- Home

- »

- Automotive & Transportation

- »

-

Electric Trucks Market Size & Share, Industry Report, 2033GVR Report cover

![Electric Trucks Market Size, Share & Trends Report]()

Electric Trucks Market (2026 - 2033) Size, Share & Trends Analysis Report By Vehicle Type (Light Duty Trucks, Medium Duty Trucks, Heavy Duty Trucks), By Propulsion Type, By Vehicle Range, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-061-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Trucks Market Summary

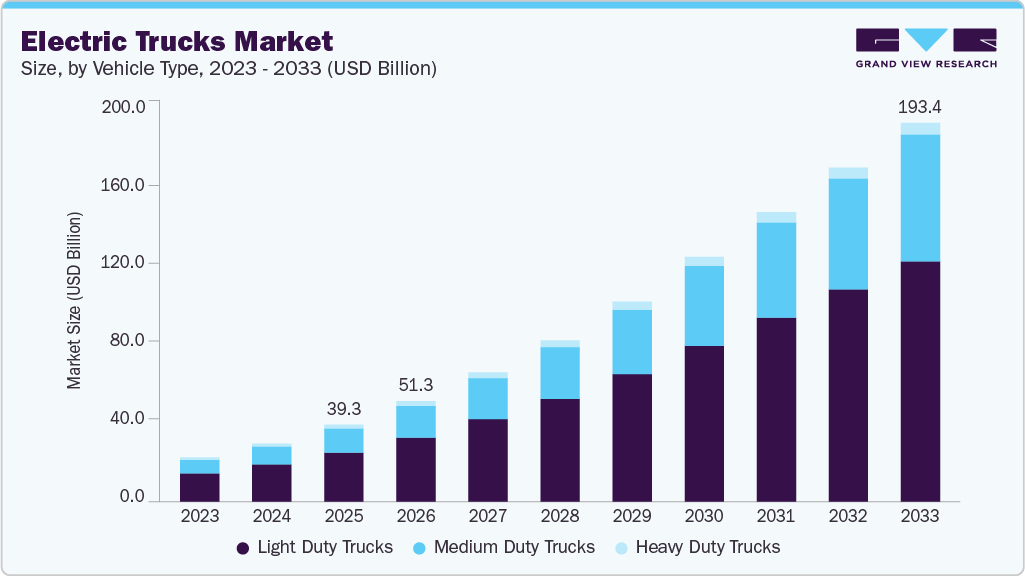

The global electric trucks market size was estimated at USD 39.30 billion in 2025, and is projected to reach USD 193.40 billion by 2033, growing at a CAGR of 20.9% from 2026 to 2033. This steady growth is attributed to stricter emission regulations, expanding charging infrastructure, falling battery costs, supportive government incentives, and increasing adoption of electric trucks by logistics and fleet operators to reduce operating costs and meet sustainability targets.

Key Market Trends & Insights

- The Asia Pacific electric trucks market accounted for a 78.0% share of the overall market in 2025.

- The electric trucks industry in China held a dominant position in 2025.

- By vehicle type, the light duty trucks segment accounted for the largest share of 63.9% in 2025.

- By propulsion type, the BEV segment held the largest market share in 2025.

- By vehicle range, the upto 300 miles segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 39.30 Billion

- 2033 Projected Market Size: USD 193.40 Billion

- CAGR (2026-2033): 20.9%

- Asia Pacific: Largest market in 2025

- North America: Fastest growing market

For instance, the Global EV Outlook 2023 report published by the International Energy Agency (IEA) revealed that over 60,000 medium- and heavy-duty electric trucks were sold worldwide in 2022, and a significant demand was observed from new markets. In addition, innovations in battery technology and economies of scale have led to significant reductions in battery costs, making electric trucks more competitive with their internal combustion (IC) engine counterparts. As the demand for environment-friendly logistics solutions increases, sales of electric trucks are expected to remain substantial over the forecast period.

A number of stringent emission standards and regulations have been implemented by governing bodies, such as the European Union's Euro 7, which is aimed at reducing pollution from vehicles, and the U.S. Environmental Protection Agency's (EPA) Clean Trucks Plan that was announced in 2021 and will be applicable from 2027 onwards. These policies are compelling fleet operators to adopt cleaner alternatives in their operations, driving a higher demand for electric trucks. Furthermore, governments worldwide are offering attractive incentives, such as tax credits, subsidies, and investments in charging infrastructure, to encourage the adoption of electric trucks.

Expansion of fast-charging networks and investments in charging infrastructure have helped address the issue of range anxiety among EV users and made electric trucks a more viable option for long-haul transportation. For instance, the Global EV Outlook 2023 report published by the IEA revealed that about 2.7 million public charging points were available worldwide in 2022, out of which over 900,000 points were installed that year, which was a substantial increase from 2021. The planned development of such infrastructure has encouraged consumers to purchase electric trucks. Moreover, the European Investment Bank and the European Commission, in 2021, agreed to provide 1.5 billion euros in grants by the end of 2023 for establishing alternative fuel infrastructure, such as electric fast charging stations. Furthermore, continuous improvements in electric truck technology, including increased range, payload capacity, and efficiency, are enhancing their appeal among buyers.

Vehicle Type Insights

Light duty trucks dominated the market with a revenue share of 63.9% in 2025. This is owing to their widespread adoption in urban delivery and logistics applications, where the benefits of electric vehicles are most visible. Light-duty electric trucks are ideally suited for short- to medium-haul routes, offering reduced operating costs, low to zero emissions, and improved performance. The growing demand for sustainable last-mile delivery solutions, driven by the rise of the e-commerce sector and urbanization activities, has further elevated the adoption of light-duty trucks. In addition, these trucks require less energy to operate, making them more cost-effective and increasing their appeal among fleet operators seeking to minimize their environmental footprint.

Medium duty trucks are expected to register the fastest CAGR over the forecast period. This is attributed to a combination of factors such as declining battery costs, improving technology, and expanding charging infrastructure, making medium-duty electric trucks a viable option for a wide range of applications. Their optimal alignment with the evolving needs of commercial fleets and the accelerating transition to sustainable transportation solutions has led to increased demand. Furthermore, medium-duty electric trucks are expected to fully capitalize on the growing demand for sustainable logistics and transportation services driven by consumer pressure and regulatory requirements.

Propulsion Type Insights

Battery Electric Vehicles (BEV) accounted for the largest market share in 2025 and are expected to grow at the fastest CAGR during the forecasted period. This is owing to their superior performance, reduced operating costs, and growing acceptance as a viable alternative to IC engine trucks. BEVs are powered solely by batteries and electric motors and offer a strong value proposition for fleet operators seeking to minimize their environmental impact, lower their fuel costs, and reduce maintenance expenses. Moreover, the increasing availability of BEV models across various weight classes, improvements in battery technology, and declining costs make them more competitive with diesel-powered trucks. For instance, in March 2024, Scania announced that it would be expanding its BEV portfolio by adding various axle configurations, electric machines, and better batteries in its electric trucks.

Hybrid Electric Vehicles (HEV) are anticipated to register a significant growth from 2026 to 2033. This is owing to their strategic positioning as a transitional technology, bridging the gap between traditional IC engine trucks and BEVs. HEVs offer a compelling solution to stakeholders, leveraging existing infrastructure and providing a more gradual transition to electric propulsion. They offer a balance between environmental sustainability and operational practicality, particularly in long-haul and heavy-duty applications. In addition, ongoing advancements in HEV technology, such as improved fuel efficiency and reduced emissions, have enhanced their competitiveness.

Vehicle Range Insights

Vehicles with a range of up to 300 miles accounted for the highest market share in 2025. This is owing to their optimal alignment with the daily route requirements of commercial fleets, particularly in urban and regional transportation applications. Electric trucks with this range provide a balance between the need for sufficient range to complete daily routes without excessive battery capacity, thereby reducing upfront costs and improving the total cost of ownership. This range category is well suited for applications such as parcel and package delivery, food and beverage distribution, and municipal services, where routes are predictable and charging infrastructure is more readily available. These factors have collectively led to the highest share of the segment.

The 300-600 miles segment is expected to register the fastest CAGR over the forecast period. This is attributed to the rapidly increasing adoption of vehicles offering this range among commercial fleets seeking to electrify their longer-haul operations. Electric trucks with a range of 300-600 miles offer a critical threshold, enabling fleets to transition to electric propulsion for regional and interstate transportation applications while minimizing range anxiety and charging downtime. Extensive research and innovations in battery technologies, declining costs, and expanding charging infrastructure have propelled further demand for extended-range trucks.

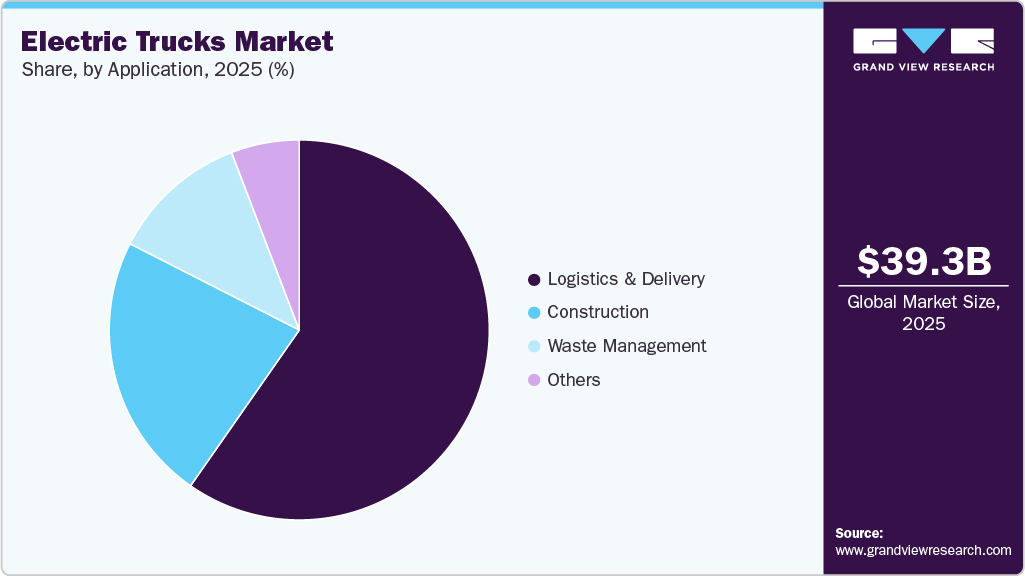

Application Insights

The logistics & delivery segment held the largest market share in 2025 and is expected to grow at the fastest CAGR during the forecasted period. This is attributed to the growing demand for sustainable and efficient last-mile delivery solutions, driven by the rise of e-commerce and increasing consumer expectations for rapid and reliable delivery of their orders. Electric trucks are particularly suitable for urban logistics and delivery applications, where routes are typically shorter and more predictable, allowing for easier integration of EVs into existing fleets. In addition, logistics and delivery companies are under increasing pressure to reduce their environmental footprint, making electric trucks a viable solution to meet sustainability goals. For instance, in June 2024, IKEA partnered with KLOG, a logistics services company, wherein the latter would deploy Scania electric trucks to migrate IKEA’s products from its factory in Paços de Ferreira to the Porto Harbour in Leixões, along with other IKEA stores. Such developments highlight the strong growth potential of this market.

Waste management is expected to register a notable growth rate from 2026 to 2033. This is owing to the increasing adoption of EV technology in this area as a means of reducing emissions, operating costs, and environmental impact. The growing demand for sustainable waste management solutions, driven by government regulations and consumer pressure, along with the need for cost-effective alternatives to traditional diesel-powered trucks, has positioned EV trucks as a viable option. These vehicles are particularly used for waste management applications, where routes are often predictable and involve frequent stops, allowing for regenerative braking and optimized energy recovery. The waste management sector is benefiting from advancements in EV technology, including increased range and payload capacity, which makes electric trucks a practical solution for a wider range of applications.

Regional Insights

North America is expected to grow at the fastest CAGR during the forecasted period. Robust government policies and incentives aimed at reducing carbon emissions have significantly propelled the transition towards electric mobility. The U.S. government, along with various state governments, has implemented tax credits, grants, and subsidies that encourage both manufacturers and consumers to invest in electric trucks. In addition, new product offerings and associated services by manufacturers have fueled demand for EVs in the region. For instance, in July 2024, Isuzu announced the launch of connected services for its BEV trucks range, which will leverage the GATEX platform for uptime support and charging management services. These solutions would be launched simultaneously with the company’s introduction of its N-Series of light-duty BEV trucks in the regional market in August 2024.

U.S. Electric Trucks Market Trends

The U.S. accounted for the largest share of the regional market in 2025. This is owing to stringent environmental regulations on transport vehicles through the implementation of supportive government policies such as the U.S. EPA’s Clean Truck Plan, compelling stakeholders to adopt EVs. Moreover, strategic partnerships between automotive manufacturers have accelerated the development of advanced features such as autonomous driving capabilities and smart logistics solutions within electric trucks. Anticipating the market potential, strategic partnerships among manufacturers for creating a robust EV ecosystem have positively affected the industry. For instance, in January 2024, Accelera, Daimler Truck, and PACCAR chose Marshall County in Mississippi as the location for their new battery cell manufacturing facility. The joint venture aims to localize battery cell production for commercial electric vehicles in the U.S. The factory is expected to expand in the future to meet the growing demand for EVs. The 21-gigawatt hour (GWh) facility is expected to start production in 2027.

Europe Electric Trucks Market Trends

Europe held a significant share of the global market in 2025. This is owing to the stringent regulatory environment and emission restrictions levied by the European Union, which compel vehicle manufacturers to adopt environment-friendly solutions. In addition, the presence of a robust vehicle engineering and manufacturing ecosystem in countries such as Germany, the UK, and France has led to innovative solutions and bundled offerings by EV manufacturers. For instance, in June 2024, Daimler Truck announced the launch of its TruckCharge brand in Europe, which offers all of the company’s solutions related to electric truck charging infrastructure. This includes consulting services, charging hardware, and digital solutions. The company aims to provide customers with a comprehensive package, from energy generation to vehicle operations, to help them maximize their benefits from electric trucks.

Germany accounted for a notable share of the European market in 2025. This is attributed to the country’s well-established machine engineering and vehicle manufacturing sector. Germany is among the leading economies that offer innovative and industry-first engineering solutions. Favorable government policies in the country have fostered research and development efforts in innovative technologies. For instance, in July 2024, Daimler Truck announced the inauguration of its new Battery Technology Center (BTC) at the Mercedes-Benz plant in Mannheim, Germany. The company aims to start research & development and subsequent production of next-generation lithium-ion batteries required for electric trucks.

Asia Pacific Electric Trucks Market Trends

Asia Pacific held the largest market share of 78.0% in 2025 in global revenue. This is attributed to favorable government initiatives and policies, such as China's New Energy Vehicle (NEV) mandate and India's Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, which have created a conducive regulatory environment for electric trucks. In addition, the region's fast-growing logistics and delivery sectors, driven by e-commerce expansion, have increased the demand for sustainable and efficient transportation solutions. Furthermore, a significant number of electric truck manufacturers, including leading players such as BYD, FAW Group, and Dongfeng Motor, have leveraged their local presence and expertise to drive product innovation and adoption in the region.

India’s automotive sector is experiencing steady growth owing to increased economic activities and rising income levels of consumers. The Indian government is making active efforts towards spreading awareness and adoption of EVs in the country by launching awareness portals such as e-AMRIT (Accelerated e-Mobility Revolution for India's Transportation). In addition, the fast-expanding e-commerce and logistics sector has compelled stakeholders to invest in efficient and sustainable short and long-distance transportation solutions. The country's steadily growing commercial vehicle market, coupled with the presence of domestic manufacturers such as Tata Motors and Ashok Leyland, which are investing heavily in EV technology, is also driving growth in this segment.

China’s electric truck market is experiencing rapid growth, driven by strong government support for new energy vehicles, strict emission regulations, and large-scale investments in charging and battery-swapping infrastructure. As China pushes toward carbon peaking and carbon neutrality goals, electric trucks are increasingly adopted across urban logistics, port operations, mining, and municipal services. The country’s dominance in battery manufacturing, cost-effective local supply chains, and the presence of major domestic OEMs enable faster commercialization and lower total cost of ownership compared to conventional diesel trucks. In addition, the rapid expansion of e-commerce, smart logistics hubs, and zero-emission zones in major cities is accelerating the deployment of electric light-, medium-, and heavy-duty trucks, positioning China as the largest and most technologically advanced electric truck market globally.

Key Electric Trucks Company Insights

Some of the major players in the electric trucks market include AB Volvo, BYD Company Ltd., Daimler Truck AG, Dongfeng Motor Company, FAW Group Co., Ltd., Foton International, ISUZU MOTORS LIMITED, Navistar, Inc, PACCAR Inc., and Scania. These companies are actively developing and commercializing electric truck platforms across light, medium, and heavy-duty segments, targeting applications such as urban logistics, long-haul freight, construction, mining, and municipal services. Their electric truck portfolios leverage advances in battery technology, power electronics, connected vehicle systems, and fleet management software to improve driving range, reduce total cost of ownership, and support zero-emission freight operations. Strong OEM fleet partnerships, global manufacturing footprints, and integration with charging and energy ecosystems position these players as core enablers of the electrification of commercial transportation worldwide.

-

AB Volvo is a global player in electric heavy-duty trucks, focusing on zero-emission solutions for urban distribution, regional haul, and construction applications. The company integrates advanced battery systems, energy-efficient drivetrains, and connected services to optimize vehicle uptime and fleet performance. Volvo’s close collaboration with logistics providers, utilities, and charging infrastructure partners strengthens its ability to deploy scalable electric truck solutions aligned with sustainability and regulatory requirements.

-

BYD Company Ltd. plays a pivotal role in the electric truck market by leveraging its vertically integrated battery and electric powertrain capabilities. BYD offers a broad range of electric trucks for ports, sanitation, mining, and urban freight, particularly across Asia-Pacific and emerging markets. Its in-house battery manufacturing and cost-efficient production enable competitive pricing and accelerated adoption of electric commercial vehicles at scale.

Key Electric Trucks Companies:

The following are the leading companies in the electric trucks market. These companies collectively hold the largest market share and dictate industry trends.

- AB Volvo

- BYD Company Ltd.

- Daimler Truck AG

- Dongfeng Motor Company

- FAW Group Co., Ltd.

- Foton International

- ISUZU MOTORS LIMITED

- Navistar, Inc

- PACCAR Inc.

- Scania

Recent Developments

-

In May 2025, AB Volvo revealed its new long-distance electric truck capable of up to 600 km range with superfast charging in ~40 minutes, marking a significant push into zero-emission long-haul freight transport and expanding its electric heavy truck portfolio ahead of a 2026 launch.

-

In May 2025, Daimler Truck AG expanded its battery-electric truck lineup with new variants of the Mercedes-Benz eActros 600, featuring updated battery configurations and chassis options, accelerating BEV solutions for heavy-duty logistics.

Electric Trucks Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 51.30 billion

Revenue forecast in 2033

USD 193.40 billion

Growth rate

CAGR of 20.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, propulsion type, vehicle range, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AB Volvo; BYD Company Ltd.; Daimler Truck AG; Dongfeng Motor Company; FAW Group Co., Ltd.; Foton International; ISUZU MOTORS LIMITED; Navistar, Inc; PACCAR Inc.; Scania

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Trucks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electric trucks market report based on vehicle type, propulsion type, vehicle range, application, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Light Duty Trucks

-

Medium Duty Trucks

-

Heavy Duty Trucks

-

-

Propulsion Type Outlook (Revenue, USD Million, 2021 - 2033)

-

BEV

-

PHEV

-

HEV

-

-

Vehicle Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Upto 300 miles

-

300-600 miles

-

Above 600 miles

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Logistics & Delivery

-

Construction

-

Waste Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the electric truck market include Dongfeng Motor Corporation, BYD Auto Co. Ltd, Daimler AG, among others.

b. The global electric truck market size was estimated at USD 39.30 billion in 2025 and is expected to reach USD 51.30 billion in 2026.

b. The global electric truck market is expected to grow at a compound annual growth rate of 20.9% from 2026 to 2033 to reach USD 193.40 billion by 2033.

b. China dominated the electric truck market with a share of 54.5% in 2025. This is attributable to the increased adoption of electric trucks as the central government in China eliminated upper weights limits on subsidies for trucks and LCVs.

b. Key factors that are driving the electric truck market growth include increasing adoption of electric trucks in the logistics & transportation sector and stringent emission norms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.