- Home

- »

- Homecare & Decor

- »

-

Electric Ranges Market Size & Share, Industry Report, 2030GVR Report cover

![Electric Ranges Market Size, Share & Trends Report]()

Electric Ranges Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Freestanding Electric Ranges, Slide-in Electric Ranges), By Application (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-472-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Ranges Market Size & Trends

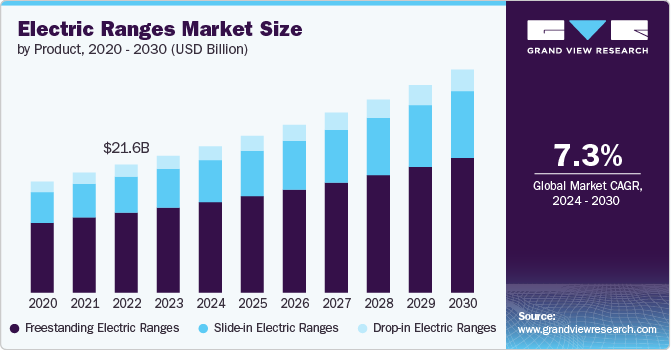

The global electric ranges market size was valued at USD 23.06 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. This growth is attributed to the increasing consumer demand for energy-efficient appliances, rising awareness about environmental sustainability, and advancements in cooking technology that enhance the convenience and functionality of electric ranges. Additionally, the growing trend of smart home integration and the popularity of electric ranges among urban consumers seeking modern kitchen solutions are further fueling the market growth.

A 2023 Climate Nexus survey reveals that American adults have mixed feelings about cooking appliances, with 43% preferring gas stoves and 42% favoring electric ones, highlighting a divided sentiment. Notably, there is significant public concern regarding the safety of gas stoves, with strong support for regulations aimed at mitigating risks associated with gas appliances and methane emissions. This shifting attitude toward gas safety and increasing awareness of the environmental impact of natural gas is likely to drive consumers toward electric ranges, especially as they seek safer and more sustainable cooking options. Consequently, the electric ranges market is poised for growth as more consumers recognize the benefits of electric cooking technologies, including energy efficiency and reduced emissions, aligning with broader trends of sustainability.

According to Consumer Reports in 2022, the comparison of electric and gas ranges reveals that electric models often outperform their gas counterparts in critical cooking tests, such as high heat and low heat performance, where nearly half of the electric smooth top ranges earn excellent ratings compared to none in gas. While gas ranges show better results in baking, electric ranges dominate in broiling, with over half receiving very good ratings. This performance gap, coupled with growing concerns over the health risks and environmental impacts associated with gas stoves-such as methane emissions-aligns with an increasing consumer shift toward electric ranges.

As awareness of these factors rises, the electric ranges market is expected to see significant growth, particularly as manufacturers enhance the performance and energy efficiency of electric models, making them more appealing to consumers seeking reliable and safe cooking options.

Product Insights

Freestanding electric ranges accounted for the largest revenue share of 62.10% in 2023 primarily due to their versatility, ease of installation, and cost-effectiveness. These appliances are popular among homeowners for their convenience, as they can be placed anywhere in the kitchen without the need for built-in cabinetry.

Models like the GE Profile 30-inch Smart Freestanding Electric Range, which features advanced smart technology and a spacious oven, and the Whirlpool 30-inch Freestanding Electric Range, known for its user-friendly design and reliable performance, highlight the appeal of freestanding electric ranges. Their wide range of features, such as self-cleaning options and multiple cooking modes, further contribute to their largest market share.

Slide-in electric range sales are projected to grow at a CAGR of 8.2% from 2024 to 2030, driven by the rising trend of modern kitchen designs that emphasize seamless integration and aesthetic appeal. These ranges are favored for their built-in look, which provides a sleek, professional appearance and eliminates gaps between the appliance and countertops, enhancing kitchen ergonomics.

Some key products include the Samsung 30-Inch Slide-In Electric Range with Flex Duo Oven, featuring dual cooking capabilities, and the Bosch 800 Series 30-Inch Slide-In Electric Range, known for its precision cooking and stylish design. As consumers increasingly prioritize both functionality and aesthetics in their kitchen remodels, slide-in electric ranges are becoming an attractive choice.

Distribution Channel Insights

Mass retailer-driven sales accounted for over 47% of the global revenue in 2023. Mass retailers are driving sales in the electric ranges market due to their ability to leverage economies of scale, extensive distribution networks, and aggressive pricing strategies. By offering a wide selection of products from various brands at competitive prices, these retailers attract a broad customer base seeking value and convenience.

For instance, during the Black Friday 2023 sales event, Best Buy stores in the U.S. offered significant discounts on popular electric range models, attracting a large volume of customers looking for both high-quality appliances and competitive prices. The featured ranges include innovative features such as convection cooking, air-fry modes, Wi-Fi connectivity, and self-cleaning capabilities, appealing to eco-conscious and health-focused consumers.

Online sales are expected to grow at a CAGR of 9.0% from 2024 to 2030. Online platforms and e-commerce channels are key distribution channels driving sales, with retailers leveraging seasonal promotions and product reviews to attract customers looking for energy-efficient and tech-enabled kitchen solutions. The convenience of shopping from home on online platforms such as Amazon allows consumers to easily compare products, read reviews, and make informed purchasing decisions without the limitations of traditional retail hours.

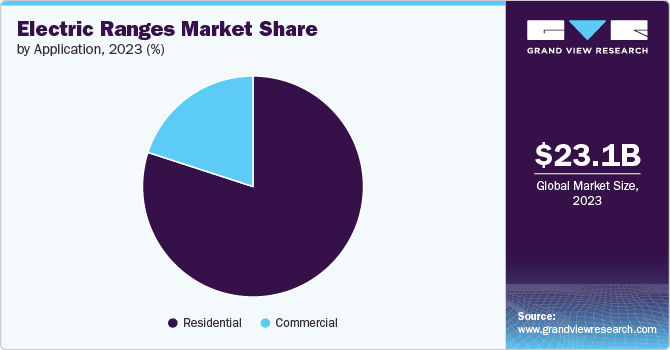

Application Insights

Electric ranges saw an increased demand in residential applications, accounting for over 80% of the global market revenue in 2023. The surge in demand for electric ranges in residential applications is attributed to the growing number of households opting for electric cooking solutions. As of 2023, approximately 67 million U.S. households-around 50% of total homes-utilized electric ranges, highlighting a significant market segment.

The demand for electric ranges in commercial applications is expected to grow at a CAGR of 8.1% from 2024 to 2030, driven by the increasing adoption of energy-efficient and environmentally friendly cooking solutions in the hospitality and restaurant sectors. As commercial establishments strive to meet stringent regulations regarding emissions and energy consumption, many are transitioning from gas to electric ranges, which offer precise temperature control and faster cooking times.

Moreover, the rising trend of sustainable practices among consumers is prompting restaurants and catering services to prioritize electric cooking appliances that align with eco-friendly initiatives.

Regional Insights

North America electric ranges market accounted for a revenue share of 37.11% in 2023, driven by factors such as a strong preference for energy-efficient appliances and innovative cooking technologies. For example, the growing popularity of induction cooking, which is not only faster but also more energy-efficient, has led to increased consumer interest in electric ranges that feature this technology. Additionally, local manufacturers like Whirlpool and GE have invested heavily in smart appliance features, such as Wi-Fi connectivity and voice control, appealing to tech-savvy consumers.

U.S. Electric Ranges Market Trends

The electric ranges market in the U.S. is expected to grow at a CAGR of 6.4% from 2024 to 2030, fueled by increasing consumer awareness of the health and environmental impacts of gas stoves, particularly concerning methane emissions. Additionally, the rising popularity of energy-efficient appliances, supported by government incentives and rebates, is encouraging homeowners to switch to electric options. The expansion of smart home technology further enhances the appeal of electric ranges, offering convenience and connectivity features that align with modern cooking preferences.

Europe Electric Ranges Market Trends

The electric ranges market in Europe accounted for a share of over 29% of the global market revenue in 2023, driven by stringent environmental regulations and a strong focus on reducing carbon emissions. European consumers are increasingly prioritizing energy efficiency, leading to a growing preference for electric ranges over gas alternatives.

Asia Pacific Electric Ranges Market Trends

The electric ranges market in Asia Pacific is expected to grow at a CAGR of 8.2% from 2024 to 2030, driven by rapid urbanization and rising disposable incomes in countries like India and China. As more households gain access to electricity and modern cooking appliances, the demand for electric ranges is increasing. Additionally, growing awareness of energy efficiency and environmental concerns is prompting consumers to shift from traditional cooking methods to electric options.

Key Electric Ranges Company Insights

The electric ranges market is concentrated in nature. Major companies, such as Whirlpool Corporation, GE Appliances, Samsung, LG Electronics, and Bosch, collectively hold a substantial share of the market due to their established brand recognition, extensive product portfolios, and continuous innovation in features and technology. This concentration allows these companies to leverage economies of scale and maintain competitive pricing, while also investing in research and development to meet evolving consumer preferences for smart, energy-efficient cooking solutions.

Key Electric Ranges Companies:

The following are the leading companies in the electric ranges market. These companies collectively hold the largest market share and dictate industry trends.

- Whirlpool Corporation

- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- General Electric (GE Appliances)

- Bosch (BSH Hausgeräte GmbH)

- Frigidaire

- Haier Group Corporation

- Miele & Cie. KG

- Brown Stove Works, INC.

- Rangaire

Recent Developments

-

In March 2024, GE Appliances introduced a new range lineup featuring 36 models, including the top-tier GE 30" Slide-In Electric Convection Range with No Preheat Air Fry and the EasyWash Oven Tray, designed for faster cooking and easier cleaning. The EasyWash tray simplifies oven clean-up, while No Preheat cooking modes reduce meal prep time. Additional features include Express Preheat, PowerBoil burners, and WiFi connectivity for remote control and future updates. The lineup is available in gas and electric models, with prices starting at USD 899.

-

In January 2023, Sharp Home Electronics showcased new 30" slide-in electric ranges and smart combi appliances at the 2023 Kitchen & Bath Industry Show (KBIS) in Las Vegas. The lineup includes electric and gas convection ranges with features like Air Fry, Pizza modes, and temperature probes. Sharp also introduced smart convection wall ovens and radiant range tops with integrated Microwave Drawer Ovens, compatible with Alexa. These appliances emphasize convenience, versatility, and premium design.

Electric Ranges Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.66 billion

Revenue forecast in 2030

USD 37.59 billion

Growth Rate (Revenue)

CAGR of 7.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia, Brazil, South Africa, UAE

Key companies profiled

Whirlpool Corporation, Samsung Electronics Co. Ltd., LG Electronics Inc., General Electric (GE Appliances), Bosch (BSH Hausgeräte GmbH), Frigidaire, Haier Group Corporation, Miele & Cie. KG, Brown Stove Works, INC., Rangaire

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Ranges Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric ranges market on the basis of product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Freestanding Electric Ranges

-

Slide-in Electric Ranges

-

Drop-in Electric Ranges

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mass Retailers

-

Electronic & Appliance Stores

-

Online/E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global electric ranges market size was estimated at USD 23.06 billion in 2023 and is expected to reach USD 24.66 billion in 2024.

b. The global electric ranges market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 37.59 billion by 2030.

b. The electric ranges market in North America accounted for a share of 37.11% of the global market revenue in 2023, driven by factors such as a strong preference for energy-efficient appliances and innovative cooking technologies.

b. Some of the key players operating in the electric ranges market include Whirlpool Corporation, GE Appliances, Samsung, LG Electronics, and Bosch.

b. Key factors that are driving the demand include increasing consumer demand for energy-efficient appliances, rising awareness about environmental sustainability, and advancements in cooking technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.