- Home

- »

- Automotive & Transportation

- »

-

Electric Van Market Size, Share, Growth, Trends Report 2030GVR Report cover

![Electric Van Market Size, Share & Trends Report]()

Electric Van Market Size, Share & Trends Analysis Report By Propulsion (Battery Electric Vehicle (BEV), Hybrid Vehicle (HEV)), By Range, By Battery, By Application (Commercial, Personal), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-428-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Electric Van Market Size & Trends

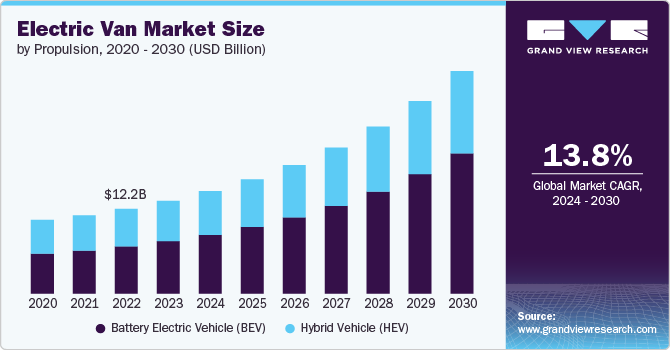

The global electric van market size was estimated at USD 13.33 billion in 2023 and is expected to grow at a CAGR of 13.8% from 2024 to 2030. Governments worldwide increasingly implement stringent environmental regulations to combat climate change and reduce air pollution. These regulations often include mandates and incentives for adopting electric vehicles, particularly in urban areas where air quality is a significant concern. Many countries are setting ambitious targets to phase out internal combustion engine (ICE) vehicles, encouraging businesses to transition to electric vans to comply with new regulations and meet sustainability goals. This push toward greener transportation solutions drives the market's growth.

Electric vans typically offer a lower total ownership cost than traditional diesel or gasoline-powered vans. While the upfront purchase price of an electric van may be higher, the lower operating costs, including reduced fuel expenses and lower maintenance costs due to fewer moving parts, make them more economical over the vehicle's lifetime. As businesses increasingly recognize the long-term financial benefits of electric vans, their adoption is accelerating, particularly among fleet operators looking to reduce operational expenses.

Moreover, the rapid growth of e-commerce and urbanization drives demand for efficient, eco-friendly delivery solutions. As cities become more congested, the need for smaller, more agile vehicles that can navigate urban environments and comply with emission regulations is growing. Electric vans are well-suited for this purpose, offering the flexibility needed for last-mile deliveries in dense urban areas. The rise of online shopping and the corresponding increase in delivery volumes have created a strong demand for electric vans that can operate efficiently in these environments while minimizing environmental impact.

In addition, many companies increasingly focus on corporate social responsibility (CSR) and seek to enhance their brand image by adopting sustainable practices. Transitioning to electric vans is seen as a way for businesses to demonstrate their commitment to environmental stewardship, appeal to environmentally conscious consumers, and differentiate themselves from competitors. This trend is particularly strong among large corporations and delivery companies that operate extensive vehicle fleets, where the shift to electric vehicles can significantly impact their overall carbon footprint.

However, the limited charging infrastructure restrains the market's growth. While urban areas have a growing number of charging stations, rural and developing regions often lack the necessary infrastructure to support electric vans. This limitation can restrict the operational range of electric vans, making them less suitable for long-distance travel or routes beyond the reach of reliable charging facilities. The slow expansion of charging networks, particularly fast-charging stations, hampers the adoption of electric vans.

Propulsion Insights

The battery electric vehicle (BEV) segment dominated the market in 2023 and accounted for 56.56% share of global revenue. Rapid advancements in battery technology drive the market's growth. Improvements in battery energy density, charging speed, and overall efficiency have significantly extended the range of electric vans, addressing one of the main concerns-range anxiety. Moreover, developing solid-state batteries and other next-generation technologies promises even greater performance, with faster charging times and longer lifespans.

The hybrid vehicle (HEV) segment is projected to grow significantly from 2024 to 2030. The increased fuel efficiency the hybrid vehicle offers compared to traditional engines drives the market's growth. Combining an electric motor with a traditional internal combustion engine allows hybrid vans to achieve significantly better fuel economy than conventional ICE vehicles. The electric motor assists during acceleration and low-speed driving, which are the most fuel-intensive phases, reducing fuel consumption.

Range Insights

The 100 to 200 miles segment dominated the market in 2023. Electric vans in the 100 to 200-mile range are often more cost-efficient than longer-range electric vehicles and traditional internal combustion engine (ICE) vehicles. The lower upfront cost relative to longer-range electric vans and lower operating costs make these vehicles economically viable for many businesses.

The above 200 miles segment is projected to grow significantly from 2024 to 2030. The increasing demand for long-range commercial vehicles drives the segment's growth. The logistics and transportation industries increasingly demand long-range electric vehicles to meet operational needs. Businesses involved in long-distance deliveries, regional transport, and other commercial activities require vehicles that can cover extended distances without frequent recharging. Electric vans with a range above 200 miles address this need by offering the ability to complete longer routes on a single charge.

Battery Insights

The lithium-ion segment dominated the market in 2023. The declining cost of lithium-ion battery production drives the segment’s growth. Over the past decade, the cost of lithium-ion batteries has dropped significantly due to economies of scale, improvements in manufacturing processes, and increased competition among battery producers. As production costs continue to decrease, the overall cost of electric vans equipped with lithium-ion batteries becomes more competitive with internal combustion engine (ICE) vehicles.

The nickel metal hydride (NiMH) segment is projected to grow significantly from 2024 to 2030. NiMH batteries are generally more cost-effective than other battery types such as lithium-ion, particularly in initial manufacturing costs. While lithium-ion batteries have become more prevalent in the electric vehicle market due to their higher energy density, NiMH batteries offer a more affordable alternative for certain segments, especially where extreme range and lightweight characteristics are not as critical.

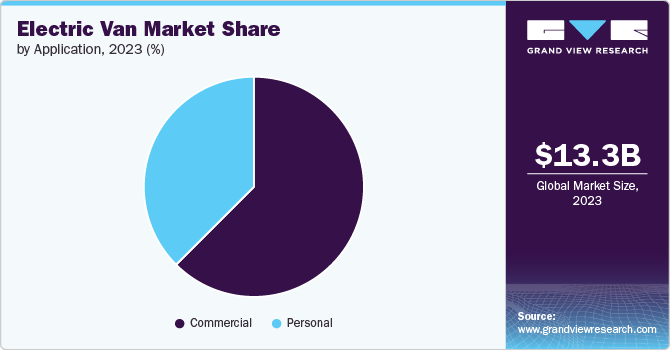

Application Insights

The commercial segment dominated the market in 2023. The growing focus on supply chain and logistics optimization drives the adoption of electric vans for commercial applications. Businesses increasingly leverage advanced analytics and telematics to optimize their supply chains and reduce operational costs. Electric vans, with their lower operating costs and integration capabilities with smart fleet management systems, align well with these optimization strategies. They enable businesses to streamline their logistics operations, reduce fuel consumption, and minimize downtime due to maintenance.

The personal segment is projected to grow significantly from 2024 to 2030. Government incentives and support play a significant role in encouraging the adoption of electric vans for personal use. Many governments offer financial incentives, such as tax credits, rebates, and grants, to reduce the upfront cost of purchasing an electric vehicle (EV). Additionally, some regions offer benefits such as reduced road taxes, exemption from congestion charges, and free or discounted parking for electric vehicles. These incentives make electric vans more affordable and accessible to a broader range of consumers.

Regional Insights

The North American electric van market held a significant share of the global market in 2023. The expansion of charging infrastructure across North America drives the growth of the market. Improved access to charging facilities makes it easier for businesses and individuals to use electric vans for daily operations and long-distance travel. Additionally, advancements in home and workplace charging solutions provide added convenience for electric van owners, further supporting their adoption.

U.S. Electric Van Market Trends

The U.S. electric van market is expected to grow at a significant CAGR from 2024 to 2030. Innovations in vehicle design and features are driving the growth of electric vans in the U.S. Electric vans are being developed with advanced features that enhance comfort, convenience, and functionality, thus driving their adoption in the country.

Europe Electric Van Market Trends

The Europe electric van market is expected to witness notable growth from 2024 to 2030. Stringent environmental regulations aimed at reducing greenhouse gas emissions and improving air quality drive growth of the electric vans market in the region. The European Union (EU) has set ambitious targets for reducing CO2 emissions from vehicles, including commercial vehicles such as vans. These regulations push businesses and individuals to adopt cleaner transportation alternatives, such as electric vans, to comply with emission standards.

Asia Pacific Electric Van Market Trends

The Asia Pacific electric van market held the largest share of 53.12% of the global revenue in 2023. The growth of e-commerce and the growing demand for delivery services are contributing to the rise of electric vans in the APAC region. As online shopping continues to expand, there is a growing need for sustainable and efficient delivery solutions. Electric vans are well-suited for last-mile deliveries due to their lower operating costs, quiet operation, and suitability for urban environments.

Key Electric Van Company Insights

The companies are focusing on various strategic initiatives, including partnerships & collaborations, new product development, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Honda launched an electric van, the N-VAN e, with a starting price of USD 15,550. The launch represents Honda's commitment to expanding its electric vehicle (EV) offerings as part of its broader decarbonization strategy, aiming for EVs and fuel cell vehicles to constitute 40% of its global sales by 2030.

-

In April 2024, Mercedes-Benz launched a luxury electric van designed for the Chinese market, utilizing its innovative VAN-EA platform. Mercedes-Benz Vans highlighted this new model as a "super-luxury variant," reflecting the company's strategy to capitalize on the growing demand for premium vans in China. The launch aligns with Mercedes-Benz's broader goal of expanding its market presence in China.

Key Electric Van Companies:

The following are the leading companies in the electric van market. These companies collectively hold the largest market share and dictate industry trends.

- Mercedes-Benz USA, LLC

- Ford Motor Company

- Rivian

- Nissan

- Volkswagen

- Stellantis

- Europe S.p.A.

- Renault

- BYD Singapore

- MAN

- Volvo Car Corporation

Electric Van Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.73 billion

Revenue forecast in 2030

USD 32.02 billion

Growth rate

CAGR of 13.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Propulsion, range, battery, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Mercedes-Benz USA, LLC; Ford Motor Company; Rivian; Nissan; Volkswagen; Stellantis Europe S.p.A.; Renault; BYD Singapore; MAN; Volvo Car Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Van Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electric van market report based on propulsion, range, battery, application, and region:

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Hybrid Vehicle (HEV)

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 100 miles

-

100 to 200 miles

-

Above 200 miles

-

-

Battery Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium Ion

-

Sealed Lead Acid

-

Nickel Metal Hydride (NiMH)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Personal

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric van market size was estimated at USD 13.33 billion in 2023 and is expected to reach USD 14.73 billion in 2024.

b. The global electric van market is expected to grow at a compound annual growth rate of 13.8% from 2024 to 2030 to reach USD 32.02 billion by 2030.

b. Asia Pacific dominated the electric van market with a share of 53.12% in 2023. The growth of e-commerce and the growing demand for delivery services are contributing to the rise of electric vans in the APAC region.

b. Some key players operating in the electric van market include Mercedes-Benz USA, LLC; Ford Motor Company; Rivian; Nissan; Volkswagen; Stellantis Europe S.p.A.; Renault; BYD Singapore; MAN; and Volvo Car Corporation.

b. Key factors that are driving the market growth include the push toward greener transportation solutions and the rise of online shopping, and the corresponding increase in delivery volumes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."