Electric Passenger Cars Market Size, Share & Trends Analysis Report By Product (Battery Electric, Plug-in Hybrid Electric), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-281-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Electric Passenger Cars Market Trends

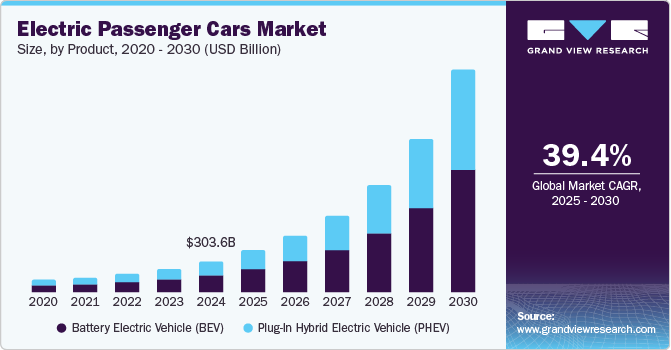

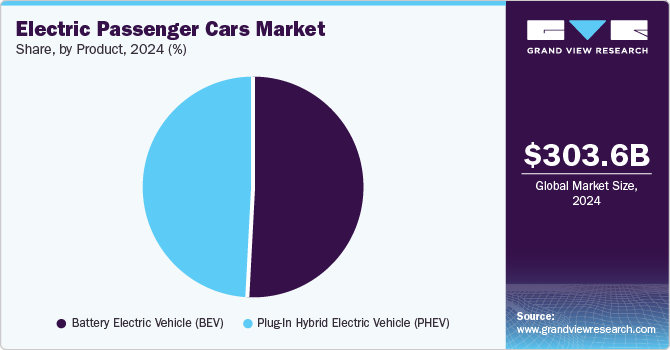

The global electric passenger cars market size was estimated at USD 303.6 billion in 2024 and is projected to grow at a CAGR of 39.4% from 2025 to 2030. The rising demand for sustainable transportation solutions, along with stringent emission regulations, is driving market growth. Factors such as advancements in battery technology, expanding charging infrastructure, and government incentives for electric vehicle adoption contribute to the market's expansion. In addition, improvements in battery efficiency have led to extended driving ranges for electric passenger cars, addressing consumer concerns about vehicle performance and convenience.

Governments worldwide are introducing policies to encourage the adoption of electric passenger cars. Financial incentives play a key role in making EVs more accessible to consumers. For instance, in June 2024, the U.S. Department of the Treasury and the IRS announced that consumers had saved over USD 1 billion in upfront costs on purchasing more than 150,000 clean vehicles since January 2024, highlighting the impact of such initiatives on market growth. In addition to subsidies, several regions are implementing stricter emission norms and fuel economy standards to drive the transition toward sustainable transportation.

The increasing focus on reducing carbon emissions and dependence on fossil fuels has accelerated the shift toward electrification in the automotive sector. Automakers are investing in research and development to introduce high-performance electric vehicles with enhanced battery capacity, faster charging capabilities, and advanced safety features. The availability of a diverse range of models, from compact urban cars to luxury electric sedans and SUVs, has broadened consumer choices, supporting wider adoption. In addition, corporate fleet electrification initiatives and the rising demand for ride-sharing services powered by electric vehicles are driving industry growth. For instance, in August 2024, Uber announced plans to add 100,000 electric vehicles to global markets, beginning with Europe and Latin America, as part of its strategy to promote sustainable transportation.

Advancements in electric vehicle technology have contributed to the integration of smart features such as AI-powered driver assistance, real-time battery monitoring, and vehicle-to-grid connectivity. Rising disposable incomes, urbanization, and government policies supporting electric mobility in developing economies have further fueled adoption. However, challenges such as the high initial cost of electric vehicles, charging infrastructure limitations, and regional regulatory variations remain significant concerns for manufacturers. Companies are addressing these challenges by expanding fast-charging networks, enhancing energy efficiency, and ensuring compliance with evolving safety standards across different markets.

Product Insights

Battery Electric Vehicle (BEV) dominated the electric passenger car market with a revenue share of 51.4% in 2024. The increasing adoption of BEVs is driven by advancements in battery technology, expanding charging infrastructure, and government policies supporting emission-free transportation. Automakers are prioritizing the development of long-range BEVs with improved energy efficiency and reduced charging times to address consumer concerns. In addition, the declining cost of lithium-ion batteries has contributed to the affordability of BEVs, making them more accessible to a broader consumer base.

Plug-in Hybrid Electric Vehicle (PHEV) is witnessing notable growth due to its ability to operate on both electric power and conventional fuel, offering consumers flexibility in driving range. Government initiatives promoting EV adoption are further contributing to this trend. For instance, in February 2025, the European Union proposed measures to boost EV demand and require more locally produced batteries, aiming to support European automakers in electrifying their fleets and competing globally. Such policies are expected to encourage the expansion of PHEVs alongside fully electric models. Automakers are responding by introducing a wider range of PHEV options, integrating advanced energy management systems to enhance fuel efficiency and optimize battery usage.

Regional Insights

North America electric passenger car market is expected to register the highest CAGR of 40.2% over the forecast period. The region's growth is driven by increasing government incentives, expanding charging infrastructure, and rising consumer awareness of sustainable mobility solutions. Automakers are investing in electric vehicle production to meet stringent emission regulations and the growing demand for zero-emission transportation. In addition, advancements in battery technology and the availability of diverse EV models, ranging from compact cars to high-performance vehicles, contribute to market expansion.

Governments in North America are actively supporting EV adoption through infrastructure investments and policy initiatives. In February 2024, Canada's Minister of Energy and Natural Resources announced a federal investment of nearly USD 5 million to install over 500 new EV chargers, including 40 fast chargers, across Toronto. This initiative aligns with the national goal of achieving 100% zero-emission vehicle sales by 2035, making EV adoption more accessible. The presence of key industry players, increasing fleet electrification, and the integration of smart charging solutions are further accelerating market growth in the region.

U.S. Electric Passenger Cars Market Trends

The U.S. dominated the North America electric passenger car market in 2024, driven by widespread EV adoption, government incentives, and advancements in charging infrastructure. Federal and state-level policies promoting zero-emission vehicles, coupled with automakers’ investments in battery technology and production expansion, have strengthened the market. The availability of a diverse range of electric passenger cars, from budget-friendly models to premium offerings, has further supported adoption. Additionally, increasing corporate fleet electrification and commitments from ride-hailing companies to transition to EVs continue to reinforce the country's leadership in the region.

Europe Electric Passenger Cars Market Trends

Europe witnessed notable growth in the electric passenger car market in 2024, supported by stringent emission regulations, government subsidies, and expanding charging infrastructure. The region's push toward carbon neutrality has accelerated EV adoption, with several countries implementing incentives to encourage consumers to switch to electric mobility. Automakers are expanding production capacities and launching new models to cater to the growing demand. In addition, advancements in battery efficiency and the development of high-speed charging networks have addressed range concerns, further supporting market expansion.

Asia Pacific Electric Passenger Cars Market Trends

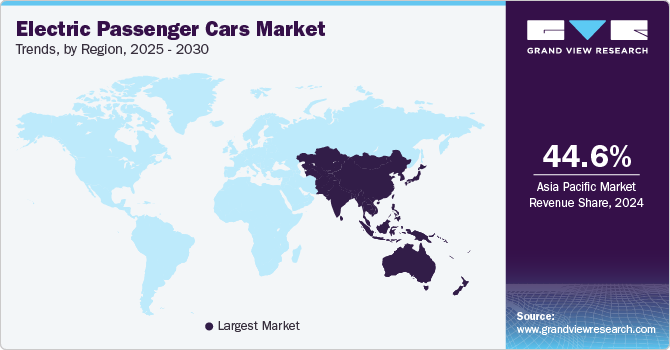

Asia Pacific electric passenger car market dominated the industry, accounting for 44.6% of the share in 2024. The region's growth is driven by strong government policies, increasing investments in charging infrastructure, and rising consumer preference for sustainable transportation. Countries such as China, South Korea, and Japan play a significant role in shaping the market landscape, with China leading as the largest manufacturer and consumer of electric passenger cars.

Supportive government initiatives such as subsidies for EV buyers and regulations mandating automakers to produce a certain percentage of electric vehicles have accelerated market expansion. In addition, the development of extensive charging networks and advancements in battery technology continue to strengthen the region’s position in the global electric passenger car industry.

China's electric passenger car market dominated the Asia Pacific electric passenger car industry with the largest revenue share in 2024. The country's strong government support, well-developed charging infrastructure, and leadership in EV manufacturing have contributed to market growth. Policies such as subsidies for EV buyers, tax incentives, and production mandates for automakers have accelerated adoption. In addition, advancements in battery technology and expanding high-speed charging networks have further strengthened China's position in the industry.

The presence of leading domestic manufacturers offering a wide range of electric passenger cars, from affordable models to premium variants, has played a key role in market expansion. The growing focus on sustainable transportation and environmental initiatives has encouraged consumers to transition to electric mobility. With continued government initiatives and investments in EV technology, China remains at the forefront of the Asia Pacific electric passenger car market.

Key Electric Passenger Cars Company Insights

Some of the key companies operating in the electric passenger cars industry are BYD Company Ltd.; Mercedes-Benz Group AG.; and Ford Motor Company. These companies are expanding their market presence by launching new products, collaborating, and adopting various other strategies.

-

BYD Company Ltd. is a key player in the electric passenger car market, offering a range of electric vehicles designed for urban and long-distance travel. The company focuses on sustainability and technological advancements, integrating high-performance battery systems, energy-efficient drivetrains, and smart connectivity features. Through continuous innovation and a commitment to environmentally friendly transportation, BYD supports the global transition toward electrified mobility in the electric passenger car industry.

-

Mercedes-Benz Group AG is a prominent player in the electric passenger car market, offering a range of premium electric vehicles that combine performance, luxury, and advanced technology. The company emphasizes innovation in battery efficiency, intelligent driving systems, and sustainable mobility solutions. With a strong focus on electrification and cutting-edge automotive design, Mercedes-Benz continues to shape the future of electric transportation in the electric passenger car industry.

Key Electric Passenger Cars Companies:

The following are the leading companies in the electric passenger cars market. These companies collectively hold the largest market share and dictate industry trends.

- BYD Company Ltd.

- Mercedes-Benz Group AG. (Daimler AG)

- Ford Motor Company

- General Motors

- Lucid

- MITSUBISHI MOTORS CORPORATION

- Nissan Motor Co., Ltd.

- Tesla

- TOYOTA MOTOR CORPORATION

- Volkswagen Group

Recent Developments

-

In January 2025, Tesla launched the updated Model Y in the U.S. and Canada. This new version, referred to as the "Launch Series," features a redesigned exterior, upgraded interior, and improved performance. Priced at USD 59,990 in the U.S., the model includes Tesla’s advanced driver-assistance system, "Full Self-Driving (Supervised)," as a standard feature. Deliveries are set to begin in March 2025.

-

In July 2023, Mercedes-Benz Camiones y Buses Argentina announced an additional USD 30 million investment to expand its operations in Argentina. Focused on enhancing logistics and distribution capabilities, this investment aimed to support the company's growing presence in the commercial and electric vehicle segments.

Electric Passenger Cars Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 405.0 billion |

|

Revenue forecast in 2030 |

USD 2.13 trillion |

|

Growth rate |

CAGR of 39.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

March 2025 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

BYD Company Ltd.; Mercedes-Benz Group AG (Daimler AG); Ford Motor Company; General Motors; Lucid; MITSUBISHI MOTORS CORPORATION; Nissan Motor Co., Ltd.; Tesla; TOYOTA MOTOR CORPORATION; Volkswagen Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Electric Passenger Cars Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric passenger cars market report based on product and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Plug-In Hybrid Electric Vehicle (PHEV)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."