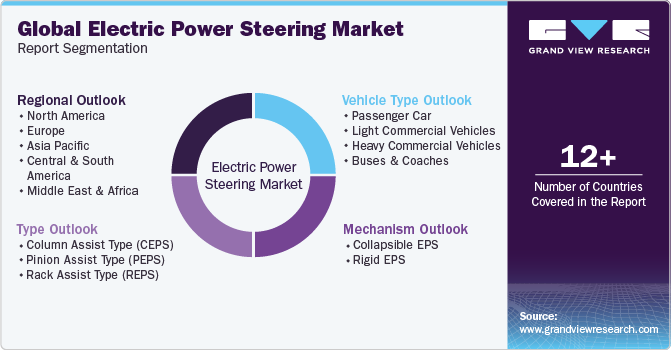

Electric Power Steering Market Size, Share & Trends Analysis Report By Mechanism (Collapsible EPS, Rigid EPS), By Type (CEPS, PEPS), By Vehicle Type (Passenger Car, Light Commercial Vehicles), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-266-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Electric Power Steering Market Trends

The global electric power steering market size was estimated at USD 25.32 billion in 2023 and is expected to grow at a CAGR of 6.6% from 2024 to 2030. The growing trend of autonomous vehicles drives the adoption of electric power steering systems as a modern alternative to traditional steering mechanisms, such as hydraulic and electro-hydraulic systems. This shift is significantly boosting the demand for electric power steering (EPS) systems globally. Vehicles with EPS systems benefit from reduced weight, thereby enhancing fuel efficiency.

Regulatory requirements for fuel efficiency and emission reduction have driven the demand for electric power steering systems. Automakers are pressured to comply with strict vehicle pollution and fuel economy regulations imposed by authorities globally. To meet these standards, manufacturers invest in fuel-efficient technologies like electric power steering, which offer improved efficiency and reduced carbon emissions.

The COVID-19 pandemic had a negative impact on the electric power steering systems market. The pandemic led to a significant decline in the global economy, causing production, supply chains, and vehicle demand disruptions. Manufacturers faced challenges in introducing new technologies and products during this period, leading to a slowdown in market expansion.

However, post-pandemic recovery efforts and stimulus packages introduced by governments worldwide to revive economies, including the automotive sector, helped mitigate some of the adverse effects. These measures included incentives for vehicle purchases, which contributed to driving demand for vehicles equipped with electric power steering systems. As economies recovered and operations resumed in the automotive industry, there was a positive impact on the growth of the automotive electric power steering market.

Market Concentration & Characteristics

The electric power steering industry is significantly fragmented in nature. However, the growth stage of the industry is medium, and the pace of industry growth is accelerating. The industry is characterized by a high degree of innovation due to the automotive industry's push towards more fuel-efficient, safer, and smarter vehicles.

EPS systems increasingly integrate with Advanced Driver Assistance Systems (ADAS) features such as lane-keeping assist, park assist, and adaptive cruise control. For instance, in September 2022, Hitachi Astemo, Ltd. launched a cutting-edge steer-by-wire vehicle system, a pivotal technology for autonomous and next-generation vehicles. This innovative system eliminates the traditional steering wheel, connecting steering and turning actuators through electric signals to control the vehicle's direction.

The level of merger and acquisition activities is high in the industry as companies within the automotive industry look to strengthen their position in the EPS market and broaden their product portfolios, enter new markets, and gain a competitive edge by leveraging the advanced technologies and expertise of the companies they acquire or merge with. For instance, in May 2022, NSK Ltd. collaborated with thyssenkrupp AG to enhance their technological capabilities in the steering businesses and expand their market positions.

The impact of regulation in the EPS industry is high as regulatory bodies such as the National Highway Traffic Safety Administration (NHTSA) in the U.S. and other organizations globally have enforced strict guidelines concerning emissions, fuel efficiency, and vehicle safety. These regulations compel automotive manufacturers to integrate cutting-edge technologies to comply with these standards. In electric power steering systems, these regulations have spurred the creation of more effective and eco-friendly systems that enhance fuel efficiency and lower emissions.

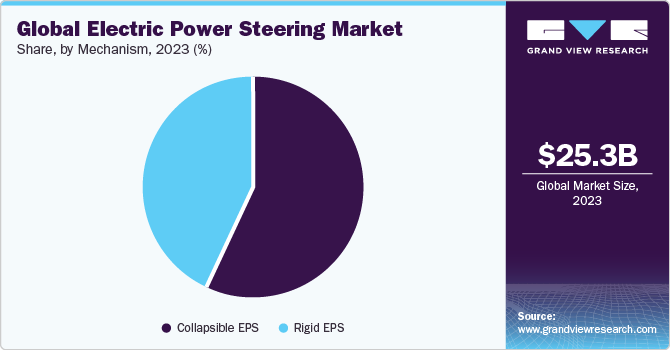

Mechanism Insights

The Collapsible EPS (CEPS) segment accounted for the largest market share of 57.2% in 2023. Unlike traditional hydraulic power steering systems that rely on hydraulic fluid, CEPS employs an electric motor to aid the driver in turning the wheels. The main advantage of CEPS is its ability to collapse the steering column in the event of a frontal impact, thereby providing additional safety to the driver by reducing the risk of chest and head injuries. This feature enhances overall vehicle safety and aligns with the increasing focus on advanced safety features in modern vehicles.

Rigid Electric Power Steering (REPS) is anticipated to register the fastest CAGR over the forecast period. The demand for fuel-efficient vehicles, enhanced driving experiences, and the increasing adoption of electric vehicles are key drivers propelling the growth of the REPS market. As the automotive industry shifts towards electric power steering systems, REPS stands out for its advantages over hydraulic power steering systems, including improved fuel efficiency, reduced complexity, and better performance.

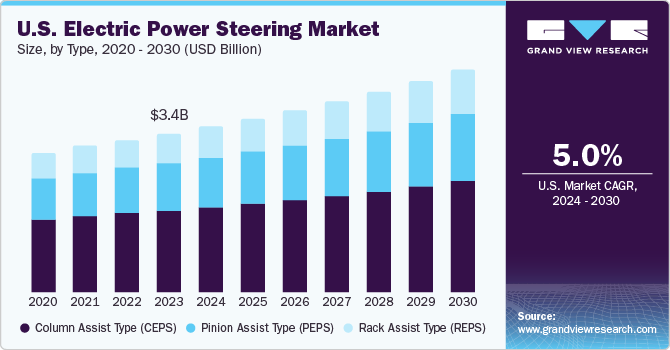

Type Insights

The Column Assist Type (C-EPS) segment accounted for the largest market revenue share in 2023. The emphasis on enhancing driving comfort and safety has contributed to the growth of the C-EPS market. The advanced features integrated into C-EPS systems, such as improved manoeuvrability and responsiveness, enhance the overall driving experience for consumers. For instance, in October 2021, Nexteer Automotive enhanced its EPS product line by launching an innovative Modular Column-Assist EPS System (mCEPS), providing a cost-effective, scalable, and flexible platform design. This system caters to a diverse range of OEM needs, showcasing Nexteer's commitment to innovation and adaptability in steering solutions.

Rack Assist Type (R-EPS) is anticipated to register the fastest CAGR over the forecast period. Advancements in electronic components and sensor technologies have enabled the integration of innovative features into R-EPS systems. These features include adaptive steering assistance, lane-keeping assistance, and autonomous driving capabilities, fuelling the adoption of R-EPS in modern vehicles.

Vehicle Type Insights

The passenger car segment accounted for the largest market revenue share in 2023. EPS systems enable advanced safety features in passenger cars, such as lane-keeping assist and automated parking. According to ACEA - European Automobile Manufacturers' Association, more than 10 million new passenger cars were registered in 2023. The growth in the sales of passenger cars fuels the EPS market.

Light commercial vehicles segment is anticipated to register the fastest CAGR over the forecast period. EPS is crucial in enhancing safety and steering control in light commercial vehicles. EPS systems' precise and responsive nature improves vehicle stability, especially during challenging driving conditions or emergency manoeuvres, which is vital for ensuring driver confidence and overall road safety.

Regional Insights

The North America EPS market is anticipated to grow significantly over the forecast period due to increased vehicle production and sales in the region, which predominantly uses EPS systems. The regulations imposed by the U.S. and Canadian governments regarding standards required in the automotive industry to increase fuel efficiency and reduce emissions are driving the adoption of EPS systems in the region.

U.S. Electric Power Steering Market Trends

Over the recent years, the U.S. market has witnessed tremendous transformation in the automotive industry. As the shift to hybrid and electric vehicles gains traction, EPS technology remains at the forefront, delivering lightweight and energy-efficient solutions. Strategic collaborations for technological enhancements are fueling the product demand in the country. For instance, in January 2021, Nexteer Automotive collaborated with Tactile Mobility to enhance the EPS systems. This collaboration enabled Nexteer Automotive to utilize Tactile Mobility's software, which collects data from vehicles' non-visual sensors like wheel speed, wheel angle, RPM, and more, to provide real-time insights on-road attributes and vehicle dynamics.

Asia Pacific Electric Power Steering Market Trends

The Asia Pacific market accounted for the largest revenue share of 50.5% in 2023. This growth is primarily driven by factors such as the increasing demand from emerging economies including India and China, in the region. The rising income levels of middle-class customers contribute to the increased demand for vehicles, especially in the budget and sports segment. Original Equipment Manufacturers (OEMs) are focusing on cost-effective EPS systems, leading to their widespread adoption in passenger and light commercial vehicles.

The China electric power steering market accounted for over 20% of the global market in 2023 and is expected to grow significantly over the forecast period. The growing population in China is a significant factor contributing to the growth of the country's market. According to the WHO, the population of China reached 1.42 billion in 2023, making it the second-largest populous country in the world.

The electric power steering market in South Korea is anticipated to register the fastest CAGR over the forecast period. The country's advanced automotive industry and the global shift towards more energy-efficient and environmentally friendly automotive technologies are driving the growth of EPS systems. South Korea, home to automotive companies such as Hyundai Motor Company and Kia Corporation, is at the forefront of adopting and integrating EPS systems in vehicles.

Europe Electric Power Steering Market Trends

Europe is anticipated to register the fastest CAGR over the forecast period. The European Union has been at the forefront of implementing stringent emission and fuel efficiency standards. These regulations encourage the adoption of technologies such as EPS, which contribute to reducing vehicle emissions and improving fuel efficiency by replacing the traditional hydraulic power steering systems.

The Germany electric power steering market accounted for the largest market revenue share in the European region in 2023. The rise in demand for ADAS and the push toward autonomous vehicles are the crucial drivers for adopting EPS systems in the country. Germany is home to a few of the largest manufacturing companies, such as Volkswagen Group, BMW AG, and Mercedes-Benz, which further fuels the growth of the market in the country.

Key Electric Power Steering Company Insights

Some of the key players operating in the market include Hyundai Mobis, Nexteer Automotive, and others.

-

Hyundai Mobis offers EPS systems and other automotive components to various automakers worldwide. The company heavily invests in research and development to innovate and improve its EPS technology. Hyundai Mobis EPS solutions are designed to cater to a wide range of vehicles, from compact cars to SUVs and trucks.

-

Nexteer Automotive offers a comprehensive portfolio of EPS systems that cater to vehicles of all sizes, ranging from small cars to heavy-duty trucks and light commercial vehicles. The company’s EPS solutions provide advanced safety, comfort, and fuel efficiency benefits while ensuring precise steering control and a connected feel to the road.

Key Electric Power Steering Companies:

The following are the leading companies in the electric power steering market. These companies collectively hold the largest market share and dictate industry trends.

- JTEKT Corporation

- Denso Corporation

- GKN Automotive Limited

- Hitachi Astemo, Ltd.

- Hyundai Mobis

- Mitsubishi Electric Corporation

- Nexteer Automotive

- NSK Ltd.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- thyssenkrupp AG

Recent Developments

-

In April 2023, Nexteer Automotive launched the Modular Rack-Assist Electric Power Steering (mREPS) system, enhancing the company's cost-effective, modular EPS solutions. mREPS offers adaptability to effectively address the diverse needs of OEMs for advanced steering systems in heavier vehicles including EVs and light commercial vehicles.

-

In September 2020, Denso Corporation launched a cutting-edge Electric Power Steering Motor Control Unit (EPS-MCU) known as the Denso Dual Assist 2nd Generation (DDA2) to enhance vehicle safety and handling. This advanced unit, featured in the Toyota Harrier, integrates multiple drive circuits and motor windings, ensuring improved reliability and safety.

-

In May 2020, JTEKT Corporation expanded its operations in Canada by establishing a new research and development facility that boosts its expertise in electric power steering innovation. This acquisition enhances JTEKT's global capabilities in developing ECUs for vehicle steering and driveline products, positioning the company for further growth in global electrification.

Electric Power Steering Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 26.82 billion |

|

Revenue forecast in 2030 |

USD 39.27 billion |

|

Growth rate |

CAGR of 6.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Mechanism, type, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East and Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

JTEKT Corporation; Denso Corporation; GKN Automotive Limited; Hitachi Astemo, Ltd.; Hyundai Mobis; Mitsubishi Electric Corporation; Nexteer Automotive; NSK Ltd.; Robert Bosch GmbH; ZF Friedrichshafen AG; thyssenkrupp AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Electric Power Steering Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric power steering market report based on the mechanism, type, vehicle type, and region:

-

Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Collapsible EPS

-

Rigid EPS

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Column Assist Type (CEPS)

-

Pinion Assist Type (PEPS)

-

Rack Assist Type (REPS)

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Car

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

Buses & Coaches

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global electric power steering market size was estimated at USD 25.32 billion in 2023 and is expected to reach USD 26.82 billion in 2024.

b. The global electric power steering market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 39.27 billion by 2030.

b. Asia Pacific dominated the electric power steering market with a share of 50.5% in 2023. The rising income levels of middle-class customers are contributing to the increased demand for vehicles, especially in the budget and sport segment.

b. Some key players operating in the electric power steering market include JTEKT Corporation; Denso Corporation; GKN Automotive Limited; Hitachi Astemo, Ltd.; Hyundai Mobis; Mitsubishi Electric Corporation; Nexteer Automotive; NSK Ltd.; Robert Bosch GmbH; ZF Friedrichshafen AG; thyssenkrupp AG.

b. Factors such as the regulatory requirements for fuel efficiency and emission reduction are driving the demand for electric power steering systems.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."