- Home

- »

- Automotive & Transportation

- »

-

Electric Utility Vehicle Market Size, Industry Report, 2030GVR Report cover

![Electric Utility Vehicle Market Size, Share & Trends Report]()

Electric Utility Vehicle Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type, By Battery Type (Lead-Acid, Lithium-ion, Others), By Drive Type, By Propulsion Type, By Seating Capacity, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-110-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Utility Vehicle Market Summary

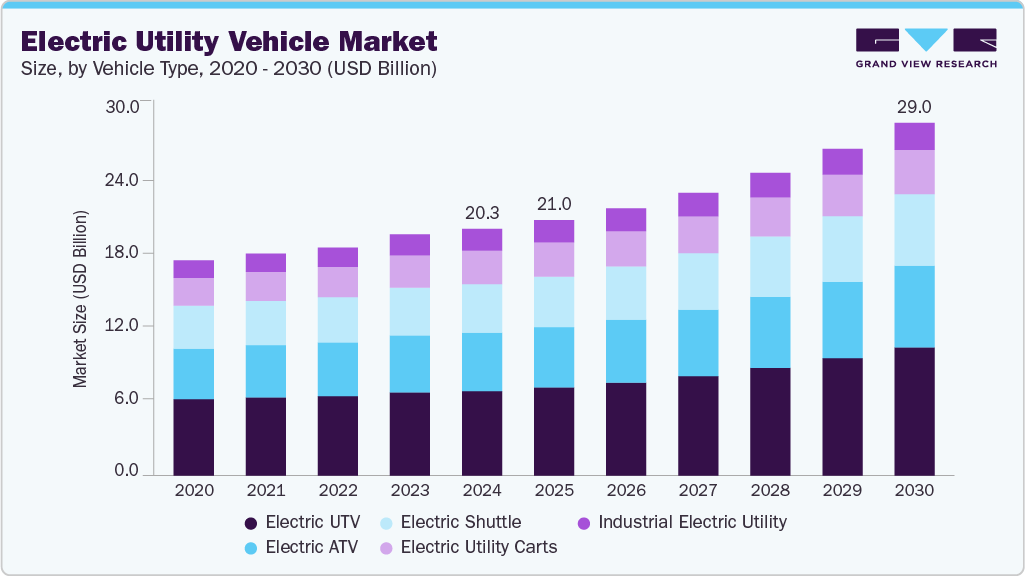

The global electric utility vehicle market size was estimated at USD 20.35 billion in 2024 and is projected to reach USD 29.07 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The growth of the electric utility vehicle (EUV) market is primarily fueled by the rising adoption of electric utility task vehicles (UTVs) in agriculture, which are increasingly used for tasks such as towing, hauling, and farm surveying.

Key Market Trends & Insights

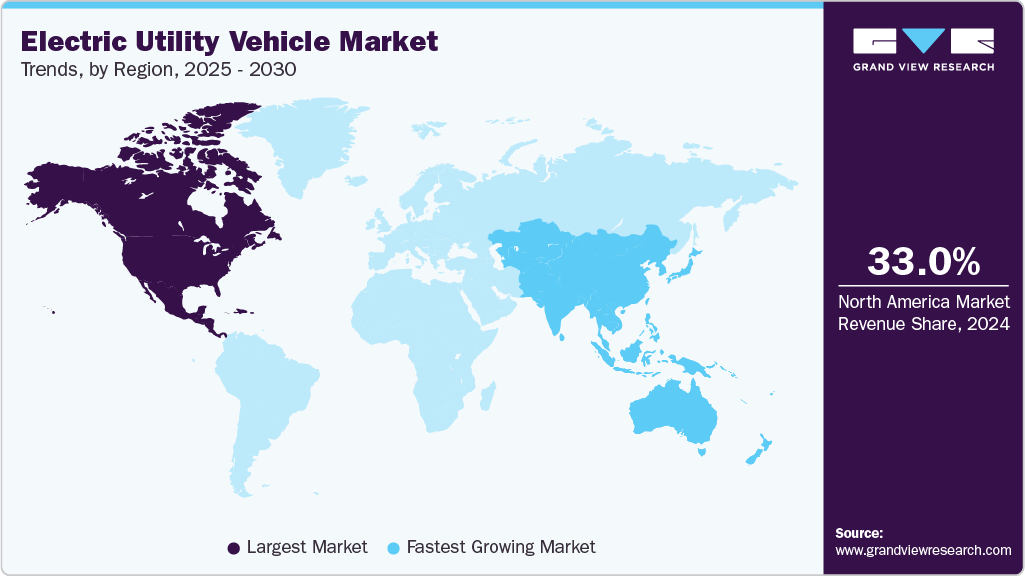

- North America electric utility vehicle market accounted for a significant share of over 33% in 2024 of the global revenue.

- The U.S. electric utility vehicle (EUV) market is experiencing robust growth.

- By vehicle type, the electric UTV segment accounted for the largest share of over 34% of the electric utility vehicle market in the year 2024.

- By battery type, the lithium-ion segment accounted for the largest share of over 58.0% of the global electric utility vehicle market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.35 Billion

- 2030 Projected Market Size: USD 29.07 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Farmers are shifting toward electric UTVs due to their lower operational costs, reduced emissions, and quieter operation compared to traditional gasoline or diesel-powered alternatives. Governments in key agricultural regions, including North America and Europe, are further encouraging this transition through subsidies and incentives aimed at promoting sustainable farming practices. This trend is likely to persist as more farms acknowledge the long-term economic and environmental advantages of electric utility vehicles. Another major driver of market growth is the expanding use of electric utility vehicles in industrial logistics and warehousing. With the rapid growth of e-commerce and automated supply chains, businesses are increasingly relying on electric UTVs and low-speed electric vehicles (LSEVs) for material handling, warehouse operations, and factory logistics. These vehicles are particularly valued for zero emissions, making them ideal for indoor use in warehouses and manufacturing plants. Additionally, ports and airports are adopting electric utility vehicles for baggage handling, maintenance, and personnel transport, further boosting demand. The efficiency and cost savings associated with electric fleets in logistics are expected to sustain this upward trend.

The growing usage of connected vehicle technology and increasing internet & smartphone penetration also support the demand for electric utility vehicles. Electric UTV manufacturers use connected vehicle technology to provide riders with an improved riding experience, enhancing performance, efficiency, and effectiveness. For instance, in August 2022, Polaris Inc. introduced Ride Command+, a subscription-based connected vehicle service available across its entire UTV lineup. This advanced platform leverages vehicle-to-cellular connectivity to enable over-the-air (OTA) updates, ensuring vehicles remain up-to-date with the latest features and performance enhancements. A key offering of Ride Command+ is Vehicle Health, which provides users with remote access to critical diagnostics, including battery life status and estimated driving range, enhancing convenience, safety, and overall vehicle management.

In the rapidly growing electric utility vehicle market, custom-made UTVs are becoming increasingly popular among customers due to their ability to cater to specific purposes. Whether it's for off-road exploration, agriculture, industrial use, or Recreation activities, customers can now have UTVs built precisely to match their requirements. This level of customization allows customers to maximize the utility and effectiveness of their electric UTVs while contributing to a greener and more sustainable future. As the demand for eco-friendly solutions rises, the availability of custom-made UTVs provides a promising pathway toward a cleaner and more versatile electric utility vehicle market.

Also, manufacturers worldwide are directing their attention toward vehicle electrification in response to growing environmental concerns. Many of these manufacturers are actively developing and launching new electric utility vehicles with the aim of reducing carbon footprints. For instance, in July 2022, American LandMaster announced the launch of its 2022 4-seater lithium-ion battery-powered electric utility vehicle. The utility vehicle has an independent L-ROSS suspension, weather-sealed electrical connectors, and automotive-grade ball joints & bushings. The electric UTV's suspension system provides a bed capacity of 500 lbs. and a towing capacity of 1,500. Optional accessories include a steel-framed weather enclosure, a 3,000lb electric winch, and an HD oversized steel cargo bed.

Vehicle Type Insights

The electric UTV segment accounted for the largest share of over 34% of the electric utility vehicle market in the year 2024. This dominant position is fueled by strong demand across both commercial and recreational sectors. In industrial applications, businesses are increasingly adopting electric UTVs for warehouse operations, agricultural work, and logistics due to low operating costs, zero emissions, and quiet operation. Eliminating fuel costs and reduced maintenance requirements compared to traditional gas-powered models make them particularly attractive for fleet operators.

The electric shuttle segment is expected to grow at a considerable CAGR over the forecast period. The segment’s expansion is driven by several key factors, including the global push toward sustainable urban mobility, the rise of smart city initiatives, and increasing demand for zero-emission public transportation solutions. Governments and municipalities worldwide are implementing stricter emissions regulations and offering subsidies to encourage the adoption of electric shuttles, particularly for last-mile connectivity, campus transportation, and urban transit networks.

Battery Type Insights

The lithium-ion segment accounted for the largest share of over 58.0% of the global electric utility vehicle market in 2024. The growth of this segment is attributed to the growing demand for their affordability and suitability for specific applications to drive their usage in certain segments of the electric utility vehicle market. The demand for this segment is increasing in automobile applications, including lighting, starting, and ignition purposes.

The others segment is expected to grow at a significant CAGR over the forecast period. This growth is driven by the need for higher energy density, faster charging, improved safety, and reduced reliance on traditional lithium-ion chemistries, which face challenges like raw material scarcity and thermal instability. Additionally, government and private sector funding for next-gen battery research is accelerating adoption. The U.S., Europe, and China are prioritizing subsidies and R&D grants for alternative battery technologies to diversify supply chains and enhance energy security.

Drive Type Insights

The rear wheel drive segment accounted for the largest share of over 49% of the global electric utility vehicle market in 2024. The growth of the segment is attributed to the advantageous features of rear wheel drive, such as improved fuel economy and a balanced vehicle weight distribution, resulting in enhanced stability on challenging terrains. Moreover, rear wheel drive is a cost-effective choice for consumers due to lower maintenance requirements in drivetrains and the engine's ability to provide extra vehicle mileage, and these features are contributing to the growth of this segment.

The all-wheel drive segment is expected to grow at the fastest CAGR over the forecast period. There is a rising demand for all-wheel drives in electric utility vehicles for efficient power distribution to all four corners of the utility vehicle, resulting in enhanced grip capacity, improved acceleration, and smooth handling. This superior traction capability eliminates the risk of utility vehicle slippage on icy, wet, and uneven roads, making all-wheel drive with an electric powertrain a highly favored choice.

Propulsion Type Insights

The battery electric vehicle segment accounted for the largest share of over 76% of the global electric utility vehicle market in 2024. The growth of the segment is owing to the growing adoption of electric vehicles. Several utility vehicle manufacturers are offering electric utility vehicle product segments. Some key players offer electric utility vehicles, such as Polaris Inc., CLUB CAR, Marshell Green Power, and Star EV Corporation. Moreover, advancement in technology of electric utility vehicles offers impressive torque and acceleration, providing better performance than traditional gasoline or diesel-powered utility vehicles. This has led to increased adoption of electric utility vehicles among users that need value efficiency and responsiveness, contributing to the growth of this segment.

The battery electric vehicle segment is expected to grow at a considerable CAGR over the forecast period. The growth of this market segment is increasing significantly due to the growing demand for this type of vehicle throughout developing countries, due to their fragile charging infrastructure. The charging infrastructure among developing and underdeveloped countries can support fully electric vehicles, bolstering the growth of this market segment.

Seating Capacity Insights

The more than 2-seater segment accounted for the largest share of over 51.0% of the global electric utility vehicle market in 2024. The growth is attributed to the rising popularity of family adventure activities, which is driven by an increase in global disposable income. As more people have the financial means to indulge in such activities, the demand for products in this segment has significantly expanded, bolstering its overall growth.

The 2-searter segment is expected to grow with a significant CAGR over the forecast period. The growth of last-mile delivery services has created vast demand for compact electric vehicles that can efficiently transport small cargo loads while minimizing operating costs. Food delivery platforms, micro-fulfillment centers, and urban logistics providers are increasingly adopting 2-seater EVs to replace traditional gas-powered vehicles and even motorcycles.

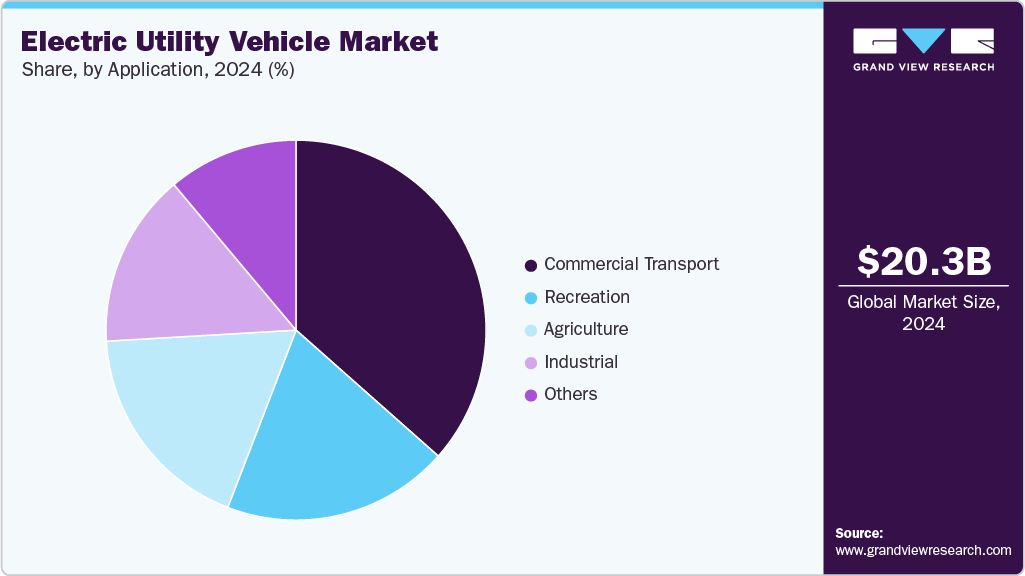

Application Insights

The commercial transport segment accounted for the largest share of 36.5% of the global electric utility vehicle market in 2024. The segment growth is attributed to rising demand for electric shuttles for passenger Commercial Transport in urban areas and utility carts for slightly longer last-mile travel in both rural and urban settings is on the rise. Major manufacturers like Columbia Vehicle, CLUB CAR, Electric Last Mile Solutions, and Ari Motors manufacture electric utility carts catering to commercial transport needs. These vehicles offer efficient and eco-friendly mobility solutions for various applications in different locations.

The recreation segment is expected to witness considerable growth over the forecast period. The growth of this segment is due to the rise in the adoption of electric vehicles as part of their eco-friendly initiatives. Moreover, the rapid adoption of autonomous ATVs in activities like excavating land, reclaiming land, clearing mud, and maintaining reservoirs, ponds, riverbeds, and swamps is expected to impact the segment's growth positively.

Regional Insights

North America electric utility vehicle market accounted for a significant share of over 33% in 2024 of the global revenue. Several key factors, including a robust e-commerce sector and a mature industrial and manufacturing ecosystem, drive this strong market position. Additionally, the surge in recreational activities, such as hunting, camping, and off-road forest excursions, during the pandemic has further accelerated regional demand for electric UTVs. Market leadership in the region is held by prominent players such as Polaris Inc., Textron Specialized Vehicles Inc., and Deere & Company. These companies have been instrumental in shaping the competitive landscape and addressing the increasing demand for electric UTVs across diverse applications.

U.S. Electric Utility Vehicle Market Trends

The U.S. electric utility vehicle (EUV) market is experiencing robust growth, driven by a convergence of environmental, economic, and technological factors. A primary catalyst is the increasing focus on sustainability across both public and private sectors, with stringent emissions regulations pushing fleet operators toward electrification. The Biden administration's infrastructure plan and Inflation Reduction Act have accelerated this transition through substantial incentives, including tax credits for commercial EV purchases and funding for charging infrastructure development.

Asia Pacific Electric Utility Vehicle Market Trends

Asia Pacific is projected to emerge as one of the most lucrative regions for the market in terms of revenue during the forecast period, growing at a significant CAGR. The region's dominance can be attributed to various factors, such as the rapid economic development in some Asia Pacific countries has led to an increase in commercial activities, logistics, and industrial operations, and investment by the government in the development of the charging infrastructure for electric vehicles, including utility vehicles.

As the world’s largest EV market, China has been aggressively promoting new energy vehicles (NEVs), including electric utility vehicles, through subsidies, tax incentives, and stringent emissions regulations. The Dual Carbon goals (peaking emissions by 2030 and achieving carbon neutrality by 2060) have accelerated the shift away from fossil fuel-powered utility vehicles, particularly in logistics, construction, and municipal services.

India electric utility vehicle marketis experiencing growth due tothe Indian government’s Faster Adoption and Manufacturing of Electric Vehicles (FAME II) scheme, along with state-level subsidies, has been instrumental in promoting electric mobility, including utility vehicles used in logistics, agriculture, and public services. Policies like production-linked incentives (PLIs) for advanced battery manufacturing and lower GST rates on EVs (5% vs. 28% for ICE vehicles) are making electric utility vehicles more affordable for businesses and fleet operators.

Europe Electric Utility Vehicle Market Trends

The European electric utility vehicle (EUV) market is experiencing robust growth, primarily driven by stringent environmental regulations and ambitious decarbonization goals. The European Green Deal and the Fit for 55 package have set aggressive targets for reducing transport emissions, pushing industries and municipalities to transition from fossil fuel-powered utility vehicles to zero-emission alternatives.

UK electric utility vehicle market is experiencing growth due to the UK government’s 2030 ban on new petrol and diesel vehicle sales—extended to 2035 for hybrids—has created a clear roadmap for fleet electrification, accelerating demand for electric vans, trucks, and specialized utility vehicles. Policies like the Plug-in Van Grant (PIVG), which offers up to 5,000 for large electric vans and £2,500 for small models, along with reduced benefit-in-kind (BIK) taxes for electric company vehicles, are making EUVs financially attractive for businesses.

Key Electric Utility Vehicle Company

Some of the key players operating in the electric utility vehicle market include Addax Motors, Alke, American Landmaster, and CLUB CAR. The electric utility vehicle market is considerably fragmented, with numerous large and medium-sized players in the market. Prominent market players are making investments in research and development (R&D) to expand their offerings, thereby fostering further growth in the electric utility vehicle market. These market players also pursue diverse strategic initiatives to enhance their global presence, such as launching new products, entering into contractual agreements, engaging in mergers and acquisitions, ramping up investments, exploring market developments, and forging collaborations with other organizations.

-

Addax Motors is a Belgian manufacturer specializing in 100% electric utility vehicles designed for professional applications such as urban logistics, municipal services, facility management, and last-mile delivery. Established in 2015 and headquartered in Deerlijk, Belgium, the company focuses on producing compact, emission-free vehicles that are fully customizable to meet diverse operational needs.

-

American Landmaster is a U.S.-based manufacturer specializing in utility terrain vehicles (UTVs) for both work and recreational applications. The company operates from its production facility in Jonesboro, Arkansas, where it assembles a range of gas-powered and electric models. Its product lineup includes work-oriented vehicles with cargo beds and towing capabilities alongside recreational models designed for off-road use, with available configurations accommodating different terrain and load requirements.

Key Electric Utility Vehicle Companies:

The following are the leading companies in the electric utility vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- Addax Motors

- Alke

- American Landmaster

- CLUB CAR

- Columbia Vehicle Group Inc.

- HISUN

- Marshell Green Power

- Polaris Inc.

- Star EV Corporation

- Textron Specialized Vehicles Inc.

Recent Developments

-

In February 2025, American Landmaster announced the release of 16 new classic utility vehicle models as part of its 2025 lineup. These models are designed to offer enhanced performance, durability, and customization options, catering to a wide range of applications including agriculture, property maintenance, and recreational use. The introduction of these vehicles underscores company's commitment to providing versatile and reliable American-made UTVs that meet the evolving needs of their customer base.

-

In January 2024, Addax Motors announced a strategic partnership with Australia's EcoPower Equipment to distribute its electric light commercial vehicles across the Australian market. This collaboration marks Addax Motors' first distribution agreement outside Europe, expanding its network to 21 countries.

-

In July 2023, ZeroNox Inc. announced its partnership with E-LIX Elektromobile GmbH, a German-based company, and Chateaux Des Langues, a French-based company. This partnership aims to distribute ZeroNox Inc.’s Tuatara electric utility terrain vehicles (UTVs) to their offerings for off-highway vehicle customers across Europe. Companies are involved in developing source components such as powertrains, batteries, and electric connectors.

-

In April 2023, Sypris Technologies, Inc., a U.S.-based supplier and manufacturer of drivetrain and vehicle components for commercial vehicles, received a program authorization to provide drivetrain components for UTVs in the American market. Consequently, the company entered into a multi-year agreement with a major player in the UTV market, ensuring compliance with production demands starting from 2024.

-

In August 2022, Volcon announced a partnership with General Motors to power Volcon electric UTVs with General Motors' electric propulsion system. The companies are also working on improving their sales channel strategies to attract more consumers to their products.

Electric Utility Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.05 billion

Revenue forecast in 2030

USD 29.07 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, battery type, drive type, propulsion type, seating capacity, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Addax Motors; Alke; American Landmaster; CLUB CAR; Columbia Vehicle Group Inc.; HISUN; Marshell Green Power; Polaris Inc.; Star EV Corporation; Textron Specialized Vehicles Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Utility Vehicle Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global electric utility vehicle market report based on vehicle type, battery type, drive type, propulsion type, seating capacity, application, and region:

-

Vehicle Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Electric ATV

-

Electric UTV

-

Electric Utility Carts

-

Electric Shuttle

-

Industrial Electric Utility

-

-

Battery Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Lead-acid

-

Lithium-Ion

-

Others

-

-

Drive Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Front Wheel Drive

-

Rear Wheel Drive

-

All Wheel Drive

-

-

Propulsion Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Battery Electric Vehicle

-

Hybrid Electric

-

Others

-

-

Seating Capacity Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

1-Seater

-

2-Seater

-

More than 2-Seater

-

-

Application Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Commercial Transport

-

Industrial

-

Recreation

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric utility vehicle market size was estimated at 18.78 million in 2022 and is expected to reach 19.87 million in 2023.

b. The global electric utility vehicle market is expected to grow at an annual compound rate of 5.59% from 2023-2030 to reach 29.07 million by 2030.

b. The vehicle segment accounts for the largest market share. The growth of this segment is attributed to the increasing popularity of passenger transportation, the minimal noise emissions of the vehicles, their cost-effective ownership, and their utilization for military purposes.

b. The key players that dominated the electric utility vehicle market in 2022 Addax Motors, Alke , American Landmaster, CLUB CAR, Columbia Vehicle Group Inc. , HISUN, Marshell Green Power, Polaris Inc., Star EV Corporation, Textron Specialized Vehicles Inc.

b. The growth of the electric utility vehicle market is majorly attributed to the increasing adoption of electric UTVs in farming activities like towing, hauling, and farm surveying, as well as their application in industrial logistics and warehousing. Additionally, the growing popularity of custom-made UTVs among customers is due to their ability to cater to specific purposes, thereby driving market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.