- Home

- »

- Automotive & Transportation

- »

-

Electric Vehicle Battery Market Size, Industry Report, 2030GVR Report cover

![Electric Vehicle Battery Market Size, Share & Trends Report]()

Electric Vehicle Battery Market (2025 - 2030) Size, Share & Trends Analysis Report By Battery Type (Lithium-Ion Battery, Lead-Acid Battery), By Propulsion Type (BEV, PHEV), By Vehicle Type (Two-Wheeler, Passenger Cars, Buses), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-687-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Vehicle Battery Market Summary

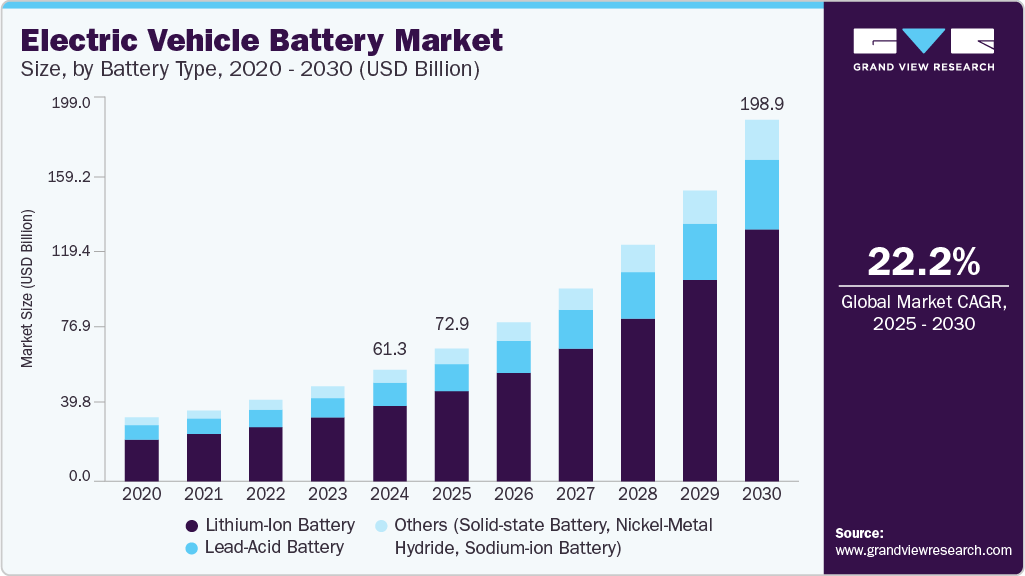

The global electric vehicle battery market size was estimated at USD 61.31 billion in 2024 and is projected to reach USD 198.86 billion by 2030, growing at a CAGR of 22.2% from 2025 to 2030. The growing emphasis of leading automakers on rolling out electric vehicles and rising battery demand for EVs are major factors behind the market growth.

Key Market Trends & Insights

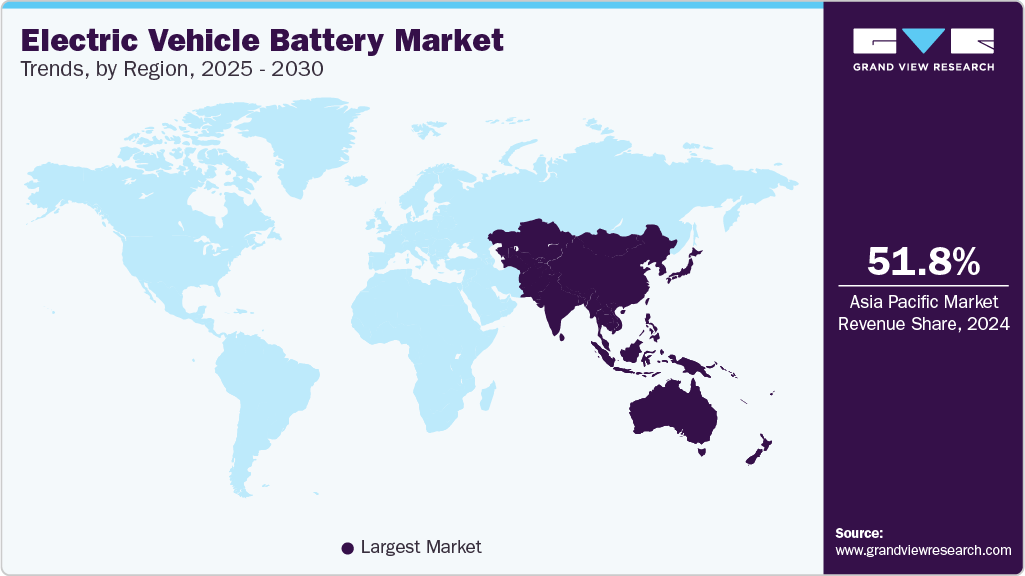

- Asia Pacific electric vehicle battery market led the global market with a revenue share of 51.8% in 2024.

- The China electric vehicle battery market is the global leader in EV battery production and demand.

- In terms of battery segment, the lithium-ion battery segment accounted for the largest share of 67.4% in 2024.

- In terms of propulsion segment, the battery electric vehicle (BEV) segment held the largest market share in 2024.

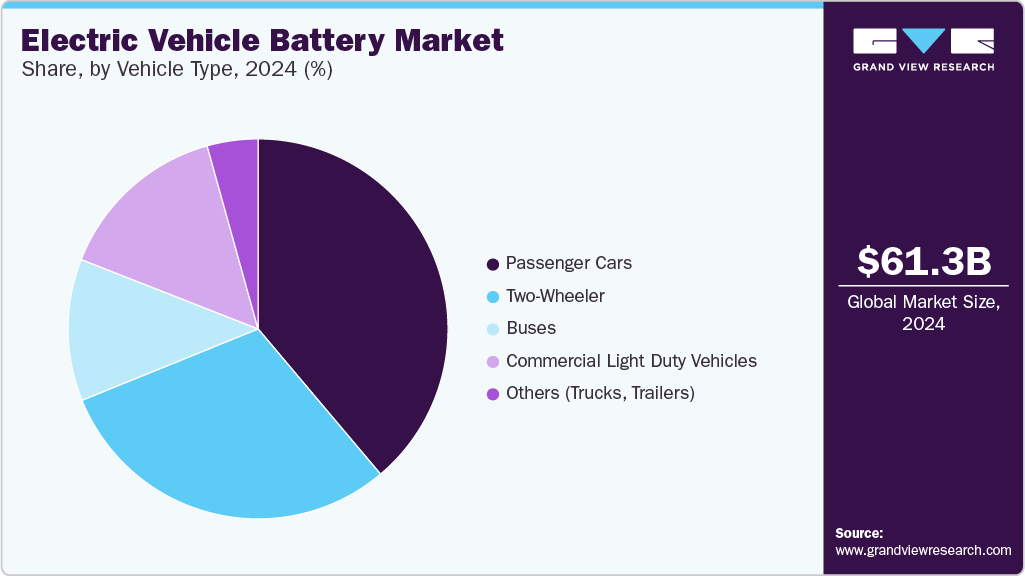

- In terms of vehicle segment, the passenger cars segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 61.31 Billion

- 2030 Projected Market Size: USD 198.86 Billion

- CAGR (2025-2030): 22.2%

- Asia Pacific: Largest market in 2024

According to the International Energy Agency's (IEA) Global EV Outlook, 2023 report, the surge in demand for automotive lithium-ion batteries is primarily attributed to the growth in electric passenger car sales, resulting in an estimated 65% increase in demand, from approximately 330 GWh in 2021 to 550 GWh in 2022. In addition, supportive government policies, growing consumer interest, and various strategies by automakers to speed up the electrification of new trucks, buses, and cars are contributing to the market growth. The growing developments in EV battery swapping technology and several battery manufacturers' introduction of swappable battery packs for EVs further fuel the industry's growth. For instance, in October 2021, Gogoro Inc. introduced its innovative battery-swapping system in China, the world's largest market for two-wheeler vehicles. The company partnered with two of China's prominent vehicle manufacturers, Dachangjiang (DCJ) and Yadea, to launch Huan Huan, a battery-swapping brand, starting with Hangzhou and expanding to more cities in China.

Furthermore, strategic collaborations between battery manufacturers, e-mobility providers, and energy suppliers are also expected to drive product sales in the forecast period. Leading suppliers are utilizing the most advanced technologies to improve the durability and lifespan of batteries during usage. These suppliers are employing strategic measures and advanced techniques to attain their net-zero emissions goals while simultaneously enhancing the efficiency of batteries. These efforts lead to batteries with extended lifespans, reduced electronic waste, and a reduced environmental impact related to their production and utilization.

The increasing automotive production, mainly in China, Germany, Japan, Mexico, South Korea, and India, among other nations, is also a significant factor driving the market growth. The increasing government spending on developing EV charging infrastructure in numerous countries also contributes to the market’s growth. The growing inclination of consumers toward personal conveyance is further boosting the demand for EV batteries. However, volatility in raw materials prices, such as lithium-ion and lead acid, can affect battery production costs and restrain market growth.

Battery Type Insights

The lithium-ion battery segment accounted for the largest share of 67.4% in 2024. The segment is also anticipated to grow at the highest CAGR during the forecast period. The numerous benefits of lithium-ion batteries have led to their widespread adoption in electric vehicles. They offer significant advantages over lead-acid batteries, including being up to 60% lighter in weight and having a higher energy density, allowing for smaller and more space-saving battery packs. Lithium-ion batteries are also highly efficient and can be fully charged within one to three hours, making them the preferred choice of electric vehicle manufacturers. As a result, there has been a rapid increase in the adoption of lithium-ion batteries in electric vehicles.

The others (solid-state battery, nickel-metal hydride, sodium-ion battery) segment is expected to grow at a significant CAGR during the forecast period. The increasing focus of several automobile manufacturers on developing EVs with solid-state battery technology is expected to boost segment growth. For instance, in February 2023, Nissan Motor Corp., an automobile manufacturer, announced its plans to bring its first electric car with a solid-state battery in 2028. The company is progressing in developing solid-state batteries and is expected to have pilot production by 2025. The engineering of the initial technology is anticipated to be completed by 2026, and the first mass-produced electric vehicle with this technology is expected to be available by 2028.

Propulsion Type Insights

The battery electric vehicle (BEV) segment held the largest market share in 2024. The segment is also anticipated to grow at the highest CAGR during the forecast period. BEVs are fully electric vehicles with rechargeable battery packs and no gasoline engine. The growing popularity of removable and rechargeable EV batteries can be attributed to the supportive government policies aimed to achieve net-zero emissions and the increasing consumer interest in BEVs. These batteries can be reused numerous times, reducing waste and prolonging their lifespan, essential in achieving a zero-carbon footprint.

The plug-in hybrid electric vehicle (PHEV) segment is expected to grow significantly during the forecast period. PHEVs include a combination of batteries and another fuel source, such as diesel or gasoline, to power an internal combustion engine or other propulsion system along with an electric motor. While passenger cars constitute many plug-in hybrid electric vehicles, they are also available in various commercial and utility types, such as buses, vans, motorbikes, trucks, trains, and military vehicles. The current PHEV industry features several light-duty models, with the medium-duty models gradually making their way into the global market.

Vehicle Type Insights

The passenger cars segment dominated the market in 2024. The growing sales of electric passenger cars such as sedans, hatchbacks, SUVs, and others (including XUVs, station wagons, and minivans) continue to propel the segment's growth. According to the International Energy Agency (IEA), the electric passenger car market maintained strong momentum in 2023, with global sales exceeding 14 million units, up from 10 million in 2022. This represents a 35% year-over-year growth. The trend remains robust in 2024 as well. In the first quarter of 2024, over 3 million electric cars were sold globally, reflecting a continued upward trajectory and highlighting sustained consumer demand and policy support for electric mobility.

The two-wheelers segment is projected to grow at the fastest CAGR over the forecast period. Two-wheelers remain one of the most electrified market segments; in developing economies and emerging markets, they continue to outnumber electric cars. For example, with one of the world’s largest two-wheeler markets, India remains a leader in promoting electric two-wheelers, supported by national schemes like FAME II and various state-level incentives. In 2023, India's electric two-wheeler sales crossed 850,000 units, demonstrating rapid adoption and growing consumer acceptance. On the other hand, the commercial light-duty vehicle (CLDV) segment is projected to grow at the second-highest CAGR during the forecast period. The electrification of the light commercial vehicle stock is steadily increasing. Globally, sales of electric light commercial vehicles (e-LCVs) surpassed 400,000 units in 2023, marking a growth of nearly 30% compared to 2022, driven by fleet electrification initiatives and last-mile delivery demands, especially in urban areas.

Regional Insights

The North America electric vehicle battery market accounted for 14.6% of the overall market in 2024. The EV battery ecosystem in North America is rapidly evolving, driven by significant public and private investments. The U.S. and Canada prioritize domestic battery production and supply chain resilience to reduce import reliance. Initiatives like the U.S.-Canada Joint Action Plan on Critical Minerals and the U.S. Inflation Reduction Act (IRA) have incentivized local battery manufacturing and critical mineral sourcing across the continent. The IEA notes North American EV battery demand reached around 100 GWh in 2023, signaling robust market growth and increasing production capacity.

U.S. Electric Vehicle Battery Market Trends

The U.S. electric vehicle battery industry dominated in 2024. The U.S. Department of Energy (DOE) targets advanced battery development as a national priority. Through programs such as the Battery500 Consortium and funding under the Bipartisan Infrastructure Law, the U.S. aims to reduce EV battery costs to below USD 75/kWh while increasing domestic cell production capacity. In 2023, U.S. battery demand for EVs grew significantly, aided by IRA tax credits that favor batteries assembled in North America using locally sourced materials.

Europe Electric Vehicle Battery Market Trends

The Europe Electric Vehicle Battery industry was identified as a lucrative region in 2024. Europe continues to focus on building a sustainable and competitive EV battery value chain. The European Battery Alliance (EBA), a government-supported platform, has led the region’s efforts to scale up battery production with environmental and social standards. The European Commission’s new Battery Regulation mandates minimum recycled content and carbon footprint declarations. Europe also aims for 70% recycling efficiency of lithium-ion batteries by 2030.

The German electric vehicle battery market, Europe's automotive hub, has committed significant funding to support battery production facilities and innovation under the umbrella of the European Battery Innovation project. The government supports gigafactories like the one in Kaiserslautern, operated by Automotive Cell Company (ACC), and is facilitating lithium refining and cell manufacturing within the country to localize supply chains.

The government is pursuing the UK electric vehicle battery market through next-generation battery technologies with initiatives like the Faraday Battery Challenge. Britishvolt, once a flagship project to boost UK gigafactory capacity, collapsed in early 2023, reflecting the challenges in scaling domestic battery manufacturing. However, the UK continues to invest in solid-state and sodium-ion batteries through public R&D funding and university partnerships.

Asia Pacific Electric Vehicle Battery Market Trends

Asia Pacific electric vehicle battery market led the global market with a revenue share of 51.8% in 2024, led by China, Japan, South Korea, and emerging markets like India. The region’s supply chain is well-integrated, from mineral refining to cell production, with increasing emphasis on recycling and sustainability. Several APAC countries are investing in alternative chemistries like sodium-ion and solid-state batteries.

The China electric vehicle battery market is the global leader in EV battery production and demand. In 2023, China accounted for over 415 GWh of battery demand-more than half the global total. Supported by extensive state subsidies and industrial policy, China hosts leading battery manufacturers like CATL and BYD. The Chinese government also emphasizes vertical integration and battery recycling, with pilot projects for sodium-ion batteries deployed in commercial EVs.

The Japan electric vehicle battery market continues to prioritize battery innovation, especially in solid-state and all-solid lithium metal batteries. While it lags behind China and Korea in volume production, Japan’s Ministry of Economy, Trade and Industry (METI) supports national champions like Panasonic and Toyota in developing next-generation battery technologies. Venture funding for battery startups remains modest, focusing largely on R&D rather than manufacturing scale-up.

Key Electric Vehicle Battery Company Insights

Some major players in the Electric Vehicle (EV) Battery market include Contemporary Amperex Technology Co., Limited, LG Energy Solution, BYD Motors, Panasonic Corp., Samsung SDI Co., Ltd., among others. These companies drive innovation in battery chemistry, energy density, fast-charging capabilities, and overall battery life, which are critical to advancing electric mobility. Their expansive global manufacturing networks and vertically integrated supply chains enable them to efficiently meet the growing demand for EV batteries. Moreover, their significant research and development investments, long-term supply agreements, and joint ventures with leading automotive brands position them at the forefront of the transition to electrified transportation. Their ability to scale production rapidly while maintaining high performance and safety standards solidifies their influence in shaping the future of the EV ecosystem.

-

Contemporary Amperex Technology Co., Limited is widely recognized as the world’s largest EV battery manufacturer, holding a dominant share of the global battery market. The company has achieved this leadership through advanced lithium-ion battery technology, strategic partnerships with top EV automakers including Tesla, BMW, Hyundai, and NIO, and significant investments in global capacity expansion. Contemporary Amperex Technology Co., Limited continues to innovate with technologies like its "Qilin Battery" and sodium-ion batteries, enhancing energy density and charging efficiency. The company's aggressive international expansion, such as its newly announced battery plant in Hungary and operations in Germany, reinforces its global leadership in EV battery supply and technology innovation.

-

LG Energy Solution (LGES) is a major South Korean battery manufacturer and a key supplier to global automakers, including General Motors, Ford, Tesla, Honda, and Volkswagen. The company is known for its high-performance lithium-ion battery technologies and strong manufacturing footprint in North America, Europe, and Asia. LGES is crucial in scaling the EV market through joint ventures like Ultium Cells with GM and its supply agreement with Ford in Europe for commercial vehicle electrification. The firm’s deep focus on battery R&D, vertical integration of the battery supply chain, and significant capacity expansion plans make it a central player in meeting surging EV battery demand globally.

Key Electric Vehicle Battery Companies:

The following are the leading companies in the electric vehicle (EV) battery market. These companies collectively hold the largest market share and dictate industry trends.

- Contemporary Amperex Technology Co., Limited.

- LG Energy Solution

- BYD Motors

- Panasonic Corp.

- Samsung SDI Co., Ltd.

- SK on Co., Ltd

- Toshiba Corporation

- EnerSys, Inc.

- Hitachi, Ltd.

- Mitsubishi Corporation

Recent Developments

-

In May 2025, Contemporary Amperex Technology Co. Limited (CATL) raised approximately USD 4.6 billion through its initial public offering (IPO) on the Hong Kong Stock Exchange, marking the largest global listing of the year. The IPO proceeds are earmarked for constructing a new battery plant in Hungary to serve European clients, further solidifying CATL's international expansion.

-

In October 2024, LG Energy Solution signed a supply agreement with Ford Motor Company to provide 109 GWh of batteries for Ford's electric commercial vans in Europe. The batteries will be supplied from LG's Poland facility, with production commencing in 2026, highlighting LG's commitment to supporting the electrification of commercial vehicles.

Electric Vehicle (EV) Battery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 72.88 billion

Revenue forecast in 2030

USD 198.86 billion

Growth rate

CAGR of 22.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

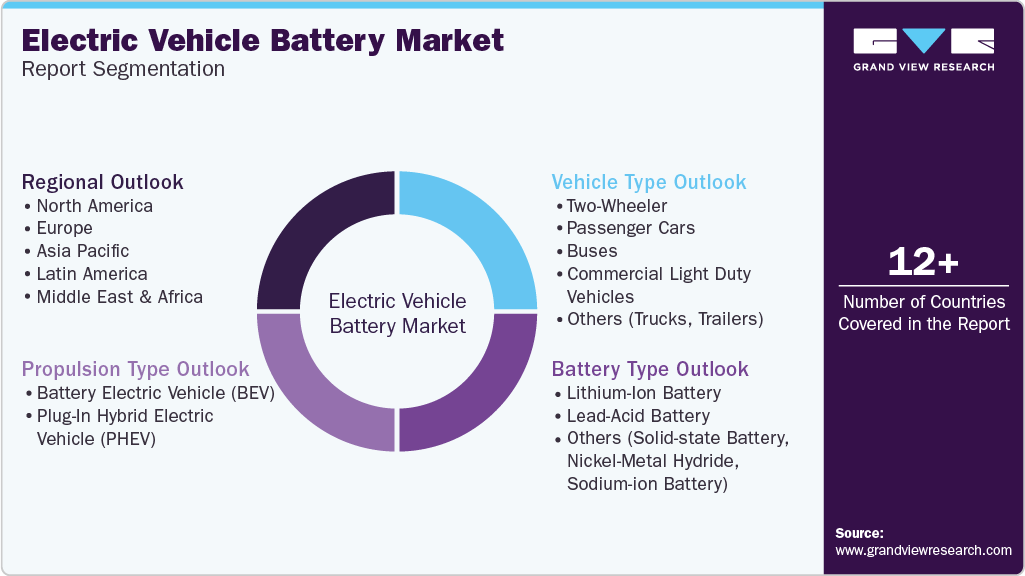

Segments covered

Battery type, propulsion type, vehicle type, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Contemporary Amperex Technology Co., Limited; LG Energy Solution; BYD Motors; Panasonic Corp.; Samsung SDI Co., Ltd.; SK on Co., Ltd; Toshiba Corporation; EnerSys, Inc.; Hitachi, Ltd.; Mitsubishi Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Battery Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric vehicle (EV) battery market report based on battery type, propulsion type, vehicle type, and region.

-

Battery Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lithium-Ion Battery

-

Lead-Acid Battery

-

Others (Solid-state Battery, Nickel-Metal Hydride, Sodium-ion Battery)

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Plug-In Hybrid Electric Vehicle (PHEV)

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Two-Wheeler

-

Passenger Cars

-

Buses

-

Commercial Light Duty Vehicles

-

Three-Wheeler

-

Four-Wheeler

-

-

Others (Trucks, Trailers)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric vehicle battery market size was estimated at USD 61.31 billion in 2024 and is expected to reach USD 72.88 billion in 2025.

b. The global electric vehicle battery market size is expected to grow at a significant CAGR of 22.2% to reach USD 198.86 billion in 2030.

b. Asia-Pacific (APAC) held the largest market share of 51.8% in 2024. The APAC region dominates global EV battery production and consumption, led by China, Japan, South Korea, and emerging markets like India. The region’s supply chain is well-integrated, from mineral refining to cell production, with increasing emphasis on recycling and sustainability.

b. Some of the players in the Electric Vehicle (EV) Battery market are Contemporary Amperex Technology Co., Limited, LG Energy Solution, BYD Motors, Panasonic Corp., Samsung SDI Co., Ltd., SK on Co., Ltd, Toshiba Corporation, EnerSys, Inc., Hitachi, Ltd., and Mitsubishi Corporation.

b. The key driving factor in the Electric Vehicle (EV) battery market is the sharp decline in lithium-ion battery prices, making EVs more affordable and accelerating their global adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.