- Home

- »

- Distribution & Utilities

- »

-

Electrical Bushing Market Size, Share & Trends Report, 2030GVR Report cover

![Electrical Bushing Market Size, Share & Trends Report]()

Electrical Bushing Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (OIP, RIP), By Insulation (Porcelain, Polymeric), By Voltage, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-407-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrical Bushing Market Summary

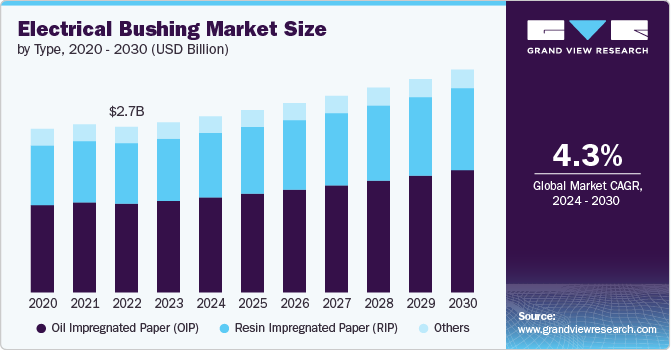

The global electrical bushing market size was estimated at USD 2.76 billion in 2023 and is projected to reach USD 3.67 billion by 2030, growing at a CAGR of 4.25% from 2024 to 2030. The growing demand for electricity for various applications, including electric vehicles (EVs), consumer electronics, and others, is driving the need for power generation, fueling the electrical bushing market.

Key Market Trends & Insights

- The Asia Pacific electrical bushing market dominated with the largest global revenue share of 38.68% in 2023.

- Based on type, the oil-impregnated paper (OIP) segment led the market with the largest revenue share of 54.14% in 2023.

- Based on insulation, the porcelain segment led the market with the largest revenue share of 55.32% in 2023.

- Based on voltage, the medium voltage segment led the market with the largest revenue share of 31.0% in 2023.

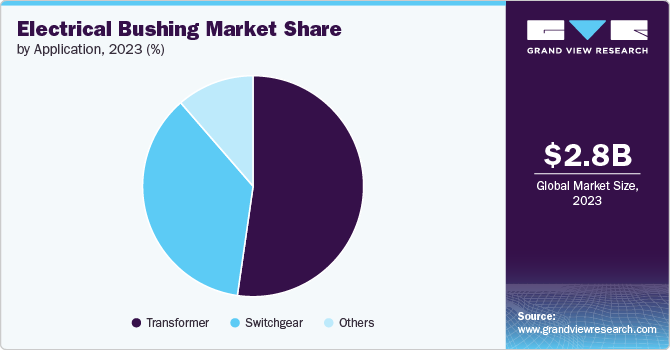

- Based on application, the transformer segment led the market with the largest revenue share of 52.28% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.76 Billion

- 2030 Projected Market Size: USD 3.67 Billion

- CAGR (2024-2030): 4.25%

- Asia Pacific: Largest market in 2023

The market is witnessing a significant trend towards the adoption of smart technology. With the rise of smart grids and the Internet of Things (IoT), there is an increasing demand for bushings that are not only reliable but also capable of real-time monitoring and diagnostics.

These smart bushings come equipped with sensors that can provide valuable data on performance, helping utilities predict failures before they happen and reduce maintenance costs. This trend is driven by the need for greater efficiency, reliability, and longevity in electrical systems.

Drivers, Opportunities & Restraints

The global push towards renewable energy sources is propelling market growth. As countries strive to reduce their carbon footprints and meet ambitious climate goals, there is a substantial increase in the deployment of wind, solar, and hydroelectric power systems. Integrating these renewable sources into existing electrical grids necessitates the use of high-quality bushings that can handle the variable and often harsh operating conditions associated with renewable energy. These bushings must ensure reliable power transmission and distribution despite fluctuations in load and environmental factors. This growing focus on renewable energy not only boosts the demand for advanced bushings but also drives innovation in the market, encouraging manufacturers to develop more resilient and efficient products.

Emerging markets, particularly in regions such as Asia-Pacific, Africa, and Latin America, present a significant growth opportunity for the electrical bushing industry. These regions are experiencing rapid urbanization, industrialization, and economic growth, which drive the demand for expanded and modernized electrical infrastructure. Governments in these regions are investing heavily in new power generation and distribution projects to meet the rising electricity needs of growing populations and expanding industries. In addition, the push towards electrification in rural areas and the development of smart cities further amplify the demand for reliable and efficient electrical components, including bushings. This escalating demand provides an excellent opportunity for bushing manufacturers to enter and establish a strong presence in these markets, offering products tailored to the specific needs and challenges of developing regions. By focusing on these high-growth areas, companies can tap into the vast market potential and drive substantial business growth.

Despite the positive growth outlook, the market for electrical bushing faces several challenges. One of the primary restraints in the electrical bushing industry is the high initial investment cost associated with advanced bushing technologies. High-performance bushings, particularly those designed for smart grids and renewable energy applications, often come with significant upfront costs. These costs can be a barrier for utilities and infrastructure projects, especially in regions with limited financial resources or where the return on investment is not immediately clear. In addition, the costs associated with the installation and maintenance of these advanced systems can further hinder market growth. While the long-term benefits of reliability, efficiency, and reduced maintenance are evident, the substantial initial investment remains a critical challenge for widespread adoption, particularly in cost-sensitive markets.

Type Insights

Based on type, the oil-impregnated paper (OIP) segment led the market with the largest revenue share of 54.14% in 2023. OIP electrical bushings are highly regarded for their exceptional reliability and performance in high-voltage applications, making this characteristic a significant driver for their demand. In the realm of power transmission and distribution, ensuring the uninterrupted flow of electricity over long distances and under varying environmental conditions is critical. OIP bushings are designed to provide superior insulation and thermal stability, which are essential for managing high voltage levels without compromising safety or efficiency. Their robust construction and ability to withstand high electrical stresses make them a preferred choice for transformers, circuit breakers, and other essential electrical equipment.

The Resin Impregnated Paper (RIP) electrical bushing segment is driven by the growing demand for enhanced safety and environmental benefits in electrical infrastructure. Unlike traditional OIP bushings, RIP bushings are dry and free from oil, significantly reducing the risk of fire and environmental contamination in the event of a failure. This makes them particularly attractive for use in high-risk environments and urban settings where safety and environmental impact are critical concerns.

Insulation Insights

Based on insulation, the porcelain segment led the market with the largest revenue share of 55.32% in 2023. Porcelain-insulated bushings are highly valued for their durability and longevity, making these characteristics a key driver for their continued use in electrical infrastructure. Porcelain, a type of ceramic material, offers excellent resistance to weathering, mechanical stresses, and electrical stresses, ensuring that bushings made from this material can operate reliably over long periods. This durability is particularly important in outdoor installations where bushings are exposed to harsh environmental conditions, such as extreme temperatures, moisture, and pollution.

Polymeric-insulated electrical bushings are gaining traction due to their lightweight and versatile design, which is a significant driver for their adoption in modern electrical systems. Made from materials such as silicone rubber or epoxy resin, polymeric-insulated bushings are much lighter than their porcelain counterparts, making them easier to handle and install. This lightweight nature also reduces the overall weight of electrical equipment, which can be beneficial in applications where weight is a critical factor, such as in mobile substations or compact installations.

Glass-insulated electrical bushings are driven by their superior electrical insulation properties and unique transparency. Glass, as an insulating material, provides excellent dielectric strength, making it ideal for use in high-voltage applications where preventing electrical breakdown is crucial. The inherent transparency of glass bushings allows for easy visual inspection, which is particularly beneficial for identifying potential defects or damage without the need for disassembly. This feature enhances maintenance efficiency and reliability in power systems.

Voltage Insights

Based on voltage, the medium voltage segment led the market with the largest revenue share of 31.0% in 2023. The demand for medium-voltage electrical bushings is driven by the ongoing expansion of urban and industrial infrastructure. As cities grow and new industrial facilities are established, there is an increasing need for reliable and efficient power distribution systems that operate within the medium voltage range, typically between 1 kV and 36 kV. These bushings are essential components in transformers, switchgear, and other electrical equipment that distribute electricity to residential, commercial, and industrial areas. The modernization of aging electrical grids in developed countries and the development of new grids in emerging economies both contribute to the rising demand for medium-voltage bushings.

The advancements in long-distance power transmission technology are a key driver for the demand for extra-high voltage (EHV) electrical bushings. These bushings are designed for voltages above 230 kV, often reaching up to 765 kV or higher, and are essential for the efficient transmission of electricity over vast distances with minimal losses. As the global energy landscape evolves, there is a growing emphasis on connecting renewable energy sources, such as hydroelectric and offshore wind farms, which are typically located far from major consumption centers. EHV transmission systems are critical for transporting this electricity over long distances to where it is needed most.

Application Insights

Based on application, the transformer segment led the market with the largest revenue share of 52.28% in 2023. The increasing demand for reliable power supply is a significant driver for the market growth in transformer applications. Transformers are crucial components in the power grid, responsible for stepping up or stepping down voltage levels to facilitate the efficient transmission and distribution of electricity. As global energy consumption continues to rise, driven by population growth, urbanization, and industrialization, the need for robust and efficient transformers becomes more critical.

The expansion of electrical networks is promoting market growth in the switchgear segment. Switchgear, which includes a range of devices, including circuit breakers, fuses, and isolators, is essential for controlling, protecting, and isolating electrical equipment in power systems. As electricity demand increases, driven by industrial growth and the proliferation of electrified transportation, the need for reliable and efficient switchgear becomes paramount. Electrical bushings in switchgear ensure the safe passage of electrical conductors through grounded barriers, maintaining system integrity and safety. The ongoing efforts to upgrade and expand power grids, especially in developing regions, necessitate the installation of advanced switchgear with high-quality bushings.

Regional Insights

North America electrical bushing market growth is driven by the expanding semiconductor industry due to the advent of technologies such as artificial intelligence (AI), machine learning (ML), IoT, cloud computing, and others. These necessitate the need for electricity, fueling the demand for electrical bushing in the region.

U.S. Electrical Bushing Market Trends

The electrical bushing market in the U.S. benefits from technological advancements and innovation across various sectors. The growing production of semiconductor due to the proliferation of smart devices is driving the market growth in the country. In addition, the federal and state governments are implementing policies and providing incentives to support the development of smart grids and the integration of renewable energy, further propelling the market growth.

Asia Pacific Electrical Bushing Market Trends

The Asia Pacific electrical bushing market dominated with the largest global revenue share of 38.68% in 2023. The Asia-Pacific (APAC) region, characterized by rapid industrialization and urbanization, is emerging as a major market for electrical bushings, driven by rapid industrialization and urbanization in the region. In addition, the low cost of labor is promoting the export of electrical bushing-based products from APAC to other regions. The market is investing heavily in renewable energy projects to meet growing energy needs and environmental commitments. The integration of these renewable energy sources into the grid requires advanced bushings that can handle the specific challenges associated with renewable power. The dynamic economic growth and extensive infrastructure development in the Asia Pacific region make it a crucial market for electrical bushings. In addition, the region is rapidly adopting EVs to replace internal combustion engine-based vehicles, creating lucrative opportunities for the market.

Europe Electrical Bushing Market Trends

The electric bushing market in Europe emphasizes sustainability and energy transition, which acts as a major driver for market growth. European countries are leading the way in adopting stringent environmental regulations and ambitious renewable energy targets. The European Union's Green Deal and various national energy policies aim to achieve significant reductions in carbon emissions and increase the share of renewable energy in the energy mix. These goals necessitate extensive upgrades to the electrical grid, including the installation of new transformers, switchgear, and bushings, boosting the need for electrical bushing in the region.

Key Electrical Bushing Company Insights

The market for electrical bushings is highly competitive, with several key players dominating the landscape. Major companies include ABB Group, TRENCH Group (SIEMENS), General Electric, Eaton, Elliot Industries, Gipro GMBH, RHM International, Toshiba, Webster-Wilkinson, Siemens, and Nexans. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Electrical Bushing Companies:

The following are the leading companies in the electrical bushing market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Group

- TRENCH Group (SIEMENS)

- General Electric

- Eaton

- Elliot Industries

- Gipro GMBH

- RHM International

- Toshiba

- Webster-Wilkinson

- Siemens

- Nexans

Recent Developments

-

In December 2023, Yash Highvoltage Ltd. announced the expansion of its product range with the introduction of a new 245kV OIP transformer bushing. This addition enhances their existing offerings, which include various types of transformer bushings, such as RIP and Resin-Impregnated Synthetic (RIS) bushings.

-

In April 2023, Eaton announced the acquisition of Jiangsu Ryan Electrical Co. Ltd., a developer of sub-transmission transformers and power distribution systems, to enhance its market presence and strengthen its position in the utility, energy, and industrial markets.

Electrical Bushing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.86 billion

Revenue forecast in 2030

USD 3.67 billion

Growth rate

CAGR of 4.25% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, insulation, voltage, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

ABB Group; TRENCH Group (SIEMENS); General Electric; Eaton; Elliot Industries; Gipro GMBH; RHM International; Toshiba; Webster-Wilkinson; Siemens; Nexans

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrical Bushing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrical bushing market report based on type, insulation, voltage, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil Impregnated Paper (OIP)

-

Resin Impregnated Paper (RIP)

-

Others

-

-

Insulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Porcelain

-

Polymeric

-

Glass

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Medium Voltage

-

High Voltage

-

Extra-High Voltage

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transformer

-

Switchgear

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electrical bushing market size was valued at USD 2.76 billion in 2023 and is expected to reach USD 2.86 billion in 2024.

b. The global electrical bushing market is expected to grow at a CAGR of 4.25% from 2024 to 2030, reaching USD 3.67 billion by 2030.

b. The transformer segment led the market with the largest revenue share of 52.28% in 2023. The increasing demand for reliable power supply is a significant driver for the electrical bushing market in transformer applications.

b. Key players operating in the electrical bushing market include ABB Group; TRENCH Group (SIEMENS); General Electric; Eaton; Elliot Industries; Gipro GMBH; RHM International; Toshiba; Webster-Wilkinson; Siemens; Nexans, among others

b. The growing demand for electricity for various applications, including electric vehicles (EVs), consumer electronics, and others, is driving the need for power generation, fueling the electrical bushing market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.