a significant revenue market share in 2022. PTFEis another major raw material. China is a key player in the PTFE market. Government support for PTFE resin manufacturers has been declining, which may affect segment growth in the coming years.

Regional Insights

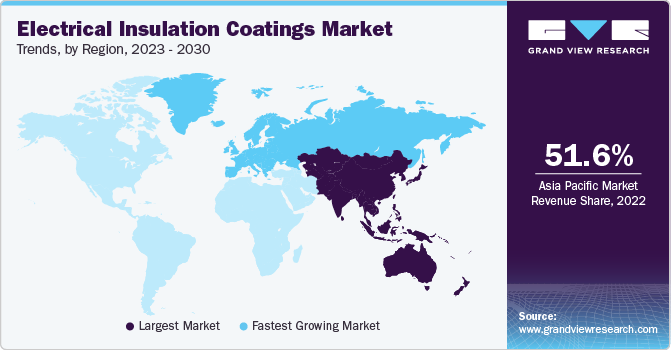

Asia Pacific accounted for the largest revenue share of 51.6% in 2022 and is expected to grow at the fastest CAGR of 5.2% during the forecast period. This can be attributed to rapid urbanization, increasing investment in infrastructure development, and robust economic growth in India and China. The easy availability of raw materials, particularly in China, is expected to increase the demand.

Europe held a significant revenue share in 2022. The regional market is expected to witness slow growth over the forecast period owing to strict regulations related to the emission of volatile organic compounds. In April 2022, PPG announced the acquisition of the powder coatings manufacturing business from the Italy-based company Arsonsisi. The acquisition will provide PPG with a highly automated powder manufacturing plant in Verbania, Italy that is capable of producing both small and big batches.

Key Companies & Market Share Insights

The global electrical insulation coatings market is highly competitive due to the presence of a large number of industry participants. Divestiture of these businesses mainly to focus on their core competencies is a key trend followed by major corporations across the industry.

The threat of substitutes is expected to be moderate as few companies have introduced insulation films to gain a competitive edge. Factors such as high integration throughout the value chain and global presence have helped these companies to expand their product portfolio, thus giving them a competitive advantage over other players.

Key Electrical Insulation Coatings Companies:

- Evonik Industries AG

- 3M

- PPG Industries, Inc.

- Thermal Spray Coatings (A Fisher Barton Company)

- GfE Gesellschaft für Elektrometallurgie mbH

- ELANTAS PDG, Inc.

- GLS Coatings Ltd.

- SK FORMULATIONS INDIA PVT. LTD.

- PTFE Applied Coatings

- Axalta Coating Systems, LLC

- Akzo Nobel N.V.

Recent Developments

-

In January 2023, AkzoNobel announced the launch of the new range of Resicoat EV powder coatings to safeguard the electric vehicle's battery system and electrical components. The new range of products comes with improved heat management capabilities and increased electrical insulating capabilities to help safeguard battery systems, motors, and electrical storage units.

-

In November 2022, Curtiss-Wright Corporation announced the acquisition of Keronite Group Limited. The acquisition of Keronite is aimed to expand the surface treatment services portfolio with the addition of specialized and complementary coatings technologies from the company that is recognized for its crucial performance in challenging service conditions.

-

In March 2021, Axalta announced the acquisition of the China-based wire enamel manufacturer, Anhui Shengran Insulating Materials Co., Ltd. The acquisition will aid in the expansion of the wire enamel product portfolio which will enhance the product selection for consumers in a variety of end markets, such as automotive, renewable energy, and consumer electronics. Additionally, it will strengthen the company’s production capabilities in the Asian market.

Electrical Insulation Coatings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.67 billion

Revenue forecast in 2030

USD 3.7 billion

Growth Rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Evonik Industries AG; 3M; PPG Industries, Inc.; Thermal Spray Coatings (A Fisher Barton Company); GfE Gesellschaft für Elektrometallurgie mbH; ELANTAS PDG, Inc.; GLS Coatings Ltd.; SK FORMULATIONS INDIA PVT. LTD.; PTFE Applied Coatings; Axalta Coating Systems, LLC; Akzo Nobel N.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrical Insulation Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrical insulation coatings market based on product, raw material, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

PTFE

-

Ceramic

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electrical insulation coatings market size was estimated at USD 2.6 billion in 2022 and is expected to reach USD 2.67 billion in 2023.

b. The global electrical insulation coatings market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 3.70 billion by 2030.

b. Asia Pacific dominated the electrical insulation coatings market with a share of 51.8% in 2022. This is attributable to rising demand for power generation and electricity owing to the rapid population as well as economic growth in the region.

b. Some key players operating in the electrical insulation coatings market include ELANTAS GmbH, 3M Company, PPG Industries, GLS Coatings Ltd., AkzoNobel N.V., and Evonik Industries AG.

b. Key factors that are driving the market growth include increasing demand for electronics and energy conversion products and surging infrastructural investments across the developing countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.